Western Digital in Advanced Talks to Buy Kioxia

Western Digital interested in buying Kioxia as Micron loses interest.

Western Digital is progressing with its talks to merge with Kioxia, its long-time production partner, a new media report claims. The deal could be valued at more than $20 billion and, if cleared by antitrust regulators, would create the world's largest maker of 3D NAND with formidable manufacturing capacities and product design capabilities.

The talks between Western Digital and Kioxia have intensified in the recent weeks and the final agreement could be reached already in mid-September, reports The Wall Street Journal. The U.S.-based maker of hard drives and some of the best SSDs reportedly intends to fund the deal with stock, which will make the consortium of investors that owns Kioxia a major shareholder of the new company.

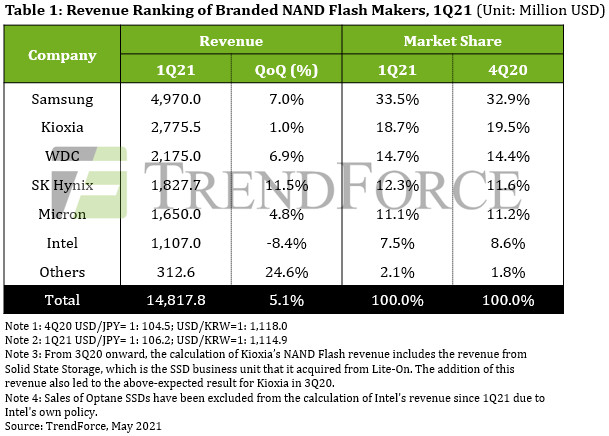

Kioxia and Western Digital jointly operate 3D NAND production facilities located at two sites in Japan. The two companies produced 33.4% of the global NAND memory output in Q1 2021 and were only 0.1% behind Samsung, according to TrendForce. If Kioxia and Western Digital merge, the combined company will be significantly larger than Micron and SK Hynix (even once the latter absorbs Intel's 3D NAND and storage business).

In fact, the merged company will be the world's largest supplier of storage devices with plenty of clients, a large portfolio of IP and patents, leading-edge 3D NAND production capacities, hard drive manufacturing, several SSD design teams, and even a group of engineers working on RISC-V CPU cores for advanced storage devices.

But building a company that will control over one third of NAND flash supply and a significant chunk of the HDD market will inevitably face scrutiny from antimonopoly regulators. Japanese authorities are usually unhappy when local companies are bought by foreigners, which is one of the reasons why Western Digital did not buy Toshiba's stake in joint manufacturing operations several years ago when Toshiba had to sell off its NAND business. Regulators from China, the U.S. and U.K. will also review the deal very thoroughly as building the world's largest storage device maker will inevitably reorder the market and will affect competitive landscape.

Western Digital's intraday market capitalization after market close on Wednesday was $20.07 billion. The company has $3.37 billion in cash and yet has to pay debt of around $8.73 billion. Western Digital's stock jumped on Kioxia merger report, according to Barron's.

Back in April we already reported that both Micron and Western Digital explored ways to gain control over Kioxia in a bid to tangibly increase their 3D NAND memory production capacities. By now, Micron has lost interest in acquiring Kioxia, according to the Wall Street Journal, which made Western Digital the only maker of 3D NAND interested in Kioxia.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Neither Kioxia nor Western Digital commented on the news story. Since the deal is not official, it may fall apart.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.