U.S. PC Shipments Dropped 12% in Q3 2022 According to New Survey

But both Apple and Acer enjoyed double digit annual growth.

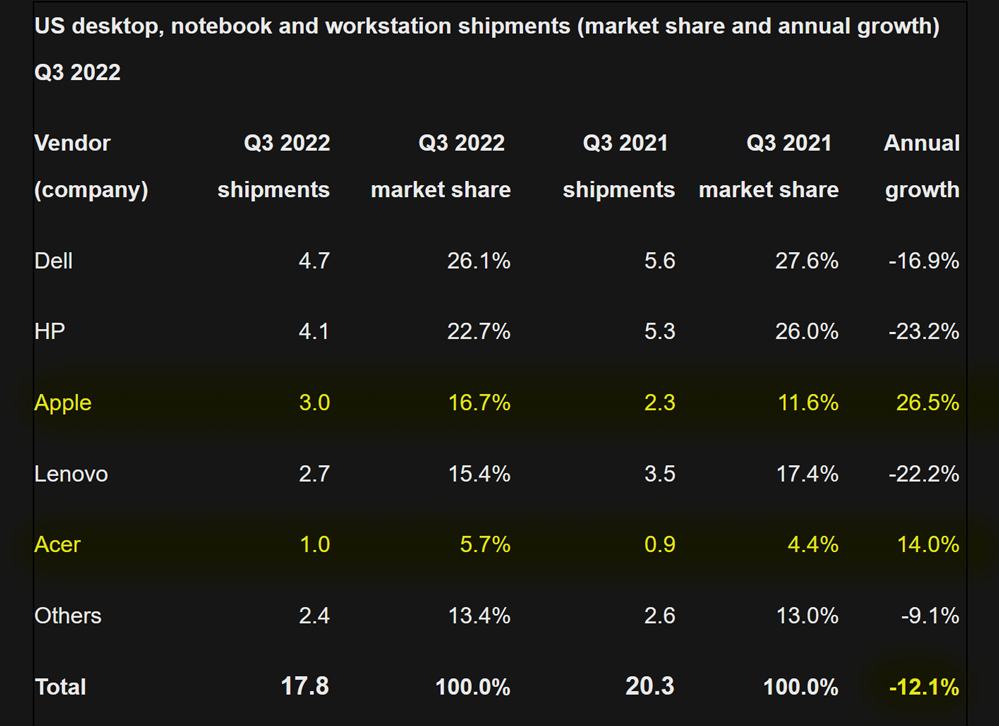

Market analyst Canalys published a report indicating that PC shipments in the U.S. fell 12% during Q3 2022. However, the picture is uneven, with desktop sales up 1%, laptop sales down 14%, and tablet sales down 1%. A total of 17.8 million PCs were sold in the U.S. during the third quarter, according to Canalys. It is also interesting to see the successes and failures among the top five PC makers, with Apple and Acer being far more successful than their rivals, achieving growth during industry adversity.

It is well documented that consumers aren’t as interested in purchasing desktops, laptops, tablets, or components as they were just a year ago. The thirst for consumer hardware and software for home-based work and play began to wane as most countries came out of pandemic lockdowns in 2020/2021. However, in the last year, we have seen even greater impacts on consumer confidence and disposable income largely due to the Ukraine / Russia war and its effect on energy prices, inflation, and disposable income.

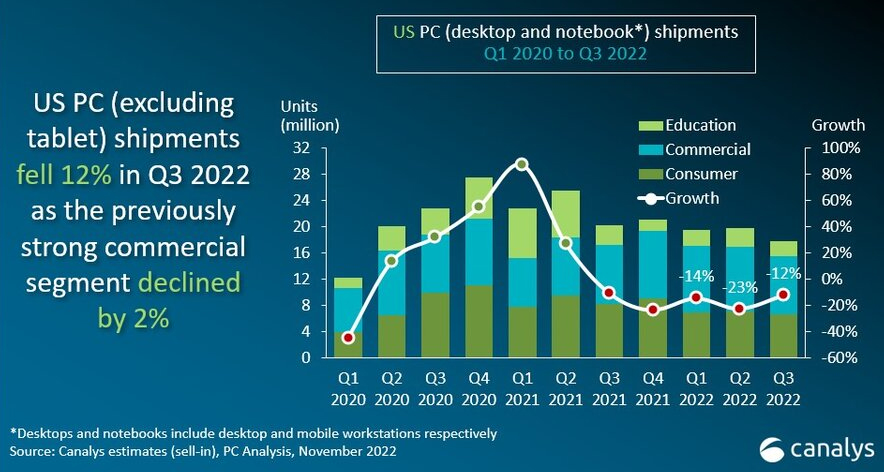

The embedded chart covering Q1 2020 to Q3 2022 helps provide an overview of the situation and the trend line. “The US PC market was already in an extended period of contraction as both consumer and education demand struggled with inflation and saturation,” commented Brian Lynch, Canalys Research Analyst.

Lynch also highlighted that the previously resilient commercial segment has started to wane, with its first YoY decline (2%) evidenced in these new figures. While consumers are being squeezed, impacting that segment, businesses are also looking to implement cost-cutting measures cautiously. As a result, device lifespans will be extended in the short term, where possible, reckons Canalys.

We are well into Q4 2022, and the Canalys analysts aren’t seeing any ‘green shoots’ of recovery. Consumers are expected to cut spending on expensive tech this holiday season, and it will take heavy promotions to clear stock. An expected slow educational segment recovery in 2023 also points to the shipment declines we have seen trend in 2022 continuing into H1 2023.

Turning our attention to the relative fortunes of the big five PC makers, there are some stark contrasts to see in the US market. Dell continues to hold the No.1 spot regarding market share in the Americas and is now further ahead of second place HP than last year. However, that isn’t really to Dell’s credit (-16.9% growth) but has more to do with the even worse decline in HP sales (-23.2%).

Apple and Acer were the clear winners of the five-horse PC race in 2022. Apple looks like it had a stunning year, with an annual growth of 26.5%. Canalys analysts say that this significant advance was due to “fulfilling backlogged orders from a supply-crunched Q2” and the arrival of new Apple M2 devices in retail.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

No remarks about Acer’s 14% growth were made other than it being “strong.” However, Acer must be getting something right with its U.S. market offerings that its Windows PC-making rivals aren’t. We have reviewed several Acer gaming laptops this year, and they have been consistently decent, but the U.S. sales success might be more to do with its mix of Chromebooks, thin and light designs, and convertible offerings.

If you are interested in tablets, Canalys breaks down the figures for these handy portable connected devices separately. The primary observation in the U.S. tablet market in Q3 2022 was the advance of the Amazon Fire tablet range (19.5% growth), which seems to have occurred at Apple and Samsung’s expense. Also, it is interesting to see Microsoft Surface device shipments slip 12% in the most recent quarter.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.