Elpida Memory Likely to Seek a Second Bailout

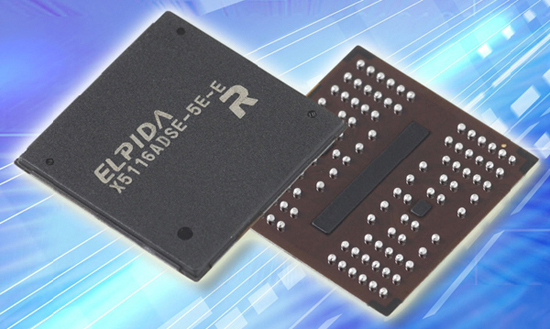

Elpida Memory, the world's third largest DRAM maker, may be seeking another round of government funding to finance its business.

The struggling chip company is reportedly not able to repay a government loan in the amount of $386 million, which it received in June 2009, following the crash of investment bank Lehman Brothers in late 2008. Elpida received a total of more than $1 billion in supporting financing.

According to The Asahi Shimbun, Elpida is likely to be seeking a second bailout. The company's current cash resources barely cover the original loan amounts and a questionable world economy as well as deteriorating DRAM pricing may keep Elpida in the red and drain its cash reserves. There is already speculation that Elpida will be denied another bailout and there are talks that Elpida could be merging with Toshiba. Digitimes wrote that the Japanese government has an interest in keeping Elpida's DRAM technology alive and especially keep it as an asset of the country. As a part of Toshiba, Elpida could be contributing to faster Flash development, Digitimes said.

Samsung, already the world's dominating DRAM maker, would gain even more control of the market, if Elpida closes its doors.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

jojesa I hope Toshiba or any other company out there besides Samsung lend a hand or buy them.Reply

The last thing we need is Samsung running a Monopoly. -

I don't agree with governments bailing out businesses that fail.Reply

I didn't want the government to bail out the car companies that produced cars that people didn't buy. Thats a part of business, when things go bad a new business will usually come about from the old one that failed. I'm sure if GM or Chrysler went under Ford or another company thats not based in the US would have taken the plants and made them useful. I'd personally like to see retooling for electric vehicles and wind turbines, but thats not viable due to the limited productions and high cost. Too bad commercial wind turbines or batteries aren't like the semiconducting industry, with ever decreasing costs. -

thesnappyfingers I generally agree with shuffman, especially companies that clearly will not be able to pay off the loans.Reply

GM and Chrysler did go under though, in terms of them declaring bankruptcy, pretty sure Chrysler was purchased (at least controlling share) by Cerberus-sounds sinister-group or something like that

What I really don't like is large financial institutions taking insanely large risky 'investments' that when fail and falter utterly destroy a nations economy. The people in charge of such institutions are suppose to invest and not speculate on bullshit. Sorry for the rant, just don't like the middle class suffering due to poor decision making that was not their own. Alas, this appears to be the trend both historically and currently.

-

joytech22 Dayum, will this affect pricing for us if Elpida should fall like so many companies?Reply -

nebun no more bailouts please....it was the worst thing ever done by the US Government....all that bailout money should have been distributed to the taxpayers, which in turn would have helped boost the economyReply -

nebun no more bailouts....this is the worst thing the US Government has ever done....they should have given the money to the tax payers which in return would have boosted the economyReply -

nebun nebunno more bailouts....this is the worst thing the US Government has ever done....they should have given the money to the tax payers which in return would have boosted the economyoops...double post :)Reply -

Pyree nebunno more bailouts please....it was the worst thing ever done by the US Government....all that bailout money should have been distributed to the taxpayers, which in turn would have helped boost the economyIt's a Japanese company. By the way, the latest news is that Toshiba would like to merge with them and the share of Elpida actually goes up.It is a tough market for DRAM maker since they are at a record low price. If they can bring out DDR4, maybe the higher profit margin can help them a bit.Reply

-

I see this also showing the lack of financial responsibility thats spreading throughout the world. Companies and individuals should save for times of loss, but with interest rates in the toilet because of the banks loaning out money to people who were risky in the first place, savings of any type is completely worthless. I can buy a used car, and I'll lose less value over time than sticking money in a bank, sad. I remember my parents having 5% and 6% interest on CDs and the inflation rates were around 3% just a few years ago. Now, just starting to build my independence its tough watching money lose value like it is with so little in return.Reply