Nvidia's Revenue Drops Further, But Demand for Ada GPUs Exceeds Supply

Nvidia's latest GPUs help to alleviate weakening consumer demand.

Nvidia on Wednesday posted results for the third quarter of its fiscal year 2023 as its latest products based on the Ada Lovelace and Hopper architectures began their ramp-up. As expected, sales of the company's gaming and professional graphics solutions dropped quarter-over-quarter and year-over-year. Still, at the same time, the company sold a boatload of data center products, including the latest H100 compute GPUs. Furthermore, demand for the latest GeForce RTX 40-series is so high that Nvidia could not meet demand.

"Our new Ada Lovelace GPU architecture had an exceptional launch," said Colette Kress, Nvidia's chief financial officer. "The first Ada GPU, the GeForce RTX 4090 became available in mid-October at a tremendous demand and positive feedback from the gaming community. We sold out quickly in many locations and are working hard to keep up with demand."

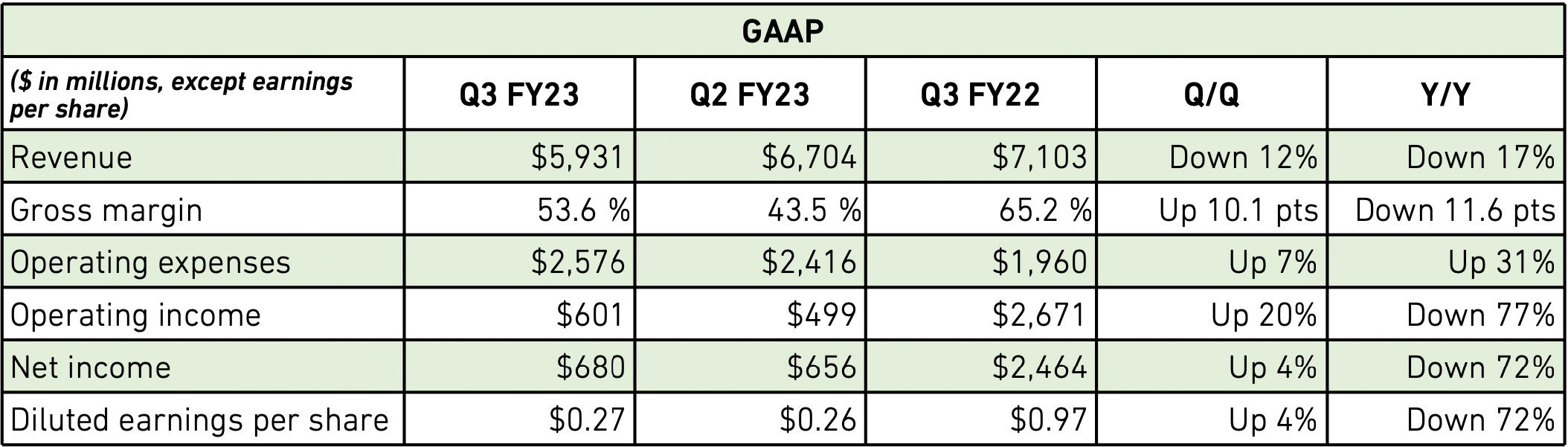

Nvidia's revenue for Q3 FY2023 dropped to $5.93 billion, down 12% sequentially and 17% year-over-year. As the company's gross margins declined to 53.6%, down from around 65% in the recent quarters (but up from 43.5% in Q2 FY2023), its net income fell to $680 million, up 4% quarter-over-quarter (QoQ), but down a whopping 72% from the same quarter a year ago.

Client GPUs Are Down

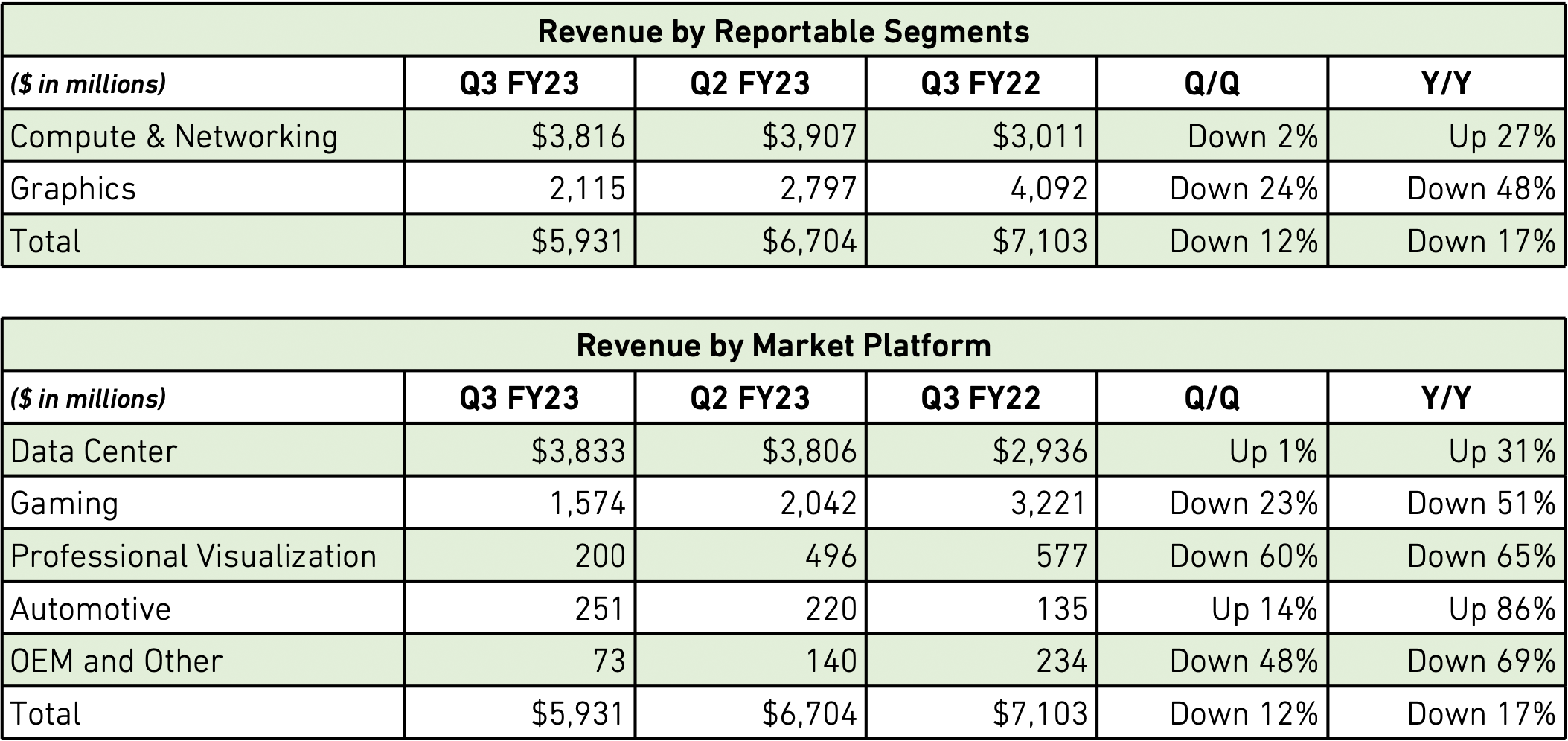

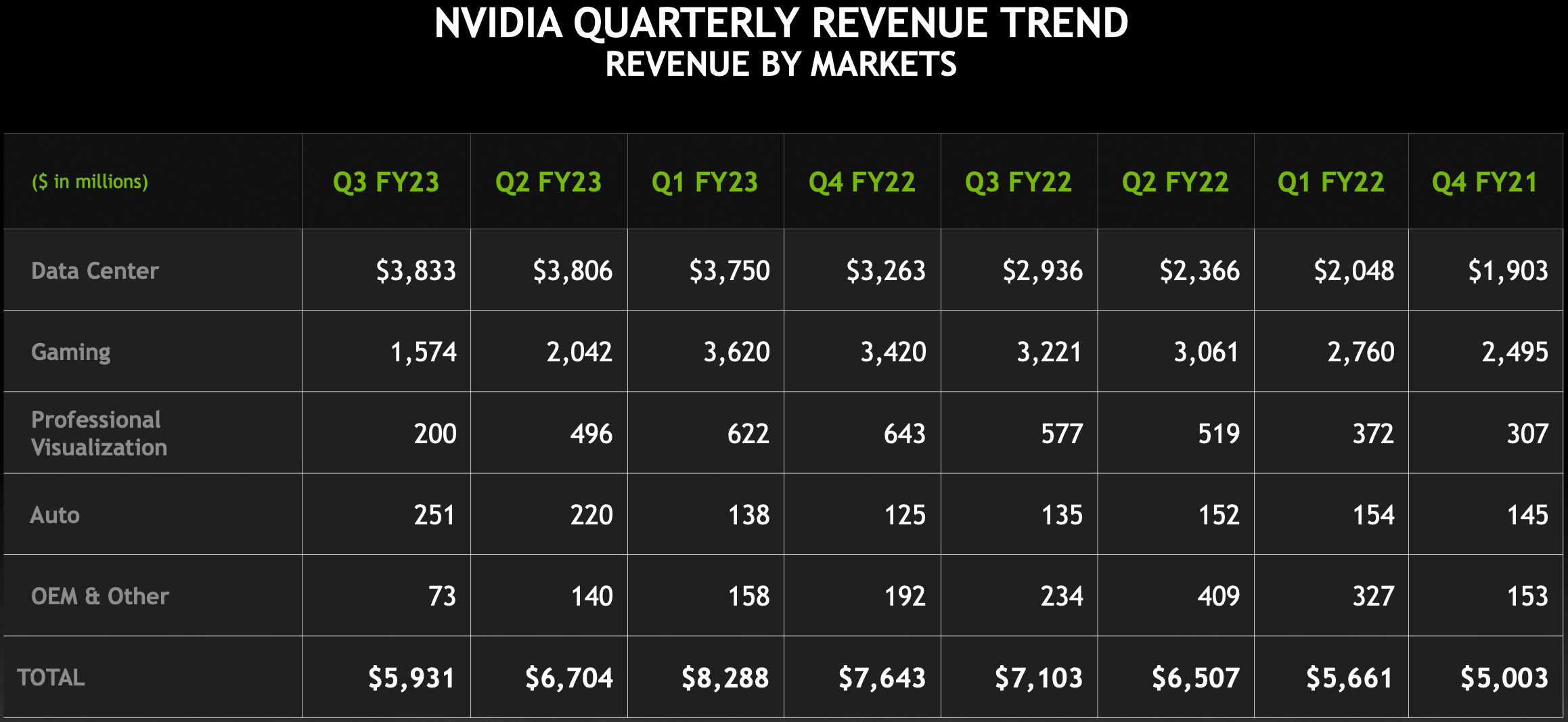

Sales of Nvidia's consumer and professional graphics cards were down in Q3 FY2023. Nvidia's gaming revenue totaled $1.57 billion, down 23% from the previous quarter and 51% from the same period a year ago. In addition, Nvidia's ProViz revenue dropped 65% YoY and 60% QoQ to $200 million. As for sales of cheap GPUs for OEMs and CMP-series GPUs for miners, they were at a multi-year low of $73 million.

Sales of graphics cards are dripping due to slowing demand on the client side and the essentially non-existent mining GPU market. Meanwhile, mining indirectly slows client GPU sales as miners sell off their boards via platforms like eBay. Most of Nvidia's GPUs available on the market are still based on the previous-generation Ampere architecture (that has been around for a couple of years) that are now sold by high-end gamers, miners, and Nvidia itself, so it is entirely expected that their supply (both from graphics cards makers and owners) now exceeds demand.

Meanwhile, since the company also initiated shipments of its all-new GeForce RTX 4090 and GeForce RTX 4080 products during the quarter, this offset declines of slow GeForce RTX 30-series sales and has a positive impact on margins. Both GeForce RTX 40-series products available today are uniquely positioned as they are the best graphics cards public, they have no direct rivals (and will not have until December 13), and there is no second-hand market for them. Yet, since the GeForce RTX 4080 and RTX 4090 carry a $1,199 and $1,599 price tag, Nvidia cannot sell a ton of them for obvious reasons, and yet it could not keep up with demand for the RTX 4090.

Interestingly, Nvidia mentioned that sequential decline of its client GPU sales was conditioned not only by lower demand for desktop discrete graphics cards, but also by lower sales of laptop GPUs. Perhaps, some customers are waiting for the new generation of laptops based on Intel's Raptor Lake and Nvidia's Ada Lovelace GPUs to arrive, whereas other are cautious of investing a lot in a device given the current economic environment.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As Data Center Products Shine

But while Nvidia is doing good in the high-end client PC segment, it is doing exceptionally well in the data center space. As a result, the company's third-quarter DC revenue rose to $3.83 billion, a 1% increase over the previous quarter and a 31% bump from the same quarter in FY2022.

During the quarter, Nvidia started volume shipments of its H100 compute GPU based on the Hopper architecture and managed to supply a boatload of expensive SXM modules and PCIe graphics cards carrying this processor to various customers. In addition, the firm continues to ship a variety of A100-based products not only to large cloud service providers but also to different other types of clients.

"[Our data center revenue] reflects very solid performance in the face of macroeconomic challenges, new export controls and lingering supply chain disruptions," said Kress. "Year-on-year growth was driven primarily by leading US cloud providers and a broadening set of consumer internet companies for workloads such as large language models, recommendation systems, and generative AI. As the number and scale of public cloud computing and internet service companies deploying Nvidia AI grows, our traditional hyperscale definition will need to be expanded to convey the different end market use cases."

Since the US government restricted sales of A100 and H100 compute GPUs to Chinese customers, Nvidia had to ship them other products (we would suggest the A30, but we are speculating) to offset the inability to supply them with more powerful options, which was a headwind for its data center business. In the coming quarters, these restrictions will be alleviated by the recently introduced A800 compute GPU that meets the export requirements of the US government and which Nvidia will continue to ship to its Chinese customers for a long time. Meanwhile, Nvidia's clients must qualify for the new product before deploying it.

Considering that Nvidia's data center sales now exceed sales of client-oriented products by 2.4 times, the green company can be officially called a data center company, or rather an AI company like the company has preferred in recent years.

Automotive Products Up

Nvidia's products for the automotive market set another all-time revenue record of $251 in Q3 FY2023, an 86% increase from last year. While the company continues to introduce new platforms for automotive applications aggressively, actual sales come from self-driving media that were announced quite some time ago and are ramping on the market now.

Outlook Remains Cautious

Nvidia expects revenue for its Q4 FY2023 to reach $6 billion ±2%, with gross margins increasing to 63.2%. However, However, $6 billion in sales will still be 21.5% below the company's earnings in the fourth quarter of fiscal 2023.

On the gaming side of its business, Nvidia expects its revenue to grow as its clients get rid of older products and replenish their stock with new GPUs. In addition, as Nvidia continues to expand the availability of its GeForce RTX 40-series graphics options, the company's sales will go up. Still, it does not quantify that increase or even give any guidance on how significantly sales of client GPUs are set to grow.

On the data center side of matters, Nvidia plans to keep ramping up sales of its H100-based products (in the form of SXM modules, PCIe cards, and DGX systems), which will offset declined sales of compute GPUs to clients in China.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError Not so long ago, Nvidia's datacenter revenues were less than half of gaming, now gaming is projected to be half as good a revenue source as datacenter within the next year. Its customer priority inversion is now complete, gaming is officially where Nvidia's dumps its wafer scraps after datacenter got its fill and gamers are stuck having to pay for the privilege of getting those scraps unless more viable and less greedy alternatives appear to pick up the slack.Reply -

TechieTwo I wonder if the Ada Lovelace GPUs sold out quickly because Nvidia is having chip production issues.Reply -

prtskg Reply

Nvidia increased datacentre GPU production to meet demand before some sanction against China decrease their sale. This was reported few months ago.TechieTwo said:I wonder if the Ada Lovelace GPUs sold out quickly because Nvidia is having chip production issues. -

watzupken Reply

Any profit making company will focus their resources on what delivers the best return on investment. So nothing surprising about Nvidia's action. I feel the same can be said of AMD focusing on the data center business over retail CPU market. But with Intel entering the same data center GPU business as Nvidia, this should give Nvidia some competition.InvalidError said:Not so long ago, Nvidia's datacenter revenues were less than half of gaming, now gaming is projected to be half as good a revenue source as datacenter within the next year. Its customer priority inversion is now complete, gaming is officially where Nvidia's dumps its wafer scraps after datacenter got its fill and gamers are stuck having to pay for the privilege of getting those scraps unless more viable and less greedy alternatives appear to pick up the slack. -

-Fran- Reply

Thank you for the good laugh. Don't forget his leather jackets.peachpuff said:Sending thoughts and prayers to jensen...

As for the report itself. Well, it's a tough time for most PC markets, I'd say? I mean, the UK just reported a 11.1% increase in cost of living (inflation), so that's about 11.1% less money you can't dedicate to gadgets and other "fun" stuff. The rest of the world in which most tech Companies deal in are not that much better either.

Making GPUs so expensive is really strange in this economic climate. I guess they'll bank on the margins and not volume during these times?

Regards. -

digitalgriffin I miss the days of 60 class <$250 GPUs you could pick up at MSRPReply

I don't think AMD board partners are going to sell at $999 price point. They will see the potential of margin given the rumored performance. You'll be damn lucky to find one at $999 for the first year.

I know someone who is a hard core computer enthusiast who makes $250k/year. He's saying "That's just f'ing stupid."

Intel is not a viable competitor yet. Even though the A770 has some perks like av1 and its price, it has one huge drawback.

Intel's commitment to money losing ventures is limited. Their history is telling. Rumors are circulating that the desktop gpu market is dead at Intel. So it's likely a dead man walking.

Intel will never admit to abandoning consumer space as it will leave them with a ton of inventory no one will touch. When Battle Mage comes out or Celestial, I might consider it a safe investment and not throw away money. -

Jimbojan whatever happening to the GPU market, it is down for NVDA, and the same for all suppliers; there is no chance NVDA will have any revenue growth in the data center or the gaming market in the current market environment, or even next year, as Intel is working hard to build it fab and design in these fields; it is almost sure Intel will win with the government support, both AMD and NVDA will suffer, so will be TSMC. Intel will gain customer from TSMC soon. I am sorry, those analysts were speculating that NVDA or AMD will have any growth is just speculation, there is no fact to it. I am sorry.Reply

gpu -

hannibal Replydigitalgriffin said:I miss the days of 60 class <$250 GPUs you could pick up at MSRP

I don't think AMD board partners are going to sell at $999 price point. They will see the potential of margin given the rumored performance. You'll be damn lucky to find one at $999 for the first year.

Most likely only AMD reference and some AIB models that you don´t see in shops after first 2 minutes...

7900XTX models are rumored to use same huge coolers than 4090 models, so they will be expensive! I am guite sure that Asus strix will be near $1800 or more... If they are fast enough. -

waltc3 When nVidia makes 3 but 6 people want to buy them, well, it's always a case of demand exceeding supply, eh?...;)Reply