WD's Big Advantage: BiCS3 64-Layer 3D NAND Coming This Year

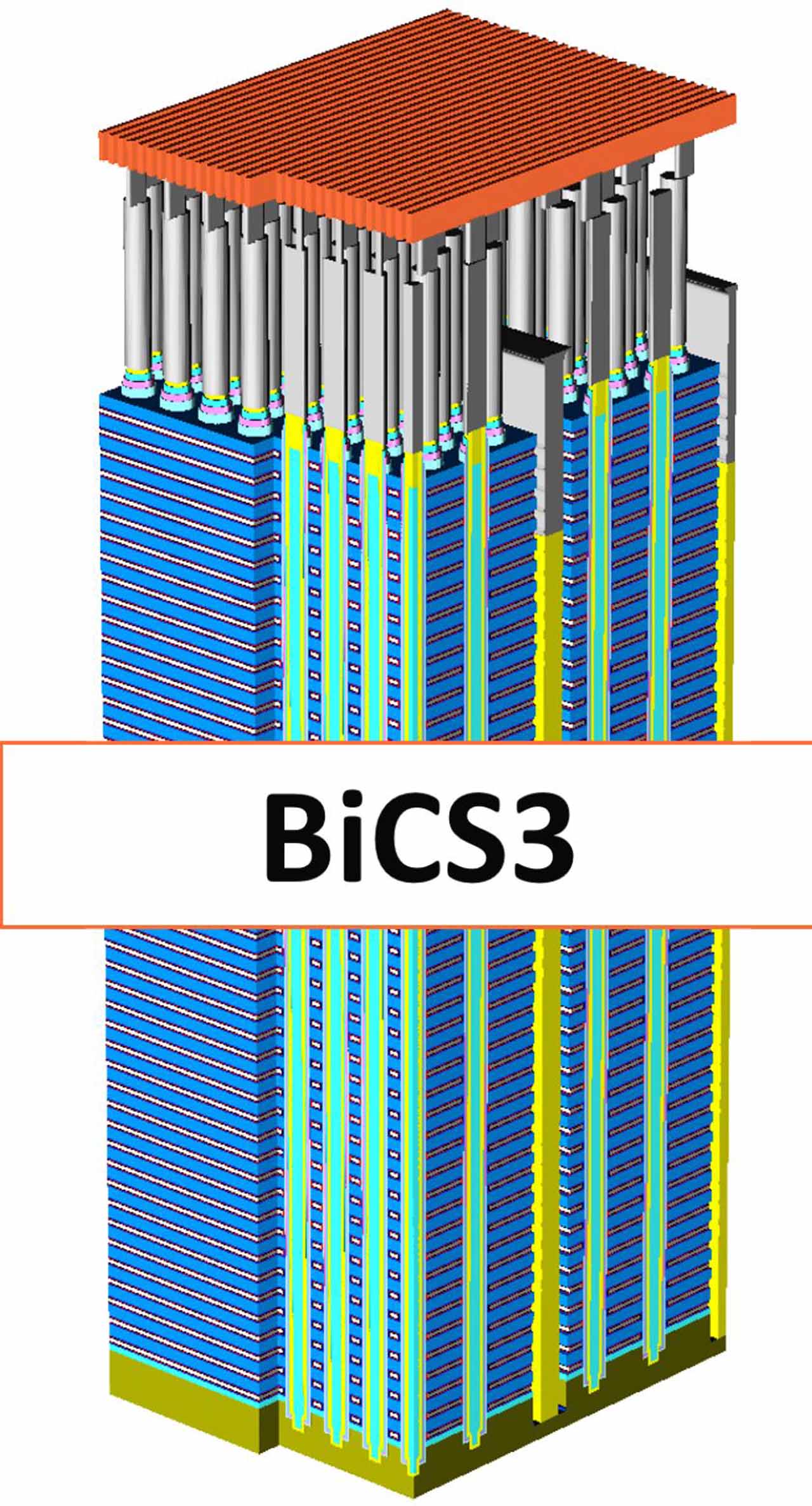

The Western Digital Corporation (WDC) announced that it has completed development and is ramping up production of BiCS3, which is the world's first 64-layer 3D NAND.

BiCS (Bit-Cost Scaling) NAND has had a winding road on its way to market. Most notably, the first generation of BiCS never actually made it to market. SanDisk (which is now a WDC brand) announced the pilot production of its 48-layer BiCS2 in August 2015, and the company indicated in the current press release that BiCS2 will continue to ship to customers in retail and OEM markets, though we have yet to see it in the wild.

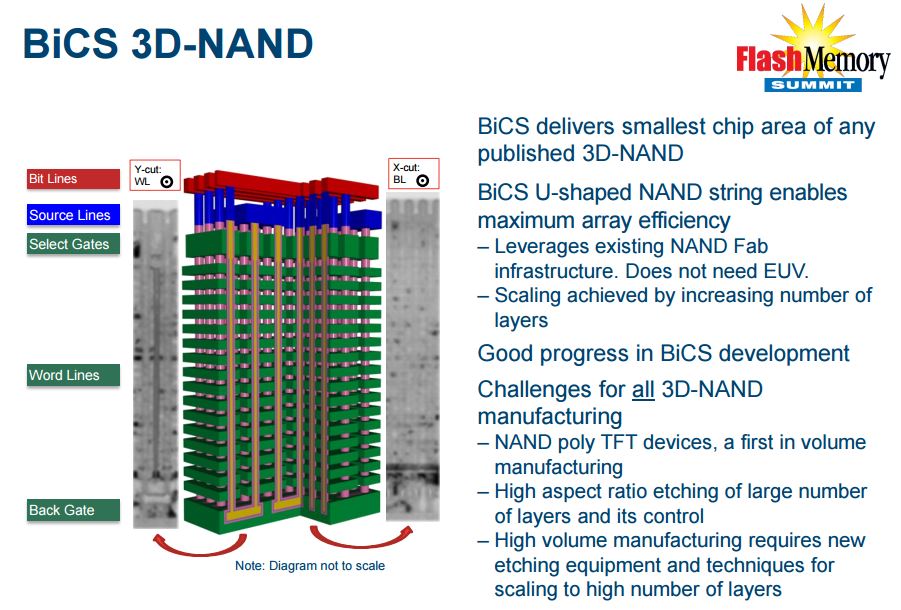

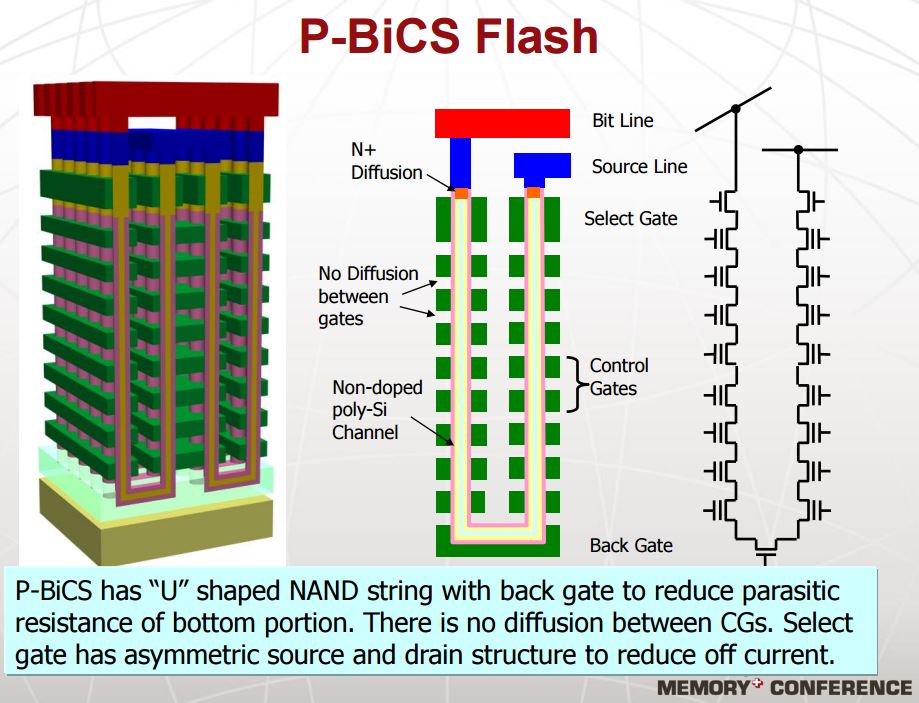

Toshiba and WD/SanDisk work together in the Flash Forward partnership, so both companies will share WD/SanDisk’s new BiCS3. However, there are very few publicly disclosed details on BiCS technology. We do know that BiCS utilizes charge traps (insulators), and although it uses a different production process than its competitors (SONOS v TANOS), its charge traps are similar to 3D NAND from SK Hynix and Samsung. BiCS3 will come in both MLC and 3-bit-per-cell (TLC) variants. The Intel/Micron IMFT tag team remains the sole 3D NAND producer that employs floating gate transistors.

"The launch of the next generation 3D NAND technology based on our industry-leading 64 layer architecture reinforces our leadership in NAND flash technology," said Dr. Siva Sivaram, executive vice president, memory technology, Western Digital. "BiCS3 will feature the use of 3-bits-per-cell technology along with advances in high aspect ratio semiconductor processing to deliver higher capacity, superior performance and reliability at an attractive cost. Together with BiCS2, our 3D NAND portfolio has broadened significantly, enhancing our ability to address a full spectrum of customer applications in retail, mobile and data center."

Curiously, the new BiCS3, which WD claimed is the worlds first 64-Layer 3D NAND, has a 256Gbit die density, which is the same density that SanDisk announced with the previous-generation 32-layer BiCS2. The company may have shrunk the die area or lithography in this generation, thus realizing more density and cost efficiency, but we have no details at this time. WD noted that it would use the new NAND to create packages up to half a TB, which indicates a 16-die stack.

| Companies | WD/SanDisk - Toshiba | Intel - Micron | SH hynix | Samsung |

|---|---|---|---|---|

| Partnership | Flash Forward | IMFT | none | none |

| 3D MLC Layers/Density | 64-layer 256Gbit | 32-layer 256Gbit | 36-layer 128Gbit | 48-layer 256Gbit |

| 3D TLC Layers/Density | 64-layer 256Gbit | 32-layer 384Gbit | - | 48-layer 256Gbit |

Samsung currently has 48-layer V-NAND with 256Gbit die density for both TLC and MLC, and Intel/Micron is producing 32-layer TLC NAND with 384Gbit density and 32-layer MLC with 256Gbit density. SK Hynix has a charge trap-based 36-layer 3D NAND V2 shipping, which has a 128Gbit die density. Flash Forward has the bragging rights of the highest 64-layer stack, but unless the company has a significantly smaller die, or is using a smaller lithography, it does not have the density lead.

The Flash Forward alliance is conducting pilot production at the 90,555ft2 Fab 2 in Yokkaichi, Japan, which the company completed this month. Flash Forward began construction in 2014, and the facility was partially completed in 2015. The first phases of 3D NAND production, likely with BiCS2, began in March.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The announcement highlights WD's new flash-powered advantage, particularly in comparison to Seagate. There is no substitute for owning a NAND fab, no matter how a vendor may spin it, and the $19 billion purchase of SanDisk, which was considerably undervalued, was a masterstroke. The ability to produce and access the NAND itself provides time-to-market, engineering and cost advantages that are almost impossible to beat in the long term. Toshiba also has both HDD and SSD production, so we expect competition to intensify between WD and Toshiba, even though the Flash Forward partnership oddly ties the companies together.

WD now has its own NAND and an entire constellation of flash IP to tie it all together, including its purchases of HGST, STEC and Virident, among others, which unquestionably gives the company the broadest portfolio of storage products on the market. The Active Archive and InfiniFlash products provide bookend enterprise storage systems, which will surely expand with time, and the company has far too many discrete SSDs to list.

The company indicated that volume shipments of BiCS3 would begin for the retail market in the fourth calendar quarter of this year, and the company will begin OEM sampling this quarter. BiCS3 will have mass availability ("meaningful shipments") in the first half of 2017, but the company did not indicate when we would see BiCS2 in the field.

As noted, we have precious little information to work with, but we will are reaching out to representatives for more information.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

WFang 2017 should be an interesting year for a lot of things... Hopefully it pans out well for SSD pricing and capacity, as well as competition on the CPU and GPU front (unrelated to this article, other than the 2017 target.)Reply -

hannibal Does anyone know about thisReply

http://hexus.net/tech/news/storage/94762-besang-incs-3d-super-nand-costs-just-2-per-gigabyte/ -

WFang Thanks for sharing, that was an interesting read.. I wonder if endurance is an issue since each cell is so much smaller? Failing that, it may be price-fixing between competitors (which is illegal but sometimes happens).. It is surprising that nobody has brought this to market yet (that I am aware of) which makes me think its either leaving out critical issues/problems (e.g. endurance) or it is a conspiracy by market leaders to keep the pricing at current high-margin levels.Reply

Sooner or later, if the technology actually delivers on its promises, someone will get greedy and undercut everyone else and flood the market with these.