Memory makers reportedly stop publishing contract DRAM prices following Taiwan earthquake — further price hikes are expected

But demand on the spot market remains weak.

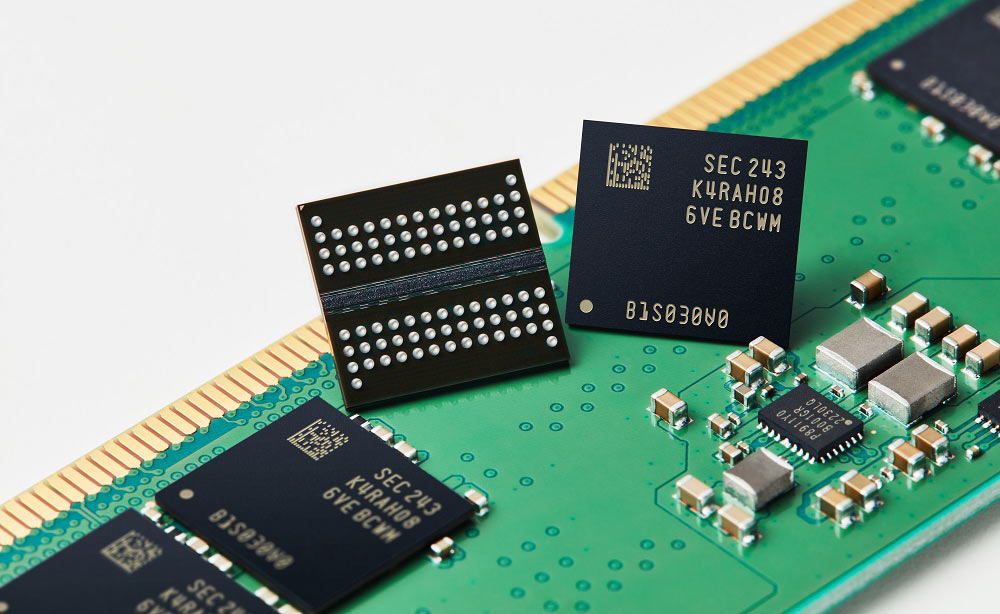

Memory makers have halted disclosing contract prices of DRAM in Q2 2024, following a major earthquake in Taiwan, which may point to potential price hikes. The earthquake disrupted wafer fab operations, impacting supply as Micron, Samsung Electronics, and SK Hynix are among those affected, reports DigiTimes. This situation may lead to sharper price increases than anticipated, as the industry was already aiming for higher prices before the quake, in a bid to recoup losses memory makers incurred in the previous years.

Micron ceased offering product quotes for the second quarter, shortly after the earthquake, with its Korean rivals quickly following suit. Industry insiders revealed that these leading memory chip manufacturers had already initiated measures to maintain a rising trend in their product prices before the April 3 quake. Now, it seems highly probable that the price hikes may be more pronounced than previously expected.

In the past, memory prices have typically surged following production disruptions caused by natural calamities or accidents. The latest incident could provide the vendors with chances to compensate for the losses incurred in 2022 and 2023. Prior to the quake, second-quarter DRAM and NAND flash contract prices were experiencing slower growth compared to the first quarter. Specifically, NAND flash prices had risen by 15% - 20% for the second quarter, as opposed to over 20% in the first quarter.

Following the earthquake, Micron announced that it would evaluate the impacts on its local production and supply chain. The company stated that it would then discuss supply schedules with its customers, hinting at potential changes in supply. Industry sources mentioned that memory fabs typically halt production during such strong earthquakes, which affects supply of memory wafers.

Memory module manufacturers, who are reportedly low on chip inventory, are now preparing for increased chip purchase costs. They had hoped that the rising price trends would decelerate, given the rising capacity utilization rates at chip suppliers. However, chip suppliers had significantly reduced production to sustain pricing last year, when demand was stagnant. Downstream customers, including server makers, might become aggressive in stocking memory products in anticipation of shortages, further driving up prices.

Although contract prices might be soaring, the spot market remains weak due to low demand from the consumer sector following the Lunar New Year. Apparently, there is still an abundant supply in the spot market, despite the disruptions and anticipated price hikes in the contract market, the report claims.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

hotaru251 from what I recall....there wasnt any dmg done to them and they sent workers back very soon after.Reply

this sounds just like their typical "we can use this as an excuse to raise prices". -

Notton Reply

First off, that was TSMC that sent its workers back to work, and TSMC doesn't do DRAM.hotaru251 said:from what I recall....there wasnt any dmg done to them and they sent workers back very soon after.

this sounds just like their typical "we can use this as an excuse to raise prices".

Second off, just because the machinery was undamaged, it doesn't mean a batch didn't get ruined from an unexpected interruption.

But yes, the earthquake offers plausible deniability to increase prices. -

DavidLejdar Reply

It can be a bit more complex than that. I.e. company A gets supplied from companies B and C, of which company B has a landslide between them and the port, and company C needs to recalibrate a production line.Notton said:First off, that was TSMC that sent its workers back to work, and TSMC doesn't do DRAM.

Second off, just because the machinery was undamaged, it doesn't mean a batch didn't get ruined from an unexpected interruption.

But yes, the earthquake offers plausible deniability to increase prices.

In any case, when a company has an annual revenue of $70bn from production there, that comes down to about $8 million per hour. And production being halted for 10 hours, $80 million right there "lost".

Add to this, that in Hualien Port as of yesterday, out of 26 terminals, 18 were not operating. This port in particular has seen some damages, such as ground cracking and sinking, including impact on buildings, where the repairs do not have the same priority as rescuing people trapped in tunnels.

And this port last year handled nearly 8.83 million tonnes of cargo (and thousands of cruise passengers). This may now mean, that a lot of the cargo gets redirected to other ports, which in turn may face some logistical challenges due to that.

And all that may quickly mean, that a single company runs hundreds of millions of $ short of what they meant to have this year (and already planned for to spend), with additional expenses, such as due to logistics.