Nvidia's Stock Up On Demand For AI Chips

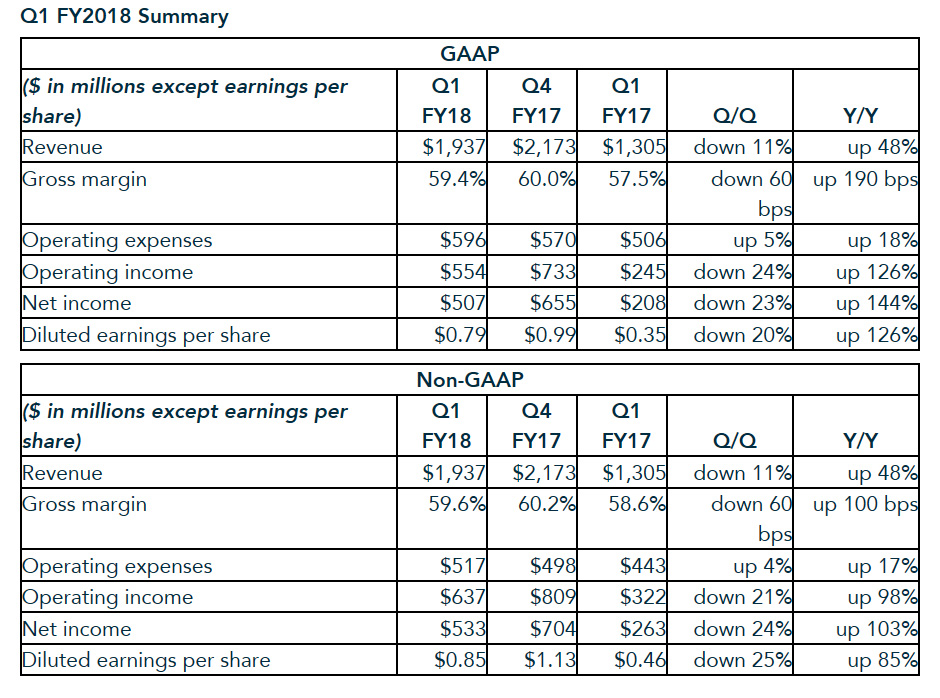

Nvidia stock is up more than 14% after the company reported quarterly revenue of $1.94 billion, up 48% year over year. The company also reported $0.79 earnings per share (EPS), up 126% versus the same quarter a year ago.

Nvidia's core gaming business revenue rose by an impressive 49% to $1.03 billion, compared to $687 million from the same quarter last year. The company's automotive business brought in $140 million, up from $113 million the previous year. Sales into data center were stronger than expected at $409 million, up from $143 million in 2016. Nvidia was very bullish on deep learning, artificial intelligence, and its data center business.

CEO Jen-Hsun Huang remarked:

"Our Datacenter GPU computing business nearly tripled from last year, as more of the world's computer scientists engage deep learning. One industry after another is awakening to the power of GPU deep learning and AI, the most important technology force of our time."

Nvidia also gave very strong guidance for the second quarter, calling for $1.95 billion in revenue plus or minus two percent. GAAP and non-GAAP gross margins are expected to be 58.4 percent and 58.6 percent, respectively, plus or minus 50 basis points.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Steven Lynch is a contributor for Tom’s Hardware, primarily covering case reviews and news.

-

bit_user Reply

Of course AMD cares about numbers, but their strategic misstep was focusing on high-volume low-margin products, like consoles and low/mid-range gaming (Polaris).19674247 said:To which AMD replied;

"Numbers aren't everything"

For too long, their GPU Compute strategy was "if you build it, they will come", where "it" was an open standards-based platform. Only in the last couple years did they finally started sponsoring people to port things like deep learning frameworks to support OpenCL (which of course also benefits Intel and others). The sad thing is that they even had technical superiority in GPU compute, up until about 2013. But Nvidia passed them with Maxwell and I have to wonder if they'll ever catch up.

Source: https://www.karlrupp.net/2013/06/cpu-gpu-and-mic-hardware-characteristics-over-time/

The double-precision pictures look a bit better, for AMD... until Pascal. And that doesn't help with machine learning. -

falchard Just goes to cement why AMD is a stronger stock right now. $984 billion for AMD $1305 billion for nVidia. Usually AMD isn't this close to nVidia in revenue. It's stock price is now around $10 verse nVidia's $121. Last year if you bought 1 share of nVidia or 50 shares of AMD, you would be rolling in the dough with AMD. AMD will still probably yield a better return than nVidia until Fall.Reply -

redgarl Nvidia stock has no reason to be that expensive, absolutely no reason. They are shoveling cloudware except of their graphic department. Seriously, saying you work on self-driving car now make your stock go 15$ higher... doesn't mean you have anything to sell.Reply

And now they are working on AI... woooooo.... Let's buy some stock... seriously, am I the only one seeing something wrong? -

redgarl We all know Vega is around 12.5 TFLOP, and that's not a Titan prenium. The big question is how well it will do in application and what the single point performance can really bring to the table.Reply

AMD won a battle at least with Freesync. Now it will be interesting to see if Crossfire will still be a priority or a good implementation. -

redgarl Derekullo, at least they are selling something... with Scorpio and PS5 coming around, they are selling a lot of chips.Reply