TSMC Price Hikes to Result in Higher Retail Pricing For Pretty Much Everything

Chip shortage should last until mid-2023

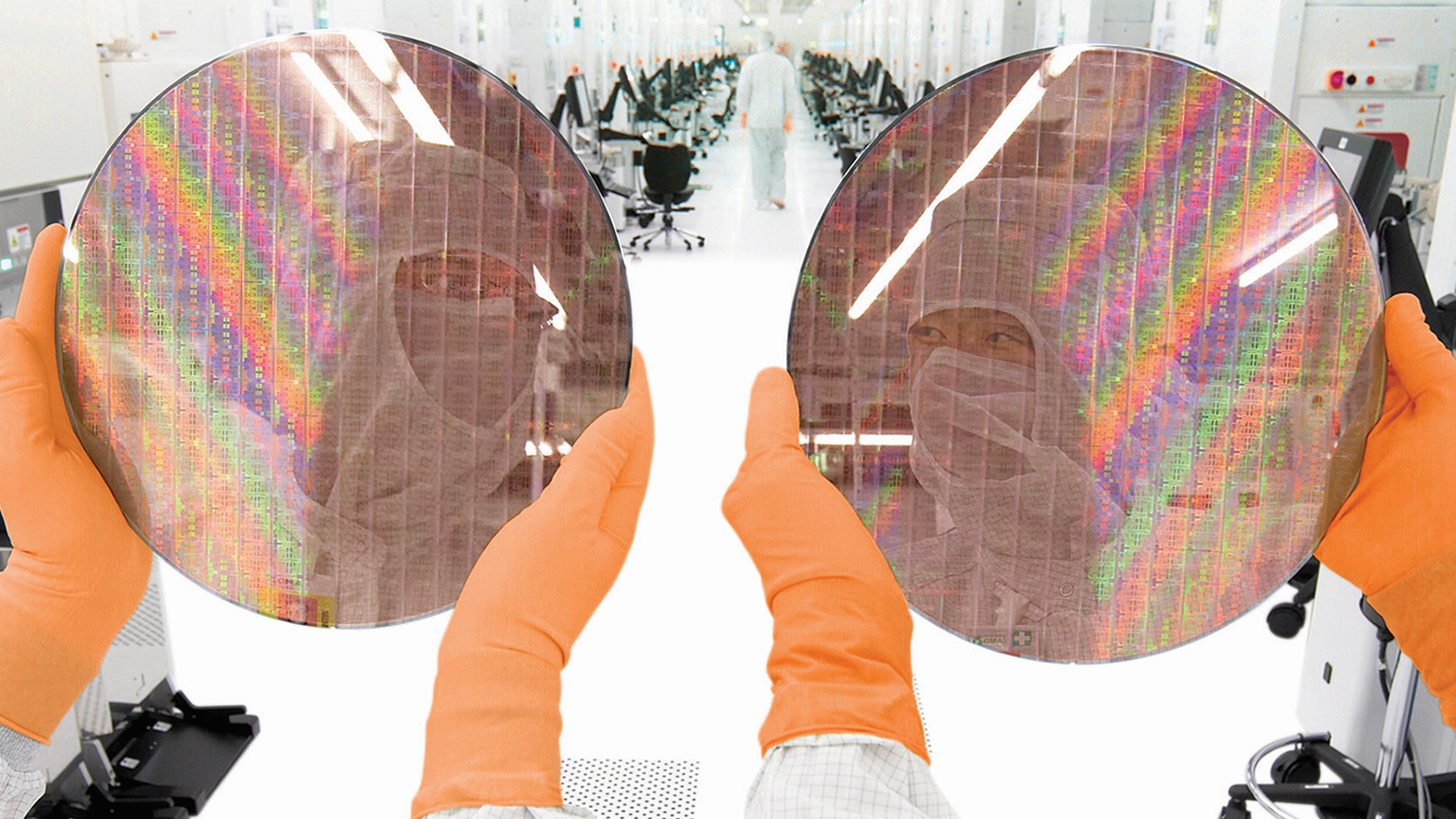

The recent increase in wafer quotes by TSMC, Samsung Foundry, GlobalFoundries, SMIC, UMC, and other contract chipmakers, particularly for chips made using mature nodes, will soon have a more serious impact on the price of actual hardware, researchers at Counterpoint claim. That includes cell phones and a broad range of everyday consumer hardware, with the expected price hikes being severe enough that analysts expect most consumers to be forced to buy lower-end hardware.

Modern PCs and smartphones usually contain one or two key chips (CPU, GPU, SoC) made using the most advanced chip tech, like a leading-edge or advanced node. But they also feature tens of logic chips made with mainstream/mature nodes (older chip tech).

The foundries, which make the actual chips, have already increased pricing for their customers. However, most chip designers and other firms that make the finished products didn't pass on the price hikes to their customers to keep prices of their entry-level and mainstream products stable so they don't scare off price-sensitive customers. While this didn't happen with graphics cards and CPUs (some of the SKUs simply went missing), many devices (smartphones, inexpensive notebooks, etc.) have basically maintained their standard MSRPs during the shortage. That's about to end.

With the recent hikes of quotes by TSMC and other foundries, the cumulative cost increases for some chips from 2020 to 2022 will be 30%, or higher. A 30% increase is impossible not to pass up the supply chain as margins are already rather thin and naturally the company's don't want to lose money. Counterpoint now expects the chip designers to increase their prices to OEMs, which will now filter down to the end products in 2022.

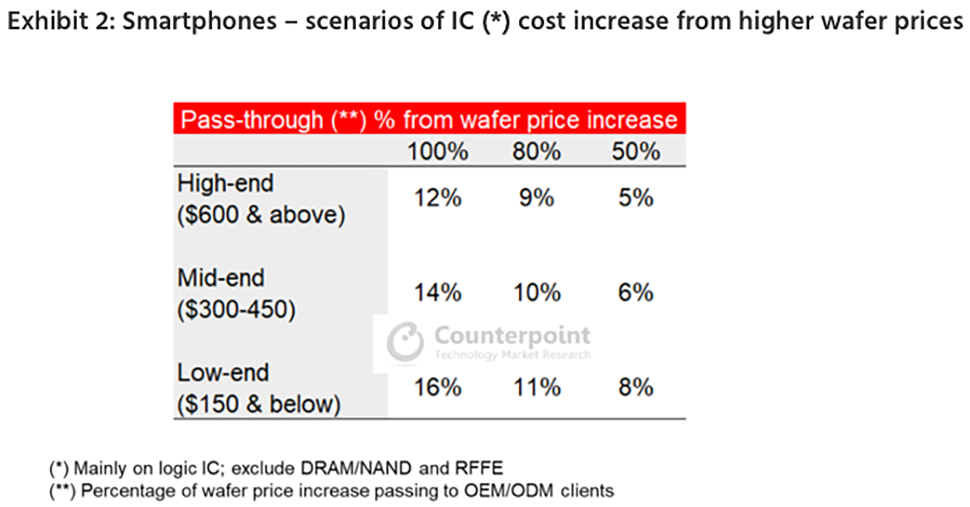

A high-end smartphone's bill-of-materials (BOM) cost, which represents how much it costs to build the device, is typically around $600. This could increase by 12% overall because chips account for a lower percentage of its overall BOM cost. Meanwhile, an entry-level handset (<$150) could jump around 16% because the chips account for a more significant portion of its BOM.

A 12% ~ 16% increase in BOM cost can have a very significant (think 25% orhigher, but we are speculating) impact on its recommended price, so it looks like next year we should expect another round of price hikes on pretty much everything.

Short-term price hikes are not a big problem, per se, but these factors will keep pricing high for years to come.

Wafer Prices: Leading-Edge & Advanced Nodes

Making chips using leading-edge fabrication technologies, such as TSMC's N7 and N5 as well as Samsung Foundry's 7LPP and 5LPE, is expensive because contract chip makers tend to charge two or three times more for processing wafers using their latest nodes than for trailing (older) nodes, like N12/N16 and above.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Developing SoCs for N5 or N7 technologies is extremely expensive, and those investments are typically made years before those chips start to earn money. As a result, only a handful of companies in the world can afford leading-edge processes.

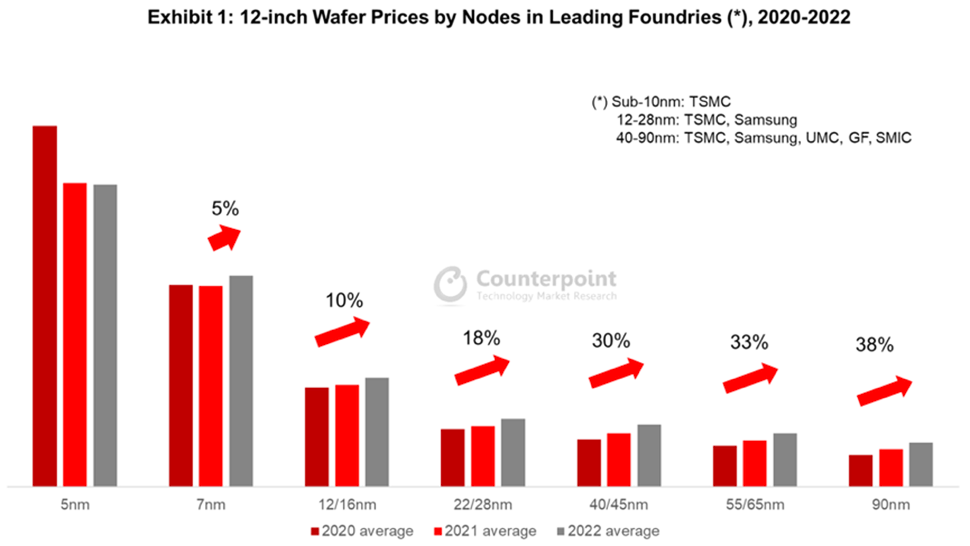

Because demand for leading-edge and advanced nodes is somewhat limited and is fairly predictable, so TSMC and Samsung Foundry do not have to rush to expand their capacity. To that end, wafers using TSMC's N5 node will not get any more expensive next year than 2021, whereas prices of N7 node will increase by around 5%, Counterpoint says.

In the coming year or two, both technologies will still remain rather inaccessible for the vast majority of chip designers, and even rather advanced chips will still be produced on 16nm and 28nm-class nodes. Meanwhile, wafer pricing for these technologies will increase by 10% to 18%, which is quite noticeable.

Nowadays chips like SSD controllers are fabbed using 12/16nm-class technologies and those types of chips are found in the vast majority of client PCs these days.

Wafer Prices: Mainstream & Mature Nodes

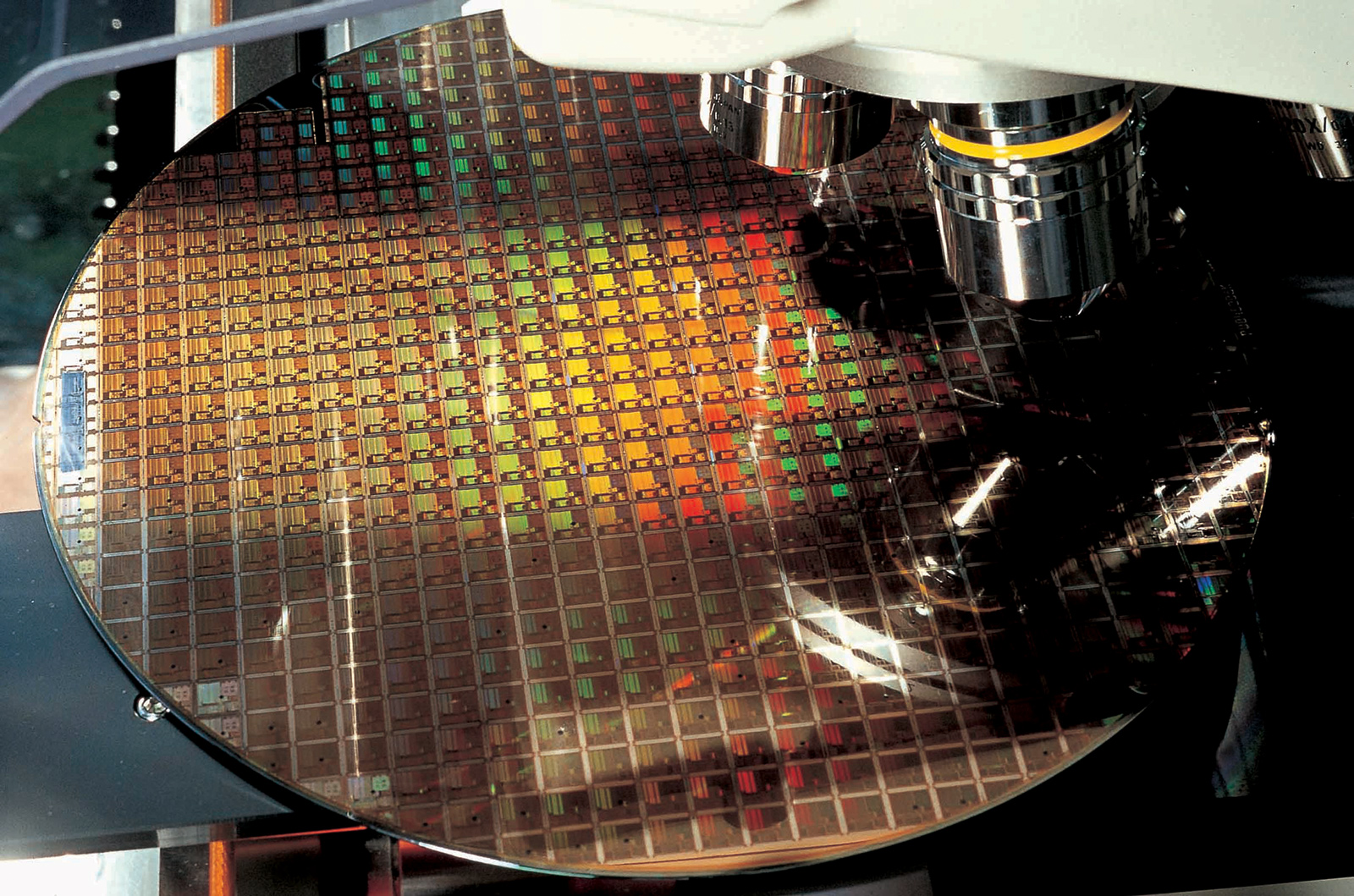

All advanced chips in modern client devices are surrounded by ICs made using mature technologies such as 40/45 nm and above: power management ICs, display driver ICs, network controllers, and many more. There are tens of thousands of designs made using mature nodes, and the number of designs is growing. These chips are widely used by all industries, including automakers, consumer electronics manufacturers, producers of industrial equipment, and even aerospace companies.

Demand for all electronics devices is already high these days (partly because many venues remain closed and people spend their money on goods). Also, since there are ongoing megatrends like 5G, AI, and HPC, chip demand is only going to increase. As a result, Counterpoint expects chips made using trailing (lagging) technologies to be in short supply for a while, and balanced supply and demand won't come until mid-2023.

In fact, demand for equipment designed for lagging-edge nodes is growing faster than demand for tools aimed at leading-edge nodes, according to fab equipment firms.

"We have just try to view that, over several year horizon that actually the lagging-edge [wafer fab equipment, WFE] grows faster than overall WFE," said Doug Bettinger, the chief financial officer of Lam Research, during a conference call with analysts and investors (via SeekingAlpha). "I still see it that way. We are at dynamics that's drives this business is lagging-edge. It is IoT, it is RF, it is power devices it is, automotive […]. The demand for that segment of the semiconductor industry is very strong."

Counterpoint says that TSMC (and probably other foundries) have increased their quotes for 40/45 nm, 55/65 nm, 90 nm, and larger nodes multiple times since mid-2020. As a result, the price of a wafer processed using 90nm technology will increase by 38% in 2022 compared to 2020.

"For foundry customers (fabless and IDMs), the impact of supply shortage weighs much greater on their business compared to the 10% – 20% increase in wafer cost, which they might pass to their end customers (device ODMs/OEMs)," wrote Dale Gai, a research director at Counterpoint.

Fabs Utilization Rate Exceeds 100%

Currently, most foundries operate at a utilization rate that exceeds 100%. TSMC does not publish its utilization rates, but SMIC's utilization rate was 100.4% in Q2 2021, whereas UMC's utilization rate exceeded 100% in Q2 2021, according to financial reports. This essentially means that fabs spend more time processing wafers and less time in maintenance, which is risky.

For a while, contract chipmakers have been buying additional equipment for their trailing nodes, and even outdated nodes that rely on 200-mm wafers. But since demand now exceeds supply, they are buying even more equipment and will have to depreciate those tools in the coming years, which will make them more reluctant to drop prices even when demand-supply balance stabilizes.

Entry-Level Devices to Thrive?

If analysts' predictions are correct and retail prices of hardware will upsurge tangibly because of prices of chips made using lagging-edge nodes, we may see an interesting implication on the market.

Price-sensitive customers who buy mainstream smartphones and PCs may start buying entry-level devices unless manufacturers add some additional value to their midrange products that will get out of price ranges that buyers come to expect. We have already seen something like this in the GPU market. Now this might happen to more popular devices.

Summary

Prices of CPUs, GPUs, and SoCs for high-end smartphones are driven primarily by high demand as well as factors like yields and undersupply. TSMC and Samsung Foundry have relatively limited capacity for their 5nm and 7nm-class nodes, but because they're interested in long-term relationships with companies that can afford to develop chips for leading-edge nodes, neither is going to increase quotes for leading-edge nodes or sell allocations through a bidding system.

But when it comes to trailing nodes, foundries increase their quotes as demand clearly exceeds supply, and that will exist for years to come. Chips made using 28nm and older process technologies are used for tens of thousands of applications, including those based on chips produced with leading-edge nodes. Today, some foundries are running at utilization rates that are over 100% to meet the demand for inexpensive chips. which is risky.

The price increases on chips made using mature nodes will affect the end cost of all devices. In the case of high-end PCs and smartphones, the additional costs will barely affect their recommended prices (if at all). But in the case of mainstream devices, the additional costs may have a drastic effect on MSRP. If this happens, buyers may cease to buy midrange products and switch to entry-level instead.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Alvar "Miles" Udell TL;DR - Inflation, which is already causing price increases in every segment, is going to be especially hard on anything which relies on a computer chip.Reply -

Jim90 Considering the huge profit some of TSMC's customers, such as Apple, are making, and despite current conditions, this was inevitable. Let's see just how quickly Apple passes this increase onto their customers, and will Samsung prevent this, or follow suit 'in sympathy' lol.Reply -

ezst036 ReplyAlvar Miles Udell said:TL;DR - Inflation, which is already causing price increases in every segment, is going to be especially hard on anything which relies on a computer chip.

Yup, agreed. Everybody loves the Fed printing more money until the bill comes due and a gallon of gas is pushing double digits. -

Alvar "Miles" Udell Apple won't hesitate to pass on the price increases, people will line up to be the first to pay it too.Reply

Considering the sluggish sales of the Galaxy S21 series though, combined with the expected limited market availability of the Galaxy S21 FE (and expected removal of the MicroSD slot), Samsung's going to have to do something with their next series to get people to upgrade, which isn't helped by the fact that, as 5G devices, they have their own set of drawbacks compared to the non-5G predecessors. Raising prices on the A series isn't the answer, at least not until they can make them decent rivals to the Pixel a series and other lower cost devices when the new generation Exynos SoC's release, and raising prices on the S series would only lead more people to hang on to their older, still very viable and capable devices instead...

Samsung Galaxy S21 sales lowest in years, company starts internal review (androidauthority.com) -

Kamen Rider Blade It's interesting how the older nodes are seeing the largest price hikes in terms of % increases.Reply

There seems to be a linear relation between older nodes and larger % price increases.

Almost as if they're consuming more raw materials during the manufacutring process. -

thisisaname ReplyKamen Rider Blade said:It's interesting how the older nodes are seeing the largest price hikes in terms of % increases.

There seems to be a linear relation between older nodes and larger % price increases.

Almost as if they're consuming more raw materials during the manufacutring process.

Had not though of wafer price but if wafer supply was the problem then it make sense to raise the price on them more. -

hannibal So shortages continue up to 2023… so maybe buying something new at 2025… ok nice to,know…Reply -

gargoylenest everybody is milking the covid cow up to the last drop. nothing new or unexpected.Reply -

Reply

Yes it’s all bull crap. And if Microsoft ever wants to make any money off of games Then they had better start producing the series X in mass quantities and making sure that individuals can actually buy themgargoylenest said:everybody is milking the covid cow up to the last drop. nothing new or unexpected.