MSI CEO Dishes on Intel Shortage, AMD Growth, Taking Share from Apple

Running a PC company is a tough job, even in the best of times, but between trade wars, chip shortages and heightened competition, 2019 could be the most challenging year yet. It's against this turbulent backdrop that MSI has brought on new CEO Charles Chiang. A veteran MSI executive, Chiang served as executive VP of desktop platform solutions, VP of R&D and AVP of R&D before taking the reins on Jan. 1.

In a 30-minute interview, Chiang shared key details he's learned about Intel's supply problems, including the chip-maker's apparent decision to prioritize mobile over desktop chips and how the shortage has hurt motherboard sales. He explained why his company doesn't use AMD CPUs in any of its systems, estimated how much tariffs are costing you and expressed his desire to steal some market share from Apple.

Intel: Desktops Come Last?

Intel's chip production problems are well-documented, but nobody feels the pain as much as hardware vendors. When we asked Chiang how he was dealing with Intel CPU shortages, he told us that he's been able to get enough processors for all of his laptop and desktop systems. However, he shared an insight we hadn't heard before, saying that Intel prioritizes fulfilling orders for data center chips and then laptop processors, with desktop CPUs in last place.

"We focus in on the high-end products and we get the priority of the CPU supply," Chiang told us. "Intel tells everybody they have a priority to supply [high-end chips]. [They say] 'let's start at data center first, mobile second, desktop last.' And then they got the higher i9, i7 processor H processor, then it's U and then it's desktop."

We reached out to Intel for comment and the chipmaker confirmed that it prioritizes high-end chips over budget models, but it did not confirm or deny that desktop CPUs are on a lower rung than laptop CPUs.

Intel Shortages Hurt MSI's Motherboard Business

Though MSI hasn't struggled with getting chips for its systems, the scarcity of low-cost Intel CPUs has had a negative effect on the company’s motherboard sales, Chiang told us. As consumers have been unable to purchase Pentiums, Celerons or even Core series processors for new builds, they've stayed away from the motherboards they'd need to power these chips.

"If this CPU shortage issue hurt MSI, I have to say that, on the motherboard side, we got hurt badly," Chiang said.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

MSI's CEO also noted that Intel's chipset problems, which forced the chipmaker to roll back to an older 22nm process for low-cost motherboards, caused confusion with partners.

"For the motherboards, it's really critical last year," he said. "They have a problem with 14nm. So [Intel] moves back to the 22nm and kept changing their roadmap. We don't have any kind of clear picture about their supply."

Chiang also noted that shortages of Intel's latest processors hurt sales of MSI motherboards with Intel's new Z390 chipset.

"A new product like a Z390 launches in the market and the high-end CPUs are in a shortage, because the desktop is the least priority to support. So it's quite challenging," he said.

Intel Supply is Improving, Fixed by Q4

Chiang said that Intel's worst supply problems are behind it as team blue ramps up production capacity for 14nm chips. However, he anticipates that shortages will continue until the last quarter of 2019.

"Q1 is still challenging. Q2, we're getting better. Q3, we'll get a lot better and Q4, I think, it's definitely no problem," he said. "Overall the worst times for Intel CPU supply have gone."

AMD Grabbing Share from Intel

Chiang said that Intel's supply stumbles have left the door wide open for AMD to grow its desktop CPU sales. He also told us that he's sold a lot more AMD motherboards as a result.

"Everybody knows that Ryzen CPU on the channel, on Etail, everything, they have a lot of market share increase because of the Intel shortage," he said. "Because Intel doesn't make it a priority to supply Pentiums, Celeron, mid-range, and low-end CPUs, that really gives AMD an opportunity to grow their market share in desktop. So we are doing very OK on the AMD side."

"We have a big portion of the AMD motherboard, which makes Intel kind of upset," Chiang explained. "But I say 'hey guys, once you solve the supply issue, let's figure out how we can get back your share.'

Why There's No AMD in MSI Laptops or Desktops . . . Yet

Despite AMD's growing stature in the marketplace and MSI's collection of AMD-powered motherboards and video cards, Chiang said that his company is is still reticent to use AMD processors in its systems for three main reasons:

- Experimentation: MSI is a smaller company than some and can't afford to experiment with different platforms right now. "I always say 'we are not big enough to make it so complicated,'" he told us. He cited all of the different gaming laptop SKUs MSI makes, from the high-end GT series to the budget GLs, when saying that their lineup is already pretty complex. He also posited that it, given the company's focus on optimizing the user experience, going with AMD adds another layer of complexity.

- Prior bad experience: MSI has used AMD processors in its systems before, but apparently had a bad experience. "At that time, their product was not right and their support was not that good," Chiang said. He didn't say which AMD CPU he was referring to, but we know that 2012's MSI GX60 had an AMD A10 chip inside. Our sister site, Laptop Mag, reviewed that laptop at the time and really liked the performance and battery life.

- Relationship with Intel: Chiang told us that, given Intel's strong support during the shortage, it would be awkward to tell Intel if he chose to come out with an AMD-powered product. "It's very hard for us to tell them 'hey, we don't want to use 100 percent Intel,' because they give us very good support," he said. He did not, however, make any claims that Intel had pressured him or the company.

Despite these reservations, Chiang said that he is strongly considering using AMD processors in the near future. "I know Ryzen and Mobile Ryzen are going to change the game," he noted. "We keep evaluating, but we don't have a plan or a specific date when we're going to do the AMD."

Tariffs: Yes, You're Paying More

In the hardware industry, everyone knows that the Trump administration's electronics tariffs on Chinese goods are leading to higher prices for consumers. However, most OEMs we've talked to either won't discuss the tariff problems on the record or say that they don't have a problem, because they've moved production outside of China.

Chiang was very open about the effect tariffs are having on MSI, saying that they are leading to price increases that are somewhere between five and ten percent. He said, however, that consumers who only buy or build new PCs every few years probably won't notice the difference.

"How often are people buying a laptop? How often are they buying a desktop? A monitor: no matter gaming monitor or the other monitor? Maybe every two years, three years or four years. So their previous purchasing [experience] is maybe three, four years ago," he said. "So, if you add five percent or ten percent, they don't feel anything."

On the other hand, he noted, large corporations who purchase new computers every year are feeling the tariff pain the most.

"For the commercial side, yes, it hurts a lot," he said. "They have a regular buying [schedule] and, when you add five percent, ten percent tariffs, they will feel the hurt immediately, because they are more frequent buyers and they are purchasing quite a decent amount."

While some companies are moving a lot of their manufacturing outside of mainland China, to places like Vietnam, Thailand and Taiwan, Chiang said he is reluctant to invest a lot of capital in trying to solve a tariff problem that could end any day.

"China is a big manufacturing country, because they have a big population and then they have skillful workers and [in] the young generation also. They are very mature right now and very cost effective," he told us. "When the tariffs happen, if you want to move that away [from China], first it takes time and then you have to invest. And you don't know when it's going to be solved."

No Chinese Company Wants to the Be the Next Huawei, ZTE

More than tariffs, Chiang posited, Chinese companies are afraid of being labeled as national security risks by the U.S. government like what happened to Huawei and ZTE.

"When you talking about national security, that can easily kill the company completely," he said. "Like a Huawei. You can see this CES. Not many Chinese customer coming for the big activity, because they invest in this market big time and then somebody says 'hey, it's a national security.' All your investment [is] completely gone."

MSI's Growth Plan: Add Prosumers, Not Budget Shoppers

Those of us who have been following the hardware industry for a while remember when MSI used to make a much broader range of computers. A decade ago, the company was a pioneer in netbooks and had a number of low-cost, lightweight computers like the MSI X370. It even sold tablets for a little while.

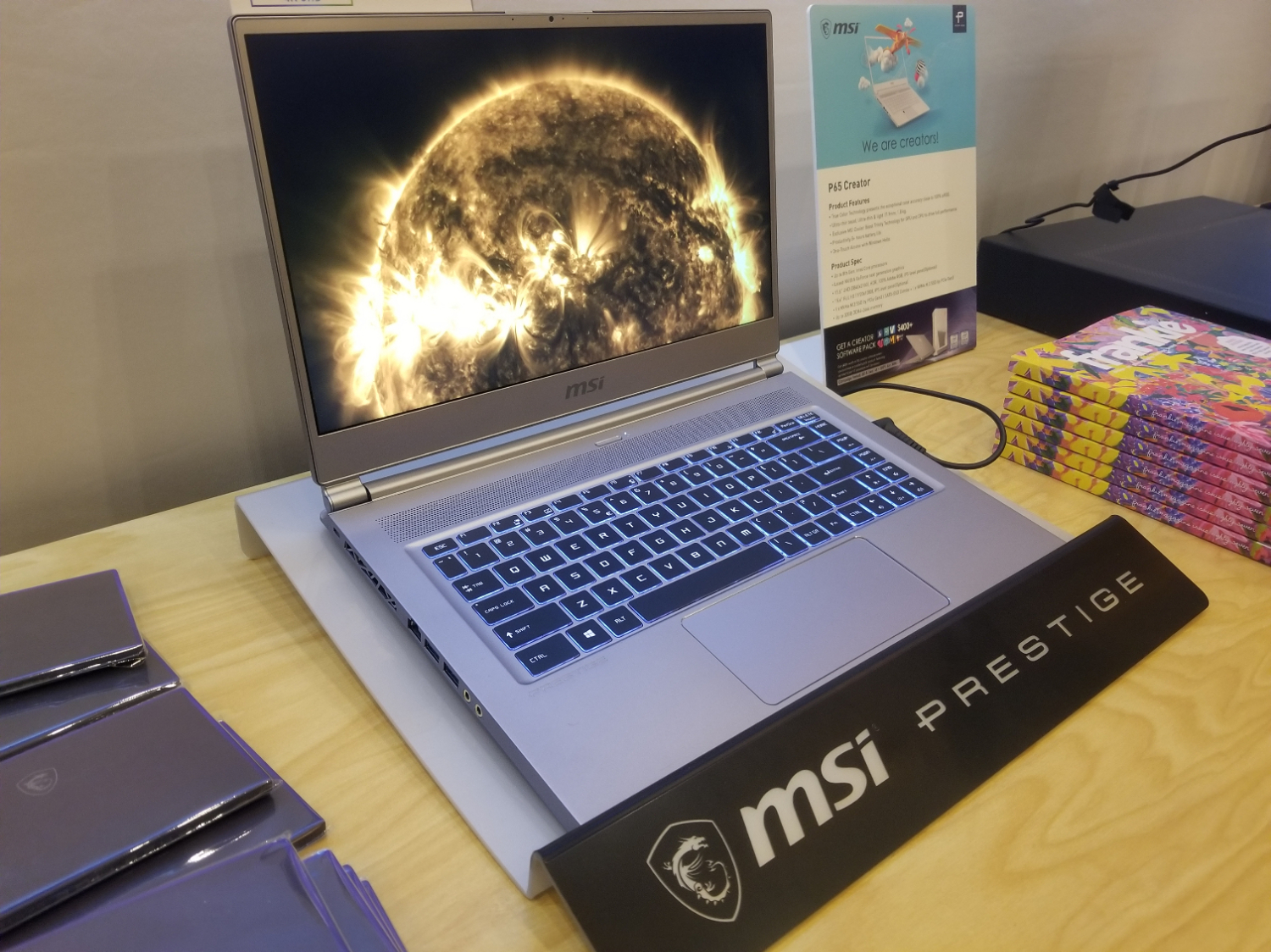

However, a few years ago, MSI decided to give up on mass market computers and focus squarely on gaming. At least, until recently. In 2018, the company expanded into prosumers / professionals by introducing its Prestige series of thin and light creative workstations (the Prestige sub-brand had been used for larger workstations in prior years). At CES 2019, MSI showed off a number of upcoming Prestige products, including a desktop and a monitor.

We asked Chiang whether he plans to get into any other segments of the PC market, besides gaming and prosumer products, but he said his company doesn't want to reach too far outside of its core competency, which is building high-performance computers.

"In terms of the economy size [computers], we cannot compete with the big guys. But we find that the [customers] demanding high performance type products are our core. We are very good at that," he said ."We started with gaming about five or six years ago and we keep growing every year We always ask ourselves what is the next area where we can grow. Definitely it's not a budget PC or business types of products.

Last year, we were thinking about 'how about prosumer' and 'how about content creator' and we talked with Nvidia, we talked with Intel. So you can see we have the Prestige."

Taking Share from Apple

Chiang seems very excited about the potential for MSI's Prestige line to make a real impact with creative professionals like video and photo editors. The company's upcoming, 15-inch Prestige Ps63 will combine up to an 8th Gen Core i7 CPU with Nvidia GTX 1050 Max-Q graphics while weighing just 3.5 pounds (1.6 kg) and promising 16 hours of battery life. It will have Creator Center, a more professionally-focused sibling to the company's powerful Dragon Center control software.

The Prestige PS341WU is a 34-inch, 5K monitor that will launch in June or July for $1,799 with impressive color (98 percent of DCI-P3), plenty of ports and a subtle white aesthetic that matches the P63. There will also be a matching keyboard and mouse.

Chiang believes that his Prestige line has a chance to steal away some Apple fans who have been disenchanted with the company's recent computers.

"We wanted to build out the overall ecosystem for our Prestige products and, if we do, we can build the user experience well and we can turn Apple users maybe 1 percent, 2 percent to us," he said. "For us, that's a big market already."

The Future of Gaming is Thin on Pounds, Heavy on Pixels

When it comes to his company's bread and butter products, gaming PCs, Chiang believes the future is thin, mobile and high resolution. He said he expects to see slimmer and lighter gaming laptops become a much bigger portion of the market in the years ahead, particularly as new processes like Intel's 10nm and AMD's 7nm bring greater power efficiency.

"New technology will use less and less power, which means you can accommodate those powerful solutions into a smaller, thinner chassis," he said. "So I can tell the gaming market is changing. The momentum is going to be thin and light and then you can achieve great performance there."

He pointed to the company's new GS75 Stealth, which combines an Intel 8th Gen Core CPU with Nvidia RTX 20 series graphics and weighs just 4.9 pounds (2.2 kg) while measuring 0.8 inches (19 mm) thick as an example of pushing more power into smaller form factors.

Small Market with Big Opportunities

Chiang told us that the number of gaming laptops sold every year worldwide is only around 8 million units out of a total laptop market of around 162 million systems.

"For the gaming laptop, I cannot tell you that it's huge growth every year, because the base is small. Maybe 8 million and if you grow 10 percent, 15 percent then will become 9 million next year," he said. "So the only way you can [grow profits] is that you need to increase your ASP (Average Sales Price), but I think that a good thing happening is exciting technology like RTX, 4K displays with fast response time [and] ultra slim types of gaming notebooks. That will really help you to increase your ASP."

Though there are a lot of companies in the gaming laptop space, Chiang feels that MSI is well positioned to succeed, because of its rich history as a gaming-first company and its focus on providing a complete ecosystem of gaming hardware, peripherals and control software. He also cited his company's deep ties to the eSports community where it sponsors teams and events.

Speaking of his company's ecosystem and reputation, Chiang said "I have to tell you that nobody can really achieve that. I don't think our competitor can do that, because we are very focused, we have a strong team working so closely and that is the way we compete."

Avram Piltch is Managing Editor: Special Projects. When he's not playing with the latest gadgets at work or putting on VR helmets at trade shows, you'll find him rooting his phone, taking apart his PC, or coding plugins. With his technical knowledge and passion for testing, Avram developed many real-world benchmarks, including our laptop battery test.

-

levijonesm Great interview! Mr. Chiang was amazingly candid about their decision not to offer any AMD powered laptop / desktop (so far). And about the rest of the topics as well. It was an enjoyable read.Reply -

shmoochie I find it interesting how he basically said that Intel's poor decision-making hurt sales for an entire year and will continue hurting it until the end of 2019, but he still doesn't want to use AMD because Intel "give us very good support." What kind of support is he talking about that makes up for almost two years worth of poor motherboard sales?Reply -

s1mon7 I'm conflicted. On one hand I really appreciate the honesty and MSI scored some brownie points for that. On the other the reasons for not using AMD, including "relationships with intel" and it being "awkward to tell them that we're not going to use 100% Intel" sounded beyond wrong in my book. I know that those "relationships" with Intel are why the OEMs aren't using as much Ryzen as the performance, value and efficiency would logically dictate, but it's just so wrong.Reply -

adi6293 Well looks like I wont be recommending any more MSI AM4 motherboards to friends and family and I did recommend few. This relationship remained me of the relationships Intel had durning Pentium 4 times, something is definitely fishy here.......Reply -

redgarl okay... not going with AMD is dumb... sooo dumb... what they are going to say when they release Ryzen 3...Reply

Msi: "Ooops..."

It is obvious that Intel is behind and paying them to prevent AMD getting there. It was like that before and it is still the case right now...

WTH is wrong with the industry? They pay more for Intel and Nvidia, but the performances are not worthing that prenium.

As of now, the only thing I wanted was a super thin laptop with a great screen and good component for office work, with a 2700u/3700u... something like a surface or something that can play AAA games at 720p. -

Krazie_Ivan i sure hope we're not witnessing a replay of 2000-2006 OEM pay-offs to block competition... just seem odd to anyone else that a company would shrug off potential sales & growth like this? how can anyone in the industry see AMD's Ryzen path, balanced against Intel's woes, and decide they don't want a slice of that pie?Reply -

mischon123 Something wrong on this planet. Looks like the IT departments (formerly known as janitors)took over. What was formerly a job collecting garbage and dumping it...the garbage is now kept and getting reprocessed and stored on site.Reply

This stuff has so little to do with actual businessprocesses...the inmates are now running the asylum. -

gdmaclew Reply21693736 said:i sure hope we're not witnessing a replay of 2000-2006 OEM pay-offs to block competition... just seem odd to anyone else that a company would shrug off potential sales & growth like this? how can anyone in the industry see AMD's Ryzen path, balanced against Intel's woes, and decide they don't want a slice of that pie?

The industry (and Users) are a lot wiser these days to Intel's tricks. I'm confidant that nothing like the shenanigans in the early part of the century could happen again. Intel would pay much more dearly if they tried something like that again.

-

mischon123 That also means that most Intel consumer desktop cpus are the garbage chips with scraped shut broken cores, caches etc. Better to go with Ryzen 8 cores and higher where everything is intact and thus priceworthy.Reply