Governments to Help Development of Advanced Process Technologies

New challenges set to change semiconductor industry.

In capital-intensive industries such as semiconductor manufacturing, the costs of pathfinding, research, development, and manufacturing are becoming extremely high. Historically, local or municipal governments have helped to build semiconductor production facilities, leaving development of process technologies to actual producers. Apparently, the semiconductor production industry has reached a point when it might need some help with R&D itself, as well as business development.

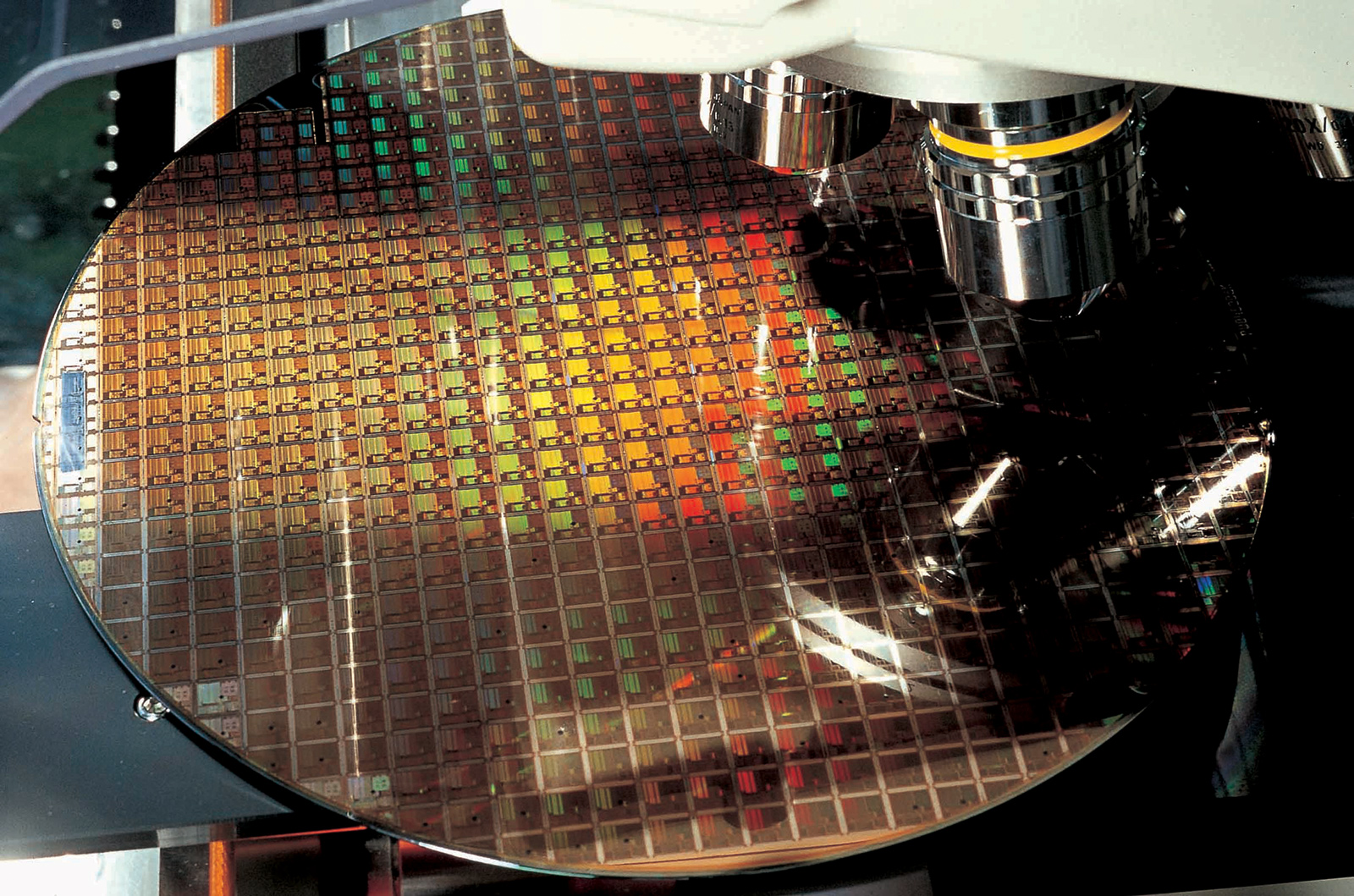

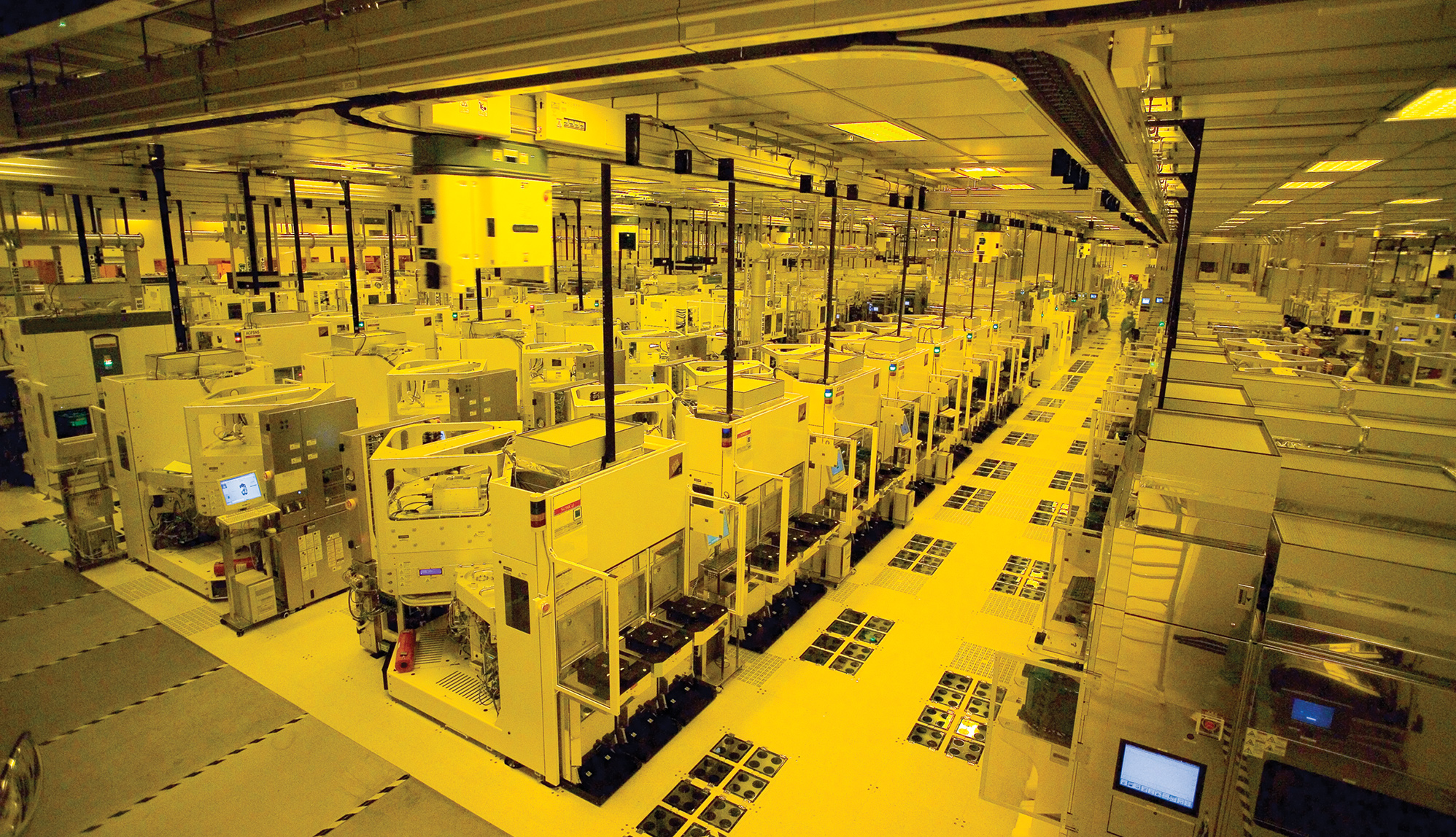

The Costs of Fabs

Companies like Intel, Taiwan Semiconductor Manufacturing Co. (TSMC) and Samsung Electronics disclose capital expenditure plans that usually total tens of billions of dollars. One modern semiconductor manufacturing facility today costs well over $10 billion, and shrinking nodes will push the cost even higher.

For example, one of TSMC's latest fabs can cost as much as $19.5 billion. From one point of view, the costs of these fabs are enormous. Yet, they are not. Nowadays, humanity consumes so many semiconductor-based electronics devices that the sales more than pays off the costs of fabs. Meanwhile, demand for chips is only going to increase.

Historically, the governments supported chip manufacturing using various incentives, which is why AMD (and then GlobalFoundries) built fabs in Dresden and in New York; Intel likewise built its fabs in the U.S., Israel, and Ireland; and TSMC became the world's largest foundry, owning fabs only in Taiwan. The U.S. did not attract many new semiconductor players to the country in the recent years, which is why only a few new fabs were constructed in the country. The CHIPS for America Act, if passed, will provide tens of billions of federal money to support American semiconductor industry in the coming years, though it remains to be seen whether it will be enough to stay ahead of other countries.

China is currently the leader when it comes to spending on semiconductor equipment as the state wants to become self-sufficient in terms of chip manufacturing by 2025. But the 'Made in China 2025' plan is not only about building fabs in the country. For years Tianxia trained local engineers and supported various scientific projects.

Semiconductor R&D Funding

Meanwhile semiconductor manufacturing facilities may not be the only overwhelmingly high type of spending in the companies' balance sheets going forward.

Leading makers of chips like Intel, GlobalFoundries, TSMC, and Samsung Foundry spend billions on research and development every year, but not all of their R&D budgets are spent on process technologies themselves. Big companies invest significant sums into fundamental science during the pathfinding phases of their research.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

But as process technologies get increasingly more complex, it is becommings considerably harder to keep introducing a new technology every 12–18 months and then modify it to address specialized applications. For example, a smartphone SoC is produced using a different fabrication process than a processor for a self-driving car, whereas chips for aviation, military, and space applications use manufacturing technologies tailored specifically for them.

Historically, states have indirectly helped commercial companies by funding universities and various research centers dealing with fundamental science. But it looks like governments plan to be more directly involved with R&D in a bid to retain or improve the competitive positions of their countries in the world of semiconductors.

The CHIPS for America Act includes spending $12 billion on various R&D activities. No details about these activities are known just yet, but they are aimed at making the U.S. chip industry more competitive, or at least sustaining current positions.

Interestingly, the U.S. government's money could first be spent on helping out scientists from Taiwan, which ultimately means TSMC and UMC. Earlier this month the American Institute in Taiwan (AIT) signed the Agreement on Scientific and Technological Cooperation (STA) with the Taiwanese Ministry of Science and Technology in a bid to enhance bilateral science and technology cooperation. Among other things, the cooperation includes research of novel materials (i.e., research co-funded by Taiwanese and U.S. governments), including next-generation semiconductor materials or two-dimensional materials.

Keeping in mind that companies like Apple, AMD, Nvidia, Qualcomm and hundreds of others benefit from and use services provided by Taiwanese makers of semiconductors, it makes a lot of sense for AIT and similar organizations to help the local chip industry. At the same time, it means enabling competitors for companies like Intel and GlobalFoundries.

U.S. Defense Department to Help Chipmakers

But while the CHIPS for America Act program has yet to pass the House and Senate, there are other instruments the U.S. government can use to help local chipmakers like GlobalFoundries. Recently the U.S. Senate passed a $741 billion defense bill that includes $25 billion which can be used to help domestic chipmakers.

GlobalFoundries runs three fabs in the U.S. Two of the fabs — in Vermont and Dutchess County — already have the Department of Defense's Trusted Foundry status, whereas its largest fab in Malta, New York, hasn't received that yet. The DoD needs chips from a trusted source to ensure the chips run as expected and don't contain any hidden features or backdoors. Otherwise, the chips might not work as intended on the battlefield, or could be used for other countries attempting to spy on the US. Therefore, DoD is more than willing to help companies like GlobalFoundries.

Traditionally, DoD and its contractors have used chips made using nodes specially designed for military use to ensure their reliable operation. However, many of these manufacturing technologies are outdated and their capabilities cannot compete against those provided by commercial processes. Developing military-enhanced versions of existing leading-edge fabrication technologies that already cost billions of dollars is not financially viable. To that end, the U.S. DoD is exploring ways to use commercial processes for its needs.

Last week the DoD disclosed plans to announce a program called "Rapid Assured Microelectronics Prototypes – Commercial" (RAMP-C). It's intended to enable local semiconductor manufacturers to produce chips for military use and ensure that the whole supply chain is completely secure.

"There is currently no commercially viable option that can provide a U.S. located leading-edge foundry that can fabricate the assured leading-edge custom integrated circuits and Commercial off the Shelf (COTS) products required for critical DoD systems," a statement from the DoD reads. "The purpose of the RAMP-C program is to incentivize such an option."

IBM and Microsoft have been picked by the DoD to secure its chip supply chain, though it is unclear how soon local chip suppliers will be able to use the new supply chain to work with the Defense Department. If the DoD significantly increases its purchases of high-tech equipment in general and semiconductors in particular, this will give a strong financial boost to American chipmakers. Companies like Intel and GlobalFoundries need to increase CapEx and R&D spending in the coming years, so the addition of a new major client will play a big role in their future.

Summary

The semiconductor industry has developed gradually over the years, and in many cases with the help of state or local governments. The CHIPS for America Act, DoD's plan to help American chipmakers and its intention to buy more from them, as well as the Scientific and Technological Cooperation (STA) deal signed by Taiwan and the U.S. indicate that governments want to get more directly involved in the research and development of semiconductors and process technologies.

It remains to be seen how significant the government influence will be on the companies, and whether they would eventually demand to have more control over actual manufacturers of chips. At this point, they do not seem to have such plans, but rather want to provide chipmakers some additional help as they see the growing importance of microelectronics in general.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

TechLurker Assuming this passes, this could be what helps push GloFo back into competition somewhat, at 7nm and beyond. The main reason they stopped in the first place was due to a lack of sufficient financial investment to help expand and upgrade their fabs to include 7nm without cutting down their mature 14nm process. Sure, they won't be cutting edge, but being on a relatively modern node like 7nm and having some backing to develop or license sub-7nm nodes, even if it's first use is government, could help push them back into the spotlight alongside Samsung, TSMC, and Intel.Reply