AMD Anoints Two New Heads Of Its Radeon Technologies Group

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Raja Koduri's departure from AMD was one of the most surprising stories of 2017, but largely because he left AMD for rival Intel. Now AMD has appointed two new graphics industry veterans to run the Radeon Technologies Group (RTG).

Earlier this year, Intel and AMD announced that AMD's Radeon Graphics were worming their way into Intel's eighth-generation H-Series processors. A day later, Raja Koduri, AMD's former senior vice president and chief architect of the RTG, announced he had left the company. Twenty-four hours after that, Intel announced that it had brought on Koduri to head its newly formed Core and Visual Computing Group business unit with the intention of developing high-end discrete graphics cards for a "broad range of computing segments."

AMD CEO Dr. Lisa Su took the RTG helm after Koduri's departure, but the company announced that it was actively seeking to fill Koduri's role. Now AMD has selected two industry veterans to lead RTG. AMD has also folded its semi-custom business unit into RTG because of its heavy reliance upon graphics IP. AMD representatives told us that the RTG restructuring means the new executives are not a one-to-one replacement for Koduri. Mike Rayfield is now the senior vice president and general manager, and David Wang is now the senior vice president of engineering. The two executives will report directly to Su, who will no longer handle the day-to-day business of RTG.

“Mike and David are industry leaders who bring proven track records of delivering profitable business growth and leadership product roadmaps,” said Su. “We enter 2018 with incredible momentum for our graphics business based on the full set of GPU products we introduced last year for the consumer, professional, and machine learning markets. Under Mike and David’s leadership, I am confident we will continue to grow the footprint of Radeon across the gaming, immersive, and GPU compute markets.”

Rayfield has 30 years of experience in the industry with extended tenure at Micron as the senior vice president and general manager of the Mobile Business Unit and as general manager of the Mobile Business Unit at Nvidia. Rayfield was in charge of the team that developed Nvidia's Tegra.

Rayfield will be responsible for strategy and business management for consumer and professional graphics. He will also serve in the same role for the semi-custom business.

David Wang most recently hails from Synaptics, where he was senior vice president of Systems Silicon Engineering. Wang also previously served as corporate vice president at AMD, where he was responsible for SoC development for AMD's processors, including GPUs, CPUs, and APUs. Wang has a rich history with AMD, beginning with ArtX and ATI, where he helped develop several game consoles along with every generation of GPU from the R3000 series to the HD 7000. Wang has a storied 25-year career in the industry that also includes time at SGI, Axil Workstations, and LSI Logic.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The Challenge Ahead

Due to the mining boom, AMD's Vega GPUs are selling as fast as the company can manufacture them. However, many in the enthusiast community were underwhelmed by AMD's latest graphics cards, and Nvidia still holds the performance crown. Nvidia's performance lead is a prime contributor to its much larger market share, so AMD will need a more competitive graphics architecture to expand beyond its current 30% share.

Nvidia also has a dominant lead in the data center with its Tesla Volta GV100 GPUs. The explosion of ML/AI in the data center is a catalyst for massive expansion, so this segment represents the biggest predictable growth and margin opportunity for both Nvidia and AMD. The most important revenue battles will undoubtedly be won and lost in the data centers.

Nvidia may be the big fish in both client and data center graphics, but Intel has also recently begun to develop its own discrete graphics cards. That poses yet another threat to AMD's market share. Intel will likely target the low-to-mid range of the desktop graphics market first, which poses more of a threat to AMD than Nvidia. The blue team will also undoubtedly try to press the advantage of its overwhelming presence in the data center to sell its graphics products. That adds yet another player with deep pockets that AMD has to contend with.

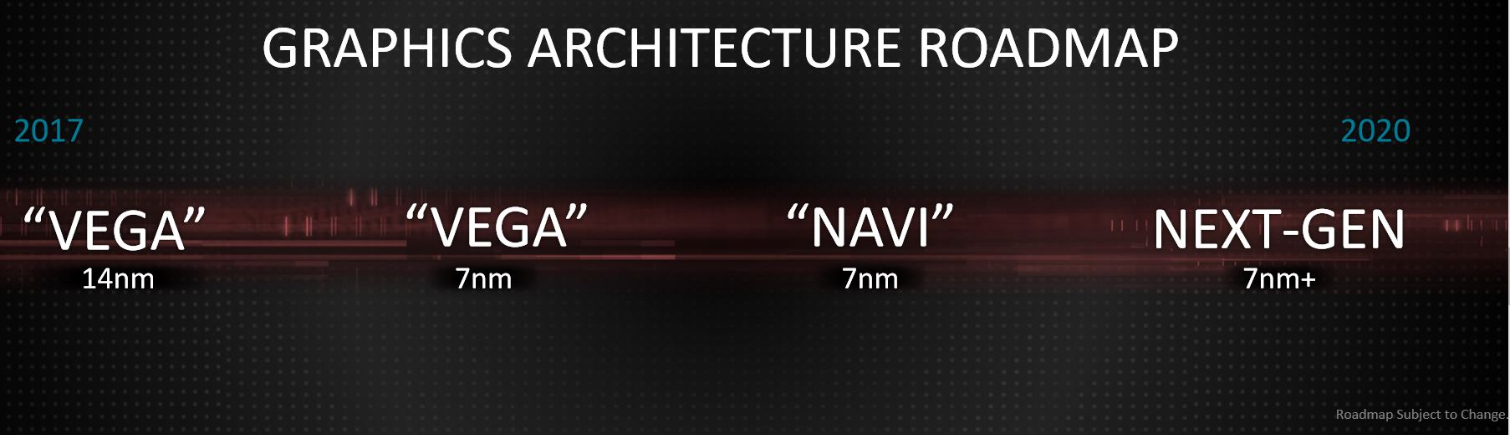

Finally, AMD recently unveiled its GPU roadmap at its pre-CES event. The roadmap transitions from the 14nm Vega directly to the 7nm Vega architecture, which is a big surprise. AMD had expressed its intentions to shift both its CPUs and GPUs to the 12nm process in 2018, which AMD CTO Mark Papermaster confirmed to us directly. The lack of a 12nm GPU in AMD's roadmap undoubtedly raises questions.

All of these factors mean that RTG needs experienced leadership that can grapple with Nvidia and the looming threat of Intel while steering development of Navi and the next-generation graphics architecture.

AMD also moved the semi-custom business into RTG, which means it removed the unit from the Enterprise, Embedded and Semi-Custom group. AMD's Semi-Custom unit isn't know for high margins, but it is thriving, as evidenced by Intel as a new customer and the long-time Sony and Microsoft game console business. The move also expands upon AMD's "Radeon Everywhere" initiative as it pushes further into the embedded graphics space.

AMD representatives also told us the Semi-Custom group has other new unannounced customers and projects, but it did not elaborate further. We debunked the initial rumors that Tesla was working directly with Global Foundries for AI chips, but that is actually good news for AMD. We suspect that Tesla is one of AMD's unannounced Semi-Custom customers, as Elon Musk recently commented at an industry party that the company is working with AMD to develop its own custom AI processors. It also helps that Jim Keller, formerly the chief architect for AMD's microprocessors, is now VP of autopilot hardware at Tesla.

It's tempting to say that it takes two industry veterans to fill Koduri's shoes, but now RTG has more responsibilities because it absorbed the Semi-Custom group. AMD representatives are quite emphatic that this move represents an increase in investment in the RTG unit and that two leaders will help boost its efforts. That's welcome news as the company has already made amazing inroads with its Ryzen processors and has strong momentum in the data center. Adding a more competitive RTG to the mix would obviously help further its other initiatives, such as the budding Radeon Instinct lineup.

We're sure to learn more details of the restructuring in AMD's financial report later this month.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

DragonAsta as long as this means we will SOON see reasonable priced GPU for the "average" consumer able to "fill" the shelves instead of the recent massive either glut or crazy higher than MSRP/MSEP on graphics cards, this will be a good thing, hard to offer financial support when a product that should cost say $200 tax/shipping instead is costing $350 or more for the same product, great for the seller (amazon etc) but terrible for the end consumer (and likely just as terrible a prospect for AMD in this case who unlikely profit from such gouging..they sell per 1k units at X price afterall)Reply

I have had Radeon since back in the 4870 release time, they seemed to be back and forth direct competition in all metrics from that time frame up until the 7000 series, and they seemed to have mis stepped, or mis judged since this time..2000 to vega have all been "ok" in their own fashion, but IMO have not been "darlings" either, and seeing as I do not buy nor support Nv in any way (who do far more damaging things in the past and tend to continue doing to us the end customer..whether folks admit it or not) we need AMD to be as directly competing on the graphics front as they are now on the cpu front.

They still have not made a "modern" 7870 replacing card given the amount of shaders, rop, tmu, buswidth, power usage etc, they need to fix that, if they could nail" better" than a 7870 for at least as good power use while having more memory and of course better performance at ~$230 MAXIMUM CAD$ pricing (tax and shipped) they will have done well.

I thought the whole point of die shrinks and such was to drive costs down (more functional chips that perform faster at lower temperature/power) I am all in for seeing more and more features on a product, but, am "ok" with them keeping roughly around the same power use but a bunch of extra performance or getting power down for around the same performance at a reduced price type deal)

Anyways, am sure it will be a great 2018, at least we know AMD is not sitting on their backside (putting the $ they make towards getting the best possible products out the door) -

redgarl Hey Toms... which brand is the best miner? A GeForce, or a Vega... miners know the answer, they bought all the Vegas while gamers have their pile of GeForce on the store shelves.Reply -

cryoburner ReplyIntel will likely target the low-to-mid range of the desktop graphics market first, which poses more of a threat to AMD than Nvidia.

That's assuming AMD doesn't have higher-end parts coming out by then. It will likely take Intel at least a couple years to release a product, after all. Intel joining the GPU market could be good for encouraging AMD to once again compete more directly with Nvidia at the high end, and maybe once again bring the efficiency levels of Radeon cards back in line with the competition. And more competition might be good for consumers, at the very least. -

derekullo Reply

Neither is the best.20628317 said:Hey Toms... which brand is the best miner? A GeForce, or a Vega... miners know the answer, they bought all the Vegas while gamers have their pile of GeForce on the store shelves.

-

mitch074 Reply20628099 said:They still have not made a "modern" 7870 replacing card given the amount of shaders, rop, tmu, buswidth, power usage etc, they need to fix that, if they could nail" better" than a 7870 for at least as good power use while having more memory and of course better performance at ~$230 MAXIMUM CAD$ pricing (tax and shipped) they will have done well.

The 7870 used the "Pitcairn" GPU; its last iteration was found in the R7 265, where it was used along with the Curaçao GPU of very similar specifications (it's actually the same chip) - the latter continued up to the 3xx generations (R7 370), and was excellent bang for the bucks. In short, if you bought a "golden" 7870 in 2012 and overclocked it some, you had a very capable card up until 2016, regularly getting better performance along with driver optimizations - and that's when the Polaris chips came out. The RX460 was meh, the RX560 is quite a bit better actually, but if you got a reference RX480 8 Gb when it came out, then you're still happily rocking a good 1080p/1440p card today. I know I do. And, yes, I went through a HD4850, a HD7770, a R9 270 and now a RX480. They all actually got better performance with time. -

Vosgy "David Wong most recently hails from Synaptics, where he was senior vice president of Systems Silicon Engineering. Wang also previously served as corporate vice president at AMD"Reply

Is it "Wong" or "Wang"?

Cheers :D