Intel Announces 'In-Silicon' Fixes For Meltdown And Spectre Coming This Year, 10nm Update

Intel reported its fourth-quarter financials today in what was probably one of the company's most anticipated briefings in recent history.

Intel's financial performance has always been solid, often led by stellar +60% margins, but this briefing was somewhat different as some predict that the shadow of the Meltdown and Spectre vulnerabilities threaten to blot out some of Intel's black ink. That surely didn't happen, though, as Intel posted record results yet again and its stock is up 4% after hours. We also learned some new information about the company's plans to address the vulnerabilities and a surprising decline in the company's desktop processor sales.

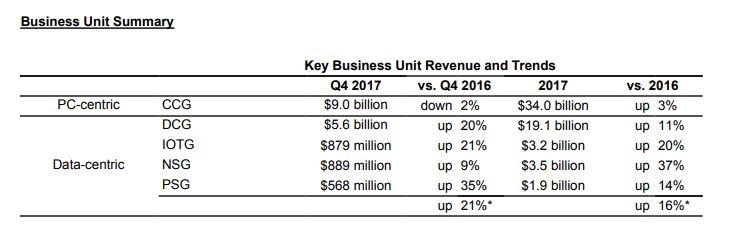

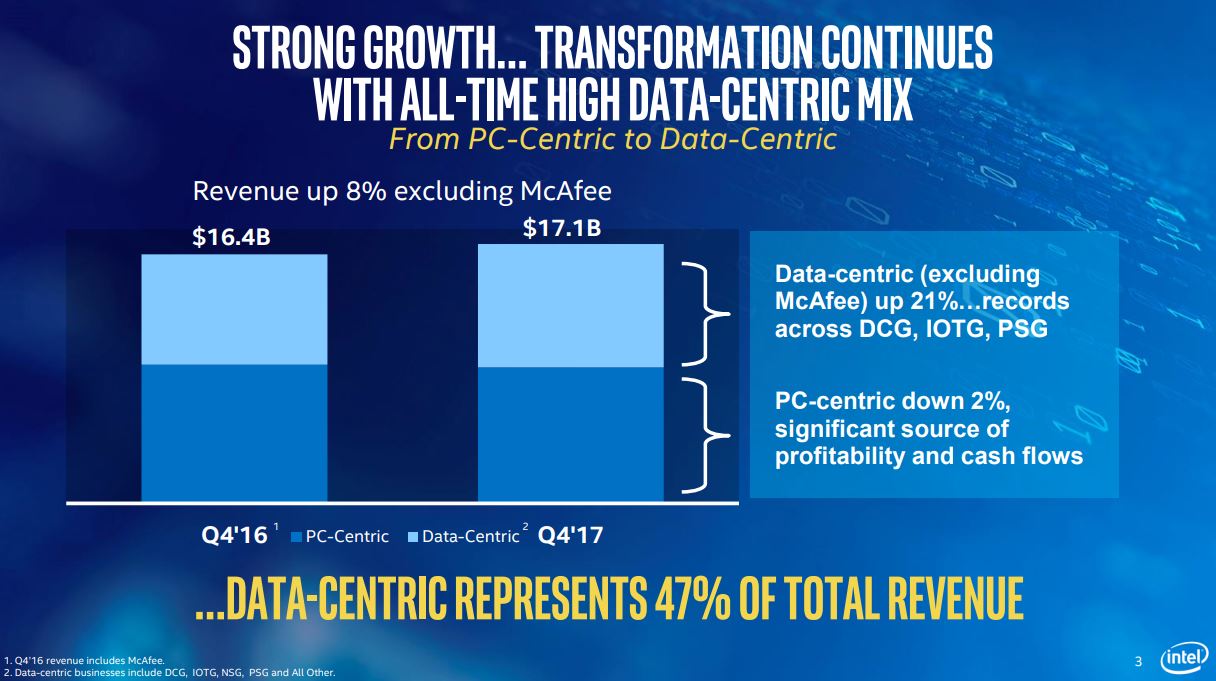

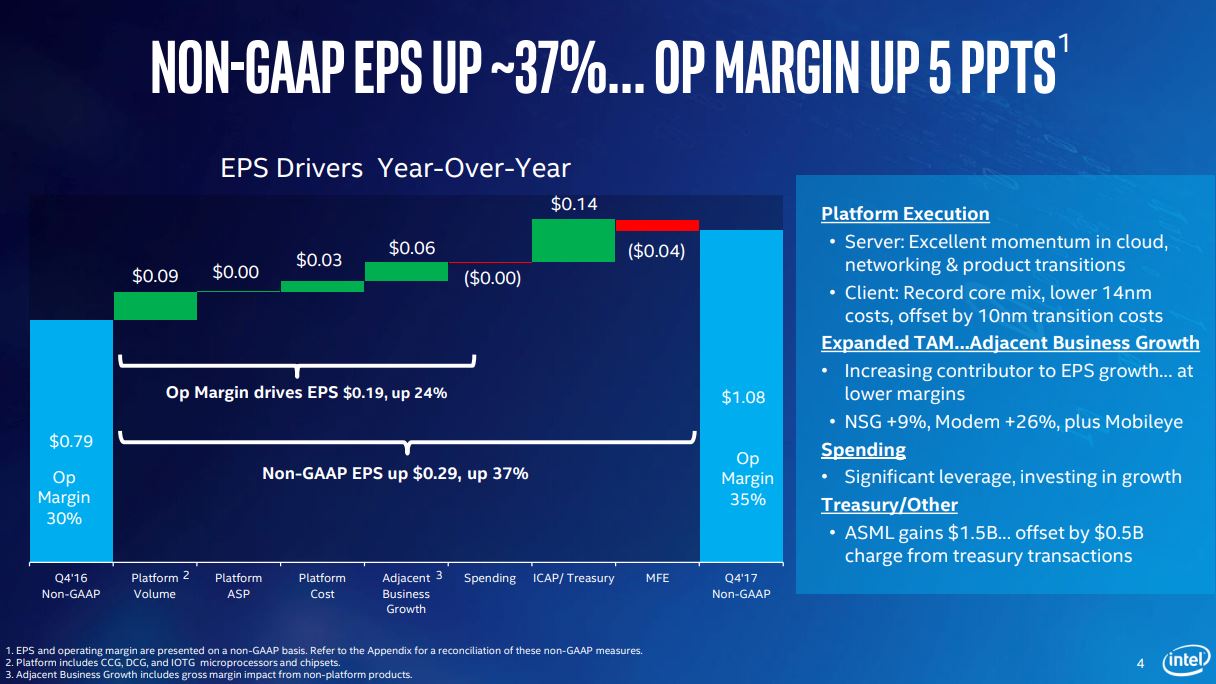

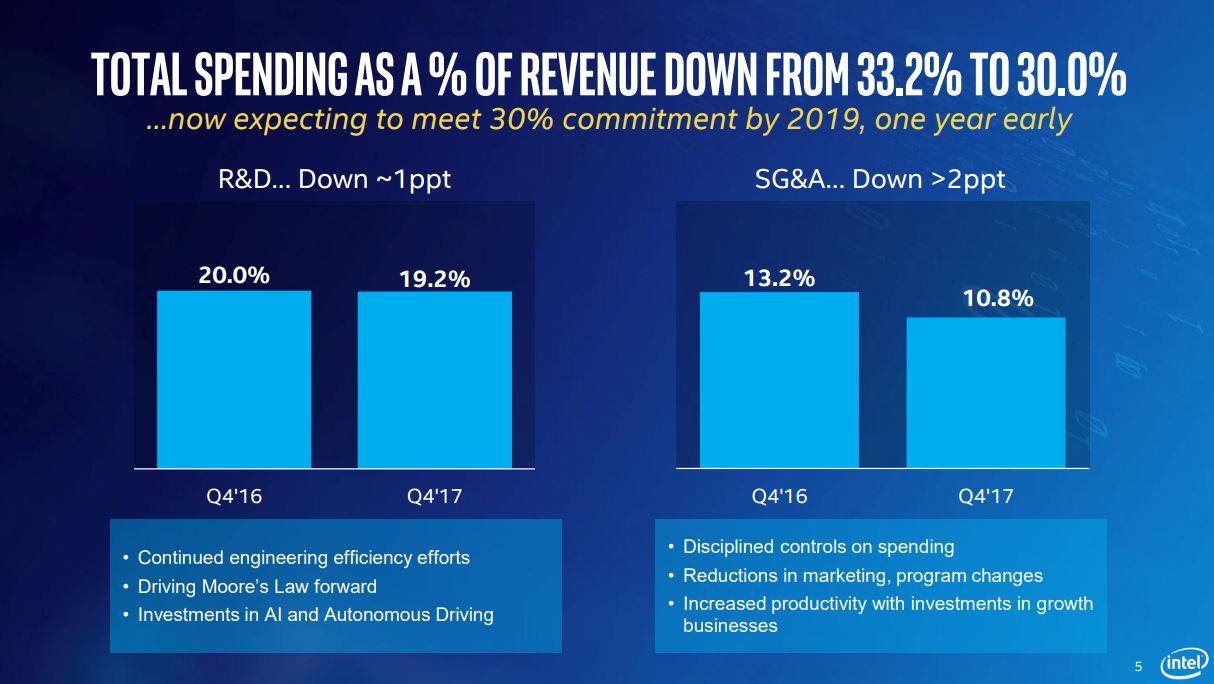

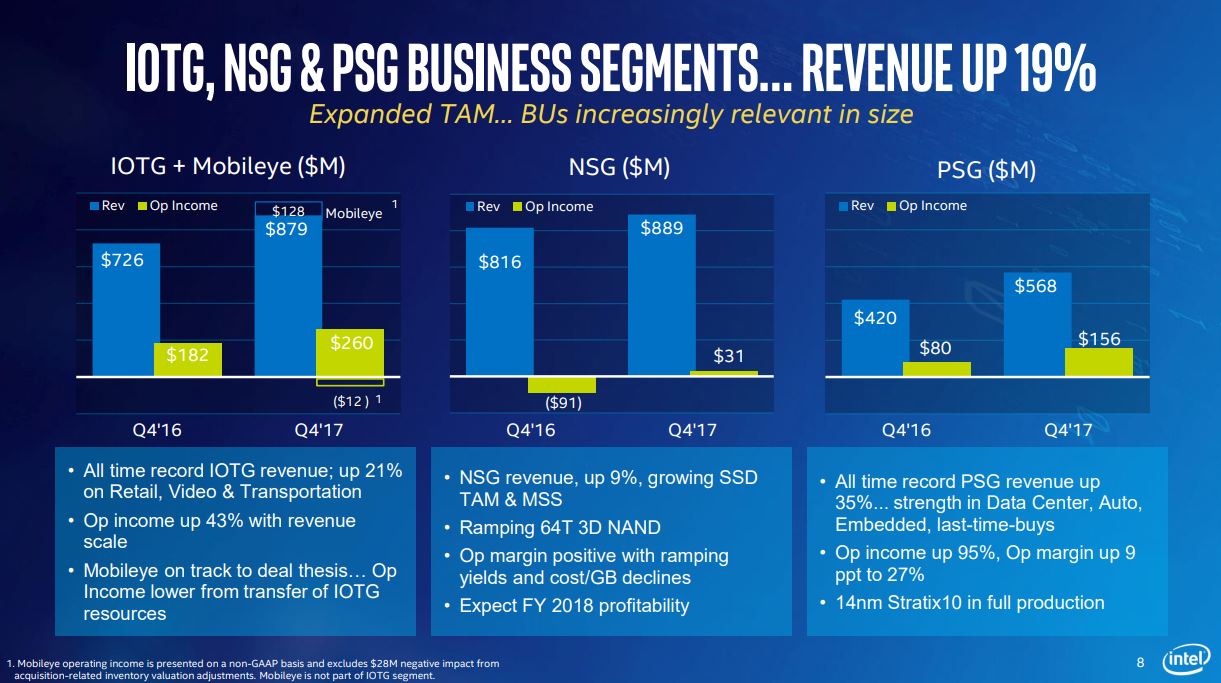

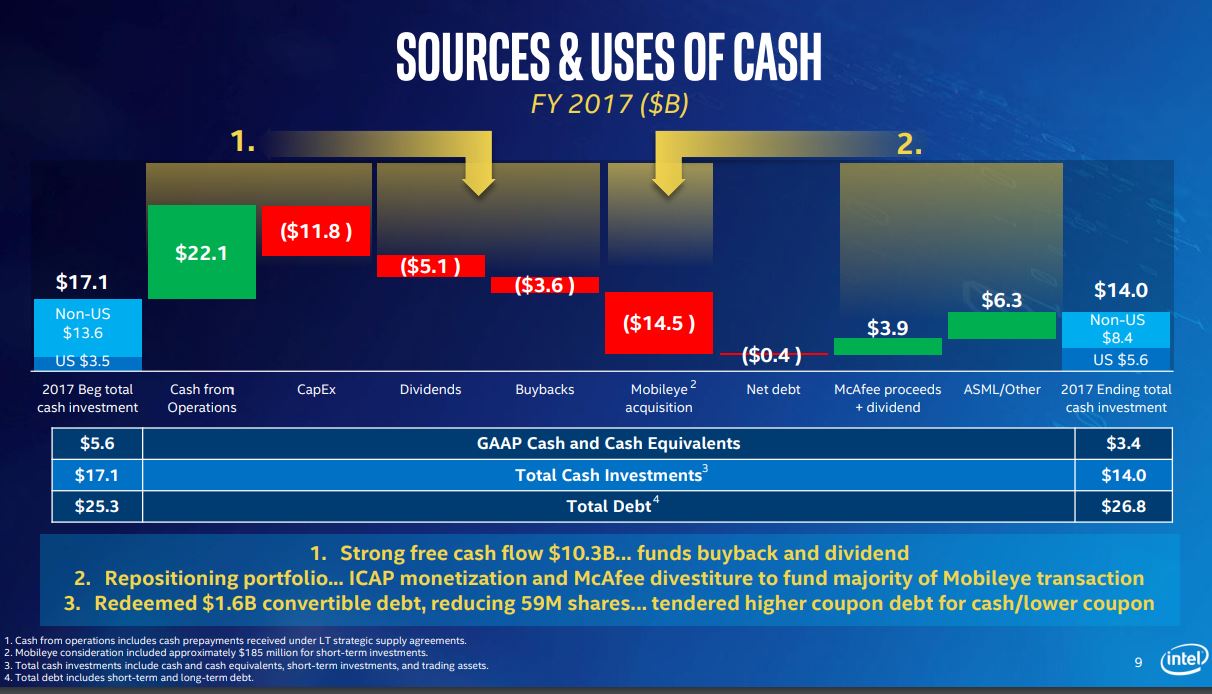

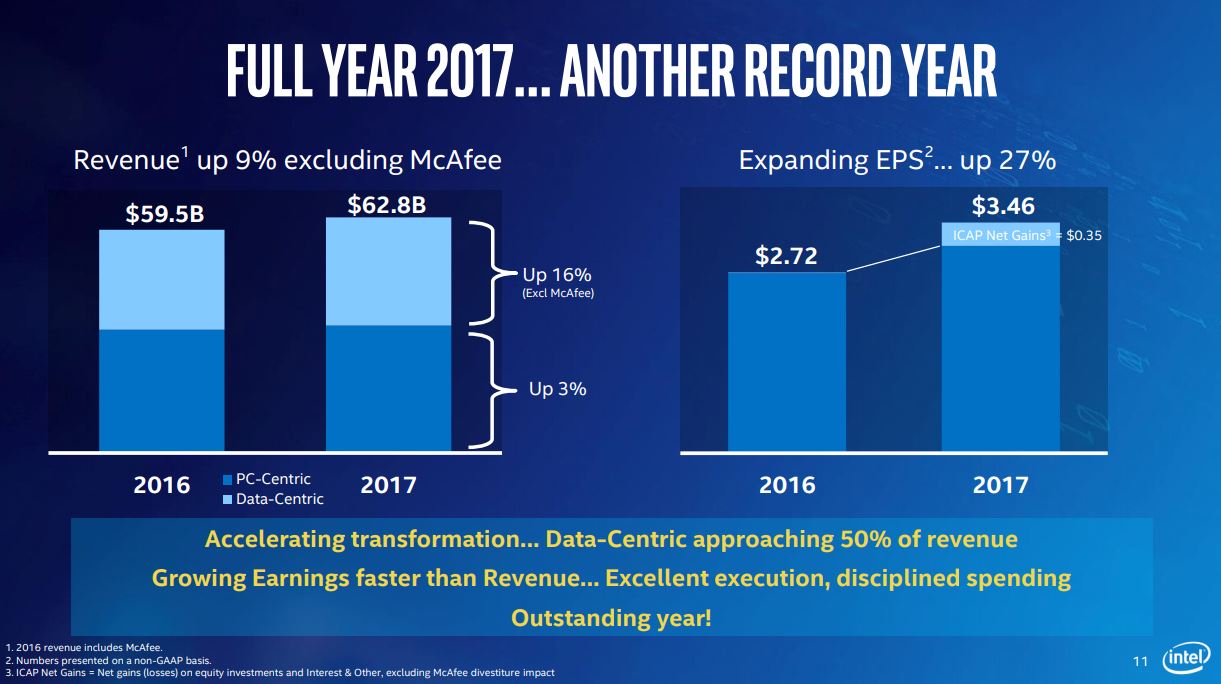

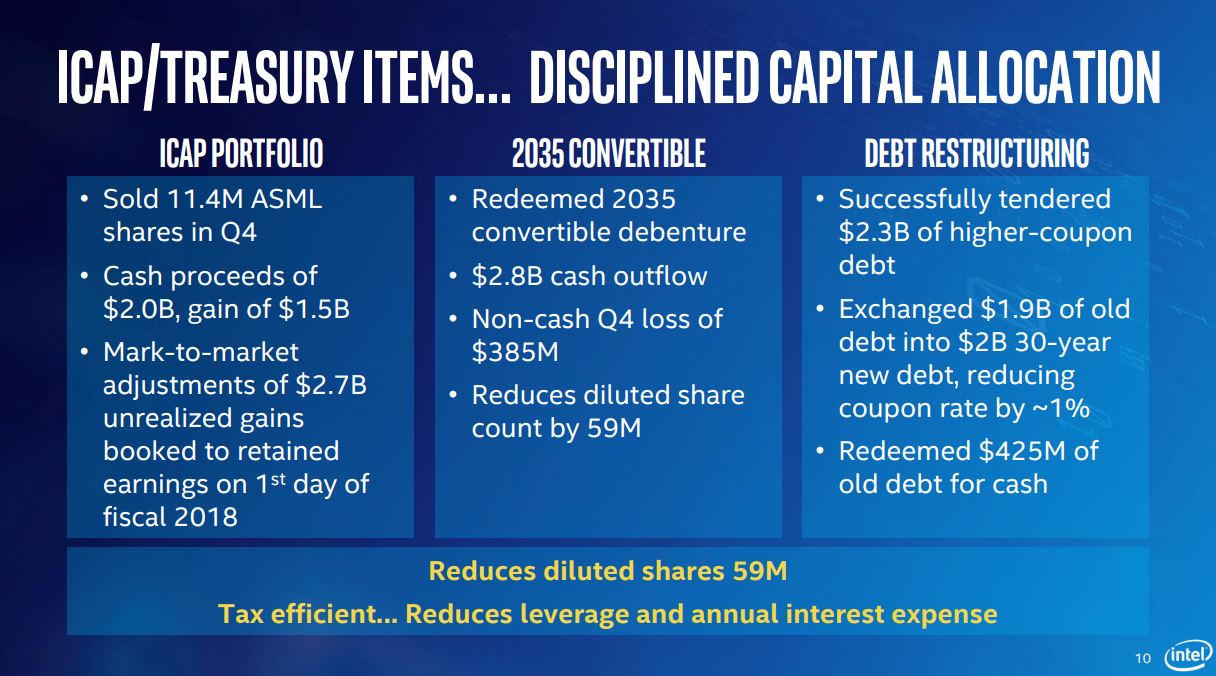

Overall, Intel reported yet another banner quarter with an 8% increase in quarterly revenue, up to $17.1 billion, with the data center, programmable solutions (FPGA), and IoT groups leading the record revenue (excluding McAfee). Full-year 2017 revenue weighed in at $62.8 billion, a healthy 9% YoY growth rate. Notably, earnings per share were up 37%.

Here Comes The Silicon Patch

Intel CEO Brian Krzanich started the call with a short restatement of the company's commitment to security, which sounded very similar to his statements in the CES 2018 keynote.

Krzanich later said the company would begin to ship products with "in-silicon" fixes for the vulnerabilities this year. He did not elaborate, but logically this means that the company will include these fixes in the 10nm generation of products. Krzanich also later stated that the company expects to continue developing its 14nm products in 2018, so we could see yet another round of 14nm processors (sigh). Of course, one could speculate that these chips might also have in-silicon mitigations for the vulnerabilities.

Intel's newer chips (post-Broadwell) support a PCID (Post-Context Identifier) feature that helps reduce the performance impact of the Meltdown patches on newer hardware. Intel's plans to institute in-silicon fixes could reduce the impact even further, or perhaps remove it entirely. That's a sorely needed feature for a company that is reeling from the never-ending onslaught of press coverage around the vulnerabilities. We're reaching out to Intel for more details about the new silicon fix.

Some analysts are predicting that Intel could experience higher sales as companies refresh their hardware to offset the lost performance from the patches. Considering Intel's apparently fast cadence of in-silicon fixes, that could hold true. Krzanich also said the company is focused on developing high-quality mitigations for customers, and it has created a website dedicated to helping customers deal with the vulnerabilities. (The link to this website has not been provided. We have requested the link.)

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Tell Us About AMD

An analyst asked Krzanich if the company had felt any pressure from AMD, but, as per Intel's unspoken policy, Krzanich did not mention AMD by name or respond directly to the question. AMD's increased pressure on Intel has been a godsend for enthusiasts and normal consumers alike, largely because it has forced Intel to deliver better value.

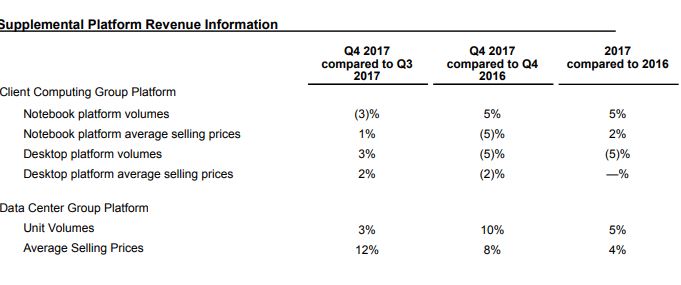

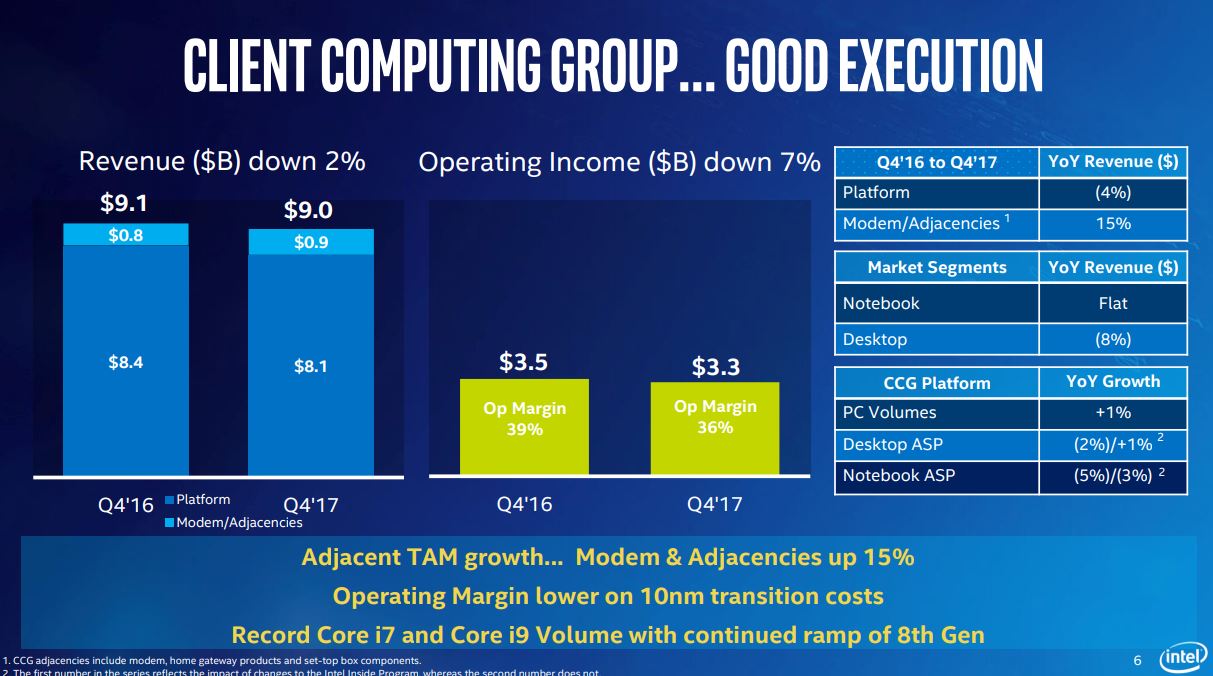

Intel's Q4 volume in desktop processors fell 5% year-over-year, which included the all-important holiday season. Intel's average selling prices also declined in both desktop and notebook segments. Intel's CCG (Client Computing Group), the CPU-making division for desktop PCs, also fell 2% this quarter. Intel chalked up to the continuing decline in the PC market, but it appears the external pressure is starting to take its toll. Intel's supply challenges with Coffee Lake processors might have also had an impact. Many customers may have opted to wait instead of purchasing the less-capable previous-gen models.

Did Someone Mention 10nm?

Intel also re-stated that it shipped some low-volume 10nm products last year, though again, the company did not provide any specifics about the number of units or the customer. Krzanich stated that the company would continue to ship 10nm processors in the first half of 2018 and then kick into high-volume manufacturing in the second half of the year. Intel noted that the cost impact of the 10nm ramp would increase in the second half of the year. That likely means we will see Ice Lake processors in that same time frame.

Potential Financial Impact Of Meltdown/Spectre

It's definitely far too early to see any potential financial impacts from any of the pending lawsuits or the costs associated with the ongoing patch efforts. For instance, during Intel's Q4 2016 earnings call, we broke the story that Intel mentioned it had created a then-undefined financial reserve to deal with a large-scale warranty return for higher than expected processor failure rates. That fund was due to the Atom C2000 failures.

In this call, Intel did not make any mention of any new funds or reserves to deal with pending re-compensation programs for customers, although it did mention that last year's fund cost them some profitability ("four points"). Intel sounds confident that it will not feel any near- or long-term pressure to its business. In response to a question from an analyst about the potential impact of the vulnerabilities on Intel's financial forecasts, Krzanich responded:

"From a cost standpoint [...] we don't expect any material impact of this security exploit on our spending or product costs, or any of that, that's how we bake that in."

Krzanich expanded and said that the company continually re-evaluates its forecasts, including over the first few weeks of this year, and the forecasts have not changed. But then Intel also stated that it had updated its risk factors to reflect the threats and litigation:

We have and may continue to face product claims, litigation, and adverse publicity and customer relations from security vulnerabilities and/or mitigation techniques, including as a result of side-channel exploits such as “Spectre” and “Meltdown,” which could adversely impact our results of operations, customer relationships, and reputation. Separately, the publicity around recently disclosed security vulnerabilities may result in increased attempts by third parties to identify additional vulnerabilities, and future vulnerabilities and mitigation of those vulnerabilities may also adversely impact our results of operations, customer relationships, and reputation.

It Isn't All Rosy

There were a few other hiccups in Intel's growth story. The company's oft-maligned 3D XPoint DIMMs are delayed for what is conceivably the remainder of the year—the company says they will not have an impact on 2018 revenue. That's a pretty significant setback for a promising technology that we last heard was coming in the second half of 2018. It's possible that Intel's delayed DIMMs are due to challenges with the first-generation media and bringing those to market with the second-generation 3D XPoint is the obvious fix. As such, this continued delay could mean that second-gen 3D XPoint isn't on schedule for volume ramp.

Intel announced that its enterprise SSDs with 64-layer NAND were delayed for a quarter, which is another setback. The company did not expand on the topic, but Micron released its 5200 enterprise SSDs with the same NAND just this week, so this is due to a qualification delay with Intel's specific device, and not the NAND.

Intel recently announced that it's parting ways with long-time NAND venture partner Micron, but the two companies will continue to develop NAND products together throughout the end of the year. That means Intel will not realize a significant impact on its 2018 financials because it will begin shouldering the extra NAND R&D load in 2020. Intel also signed a few more long-term NAND supply contracts, which is a new tactic for the company that it first mentioned last quarter. Intel now has guaranteed sales of $2 billion in NAND in 2018.

Now Intel's Other Good News

Intel touted its continuing improvement in the AI field and noted that its Nervana processor ran a neural network within the first two weeks that the company had working silicon. Those products are now shipping. Krzanich also touched on the fact that Stratix 10 is shipping, but later in the call, we learned that the company's solid performance in its PSG group (FPGAs) stems from increased end-of-life sales, not Stratix 10.

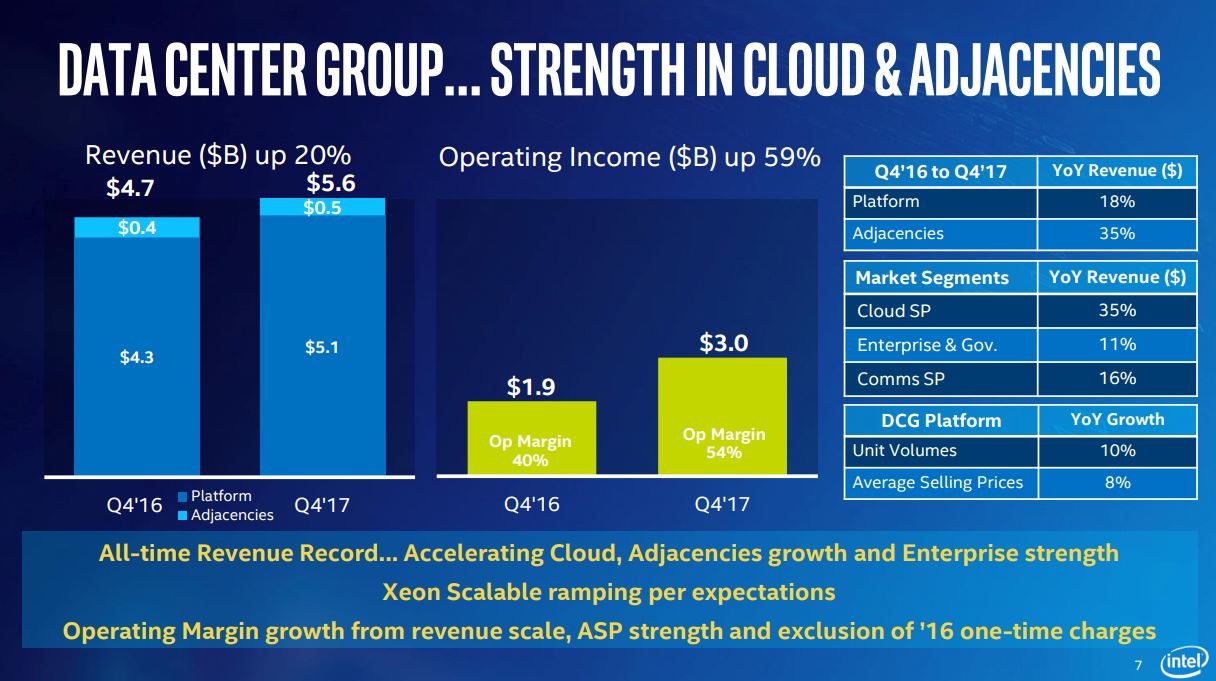

Intel also continues to profit from its 14nm process as manufacturing costs drop, and the Xeon Scalable Skylake sales ramp is fattening the bottom line. Intel's Q4 data center business (DCG) was up 20% YoY.

Intel is in the second year of a three-year effort to transition itself to a data-centric company, which means less focus on its bread-and-butter desktop PC business. Intel said that even though the PC market is down 2%, it's still a reliable source of profitability (best profit since 2007) that funds investments in the new data-centric growth areas.

Intel also noted that it's increasing its spend in R&D for GPUs, AI, and Automotive, but it did not quantify the issue further. Notably, the company did not provide any financial information for the newly-formed Core and Visual Computing Group headed by Raja Koduri.

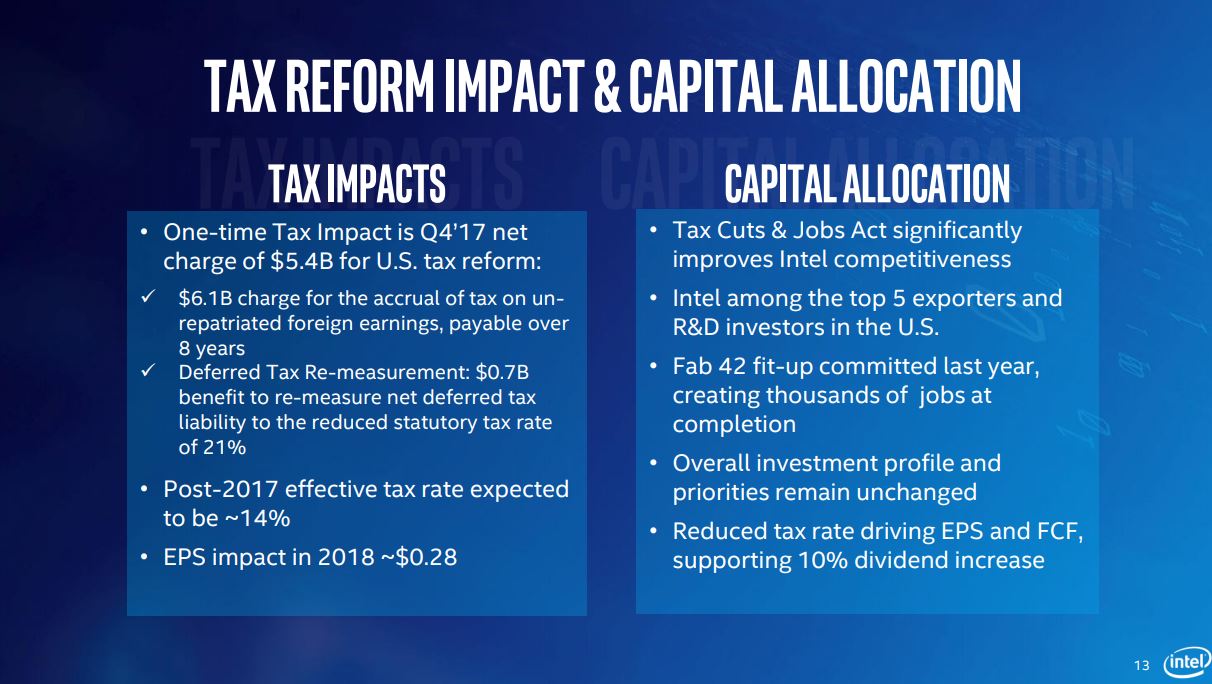

A 14% Tax Rate, But First...

Intel revealed that it will pay a 14% tax rate in 2018 (wow), but that a one-time charge this year resulted in an overall loss for this quarter of $687 million, and an effective tax rate of 52.8% for this year:

Intel's fourth-quarter results reflect an income tax expense of $5.4 billion as a result of the U.S. corporate tax reform enacted in December. This includes a one-time, required transition tax on our previously untaxed foreign earnings, which was partially offset by the re-measurement of deferred taxes using the new U.S. statutory tax rate.

Overall, Intel posted solid financial results, but looming litigation and some weakness in desktop PC sales could pose long-term threats. We'll learn more about AMD's financial situation next week during its earnings call.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

jasonelmore I want one of those "new" CPU's with the in-silicon fix. Intel, I just purchased a 7900X 2 months ago, I expect to have this CPU swapped out for a comparable "in-silicon fix" model. If you will not offer replacements, we will sue. This chip is slower than the 4790K it replaced in day-to-day task. I can notice a huge difference just in desktop animation speed after the meltdown/spectre fixes.Reply

Please offer silicon replacements, i'm asking nicely ;) -

mwryder55 "Krzanich stated that the company would continue to ship 10nm processors in the first half of 2017 and then kick into high-volume manufacturing in the second half of the year."Reply

I think you meant 2018, not 2017. -

Paul Alcorn Reply20636149 said:"Krzanich stated that the company would continue to ship 10nm processors in the first half of 2017 and then kick into high-volume manufacturing in the second half of the year."

I think you meant 2018, not 2017.

Good eye, fixed!

-

reunicorn Reply20636062 said:This chip is slower than the 4790K it replaced in day-to-day task... after the meltdown/spectre fixes.

Is your 7900X also slower than the 4790K with the patches applied on *both* processors? Because if the 4790K is only faster unpatched, it's not a fair comparison and I don't think you'd have any basis for a lawsuit.

-

bit_user Reply

Are you nuts? Of course they won't replace it.20636062 said:I want one of those "new" CPU's with the in-silicon fix. Intel, I just purchased a 7900X 2 months ago, I expect to have this CPU swapped out for a comparable "in-silicon fix" model.

Then join one of the class action lawsuits and be prepared to wait a years. When it's all said and done, maybe you get enough to buy a bigger aftermarket heatsink. Then, at least you can O/C to get back some performance.20636062 said:If you will not offer replacements, we will sue.

; ) -

boju Worried about performance don't update or patch bios. Be smart and avoid the obvious clicks. I doubt very much this bug would take an affect on anyone.Reply

It took Google to discover this flaw and my speculation probably their ai program did it and not any human. Not that they'd admit that anyway. -

AgentLozen I thought this entire article was interesting. My favorite part was:Reply

Author said:Krzanich also later stated that the company expects to continue developing its 14nm products in 2018, so we could see yet another round of 14nm processors (sigh).

This summarizes my feelings about the matter also. I'm wondering if Intel plans to follow the lead set by Broadwell and Skylake. That is - Cannon Lake might come out and be followed up with Ice Lake a month or two later. It feels like both CPUs have been baking in the over for a long time.

I'm looking forward to the -5% power consumption and +3% IPC improvement! Bring it on! -

jeremyj_83 I am surprised that they are already able to implement in silicon fixed for Meltdown/Specter. That probably means that they have known about it for quite a while longer than they say. Also would explain why 10nm is so late, probably found out about the problem just as Alpha chips were coming out and decided to fix the problem right away, therefore delaying 10nm chips by 18 months or so.Reply -

InvalidError Reply

Nothing that surprising there: since part of the microcode fix is to make the speculative execution less aggressive, baking the fix which already has a soft-fix into silicon or changing its behavior to something more difficult to exploit should be a pretty minor tweak.20637333 said:I am surprised that they are already able to implement in silicon fixed for Meltdown/Specter.

I doubt mainstream CPUs designed primarily with speed in mind will ever be safe from side-channel exploits of one sort or another. Even specifically security-hardened CPUs aren't completely immune to side-channel exploits on their own and require software to go out of its way to scramble side-channel leaks. Guaranteeing security comes at a huge performance cost. -

wownwow From the clown-like Intel CEO:Reply

Before: NO BUG, our chips operate as designed and intended.

Now: SILICON-BASED CHANGES, the products to be appear later this year.

What a dishonest, shameless CEO!

Intel keeps selling and launching faulty chips, what a dishonest, shameless company!

People tolerate both well, what a beautiful world :-D