Nvidia and AMD Gaming Revenues Are Closer Than You Think

And Nvidia shares are up 10% afterhours, due to better than expected results and a booming AI business.

Nvidia has just published its latest set of financials for its fourth quarter and fiscal 2023. Despite revenues continuing to follow a downtrend, the results were better than expected. Moreover, Nvidia is seen as a big wheel in AI accelerator hardware, so its shares surged by over 10% in after-hours trading. Another interesting result within the myriad numbers is that Nvidia’s gaming segment revenue is now only 10% more than its rival AMD.

Nvidia and AMD Gaming Segment Tussle

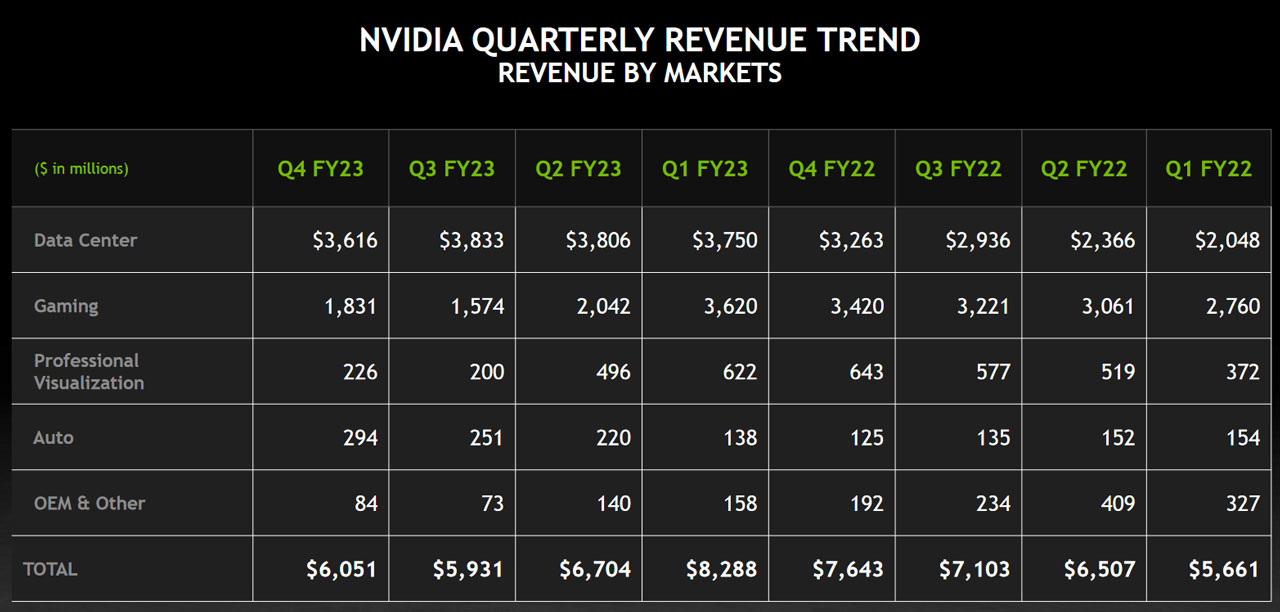

Nvidia’s gaming segment revenue takes account of income from PC GPUs, as well as its Nintendo Switch hardware and GeForce Now games streaming service. Together these operations generated $1,831M during its most recent quarter. Sadly for Nvidia, this revenue figure is down 46% YoY.

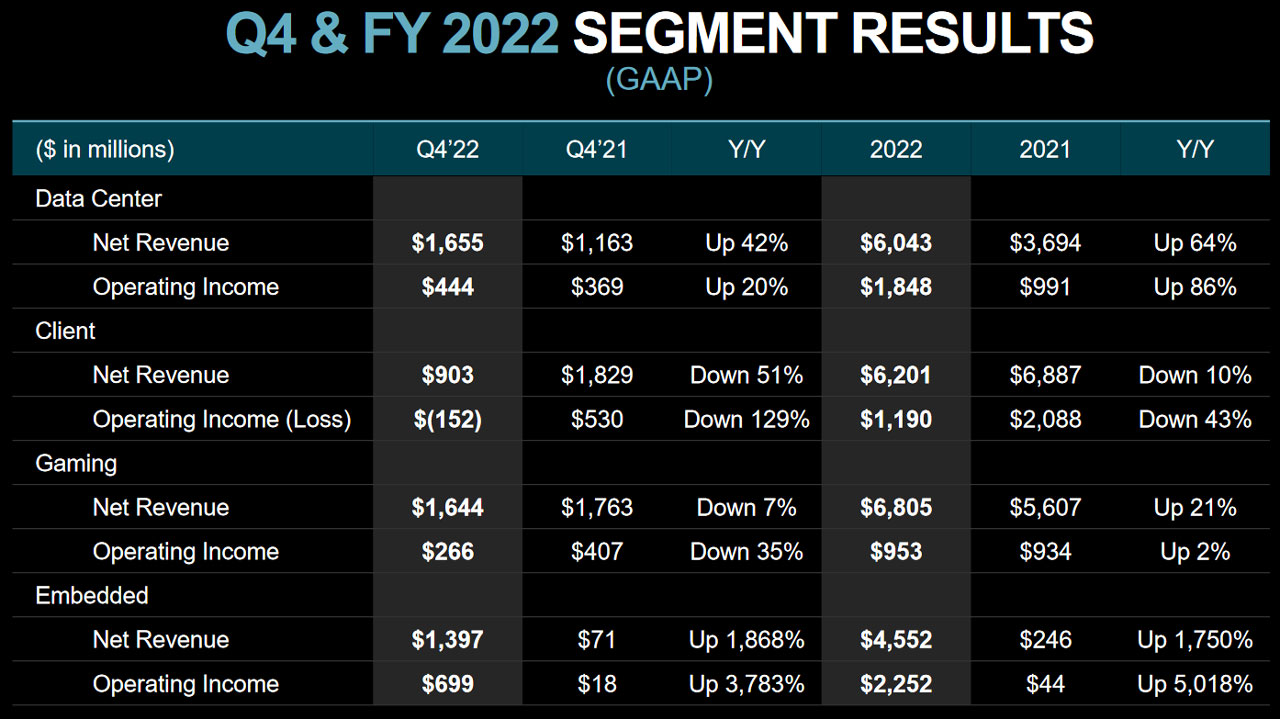

AMD’s gaming segment results are derived from the sum of its income from PC GPUs, as well as its significant semi-custom business for both Microsoft Xbox and Sony PlayStation consoles. The latest AMD figures were published at the end of January and showed that its gaming segment revenue totaled $1,644M during its most recent quarter. Thus, we observe the gaming revenue difference between the green and red teams from their latest financial statements is a measly 10 or 11%, and could turn either way in the coming months.

Considering the above comparison in terms of PC GPUs, we don’t see AMD making any waves in the discrete GPU market to account for its close gaming revenue rivalry. The latest Steam Hardware Survey shows market shares are seemingly entrenched at approx 75% Nvidia, 15% AMD, and 10% for others – for the last 18 months. Rather, as mentioned above, AMD’s console chip sales are doing well.

Nvidia’s Latest Results

Turning our focus back to today’s results from the green team, we see that the chip designer brought in $6,061M in revenue during its most recent quarter. This figure, and the net income, was higher than Wall Street expected, and that is almost always great for a share price, post-results publishing. This is despite the most recent quarterly figures being poorer than this time last year.

Yes, the gaming revenue was down, but there was a bright spot for Nvidia investors in the data center. Data center revenue was up 11% over the year, which is a good achievement in a downturn. Moreover, the data center segment includes AI accelerators, and all things AI are very hotly trending at this time.

In 2023 we have seen a lot more PC GPU action from Nvidia, so it has a good chance to grab even more share of the PC market, especially when the mainstream cards start to become available (hopefully at mainstream prices). As for total gaming segment revenue, AMD will still likely enjoy the support from the very strong demand for Sony and Microsoft consoles, but we don’t have much in the way of indications for its mainstream RDNA 3 graphics card product launches.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

rluker5 Nvidia's 1831 is a projection for Q4.23 and has 3620 for Q1.23 and 3420 for Q4.22 compared to AMD's 1644 for most recent quarter.Reply

That's still a ton of revenue for a company that apparently sells mostly console GPUs. -

thisisaname Nvidia thinks why sell something for 1.5K to gamers when you can sell nearly the same things for 6K to a data centre?Reply -

kal326 Even down 46% YOY the other thing to look at is back to FY18 into Q3FY19 where basically now they are back right where they were before. Q4FY19 into Q2FY21 they were lower than currently. So I can’t say I’m losing any sleep over Nvidia’s “slump”. Seems more like they are trying to get back to those 4x higher quarterly gaming results that totally weren’t part of a massive spend on crypto currency cards sold as “consumer gaming”.Reply

Couple that with the data center offerings running basically same silicon as those gaming cards and you can see why Nvidia has little interest so far in dropping prices. If they can gaming revenue up around or slightly over crypto rates while keeping as many usable cores for the much more lucrative DC market, unfortunately I don’t see things changing.

AI/MI looks to be basically replacing miner demand with better margins. -

Ast1on Even though the article in general was pretty ok. The first sentence "And Nvidia shares are up 10% afterhours, due to better than expected results and a booming AI business. " is not. There is no booming AI business. 1Q comparison a little bit up, compared to historical quarters still in a very bad position. Guidance was also discreetly bad for next 2 quarters.Reply

Overal it was a very disappointing Earnings. Share price most likely did not go up for " better then expected " or "positive guidance". Rather the big boys handling the retail puts in the short term.

Your point of gaming revenue coming close between two companies is valid. -

TJ Hooker Reply

No, it's not a projection, $1.8B was their actual gaming revenue for Q4 FY23. They're talking about fiscal years, not calendar years; Nvidia's Q4 of FY2023 ended 29 Jan, 2023.rluker5 said:Nvidia's 1831 is a projection for Q4.23 and has 3620 for Q1.23 and 3420 for Q4.22 compared to AMD's 1644 for most recent quarter.

AMD's $1.6B gaming revenue was during much the same period, except that their quarter ended a month earlier: 31 Dec, 2022. -

hannibal Good, good!Reply

Jensen can buy new leather jacket! And it is good to reduce gaming GPU production and move productiojn to segments that are3 willing to pay!

Sigh… this does not promise cheaper prices… -

waltc3 I haven't bought an nVidia discrete GPU since 2001, IIRC. In 2002, ATi stole the show for a couple of years with the R300 and its descendants. nVidia couldn't make anything that came close for that period. It's been a steady stream of ATi/AMD GPUs for me ever since. I have 0 complaints. My last Intel CPU was an original Pentium, circa ~1998. The A64 from AMD (Win2k & 64-bit VISTA, as I recall) was quite nice when Intel was sticking to 32-bits and running ad campaigns entitled: You don't need 64-bits on the desktop (believe it or not!), only because they weren't ready with an x86 64-bit CPU and were still trying to move Itanium with RDRAM. Eventually, Intel threw in the Itanium towel and licensed x86-64 from AMD, went to SDRAM, selling off its $1b stake in RDRAM, and then proceeded to bust AMD's performance chops at their own game for several years, when at last A64/Opteron ran out of steam and AMD had nothing planned in the pipe (most unlike the current AMD). But, I found AMD adequate, as I've said, a better buy, and there were no games I could not play. So, I've been all AMD ever since.Reply

No problems with gaming along the way, either. I'm not overly impressed with benchmarks because companies (looking mainly at you, nVidia cough) have been known to cheat with widely used benchmarks, especially synthetics. For me, angst with nVidia's tactics goes all the way back to 3dfx and I still recall the dirty tricks from nVidia in those days (the 3dMark nVidia cheat was a big deal in those days and I still recall it vividly.) My bottom line is value, and whether I can play games smoothly without stutter. AMD has been fine over the years, in that regard. Of course, today, there are no concerns over GPU frame rates or CPU performance with AMD.

But...what other people buy doesn't bother me. I want them to enjoy whatever they buy! Just like I do. We owe it to ourselves...;)