AMD Predicts Double-Digit Revenue Growth In 2018, Ramps Up GPU Production

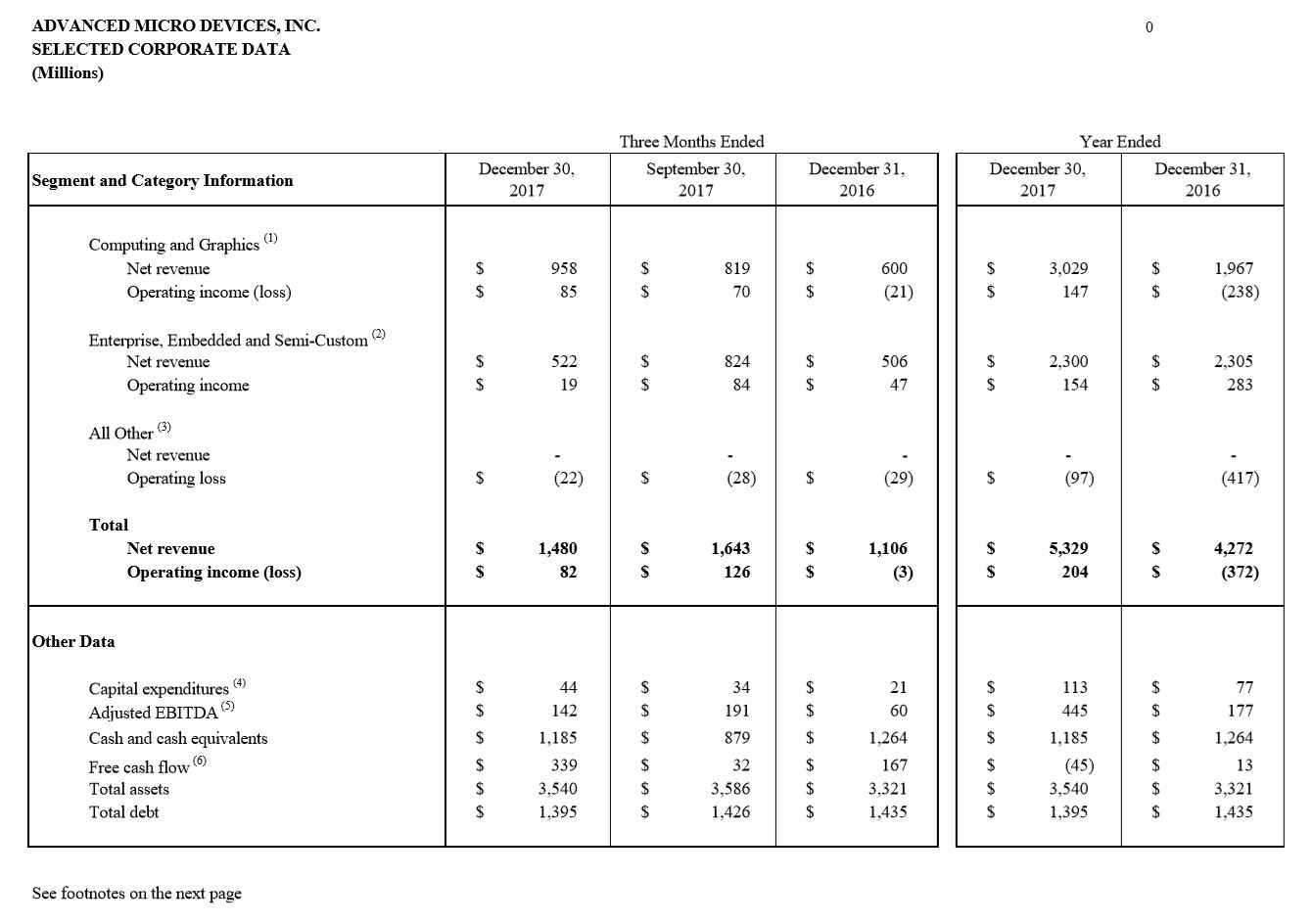

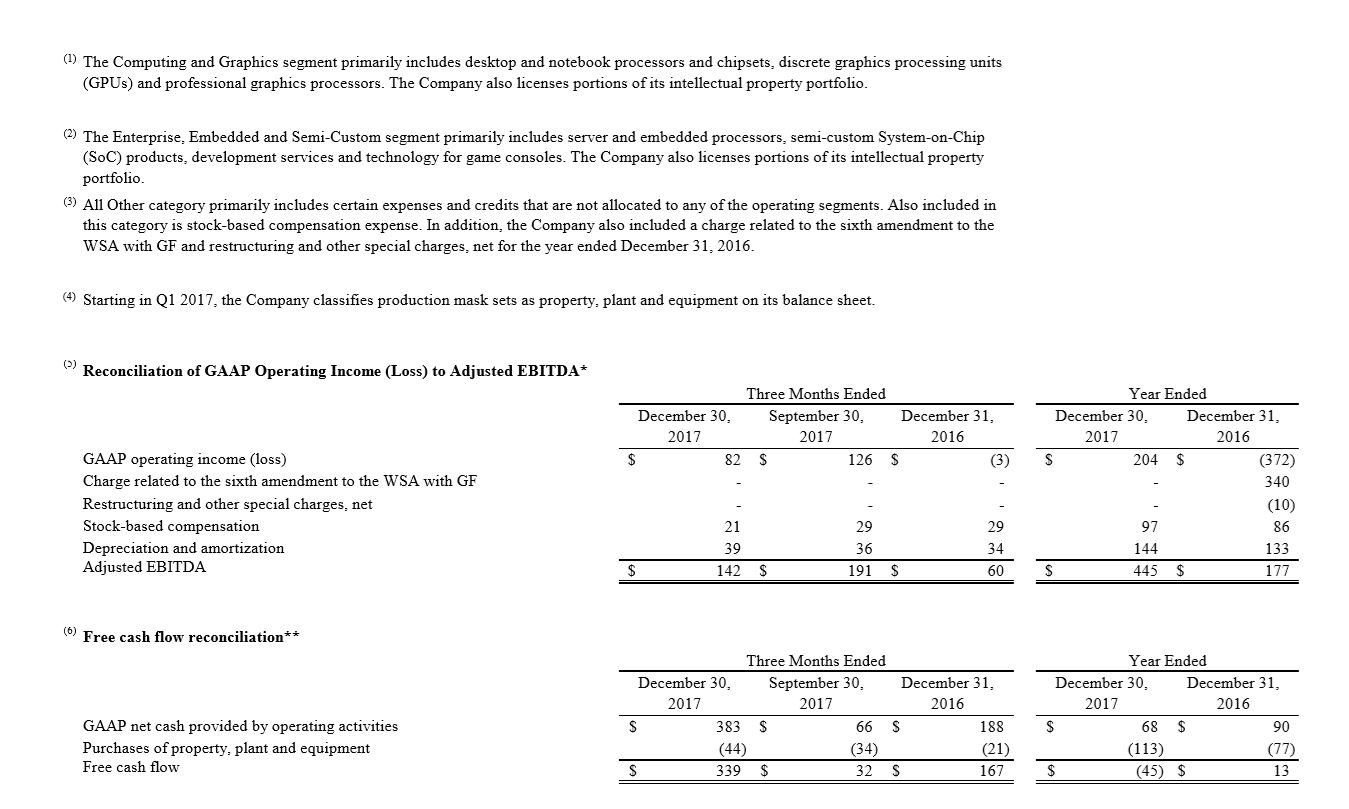

As it made clear in its earnings call, AMD capped off a turnaround year, in every sense of the word, as it raked in a $204 million in profit. That's a stark improvement over its $372 million loss in 2016.

AMD CEO Dr. Lisa Su mentioned the company's commitment to its continuing work on the Spectre mitigations. Su said the company doesn't expect any undue financial impacts from those efforts and will bake in silicon-based mitigations for Spectre in its forthcoming Zen 2 design. This is similar to Intel's announcement that it would have silicon-based mitigations out this year.

Su also noted that GPU supply in the channel is low, which isn't a surprise to anyone who has shopped for a graphics card lately, but the company is ramping up GPU production. Su specified that the company has plenty of silicon supply from its foundry partners, meaning GPUs aren't the limiting factor--instead, it's the ongoing GDDR5 and HBM shortages that are primarily to blame. Su expects graphics demand to be strong throughout the first half of 2018, with blockchain (mining) continuing to play a big role. Su also noted that although it's hard to quantify accurately, crypto mining contributed roughly 10% (or possibly more) of the company's annual revenue and a third of the company's $140 million in sequential growth.

AMD's $1.48 billion in Q417 revenue was up 24% YoY but down 10% quarter-over-quarter. That was expected due to the normal seasonal downturn in its semi-custom business. Overall, the company increased its 2017 revenue by more than a billion dollars compared to 2016.

AMD lumps its computing and graphics segments together in its financial reporting. The $985 million in revenue for these segments was up 60% YoY and 17% quarter-over-quarter.

ADM's graphics ASP (Average Selling Price) increased YoY and on the quarter due to strong sales in both desktop GPUs and the professional segment. Its Q4 professional graphics revenue was the best in the company's history. This comes partly due to growing data center sales and a sales win with Radeon Instinct GPUs to a large unnamed cloud provider. AMD also recently appointed two industry veterans to head up RTG, which should further improve the outlook in the future. AMD is also on track to deliver a 7nm GPU designed for machine learning before the end of the year.

As expected, the processor segment performed well. ASPs increased YoY but were flat sequentially. Su explained the flat ASPs were partially due to sales from the newly-introduced Ryzen 3 processors, which retail for much less than the Ryzen 5 and 7 models. Su also highlighted strong holiday sales, which we recently covered in depth. (We'll have updated Q4 desktop market share numbers in the coming days.)

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

AMD said the Zen 2 design phase is complete and that the processors will ship to partners this year. The company is also actively working on 7nm CPUs.

AMD's Enterprise, Embedded, and Semi-Custom division grew 3% YoY, which was an improvement over the flat trend in Q3. The improvement was due to increased enterprise sales that offset the expected seasonal decline in the Semi-Custom division. AMD noted that it continues to make significant headway into the enterprise market, including a recent win with Baidu for single-socket servers. Su also mentioned an upcoming server OEM announcement from Dell.

AMD's 34% gross margin in 2017 (up 3% YoY) was driven largely by Ryzen ASPs. The company projects a 36% gross margin in Q1 as it continues towards its goal of 45%.

AMD received a one-time credit of $18 million due to the recently passed U.S. tax reform. The company predicts it will pay a tax rate of 10% in 2018. Like Intel, AMD also updated its risk factors to reflect potential financial impacts of Meltdown and Spectre:

AMD's efforts to prevent and address security vulnerabilities can be costly and may be partially effective or not successful at all. For instance, AMD's mitigation efforts, including the deployment of software or firmware updates to address security vulnerabilities, could result in unintended consequences such as adverse performance system operation issues and reboots. AMD may also depend on third parties, such as customers, vendors and end users to deploy AMD's mitigations or create their own, and they may delay, decline or modify the implementation of such mitigations. AMD's relationships with its customers could be adversely affected as some of its customers may stop purchasing AMD products, reduce or delay future purchases of AMD products, or use competing products. Any of these actions by AMD's customers could adversely affect its revenue. AMD is also subject to claims related to the recently disclosed side-channel exploits, such as "Spectre" and "Meltdown," and may face claims or litigation for future vulnerabilities. Actual or perceived security vulnerabilities of AMD products may subject AMD to adverse publicity, damage to its brand and reputation, and could materially harm AMD's business or financial results.

Aside from those potential pitfalls, which could also impact every other major processor vendor, AMD had a great year that marked its return to growth and profitability. AMD also made a strong projection of $1.5 billion in revenue for Q118. Su further predicted double-digit revenue growth in 2018.

The increased revenue will help the company to further invest in R&D as it continues to improve upon its existing architectures. AMD's OEM partners will roll out over 60 OEM desktop platforms this year, which will expand the company's reach into a much larger market segment. AMD also has a string of OEM server rollouts and a strong roadmap for the remainder of the year.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

jasonkaler If AMD chips have the same security flaws as Intel one's then doesn't it mean they copied them, transistor for transistor?Reply -

papality Reply20653337 said:If AMD chips have the same security flaws as Intel one's then doesn't it mean they copied them, transistor for transistor?

...what -

parkerygc8 Ya, I can't even. Now hopefully Memory can get the lead out.Reply

This memory shortage is looking more and more like fixing to me. These companies know what they are doing, they know the pipeline. -

arielmansur Reply20653337 said:If AMD chips have the same security flaws as Intel one's then doesn't it mean they copied them, transistor for transistor?

They don't have the same.. meltdown doesn't affect them.. and spectre affects every processor in the world. -

hannibal And even then only the other Spectre variant is likely to AMD prosessors.Reply

So Intel 3 - AMD 1 ;) Intel has two extra problems compared to AMD and the meltdown is bigger problem in anyway. -

captaincharisma as long as AMD keeps lying about how the meltdown and Spectre threats affect them then this will happenReply -

bit_user Reply

Why are you worried about this? If they're lying, they get exposed and it'll be even worse for them. AMD is doing fine - they don't need to lie, and it'll only come back to bite them. Moreover, AMD can't afford to burn any trust with the lucrative data center customers they're courting.20654367 said:as long as AMD keeps lying about how the meltdown and Spectre threats affect them then this will happen

Google has implemented the exploits, and will surely tested them against all products, going forward. If products remain insecure, they will publicly disclose that.

-

pepar0 10% contribution to sales for mining? Seems more like 99 44/100th percent. Ahhh, the 10% is "overall." No one buys the entire line though. More supply will be welcome though.Reply -

papality Reply20654367 said:as long as AMD keeps lying about how the meltdown and Spectre threats affect them then this will happen

I assume you have some proof behind this -

juanrga Reply20654281 said:And even then only the other Spectre variant is likely to AMD prosessors.

So Intel 3 - AMD 1 ;) Intel has two extra problems compared to AMD and the meltdown is bigger problem in anyway.

AMD is affected by both variants of Spectre. The vulnerability of AMD to Meltdown is "unclear"

https://meltdownattack.com/

And the more serious problem is spectre both by the nature of the attack and by the performance hit.