Data centers to account for 9% of electricity demand in the U.S by 2035 — Nuclear power could help sate AI demand

Regulatory approval and standardization could take years to get them off the ground, though.

Alongside questions of how the major AI tech firms are going to afford the AI-revolution they're all driving us towards, others remain over how they're going to power it. With 9% of the entire US electricity demand expected to come from data centers by 2035, according to Bloomberg, Google, Amazon, Oracle, and others are pursuing investments in small, modular nuclear reactors as potential solutions for on-site power without the intermittent service downsides of renewable energy.

In 2024, Google struck a deal with Kairos Power to help build out 500 megawatts of small nuclear reactors by the mid-2030s. Equinix has also struck a deal with small reactor developer Oklo — a firm backed by OpenAI's Sam Altman — to build out 20 micro reactors, and that could just be the start.

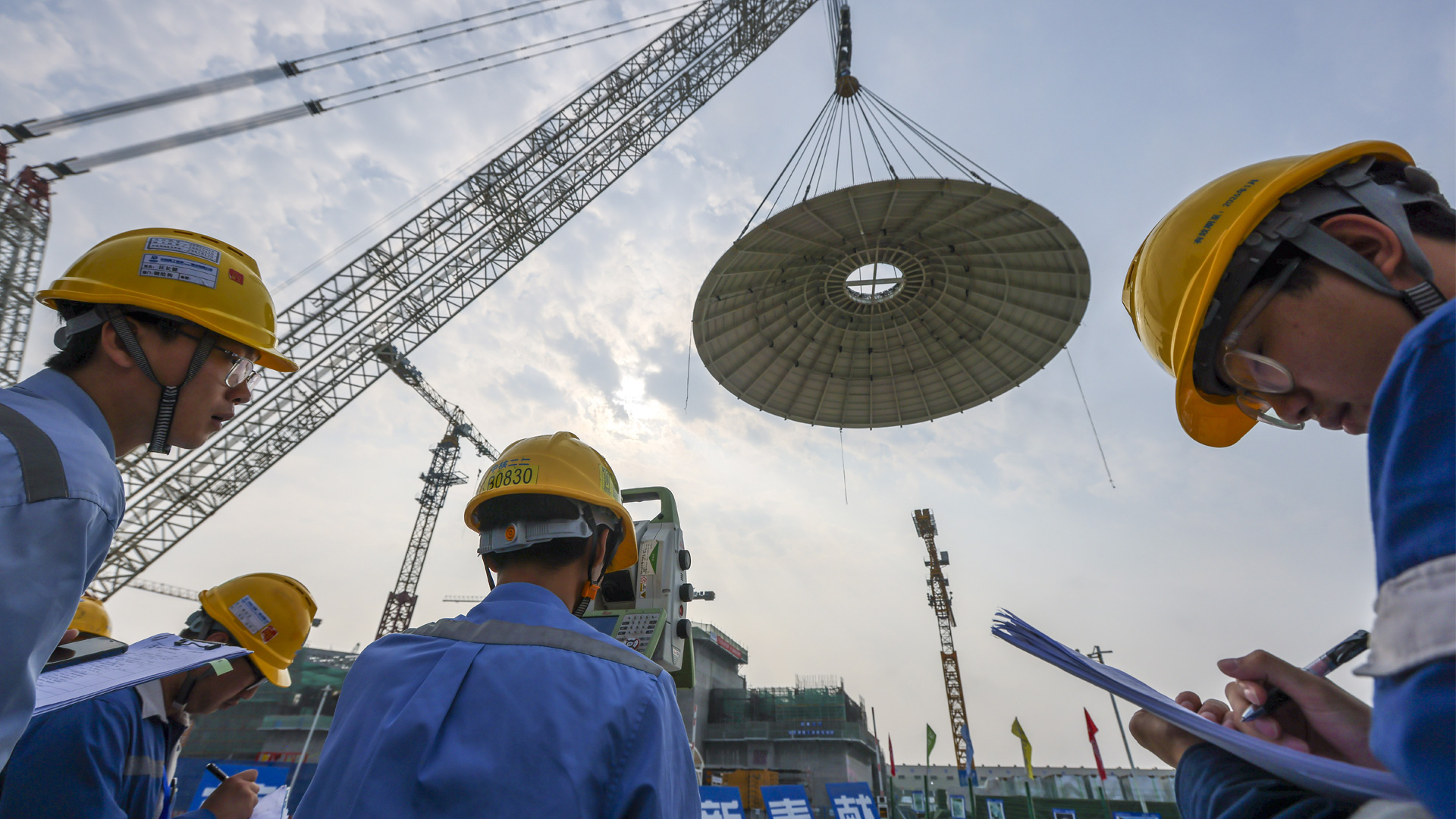

Over the past year, we've seen a flurry of announcements around enormous investments in data center creation, the buildup of "AI factories, " and huge global plans for building infrastructure to power a bevy of new AI technologies. In short, major tech companies are building data centers to house hundreds of thousands of CPUs and graphics cards, for AI usage as they look to integrate the technology into governments, the military, and everyday life for consumers.

But with individual graphics cards requiring upwards of 500W of power, there are frank discussions taking place over where all the extra electricity for these projects is going to come from. In June this year, EpochAI published a study which showed that the most capable AI supercomputing systems were pulling more power with each iteration, and doubling those needs every couple of years. Elon Musk's xAI Colossus supercomputer requires over 280 Megawatts - 20 times the power needed for the top AI data center in 2019, according to the study.

Even in that single location, hunger for more power is seemingly never-ending. In September, we reported that through the deployment of mobile gas turbines at the Memphis site, xAI's Colossus was now generating close to 500MW of power - all while sidestepping regulations. This puts it halfway to its plans to reach one gigawatt of electricity generation on site in the future.

That's just one of many projects at many companies and highlights the sheer scale of the potential power problem facing technology firms wanting to rapidly build out the AI infrastructure they're all so desperate to invest in.

One of the ways they may be able to manage this long-term is through small, modular nuclear reactors.

Small but mighty

The clue with small, modular nuclear reactors (SMR) is very much in the name. They are physically smaller, requiring less infrastructure than their more traditional counterparts, and have lower operating capacity. Where a standard reactor might start at 1,000 megawatts and go from there, SMRs are typically in the 300-500 megawatt range, and can be as small as a quarter the size of their traditional counterparts.

This might not seem like a huge innovation, but it's often the scale of nuclear plants and their associated requirements that make them so hard to build. By focusing on smaller designs, they can be built closer to where the power is needed, reducing the costs of associated power transmission infrastructure. Assuming they have access to the water and other resources needed, they could even help power off-grid and remote locations like mines, and indeed, data centers.

Their modular designs also make construction simpler, with many of their components built off-site and then assembled on-site. This streamlines, cheapens, and shortens construction times, which can extend into the decades for more traditional reactors. As Bloomberg highlights, the Vogtle 3 and Vogtle 4 traditional reactors built in Georgia took over seven years longer than intended to build and ended up costing twice their projected $14 billion price tag.

Global strategy

Outside the U.S., other governments and entities are also banking on SMRs to power much of the AI revolution into the future. During a recent trip to the UK by President Trump, alongside a number of high-profile data center and tech deals, a key announcement was a collaborative effort between US and UK companies to further develop SMR technology with Rolls-Royce.

The UK is also investing £2.5 billion($3.4 billion) in SMRs over the next decade, though the first reactor won't come online until the mid-2030s. France's state-owned Electricité de France SA is investing in the Nuward SMR project, and a number of US firms backed by Bill Gates and other tech entrepreneurs are developing SMRs in America.

The first SMRs to come online were operated by Russia's Rosatom Corp and China's China National Nuclear Corp. They launched 35-megawatt and 100-megawatt reactors earlier this decade.

The real problem is time

All the announcements and technology investments are encouraging for those concerned about the scale of power demand from these new data centers, but there is the ongoing issue with the time it takes to bring these facilities online.

Although SMRs are designed to be built faster and with fewer local regulation hurdles to clear, they are still mired in red tape and paperwork. Although there are over 100 SMR designs currently going through the approval process, none of them have completed it to date.

One 77-megawatt reactor design from Nuscale has been approved, but its project was cancelled in 2023 due to rising potential costs of the electricity it would produce. That came after over three years and $500 million spent as part of the approval process. Even with the Trump administration promising a quadrupling of US nuclear power by 2050, and plans from the US Department of Energy to invest billions in small nuclear projects, it's still unclear how fast the approval process can be made, when it's such a complicated one.

As it stands, there are significant hurdles for anyone looking to build out these designs. Although the cost of production is less impactful if it's powering a profit-making AI factory, there's no guarantee that it will be financially viable in the years to come.

But AI is going to need power, regardless of what job it ends up doing, and renewables are unlikely to be able to offer the full scale of power generation required. Although battery technology could allow for intermittent supply issues to be mitigated, most of these locations will require main grid access to ensure a consistent electricity supply.

SMRs offer an intriguing alternative and seem likely to form part of the future backbone of US power generation, but it's going to take a lot of time to get them off the ground. That then returns to the question of how these major tech companies are going to power all their new projects.

If the xAI approach is anything to go by, it'll likely involve a lot of mobile, localised gas turbines, at least for the foreseeable future.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Jon Martindale is a contributing writer for Tom's Hardware. For the past 20 years, he's been writing about PC components, emerging technologies, and the latest software advances. His deep and broad journalistic experience gives him unique insights into the most exciting technology trends of today and tomorrow.