eBay Historical GPU Prices 2023: November 2023 Update

How much for a used graphics card this holiday season?

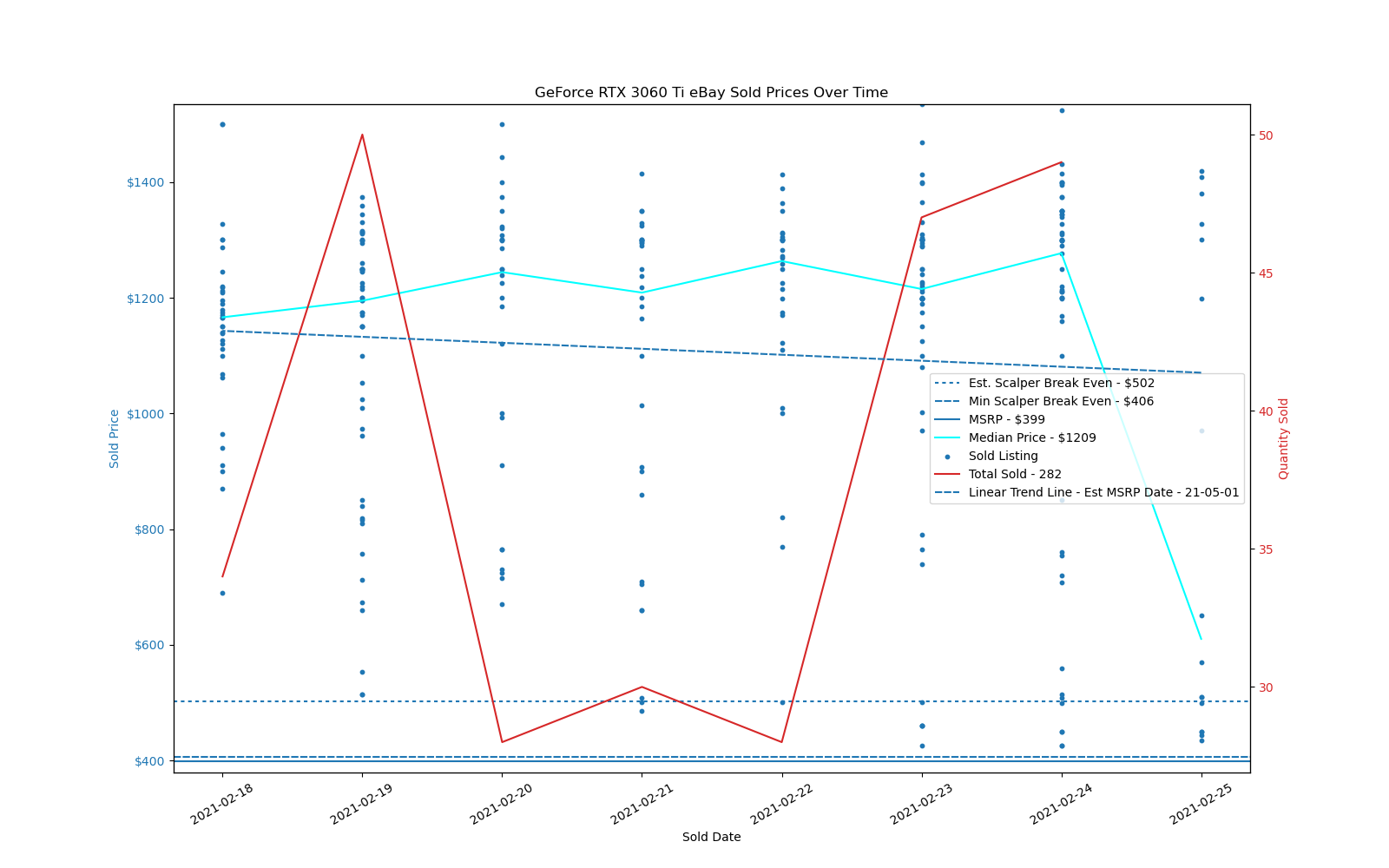

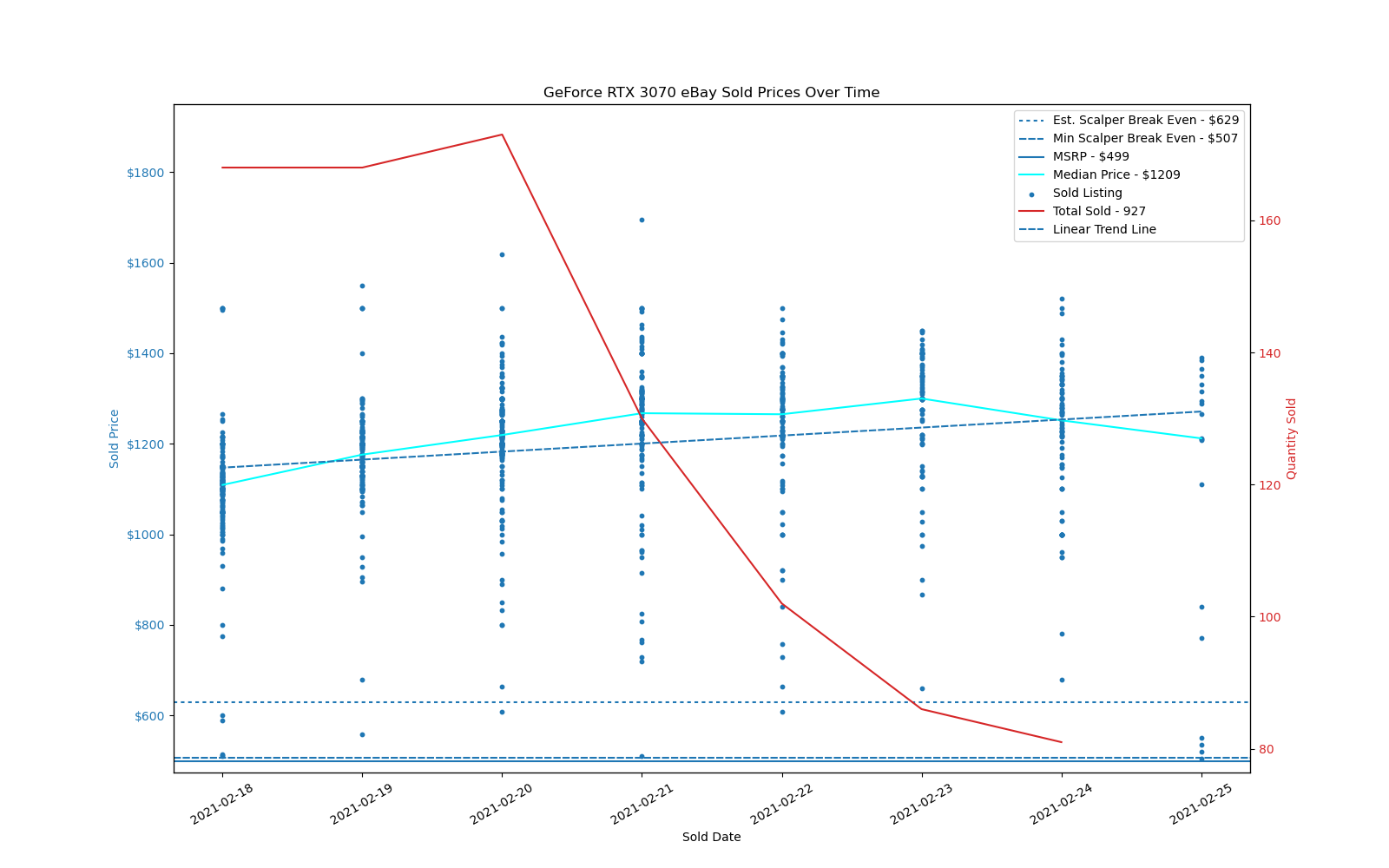

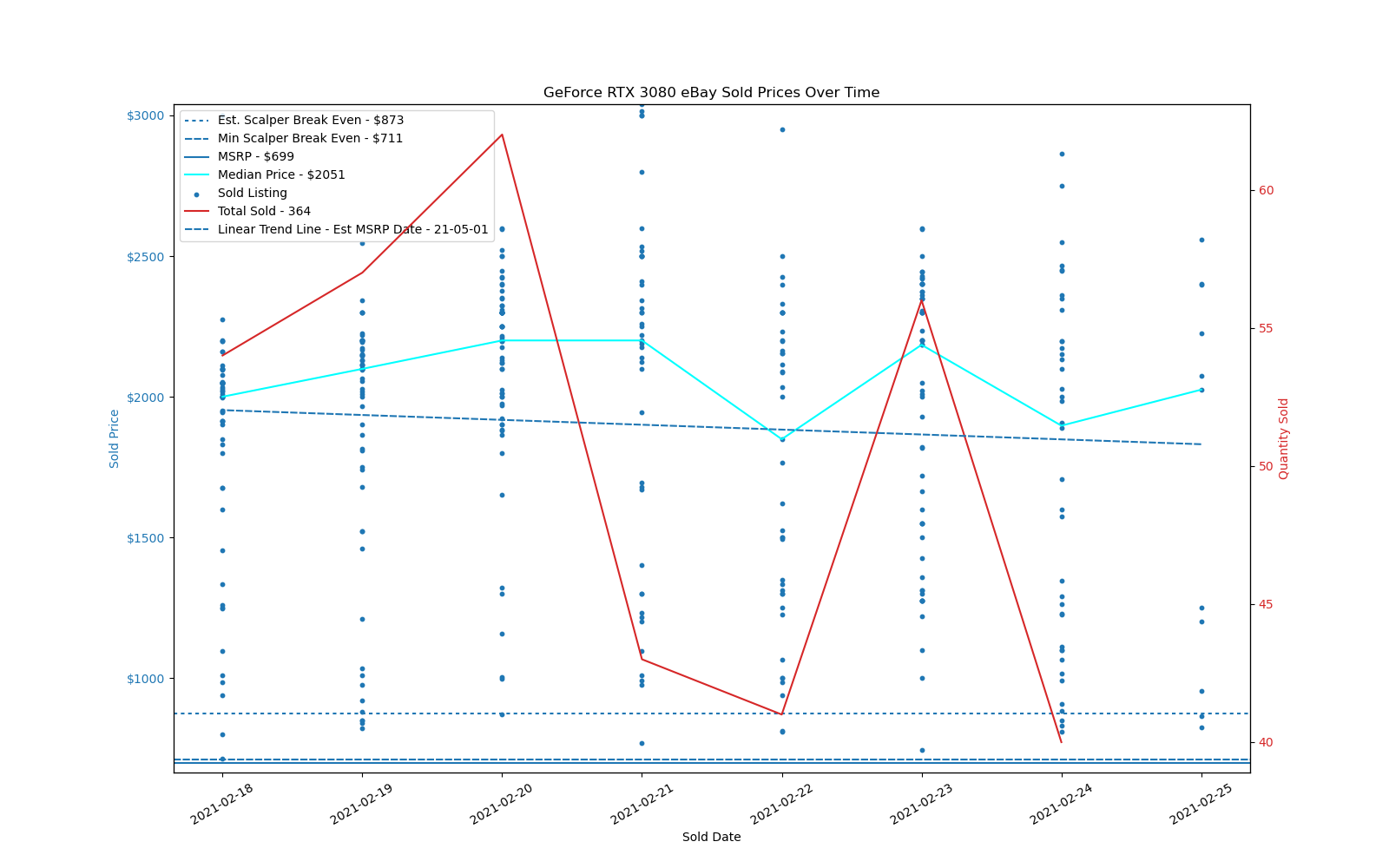

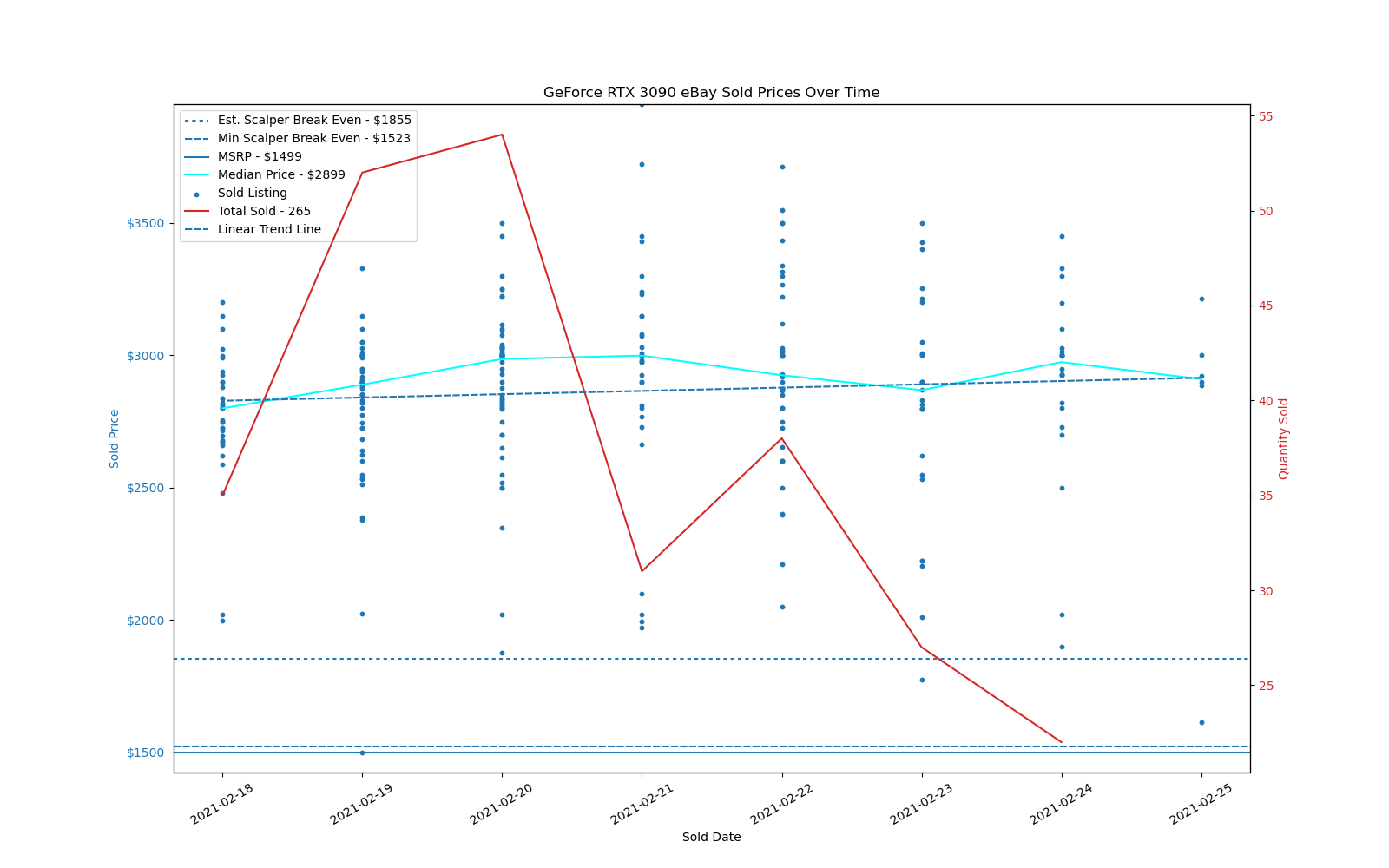

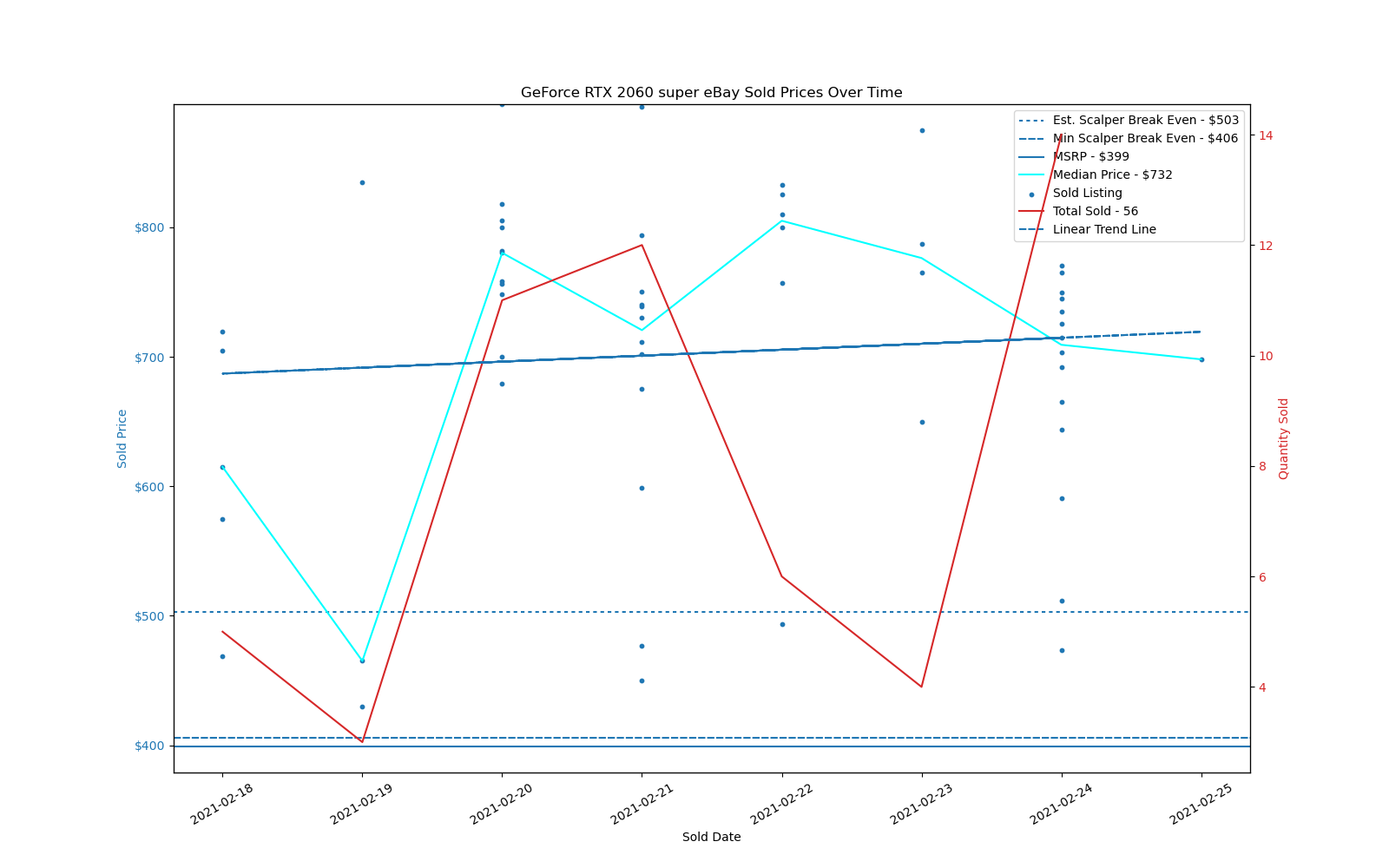

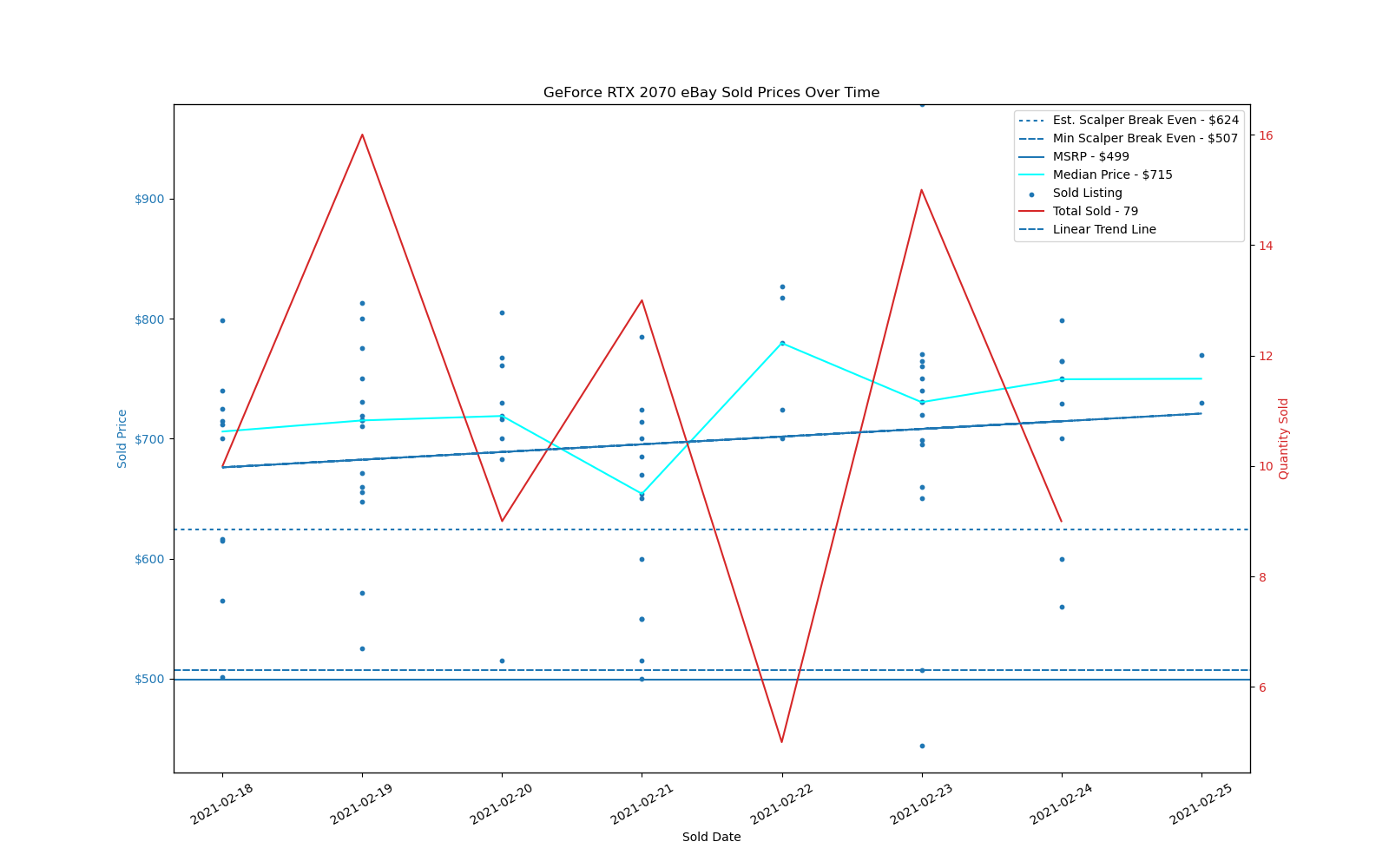

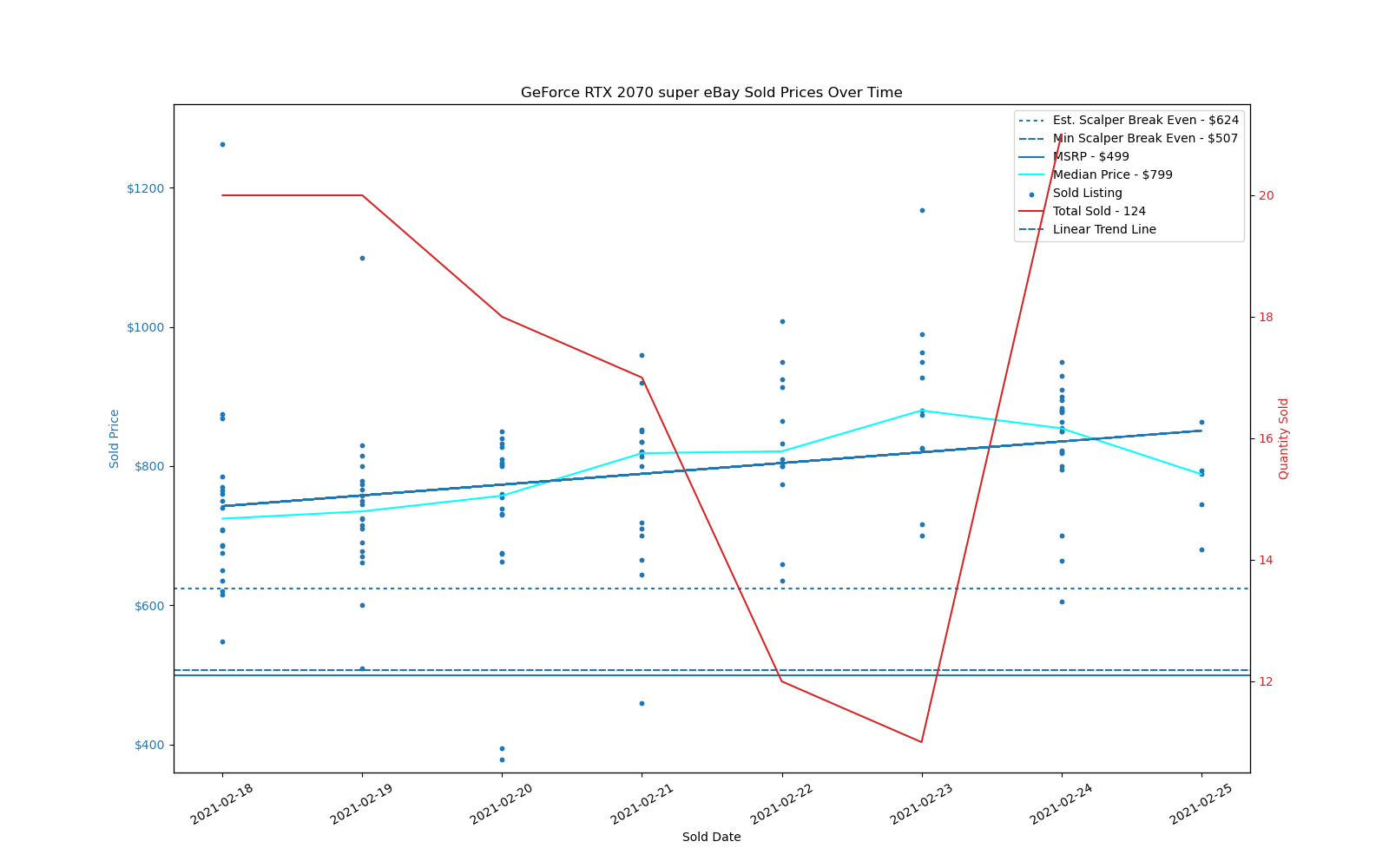

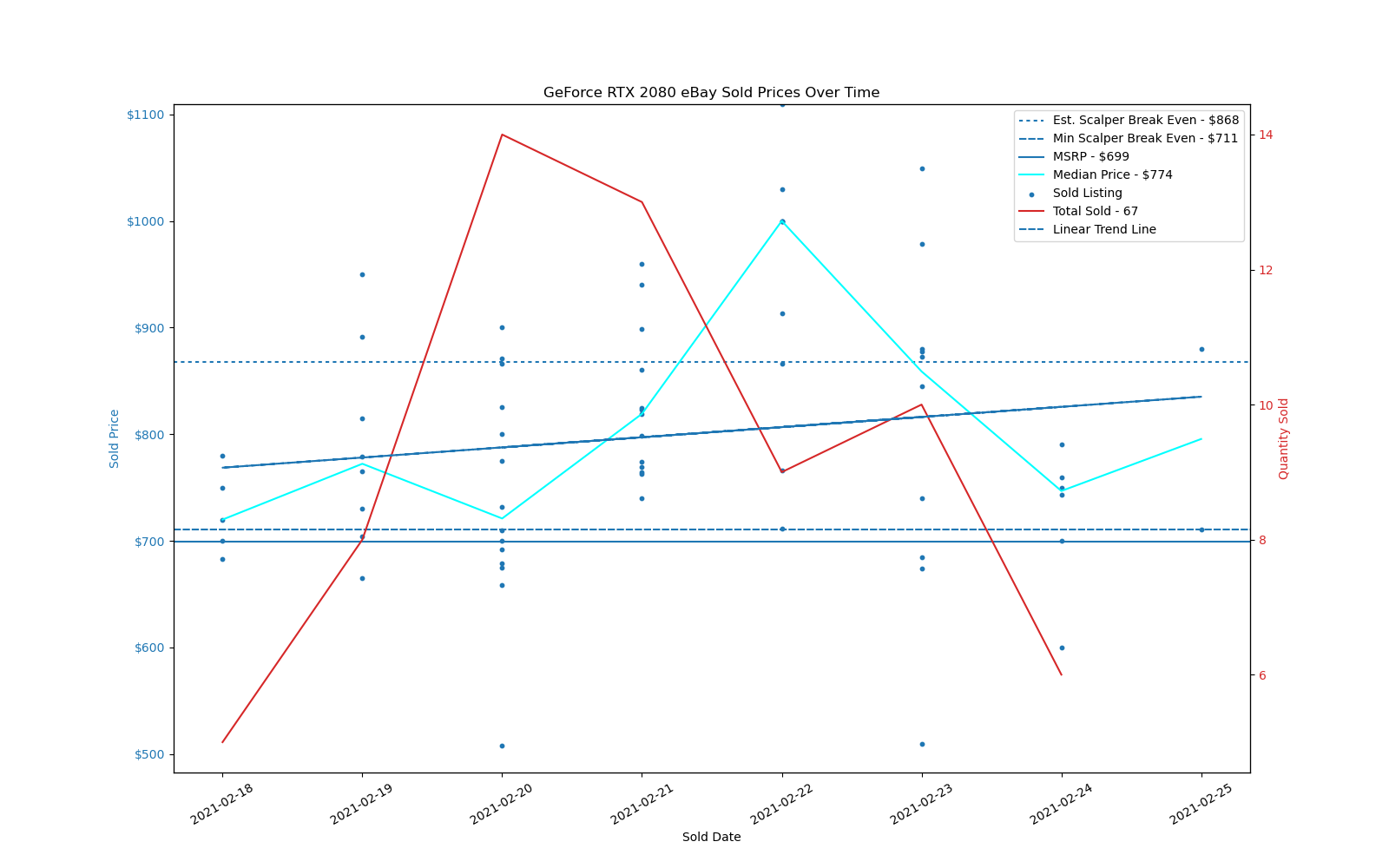

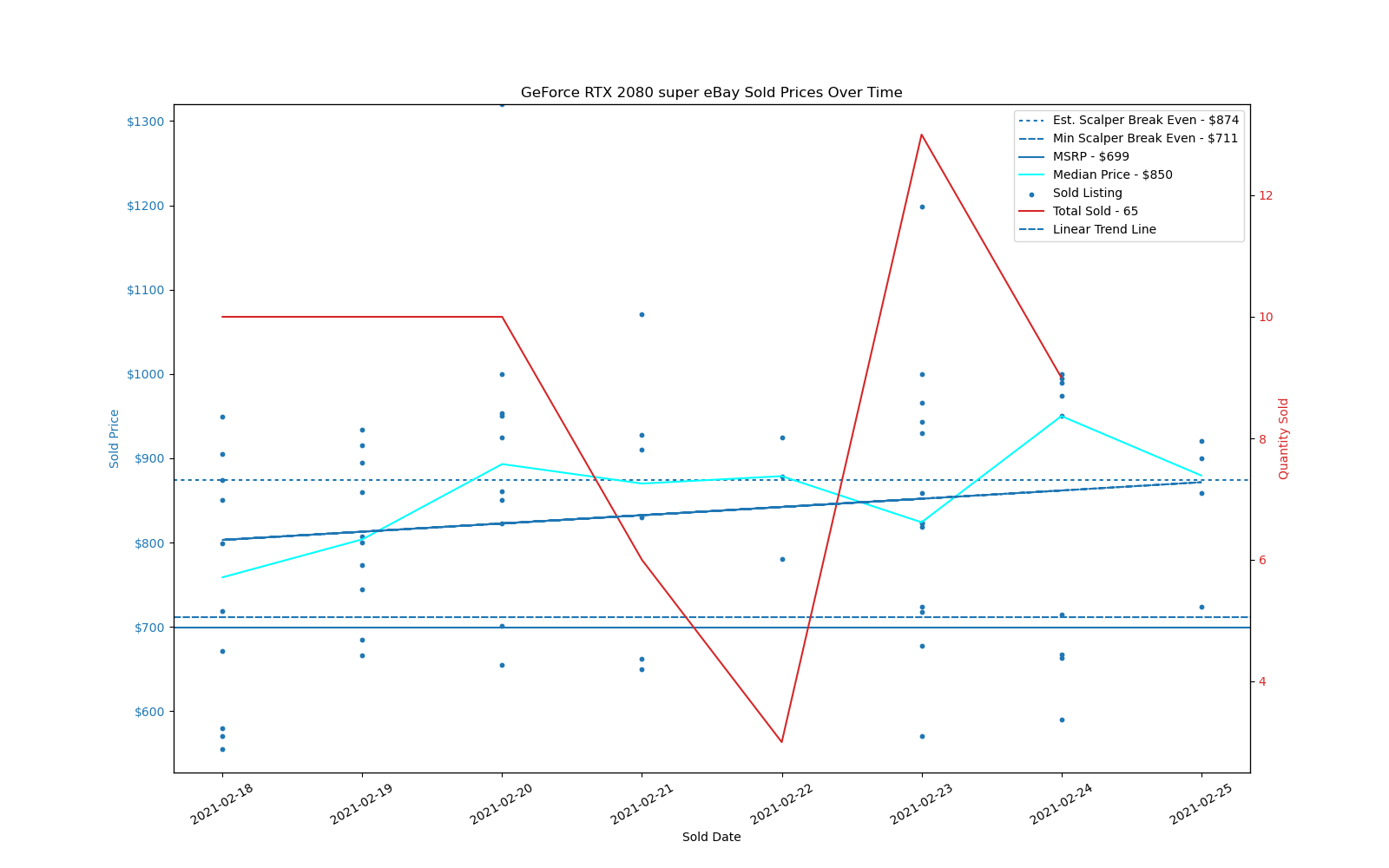

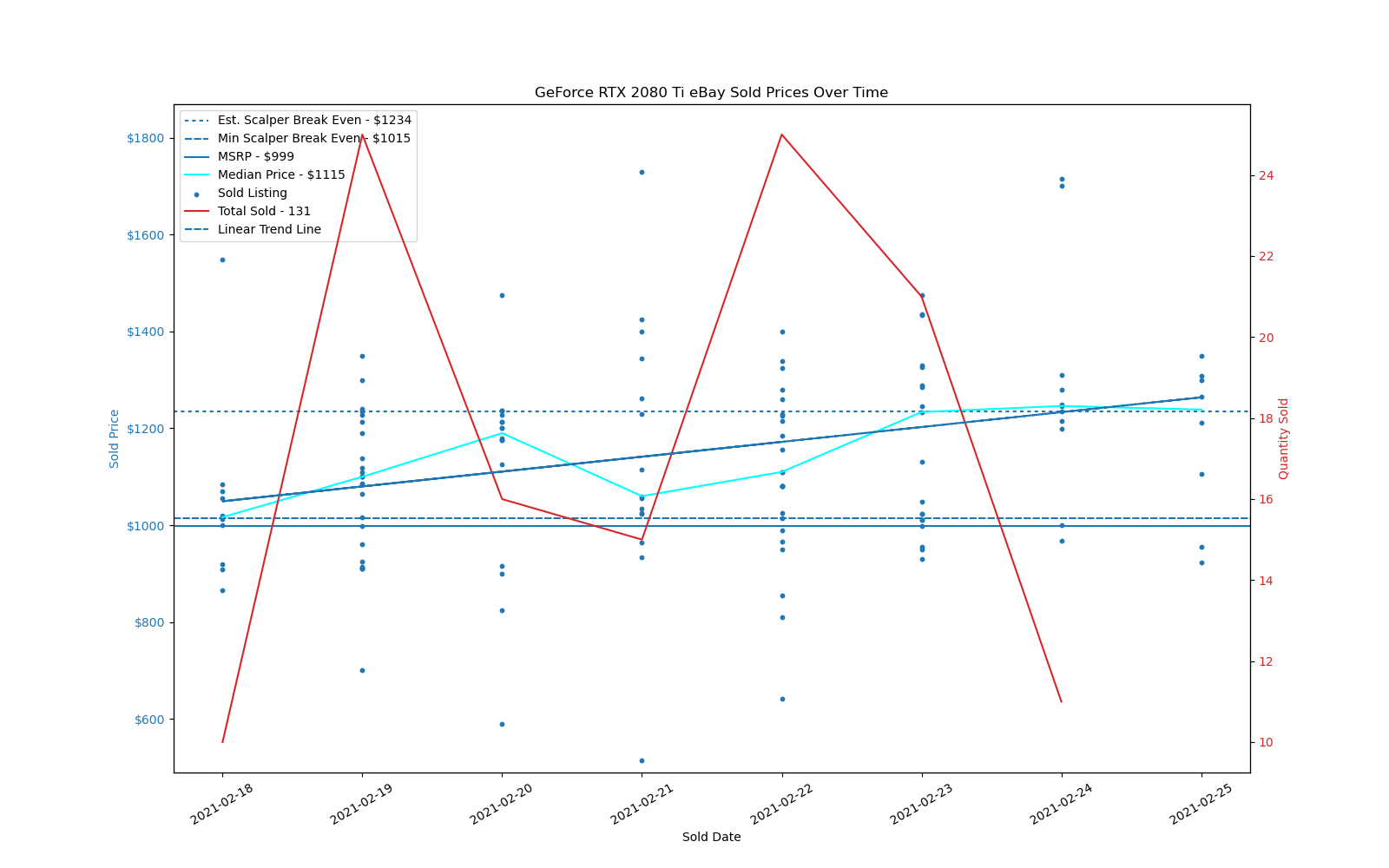

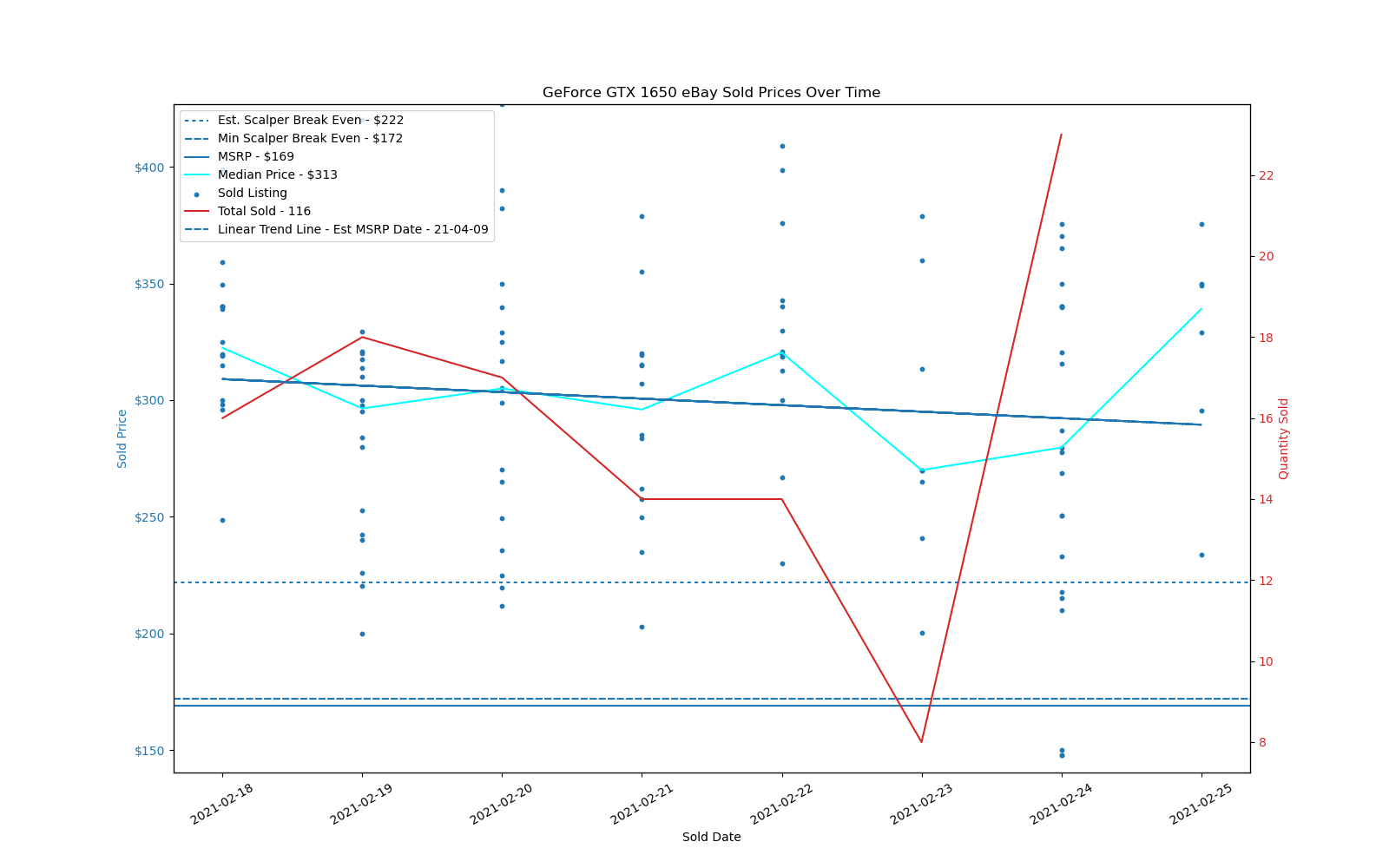

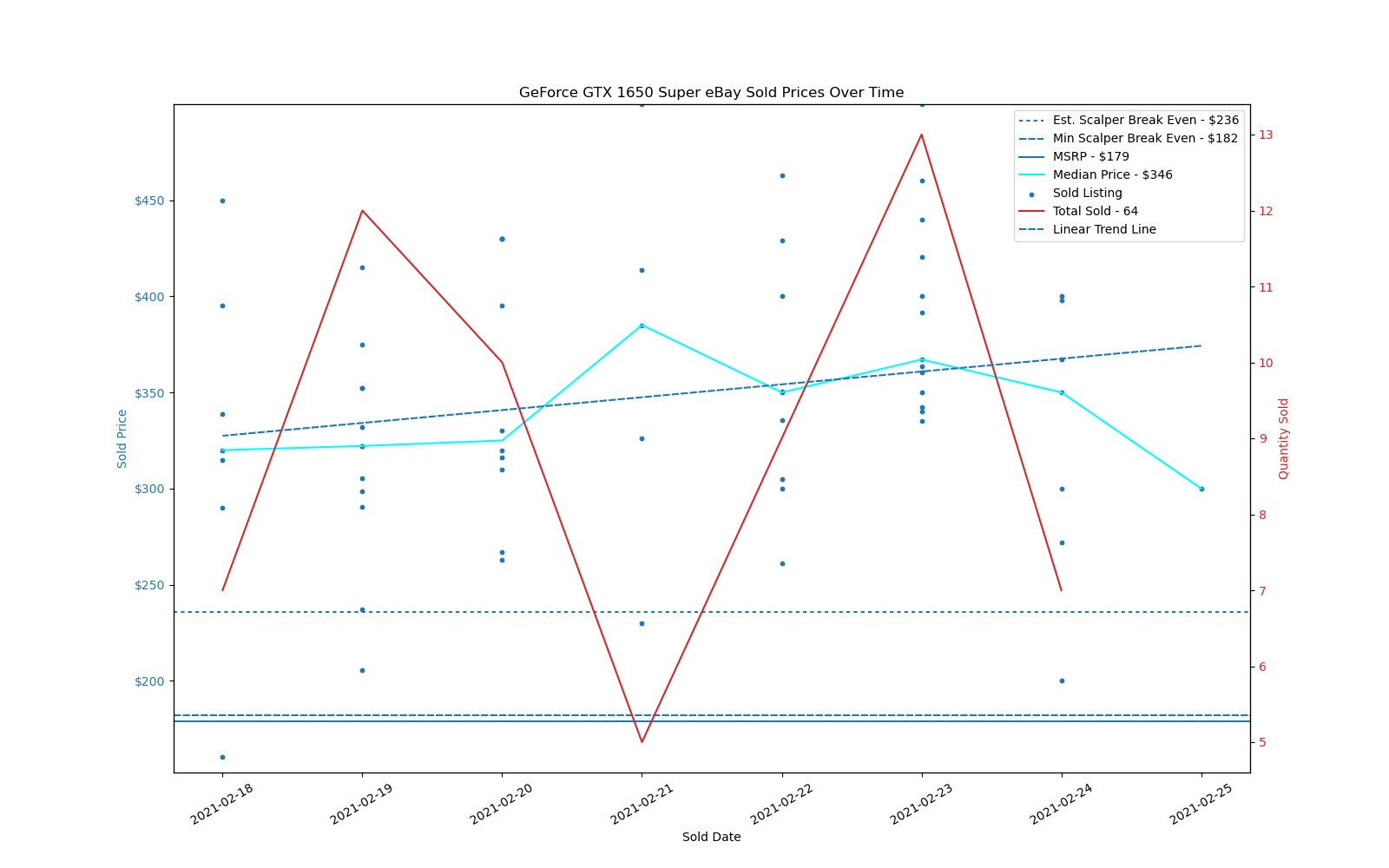

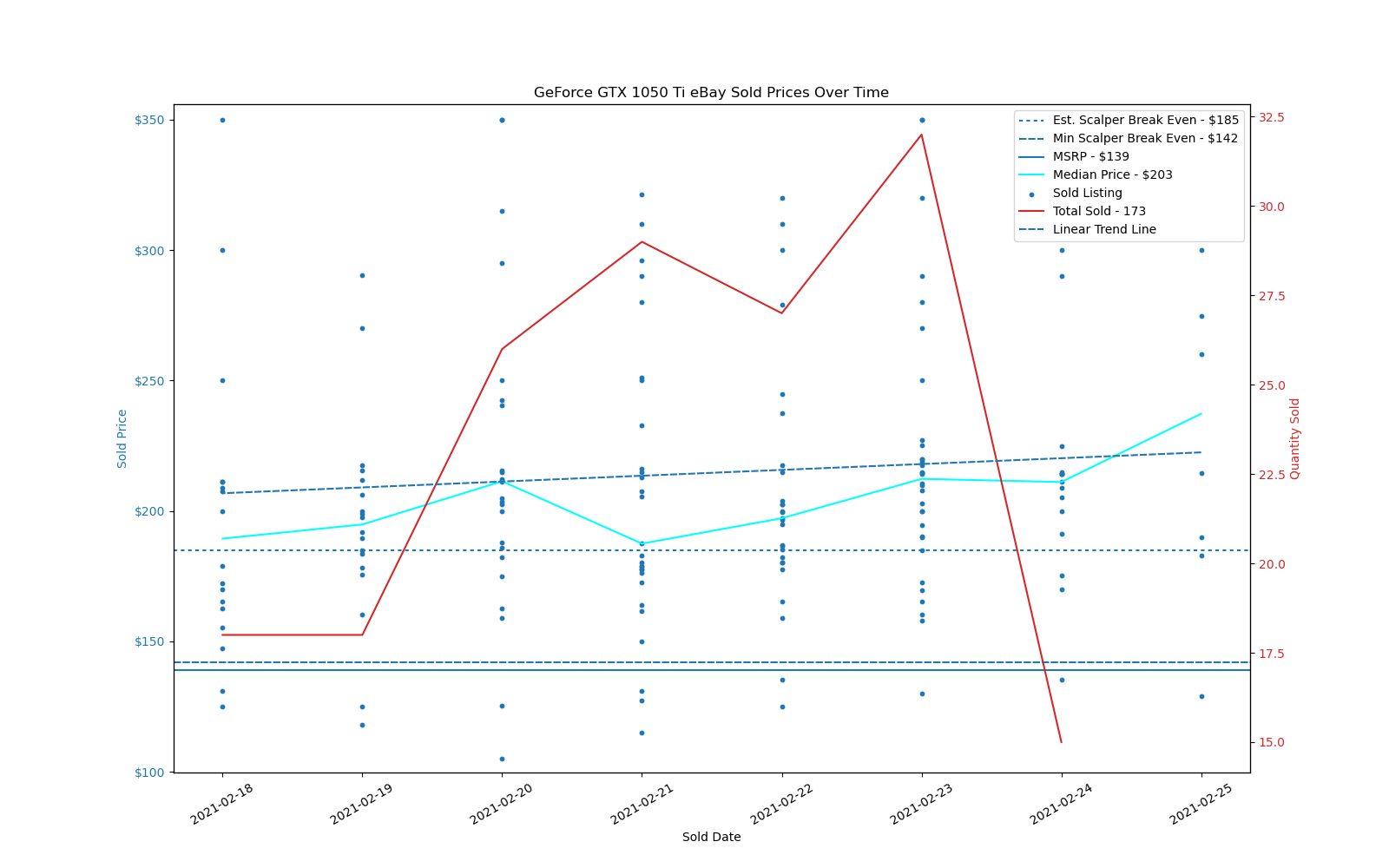

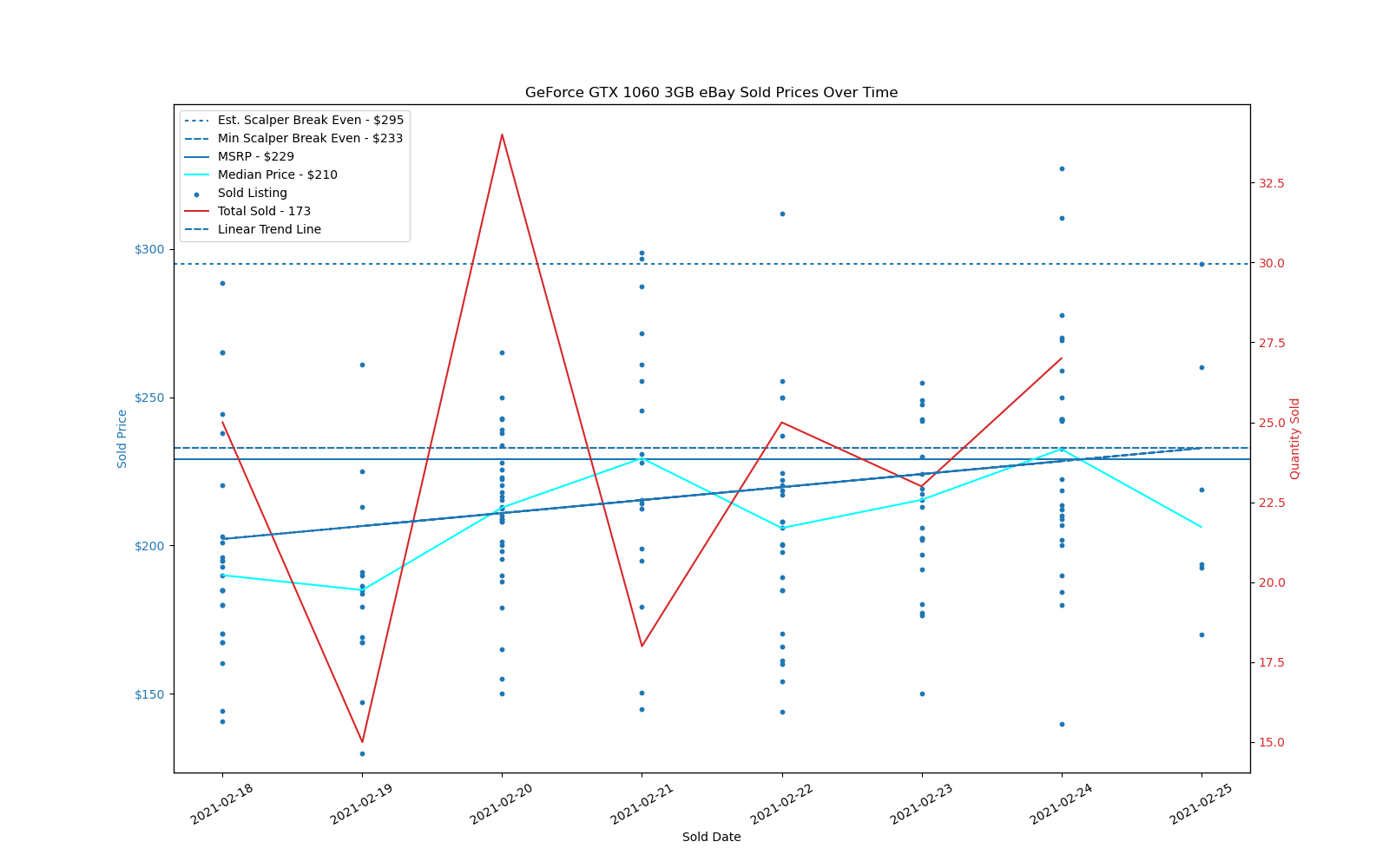

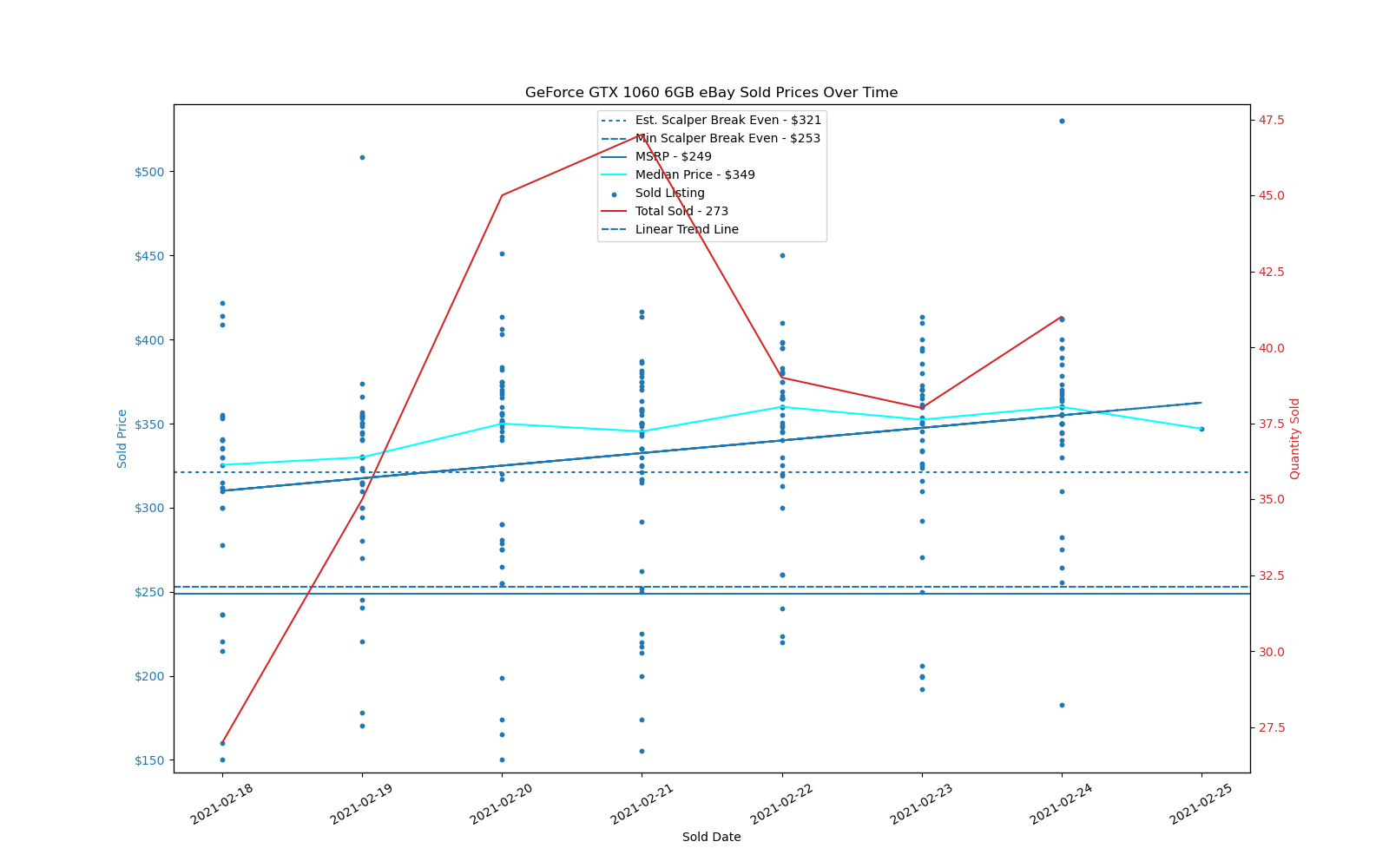

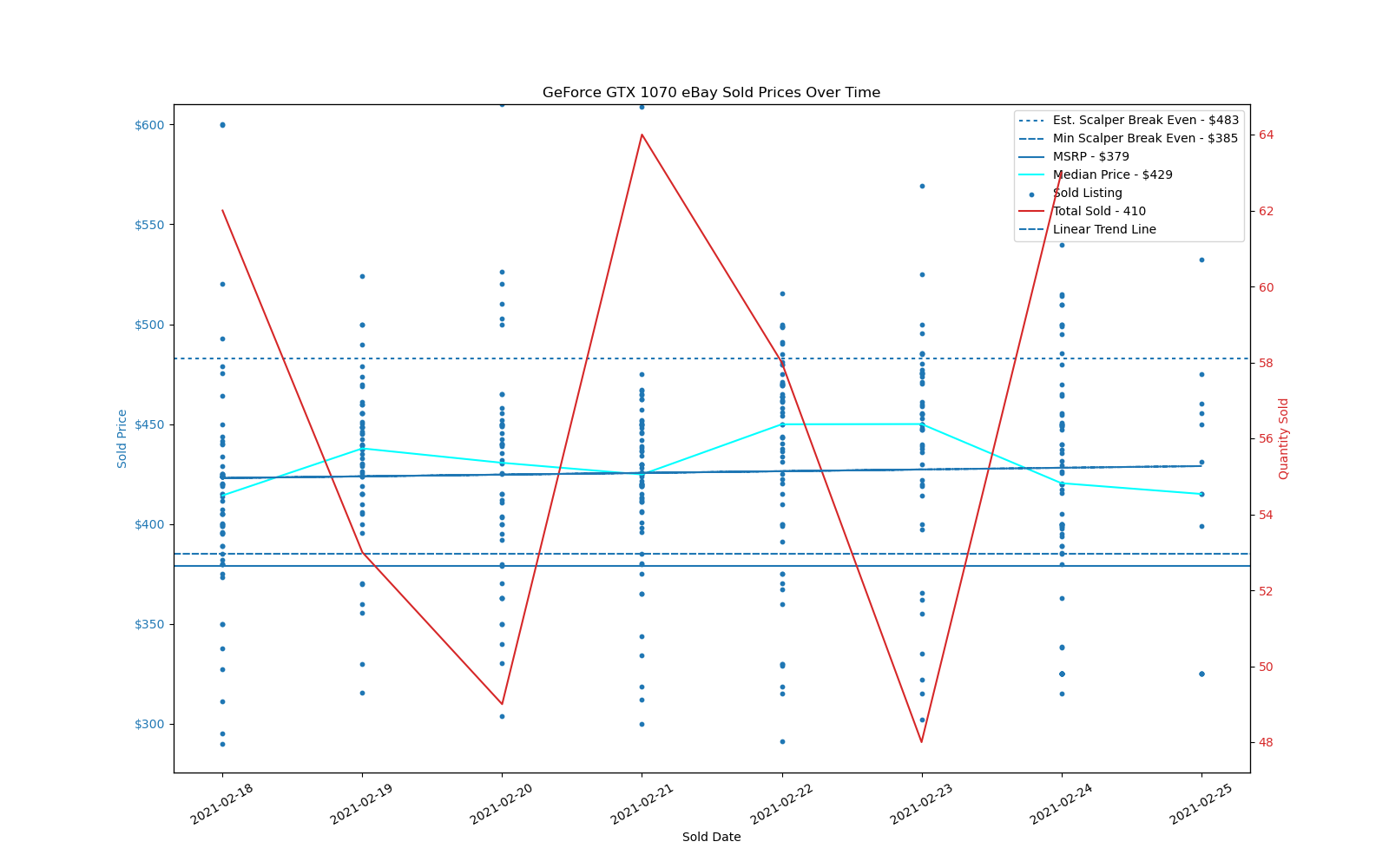

Feb 18 – 24, 2021

These charts from Feb 18-24, 2021 represent the first time we pulled all of this data into one place. We gathered data on 39 different GPUs, the day the RTX 3060 12GB launched. These earlier charts also tend to be a bit more cluttered, but we're leaving them 'as is.' Everything below this point is unaltered since Feb. 25.

Ampere and RDNA2 Graphics Cards

Starting with the latest graphics cards from AMD and Nvidia, everything continues to sell for far above the official launch prices. RTX 3080 has now breached the $2,000 mark for average eBay price during the past week, which actually starts to make the $2,889 median pricing of the 3090 seem almost reasonable. Okay, it's not at all 'reasonable,' but it's 10–15% faster for 42% more money, compared to a difference in MSRPs of 114%. Based on eBay price vs. MSRP, the RTX 3060 Ti ends up as the worst 'deal' right now: It costs more than the RTX 3070 and has a median price three times higher than its MSRP. The 3070 isn't that much better, however, selling for 2.38 times its launch price — it's also the most popular / available of the Ampere GPUs, selling more units than the other three combined. We don't have data for the newly launched GeForce RTX 3060 12GB yet, but given the reduced mining performance it will hopefully land closer to its official MSRP.

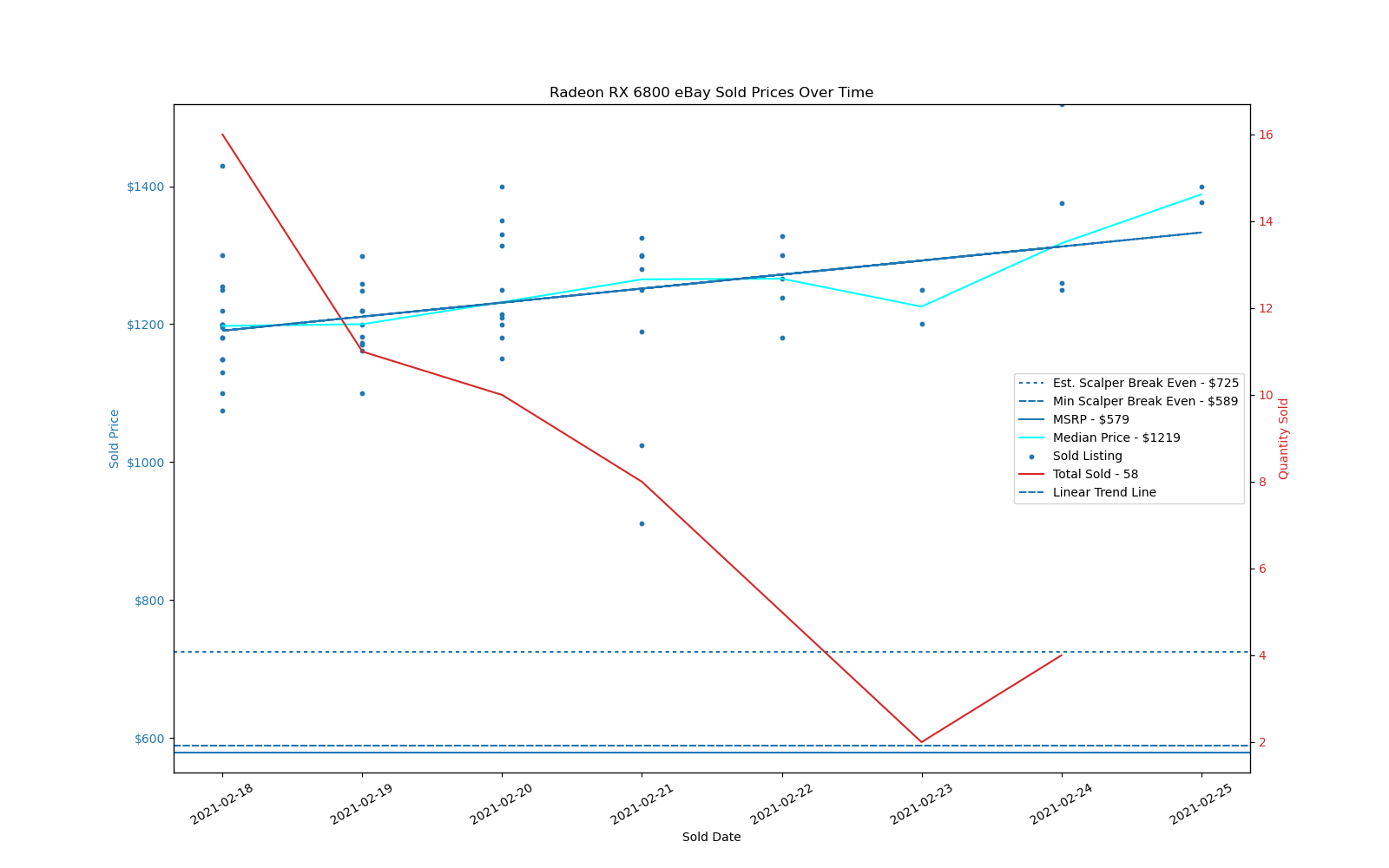

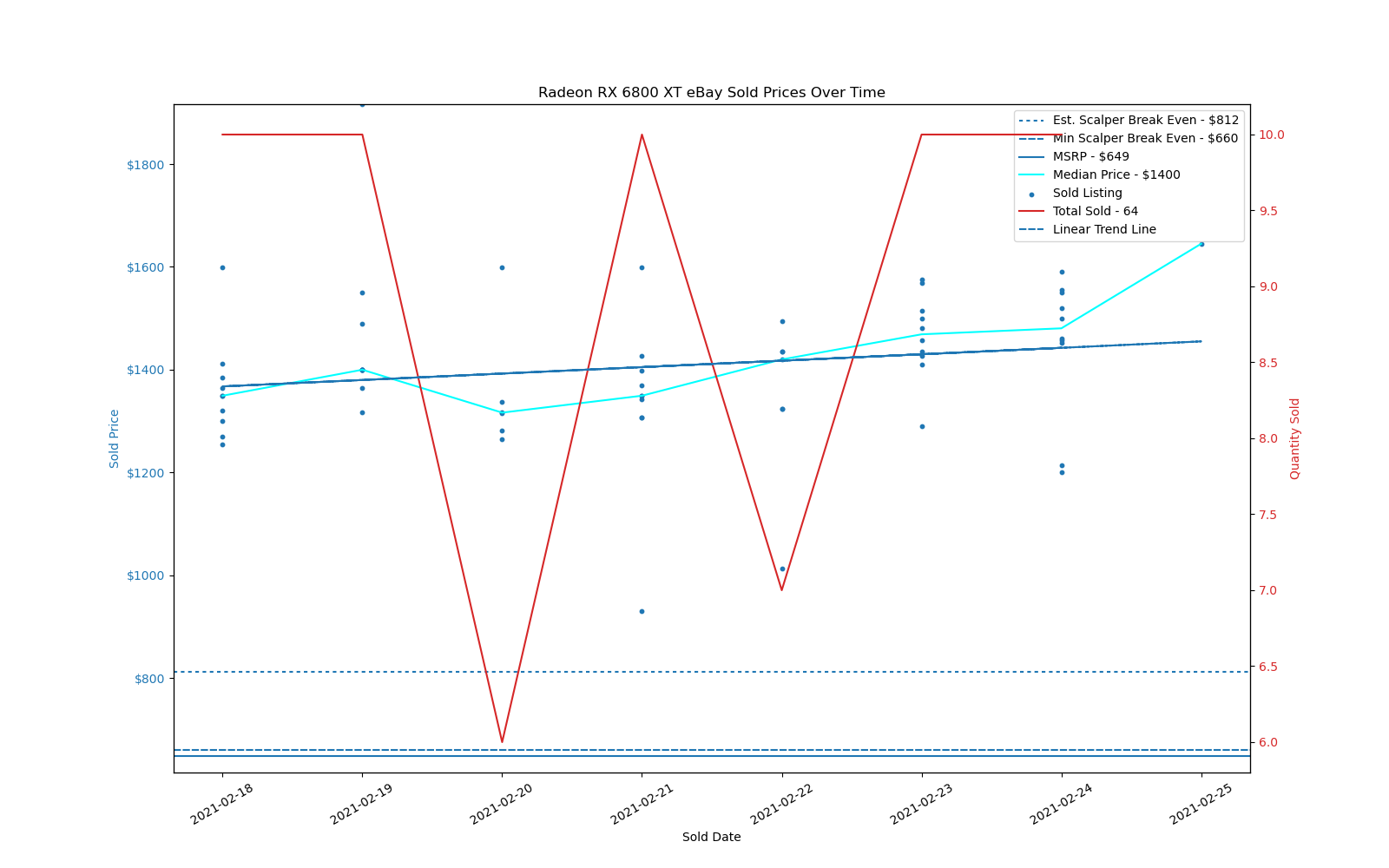

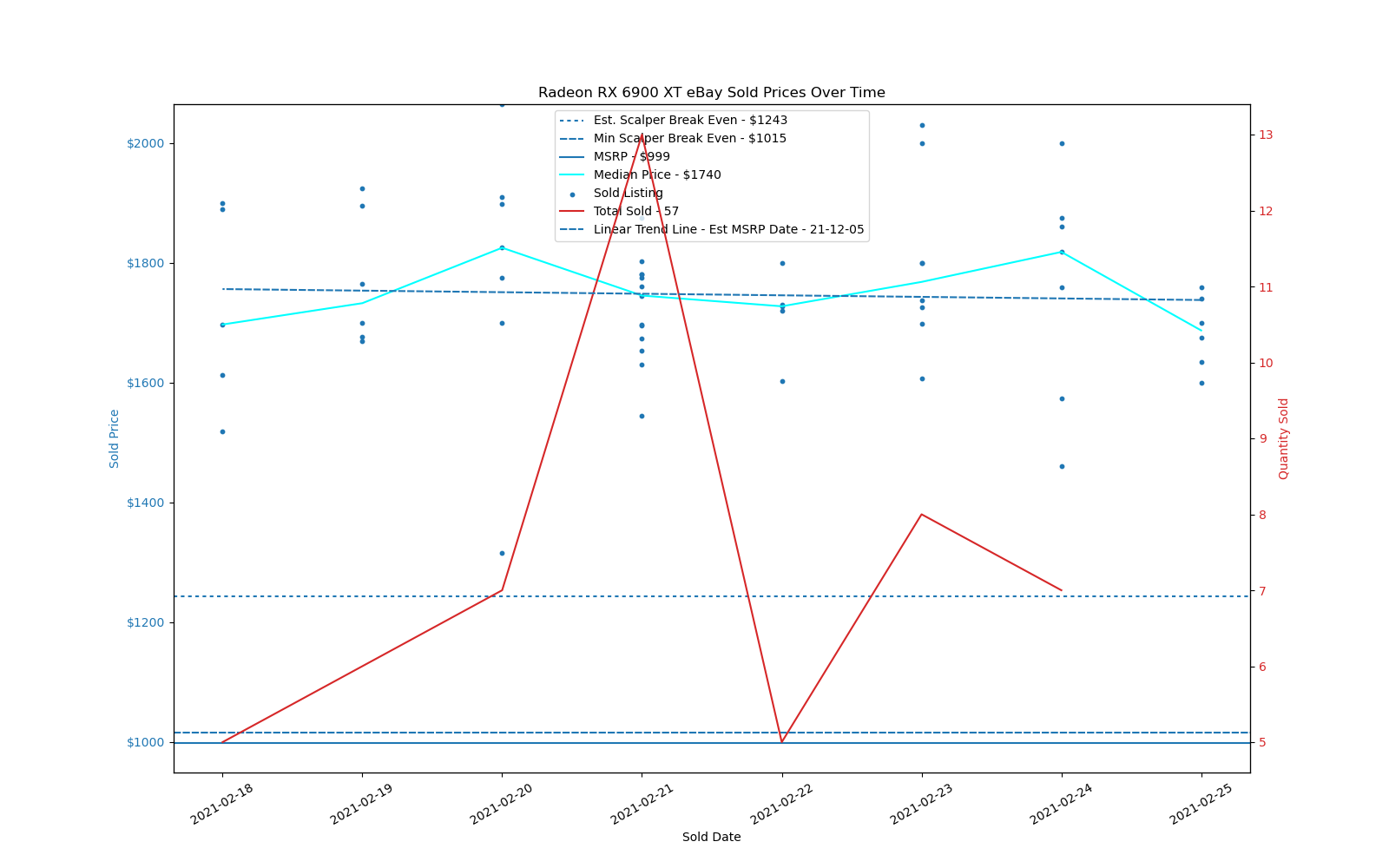

AMD's Big Navi GPUs tell a similar story. The RX 6800 costs more than double the official launch price, as does the RX 6800 XT. The RX 6900 XT is the closest to its MSRP, with a 73% markup on the median price, and given its real-world performance it might be slightly more desirable if you're willing to pay these prices. For miners, of course, the RX 6800 remains the best option of the three cards, since all three hit roughly similar hash rates.

Turing and RDNA1 Graphics Cards

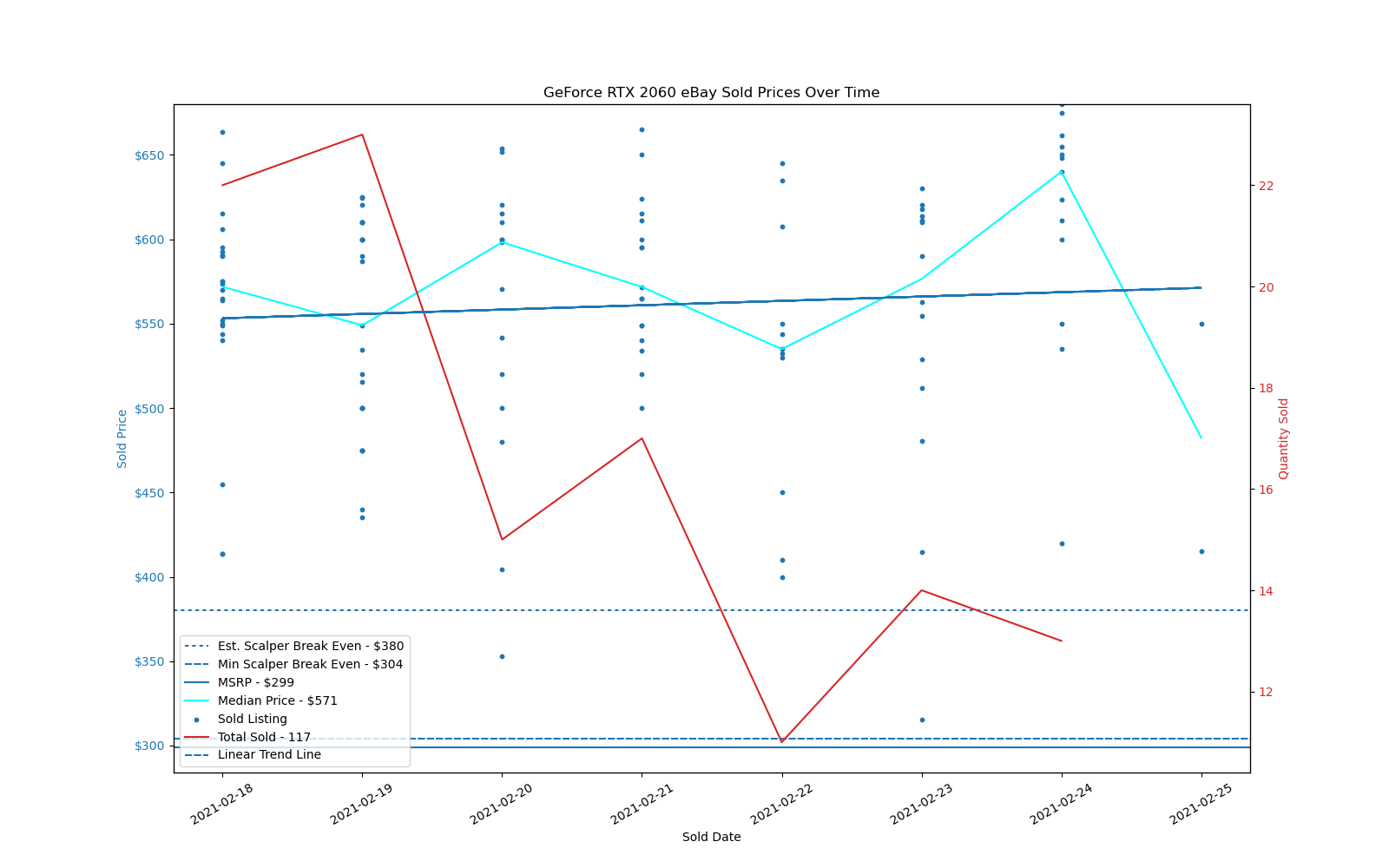

Stepping back one generation, the Turing and RDNA1 cards mostly launched in 2018 and 2019, with a few updates and additions in early 2020. Prices on some models at least get somewhat close to the original MSRPs, though normally we'd expect most of these cards to cost much less than their original launch prices. Median prices on the RTX 20-series GPUs range from just 10% over the launch price (2080 and 2080 Ti), to 80–90% above the lowest MSRP (2060 and 2060 Super). As we've noted elsewhere, most of the prices show a very strong correlation with Ethereum mining performance.

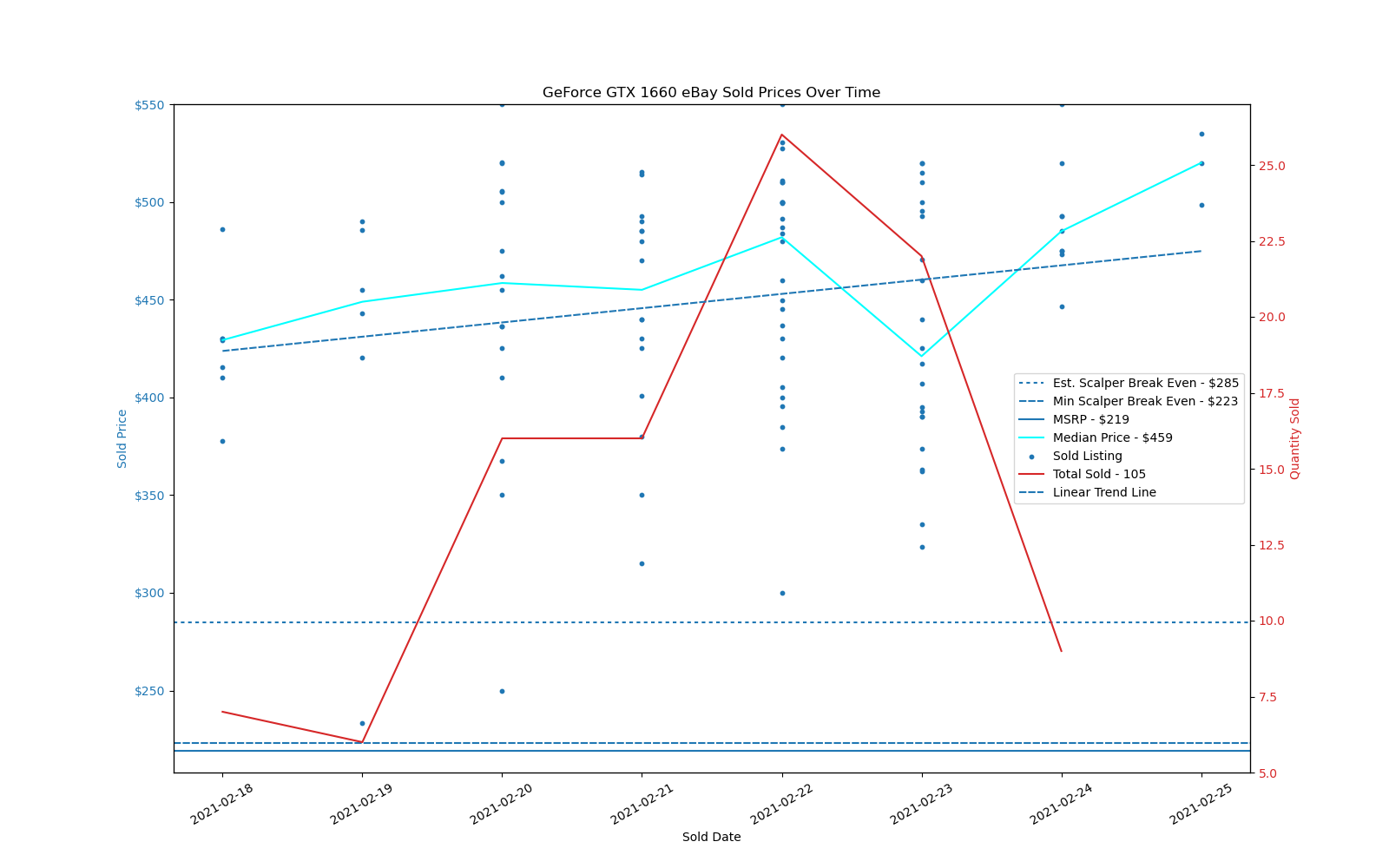

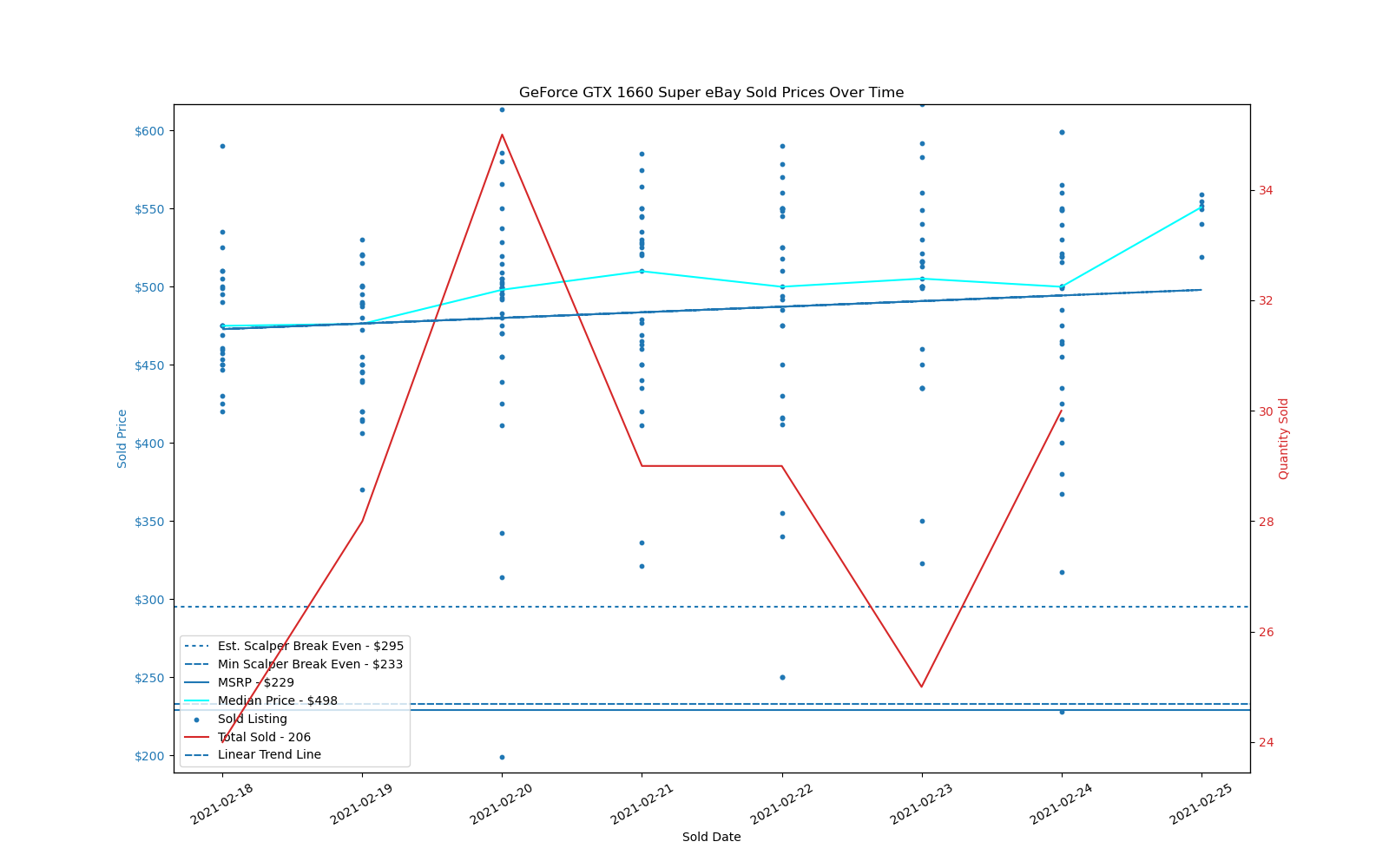

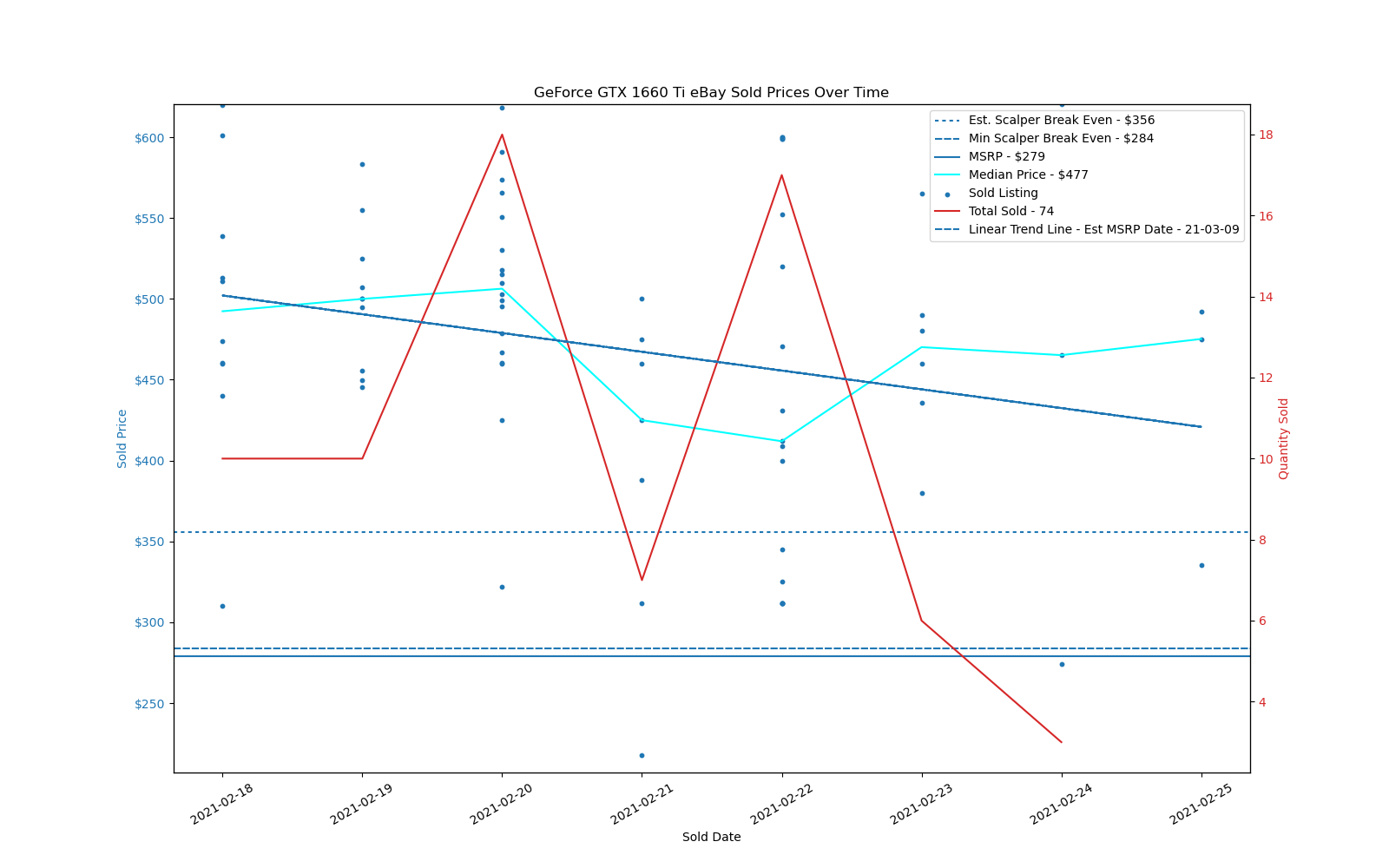

Nvidia's GTX 16-series Turing GPUs are also selling at elevated prices, and the cards with 6GB or more VRAM carry a premium. You can find lower prices on a GTX 1650 or 1650 Super compared to the 1660 cards, but performance is also quite a bit worse. The 1650 basically costs twice the launch price, as does the 1650 Super. Shift up to the 6GB cards and the 1660 GDDR5 model and 1660 Super are more than double the MSRP, while the 1660 Ti actually costs less than the 1660 Super — but only one third as many cards have been sold.

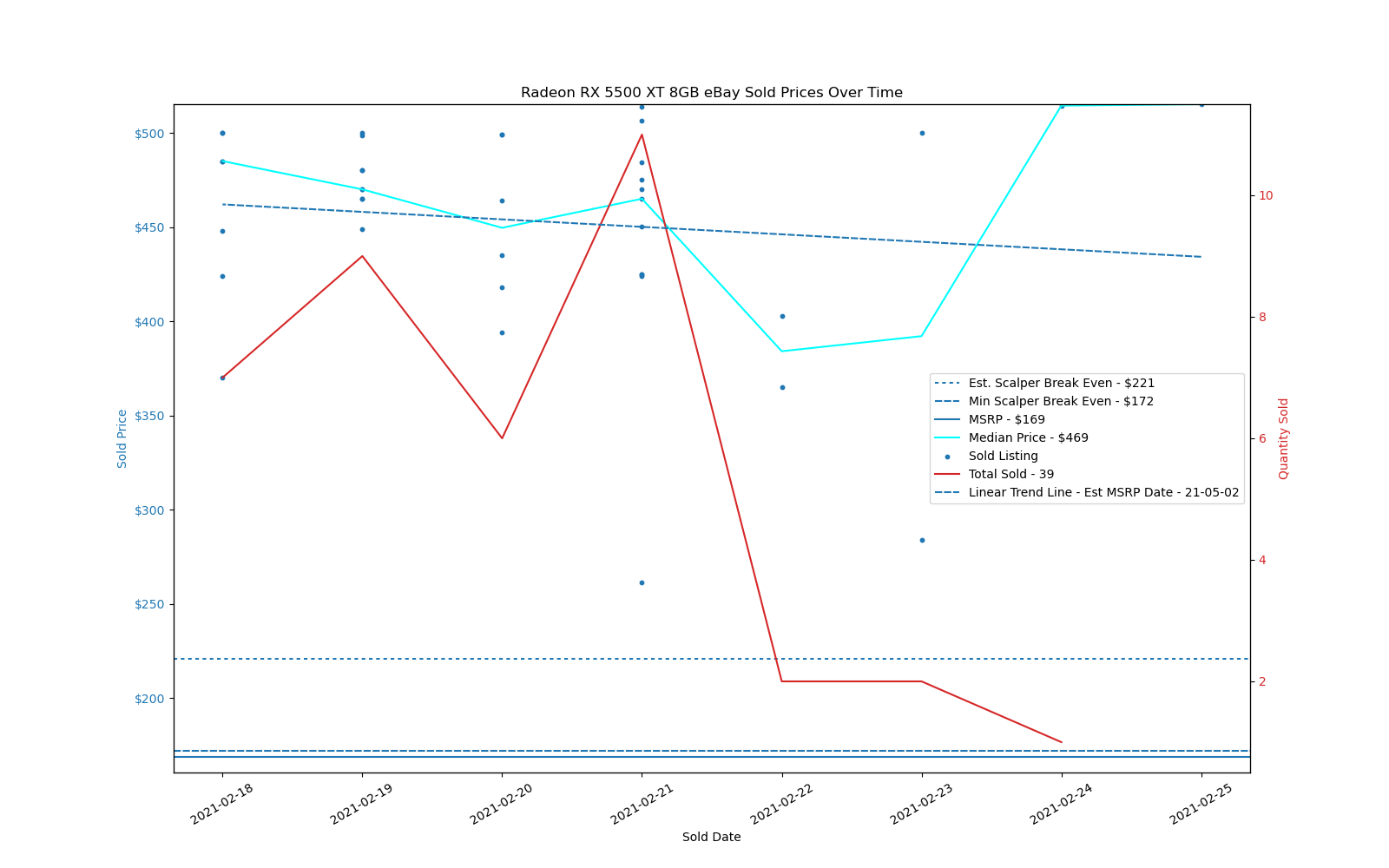

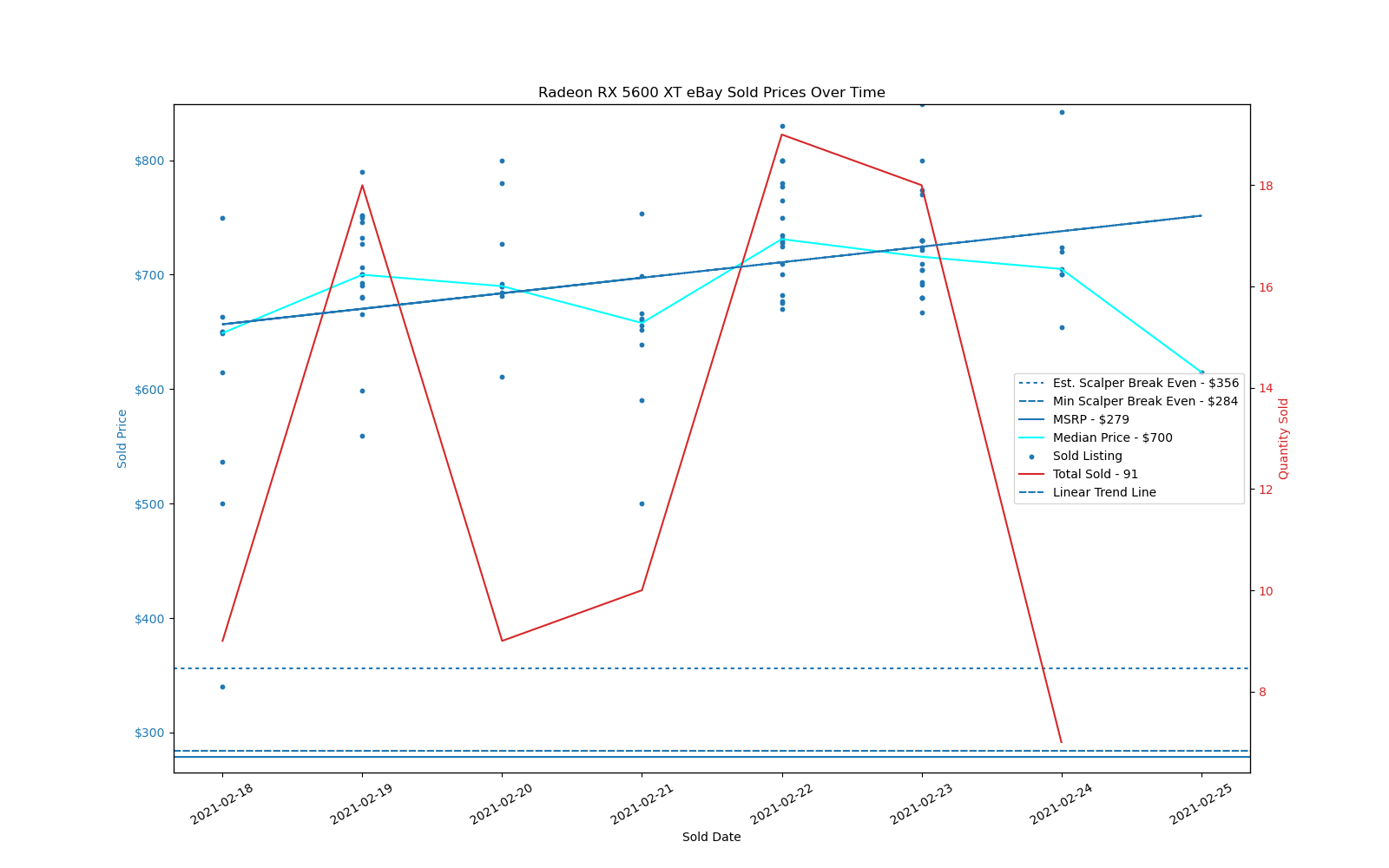

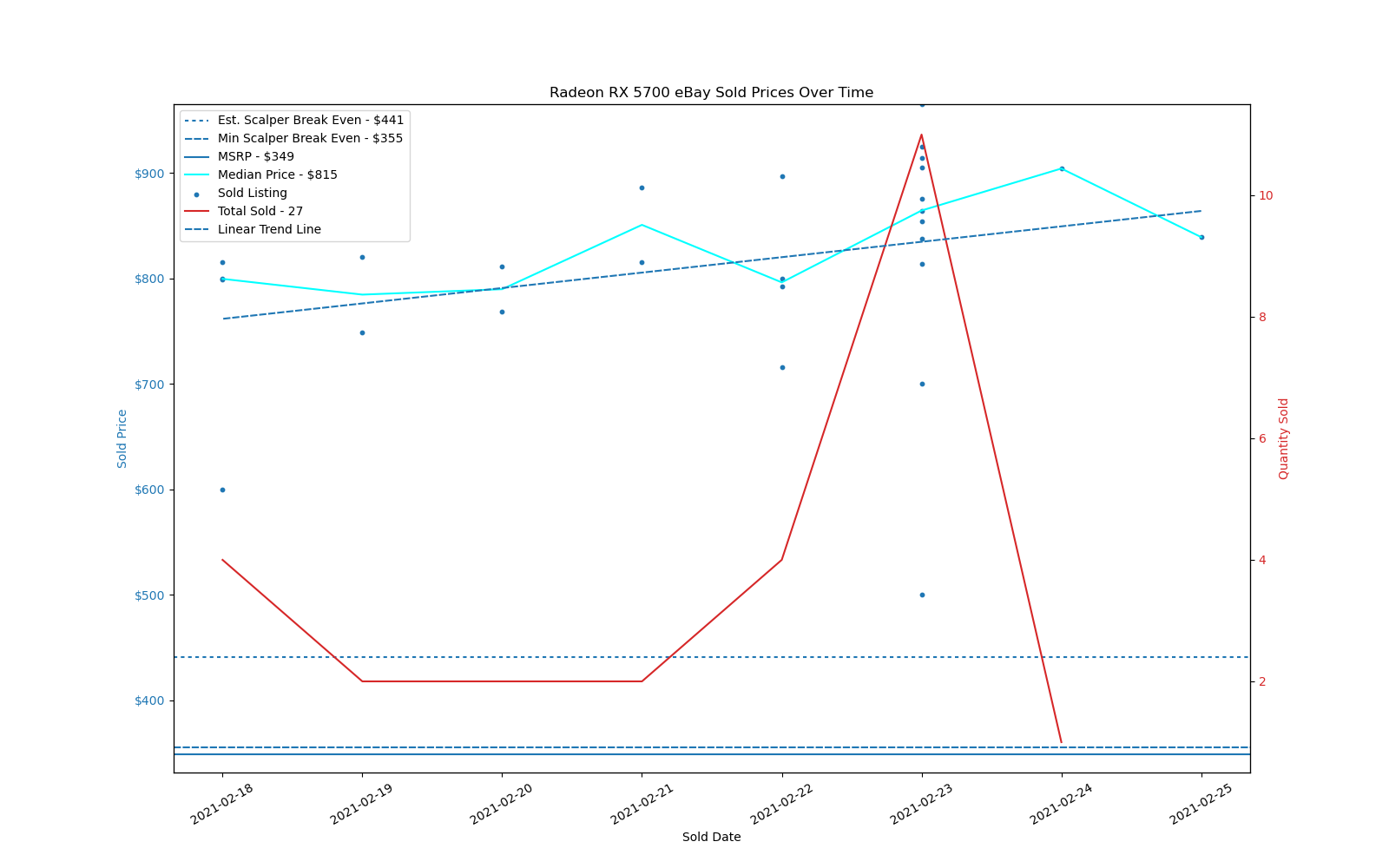

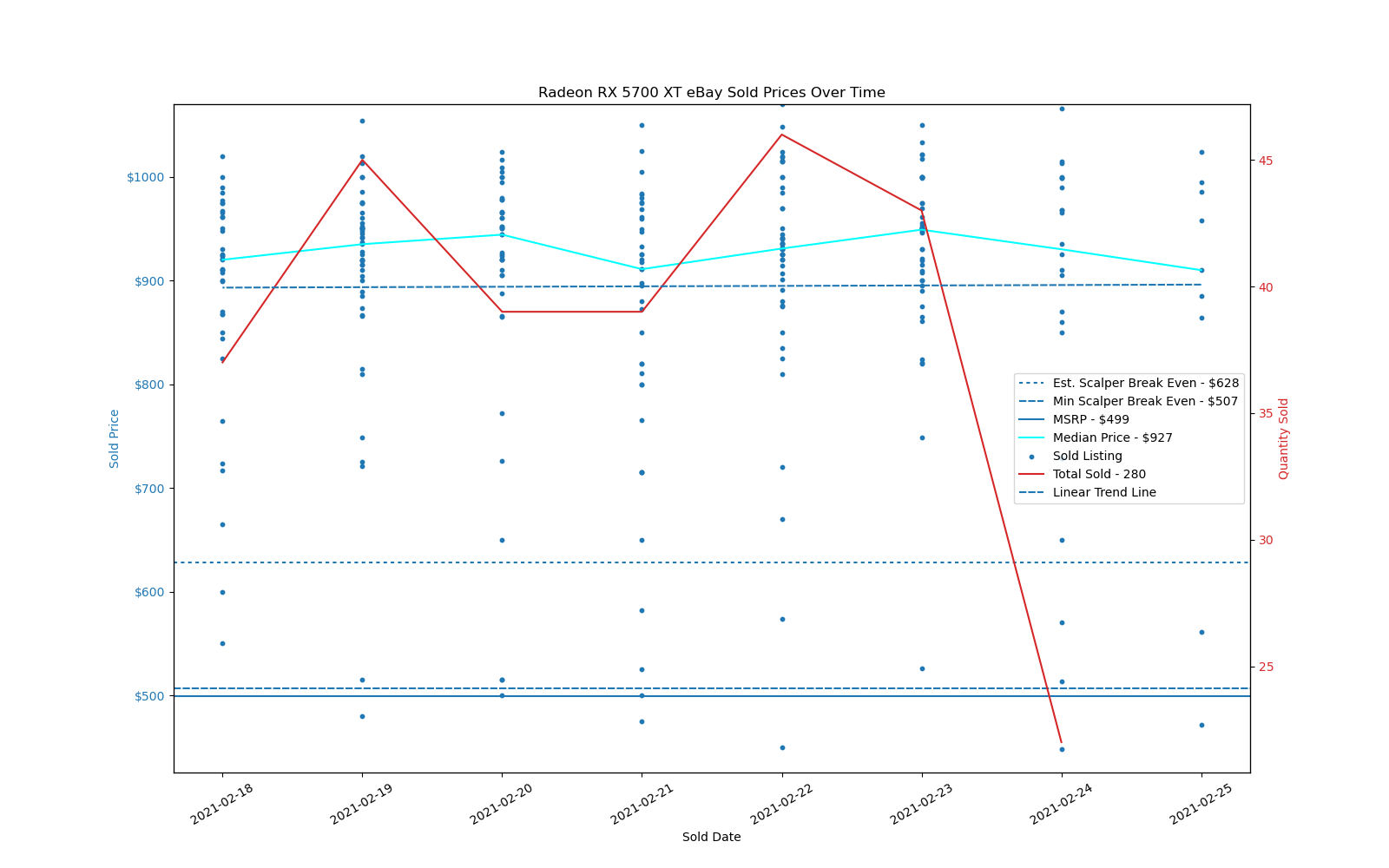

AMD's RDNA1 / Navi 1x cards are in a similar state. The most popular card, by far, is the RX 5700 XT, selling 280 units with a median price of $927. Yup, that's more than double the launch price. RX 5700 costs less but has only had 27 units sold in the past week, so good luck getting one. RX 5600 XT similarly costs 250% of the original price, and RX 5500 XT 8GB sits at nearly three times its launch price.

Pascal, Vega, and Polaris Graphics Cards

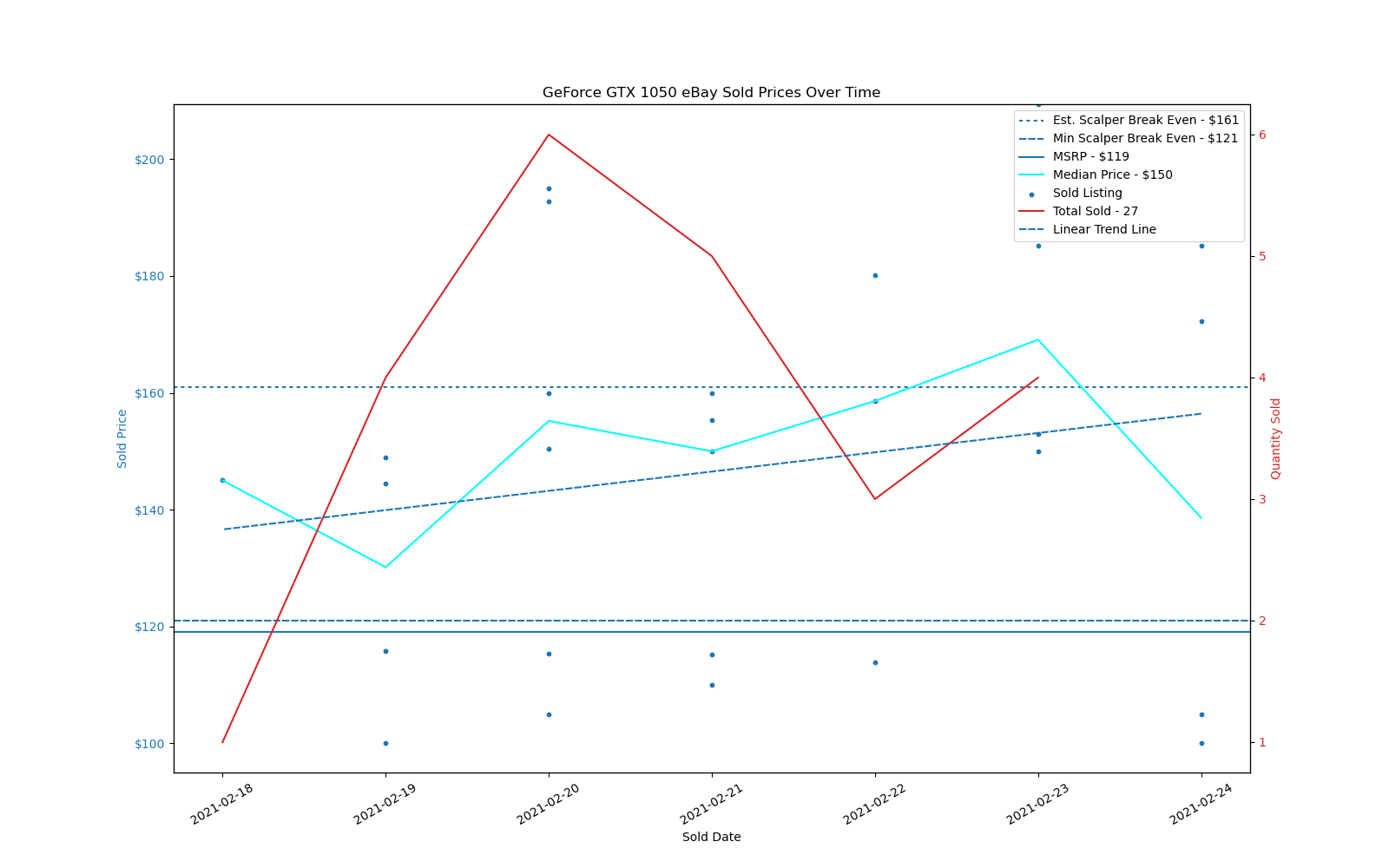

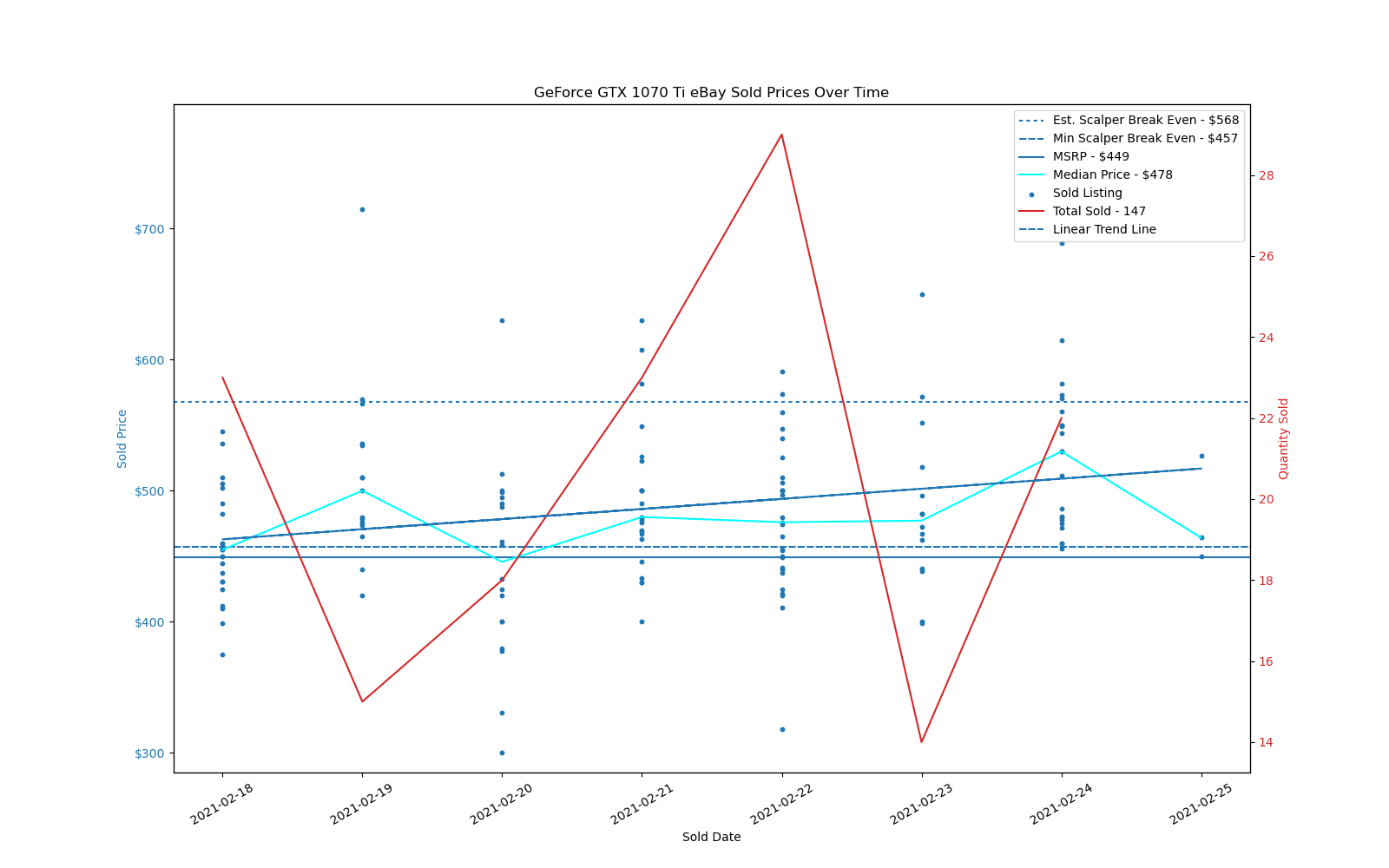

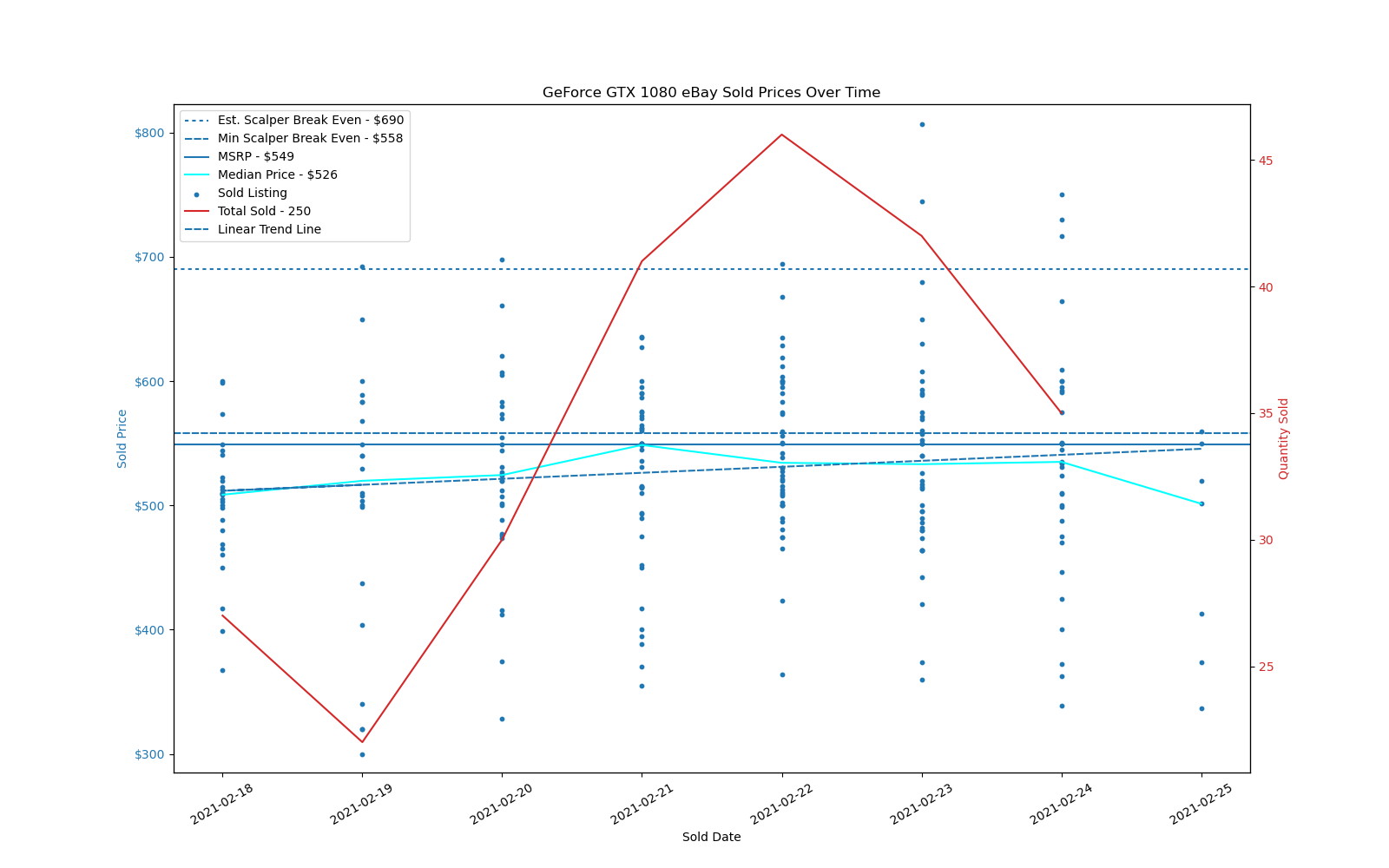

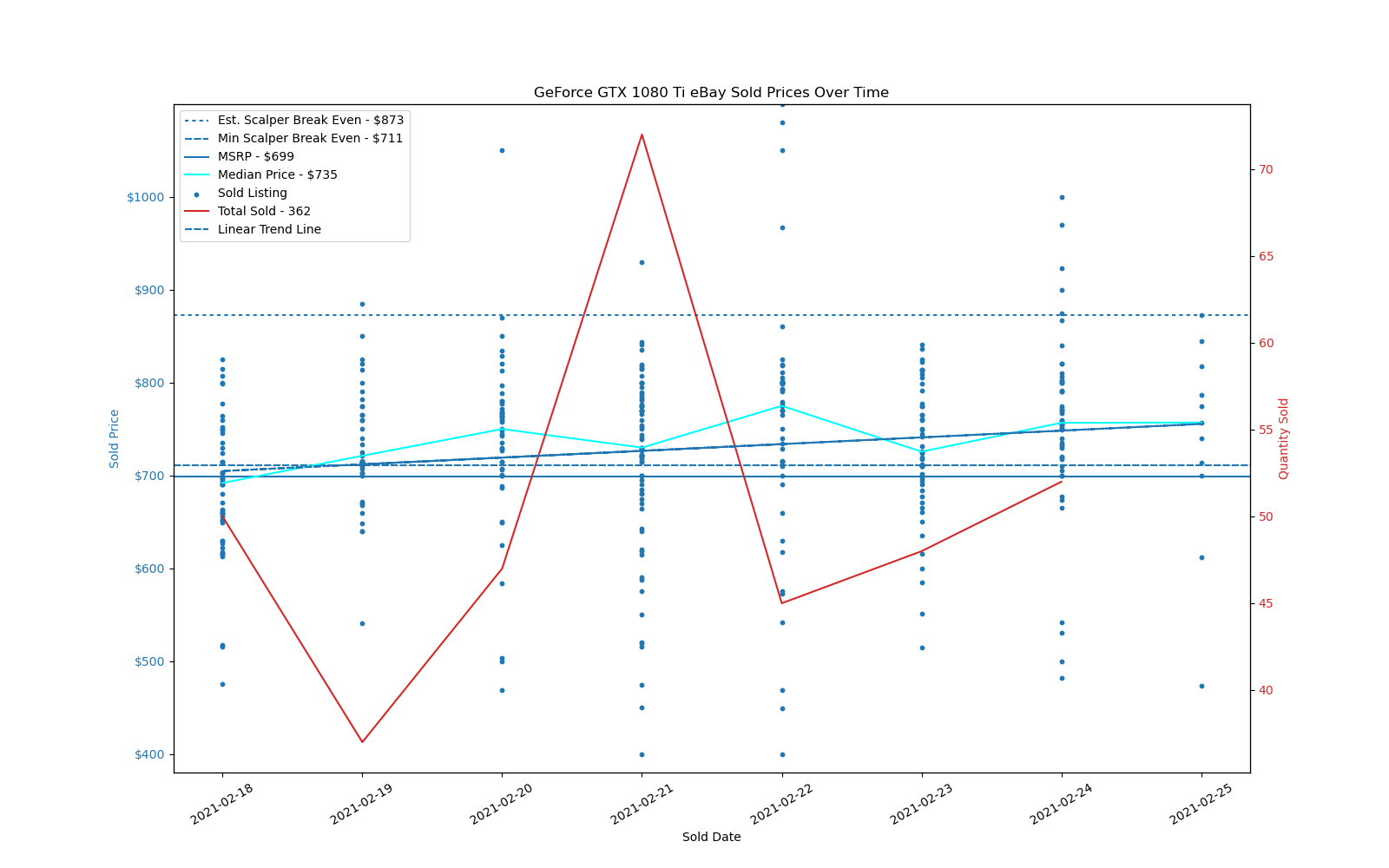

Last, we have cards that mostly launch three or four years back. These are selling at much closer to their launch prices, but in the first half of 2020 you could often find them for less than half that. GTX 1050 and 1050 Ti can still be found for $200 or less, but those aren't even fast GPUs and at one point it was possible to pick them up for under $100. If you don't care about VRAM limitations (you probably should), the GTX 1060 3GB actually costs less than the original launch price — probably thanks to being a relatively poor mining GPU. The 1060 6GB meanwhile costs 40% more than its nominal launch price, and the 1070, 1070 Ti, and 1080 Ti land just above launch pricing as well. Only the GTX 1080 costs less than the old $549 price, which is the adjusted price after the 1080 Ti arrived (it was originally a $599 card for a while).

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

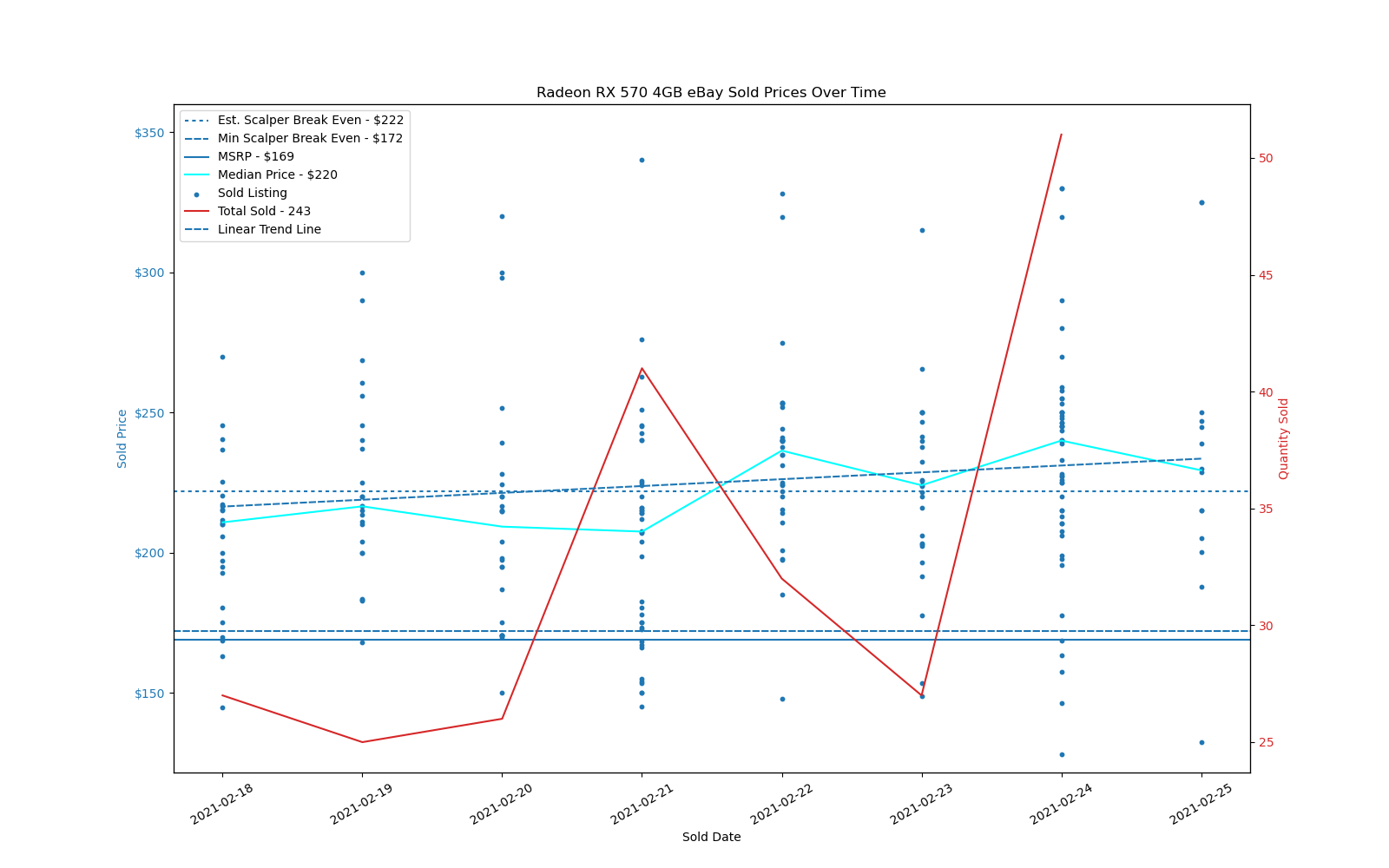

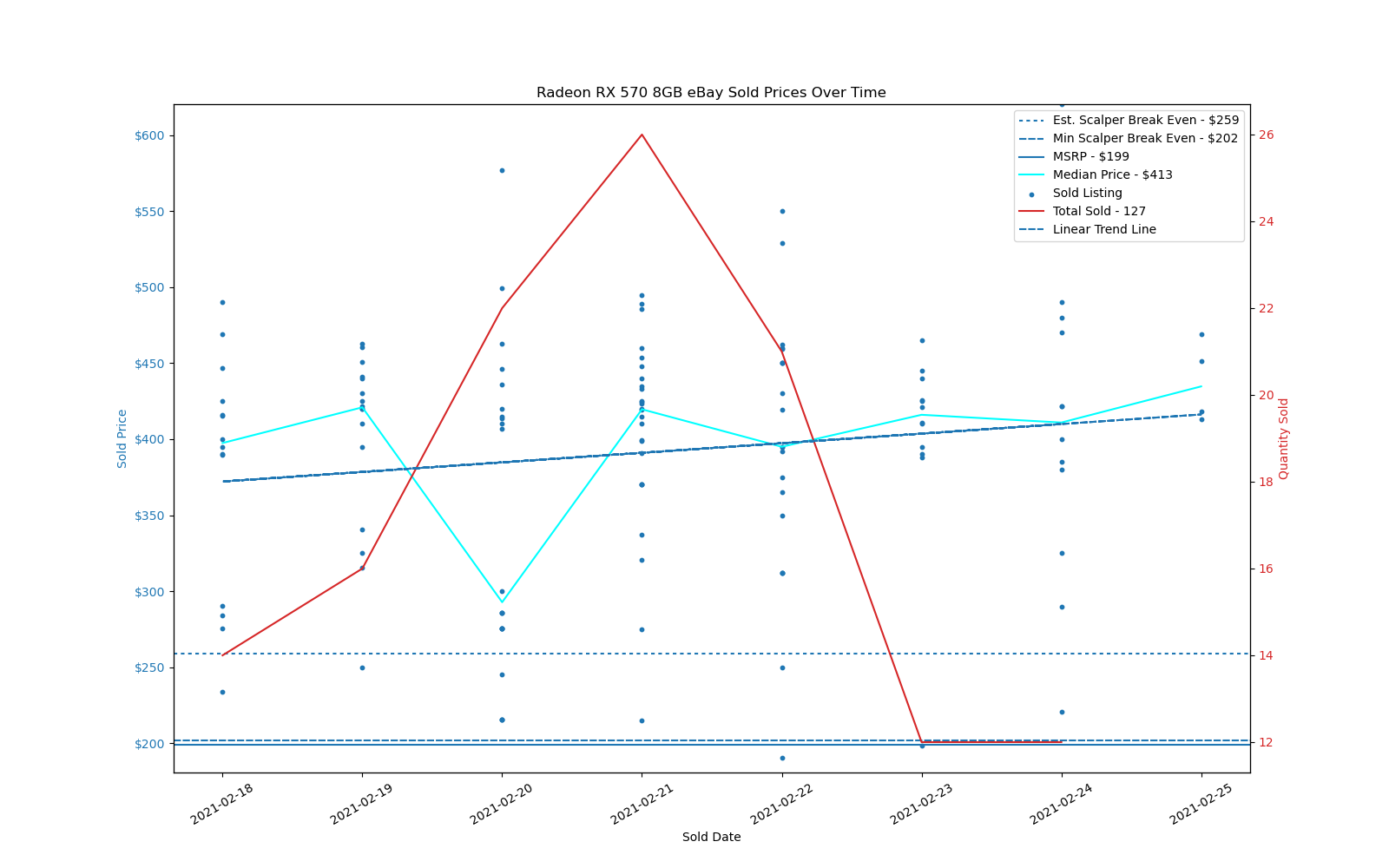

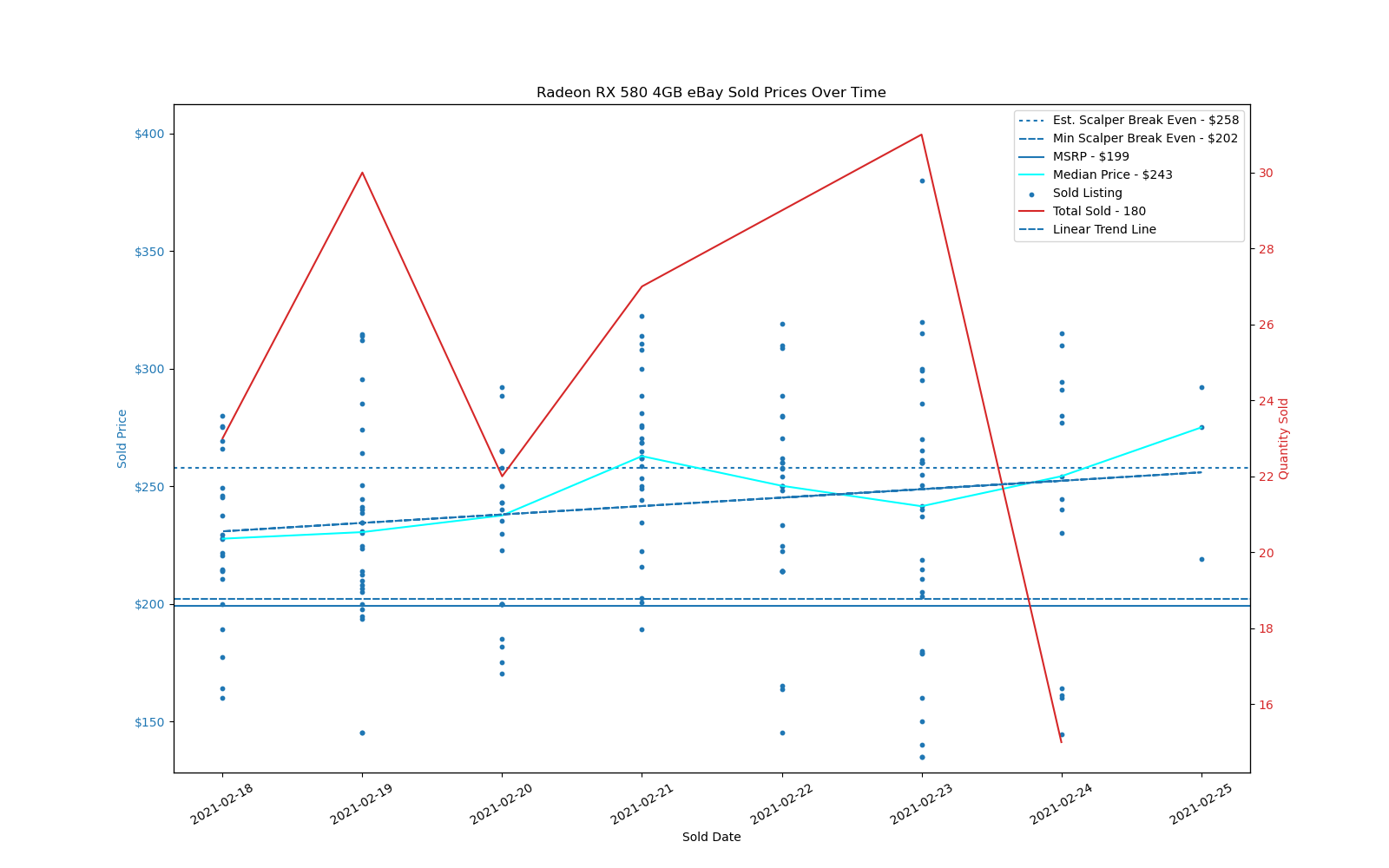

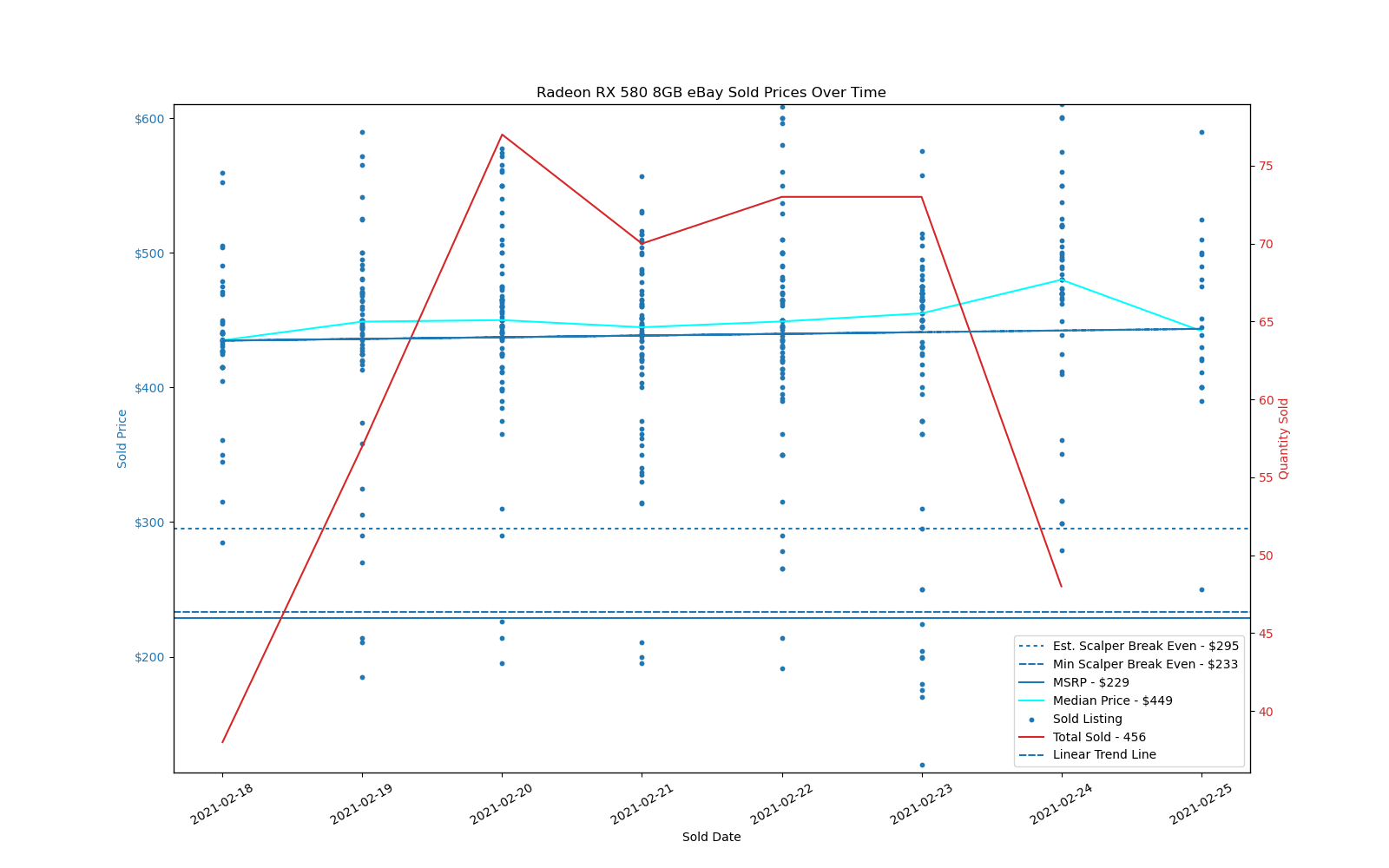

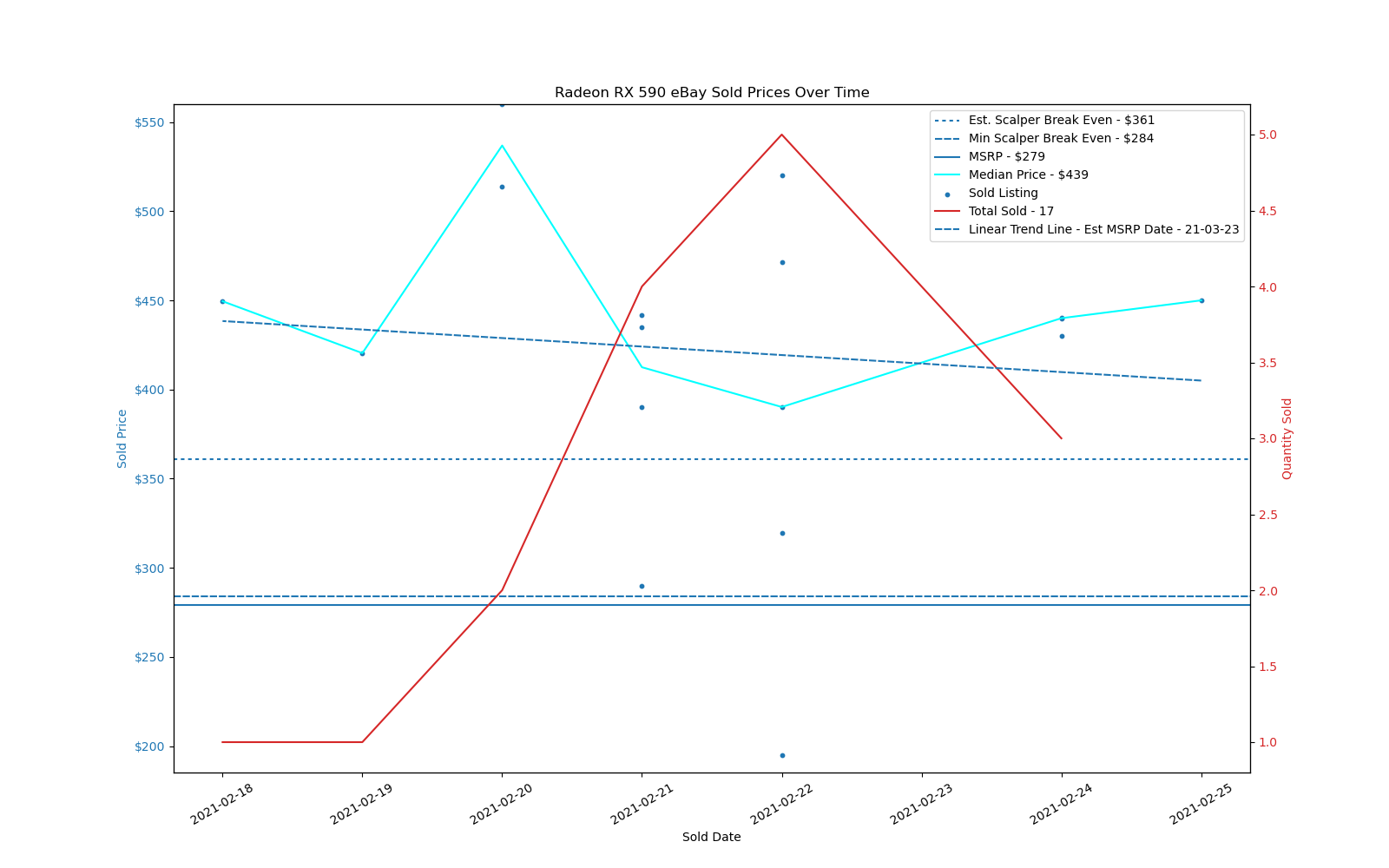

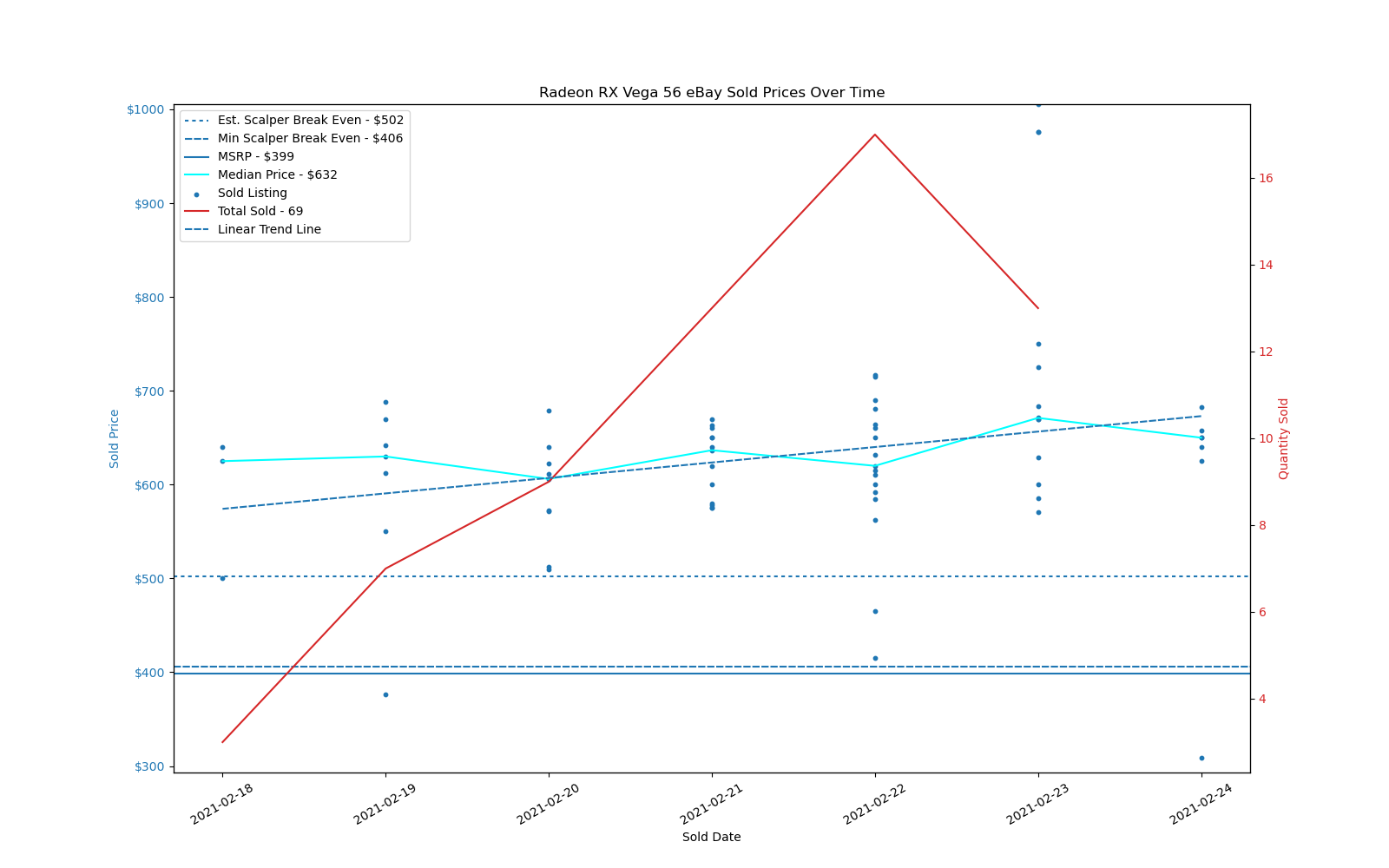

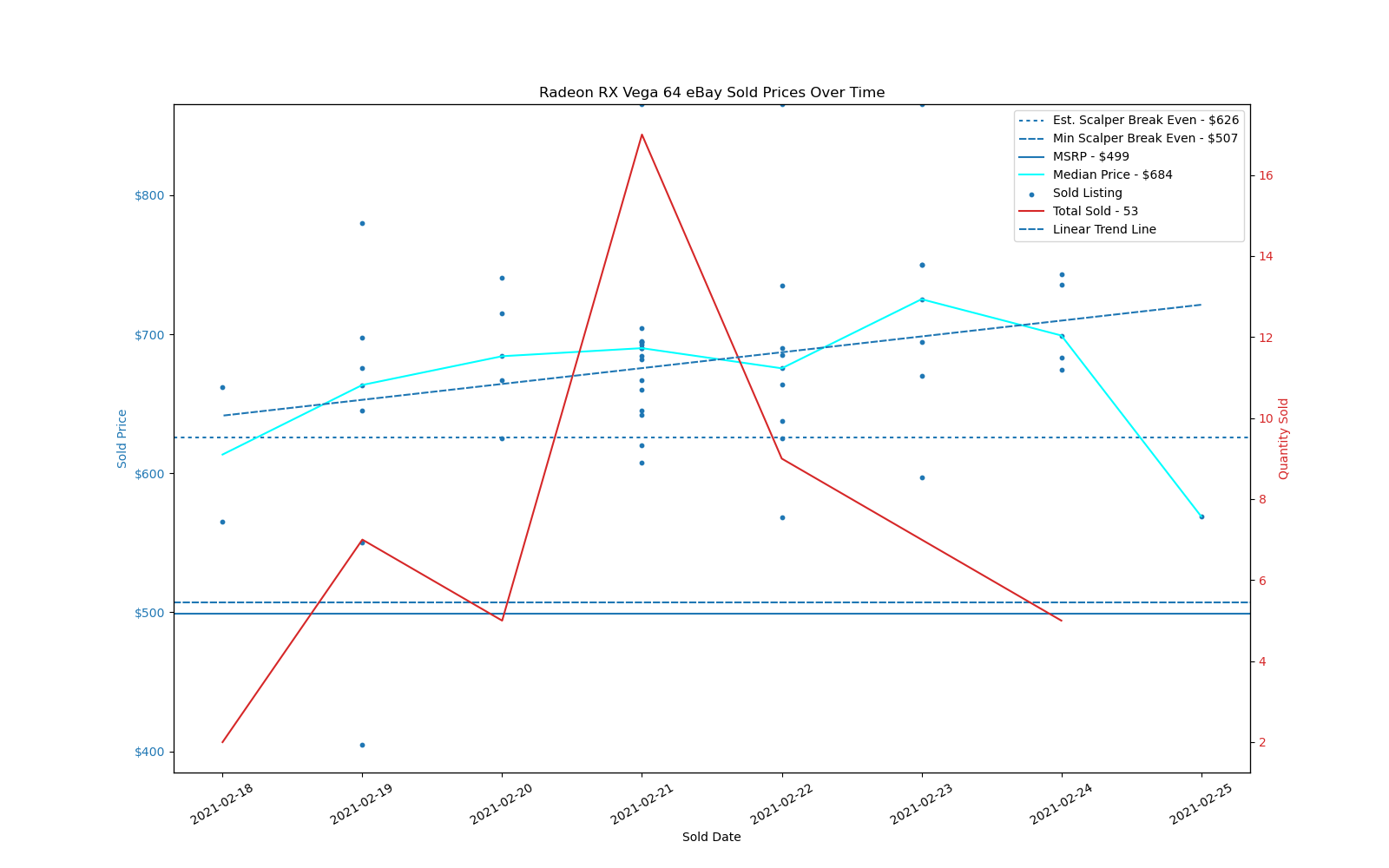

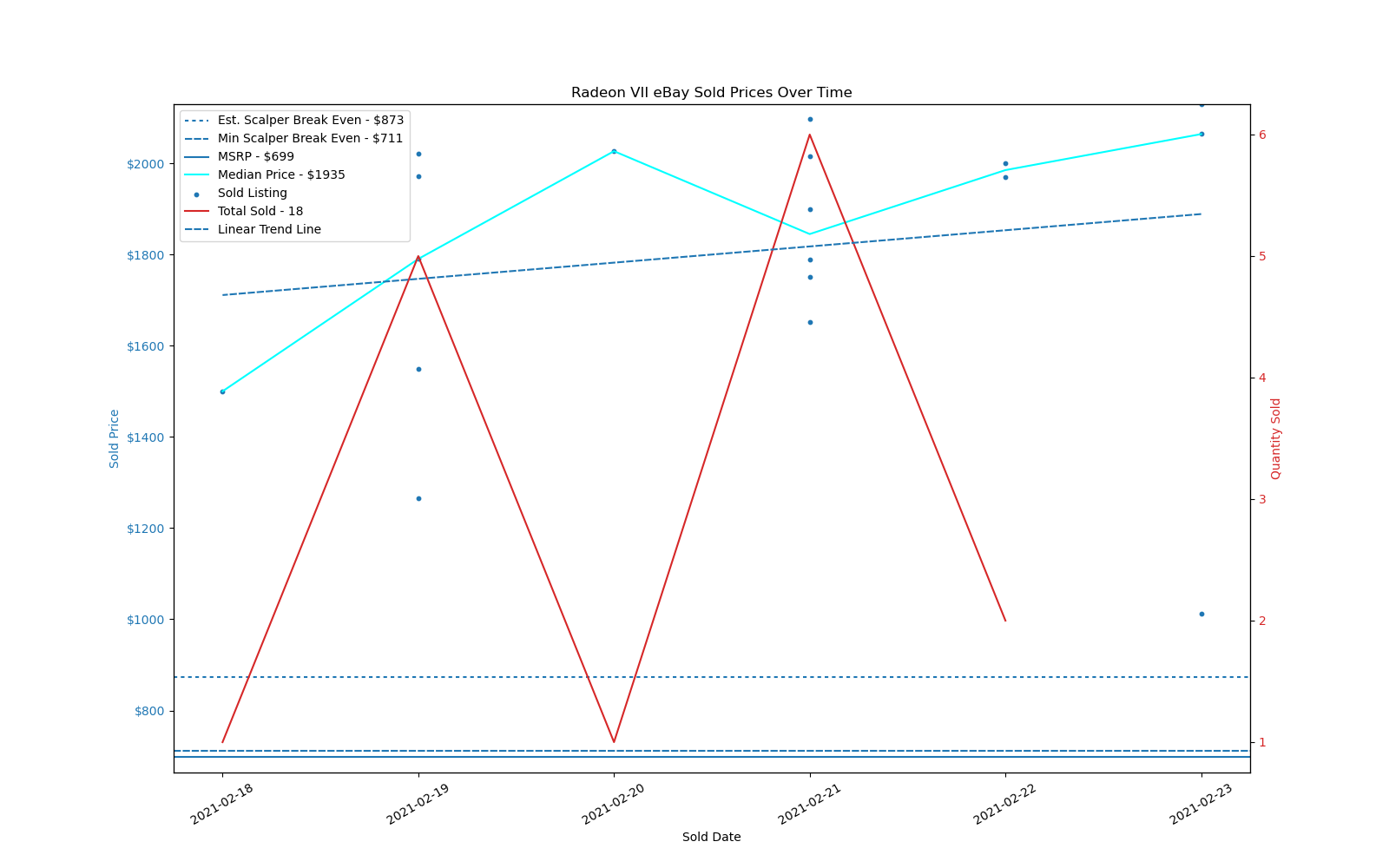

AMD's Polaris and Vega cards are also severely overpriced compared to early 2020. Remember when RX 570 4GB cards were readily available for just $120? Well, even though they're not great for mining these days, they're still selling for a median price of $220. The 8GB cards cost substantially more, at $413 for the 570 and $449 for the 580 — similar prices because they both deliver similar mining performance. The RX 590 actually costs a bit less than the 580 8GB, mostly because there aren't nearly as many of them floating around. RX Vega 56 and Vega 64 are also relatively close in price and currently cost about 50% more than at launch, while the Radeon VII — AMD's fastest mining GPU, thanks to its 1TBps of HBM2 bandwidth — is nearly triple its launch price. That's overpriced, but it's nearly double the hashing speed of Vega 56/64 and in relatively limited supply.

Weekly Summary: Mining Demand Remains Strong

Nearly every graphics card continues on an upward trajectory during the past week, mostly thanks to demand from the mining sector — at least, we can't imagine many PC gamers lining up to pay these prices. There are a few exceptions, but most aren't particularly noteworthy, especially with only one week's worth of data. The GTX 1650, GTX 1660 Ti, RTX 3060 Ti, RTX 3080, RX 590, RX 5500 XT, and RX 6900 XT all show a linear downward trend, but given they're far from returning to normal price levels.

There's perhaps some light at the end of the tunnel, though — faint and distant light, but these things can change quickly. After hitting a peak price of over $58,000 for Bitcoin and $2,000 for Ethereum, both have dropped a bit in the past few days. Mining profits from an RTX 3060 Ti now sit at an estimated $5.67 per day, which means it would take 213 days of 24/7 mining to break even at current rates, and the RTX 3080 has an estimated $8.84 per day in profits (after power), so it would require 232 days to reach the break even point (based on eBay's median pricing for the past week).

Ethereum difficulty continues to rise as well — it went up 5% in the past week — which means every GPU used for mining will make proportionately less money. What would really help GPU prices most is a big drop in cryptocurrency valuations, which has happened a bit this past week, but there's a long way to go. Bitcoin dipped by 5.4% over the past week, and Ethereum dropped 14.4% (that's from one week ago, not from the all-time high during that time frame). If both trends continue, sometime in the next month or two miners would likely stop investing in more hardware.

Meanwhile, Nvidia just announced that it made "$100 to $300 million" in estimated sales to cryptocurrency miners just in its last quarter. Let's be honest: It was probably a lot higher. Actually, that was for Q4 2020, so perhaps not, but miner sales in Q1 2021 probably account for at least half of all GPUs sold. That's just a guess, but given the massive spike in Bitcoin and Ethereum prices, it wouldn't be at all surprising. At least the new RTX 3060 12GB isn't a particularly attractive mining option, though that didn't stop it from selling out.

Jarred Walton is a senior editor at Tom's Hardware focusing on everything GPU. He has been working as a tech journalist since 2004, writing for AnandTech, Maximum PC, and PC Gamer. From the first S3 Virge '3D decelerators' to today's GPUs, Jarred keeps up with all the latest graphics trends and is the one to ask about game performance.

-

JarredWaltonGPU FYI, we're reorganizing some things and have a new forum thread here. Old comments were here: https://forums.tomshardware.com/threads/the-gpu-sadness-index-tracking-ebay-pricing.3689998/Reply

That is all. :cool: