TSMC PC and Server CPU Revenues Topped Smartphones for a Change

Data center, AI, and supercomputers are at the heart of the surge

TSMC has, for the first time in what seems like forever, achieved higher revenues from consumer and professional chips in the HPC (High Performance Computing) market segment compared to those destined for smartphones. That's probably due in part to the lack of recent smartphone chip announcements, but let's leave that for the time being.

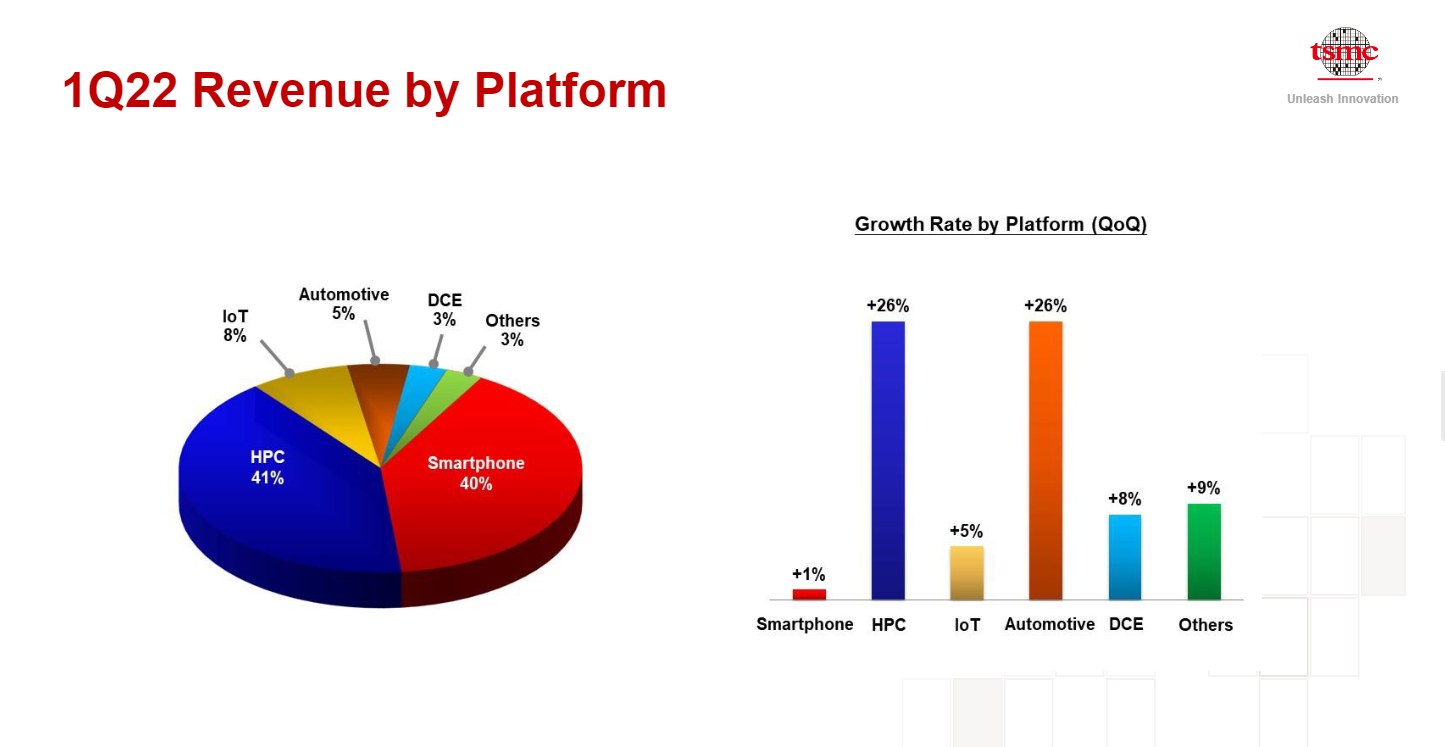

The difference wasn't significant, with HPC's 41% contribution to the company's revenue beating the smartphone segment's 40% cut. What the 41% HPC contribution "hides" from the overall picture is the explosion in TSMC's HPC earnings: the segment's revenues surged 26% sequentially. HPC was one of the principal contributors for TSMC's exceptional financial performance in the first quarter of the year, leading it to surpass guidance projections across all relevant metrics.

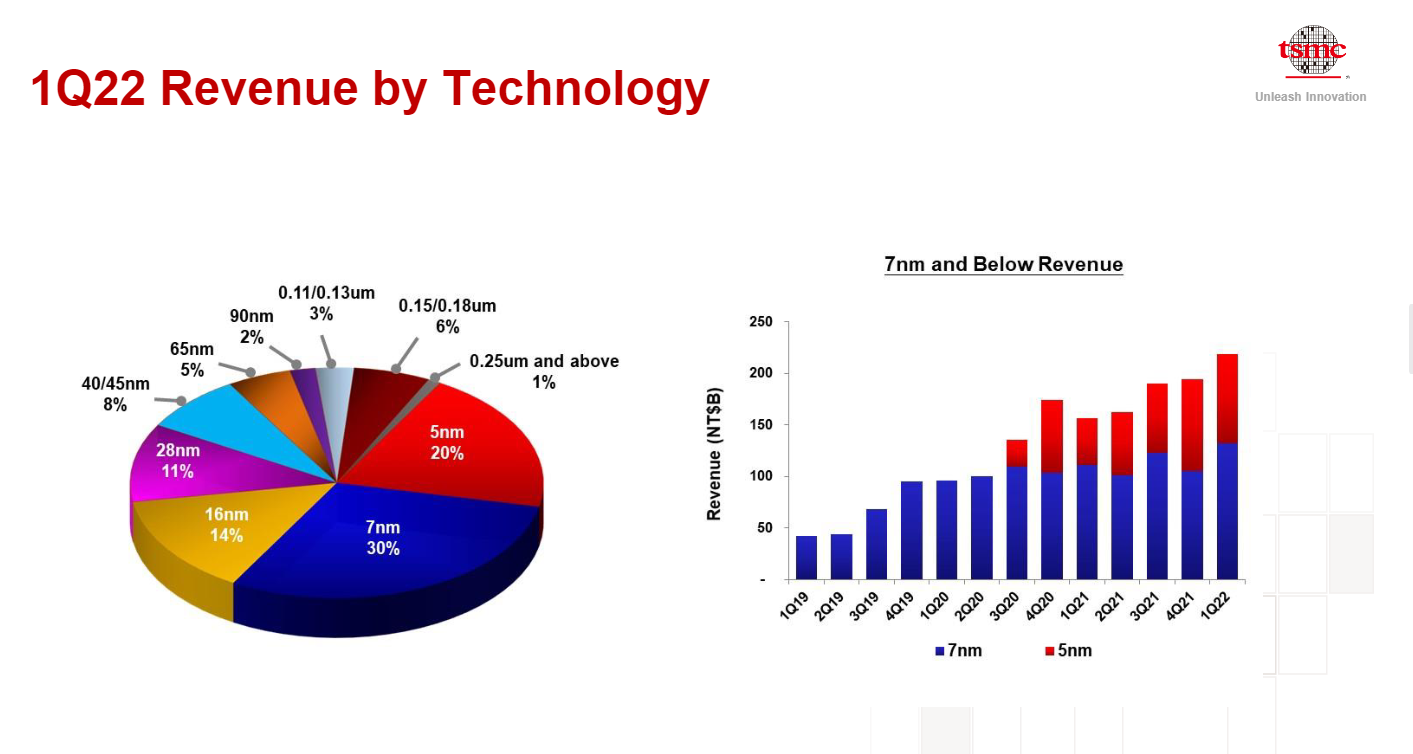

TSMC's HPC chip orders generated revenue of ~$6.8 billion in the first quarter of 2022, up significantly from the ~$4.3 billion from Q4 last year. Taking into account the stagnant smartphone market, TSMC is betting its chips on HPC as the principal force behind its 2022 growth aspirations, mainly fueled by the exploding significance of the AI, datacenter, and supercomputing markets, which itself follows the explosion in consumer electronics that followed the COVID-19 pandemic.

TSMC's industry-leading manufacturing processes, and specifically its advanced packaging capabilities, are proving to be the gasoline to the proverbial fire for its HPC revenues. The company's 3D SoIC (system-on-integrated chips) packaging technology has already attracted major HPC chip orders from customers as classic monolithic chip manufacturing is clearly on its way out. Chiplets appear to be today's best bet for the future, save for some very specific scenarios like Cerebra's Wafer Scale Engine (WSE).

Hand-in-hand with TSMC walk the likes of AMD, whose ultra-competitive Epyc CPUs are fabbed at the former's factories and are used to operate said factories themselves. Companies at the forefront of HPC innovations such as Cerebra WSE and Altera's Altra Max products all use TSMC's manufacturing capacity. Intel's manufacturing woes arguably opened up the door for both AMD — and perhaps more crucially, Arm-based chips — to enter the HPC space, where TSMC's technological dominance is naturally required for these high-impact market movements. TSMC's customer success literally makes (or breaks) its own. Even Intel now ranks among TSMC's customers for its discrete GPU offerings.

Interestingly, TSMC's automotive revenue for 1Q'2022 also increased by 26% compared to the previous quarter. It's likely that the increase in demand from the automotive market is heavily pegged to the increasing modernization and chip requirements for the fast-growing worldwide fleet of electric vehicles. Even so, automotive sales accounted for only 5% of the company's revenue pie.

Of course, smartphones will still contribute significantly to TSMC's bottom-line, and any technological transition to whatever the next big thing ends up being (which some place at the feet of AR [Augmented Reality] devices) won't occur overnight. Orders for Apple's iPhone and iPad products alone will still contribute an estimated $17 billion to the company's projected $68 billion revenue for 2022. Still, the smartphone chips' days of dominance may be coming to an end, at least for now.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.