Intel Discontinues Bitcoin-Mining Blockscale Chips, No Future Gens Announced

Came in late, leaving too early.

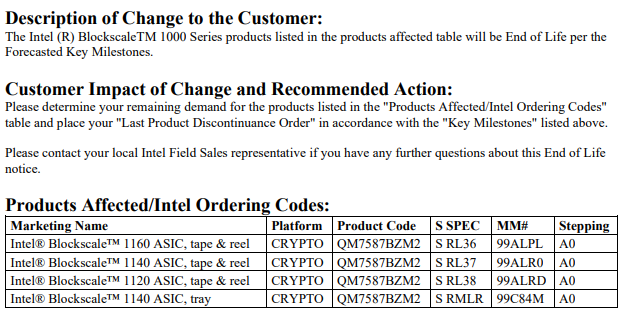

It's been just a year since Intel officially announced its Bitcoin-mining Blockscale ASICs, but today the company announced the end of life of its first-gen Blockscale 1000-series chips without announcing any follow-up generations of the chips. We spoke with Intel on the matter, and the company told Tom's Hardware that “As we prioritize our investments in IDM 2.0, we have end-of-lifed the Intel Blockscale 1000 Series ASIC while we continue to support our Blockscale customers.”

Intel's statement cites the company's tighter focus on its IDM 2.0 operations as the reason for ending the Blockscale ASICs, a frequent refrain in many of its statements as it has exited several businesses amid company-wide belt-tightening. We also asked Intel if it planned to exit the Bitcoin ASIC business entirely, but the company responded, "We continue to monitor market opportunities."

In the original announcement that the company would enter the blockchain market, then-graphics-chief Raja Koduri noted that the company had created a Custom Compute Group within the AXG graphics unit to support the Bitcoin ASICs and "additional emerging technology." However, Intel recently restructured the AXG group, and Koduri left the company shortly thereafter. We asked Intel about the fate of the Custom Compute Group, but it says it has no organizational changes to share at this time.

Intel hasn't announced any next-gen Bitcoin mining products and its Blockscale ASIC landing pages are now all inactive, but its statement implies that it is leaving the door open for future opportunities if they arise. Intel's initial entry into the market for bitcoin-mining chips came at an inopportune time, as its chips finally became available right as Bitcoin valuations crashed at the end of the last crypto craze, and Intel's apparent exit from the market comes as Bitcoin is back on the upswing — it recently cleared $30,000 for the first time in nearly a year.

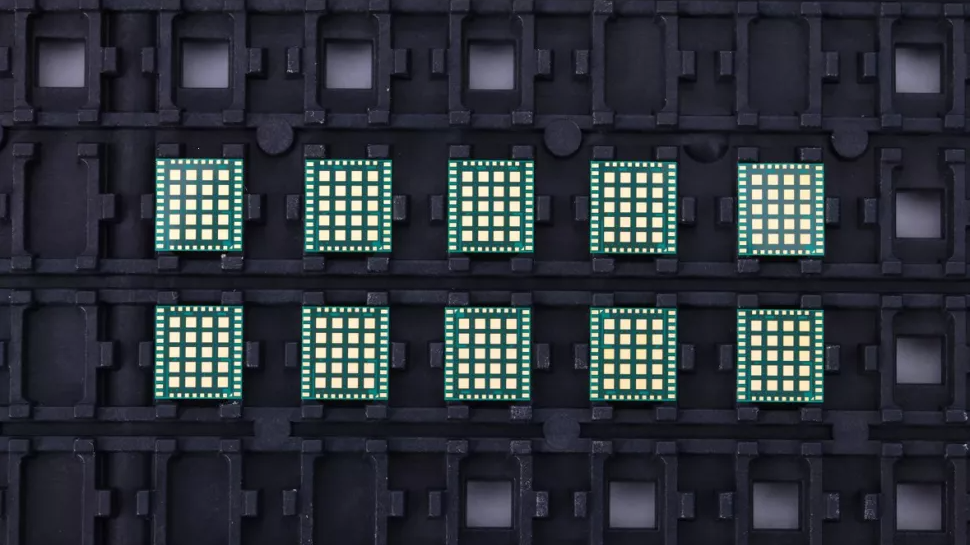

Intel's Bitcoin-mining chips initially came into the public eye under the Bonanza Mine codename it used for its R&D chips that were never commercialized, but the company later announced it would enter the blockchain market and summarily launched a second-gen model named 'Blockscale" to select large-scale mining companies like BLOCK, GRIID Infrastructure, and Argo Blockchain, among others.

Aside from exceptionally competitive performance relative to competing Bitcoin-mining chips, Blockscale's big value prop stemmed from the stability of Intel's chip-fabbing resources. Several large industrial mining companies signed large long-term deals for a steady supply of Blockscale ASICs, thus circumventing the volatility with the mostly China-based manufacturers that engaged in wild pricing manipulations based on Bitcoin valuations, were subject to tariffs, and suffered from supply disruptions and shortages, not to mention the increased costs of logistics and shipping from China.

Intel tells us that it will continue to serve its existing Boockscale customers, implying it will satisfy its existing long-term contracts. Intel's customers have until October 2023 to order new chips, and shipments will end in April 2024. Meanwhile, Intel has scrubbed nearly all of the landing and product pages for the Blockscale chips from its website.

Intel's latest move comes on the heels of a cost-cutting spree — the company sold off its server-building business last week, killed off its networking switch business, ended its 5G modems, wound down its Optane Memory production, jettisoned the company's drone business and sold its SSD storage unit to SK Hynix.

Intel's cost-cutting also applies to numerous other projects, as Intel has also shelved plans for a mega-lab in Oregon and canceled its planned development center in Haifa. The company has also trimmed some programs, like its RISC-V pathfinder program, and streamlined its data center graphics roadmap by axing the Rialto Bridge GPUs and delaying its Falcon Shores chips to 2025.

It's unclear it Intel will continue to make further cuts to its far-flung businesses, but it is clear that the company is committed to slimming down to increase its focus on its core competencies as it weathers some of the worst market conditions in decades, not to mention intense competition from multiple foes.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

gg83 Lmao! This makes me think they never wanted to do it in the first place and it was just to appease the stupid investors.Reply -

teodoreh "Came in late, leaving too early." should be their next motto.Reply

Solid State disks

mobile processors

Mining chips

Next stop: Graphics cards -

TerryLaze Reply

As a great philosopher once said:teodoreh said:"Came in late, leaving too early." should be their next motto.

Solid State disks

mobile processors

Mining chips

Next stop: Graphics cards

“You miss 100% of the shots you don't take"

Companies have to try new things if they want to get bigger and they need to know when to cut losses if they don't want to get smaller. -

kjfatl I suspect they will continue with graphics cards. They need a tile to drop into their processors that need graphics equivalent to today's mid-range graphics cards This won't make them a lot of money but will kill 1/2 of the PC graphics card market. For those doing AI and similar things Intel is more likely to fab parts for Nvidia and AMD.Reply -

JamesJones44 Reply

This one is a fairly simple equation in my opinion. GPU demand is growing and growing quickly, CPUs, mining equipment, etc. are fairly flat and the trends looks like they will be this way for at least a few years. It would be crazy to cut the GPU division in this environment, but it's hard to put anything past Intel.kjfatl said:I suspect they will continue with graphics cards. They need a tile to drop into their processors that need graphics equivalent to today's mid-range graphics cards This won't make them a lot of money but will kill 1/2 of the PC graphics card market. For those doing AI and similar things Intel is more likely to fab parts for Nvidia and AMD. -

2Be_or_Not2Be ReplyJamesJones44 said:This one is a fairly simple equation in my opinion. GPU demand is growing and growing quickly, CPUs, mining equipment, etc. are fairly flat and the trends looks like they will be this way for at least a few years. It would be crazy to cut the GPU division in this environment, but it's hard to put anything past Intel.

I don't know about GPU demand growing quickly. I think you had a spike before that was linked to crypto (multiple times), but I think that's leveling off now and even dropping. Intel doesn't seem to be a competitor w/AMD & Nvidia above the integrated graphics waterline, and I don't know if they have the willpower to keep trying to make their dGPUs better both in hardware & software, much less sales, long-term. I could see them getting out of the dGPU market again. -

JamesJones44 Reply

In datacenter it is going gang busters. For example Musk just ordered 10k A100's at 10k a pop for his "TruthAI". Add in all of the companies racing to get their version of LLM running and Nvidia is poised to capture yet another upswing in GPU sales. Only this time it's on very high margin enterprise customers.2Be_or_Not2Be said:I don't know about GPU demand growing quickly. I think you had a spike before that was linked to crypto (multiple times), but I think that's leveling off now and even dropping. Intel doesn't seem to be a competitor w/AMD & Nvidia above the integrated graphics waterline, and I don't know if they have the willpower to keep trying to make their dGPUs better both in hardware & software, much less sales, long-term. I could see them getting out of the dGPU market again.

On the consumer side I agree, things are largely level, but with the AI explosion, datacenter is going to be where the sales stay hot for a few years IMO. -

bit_user Reply

Intel bought Habana Labs, several years ago. They continue to crank out new products, though I have no idea how market uptake is going:kjfatl said:For those doing AI and similar things Intel is more likely to fab parts for Nvidia and AMD.

https://habana.ai/products/

Just like bitcoin mining eventually moved past GPUs, AI will do the same. If you compare the power-efficiency of Nvidia's H100 to Cerebras' WSE2, they're not even in the same league. AI accelerators favor a dataflow architecture and gobs of on-die SRAM. Conversely, hardware like fp64 and even most of the fp32 capability that the H100 features are largely a waste of die space, for AI.JamesJones44 said:In datacenter it is going gang busters. For example Musk just ordered 10k A100's at 10k a pop for his "TruthAI". Add in all of the companies racing to get their version of LLM running and Nvidia is poised to capture yet another upswing in GPU sales. Only this time it's on very high margin enterprise customers.