A Look Into The Hard Drive's Future

Philosophies and Production Details

Seagate is the only hard drive manufacturer that offers hard drives in all product categories. The Barracudas target the 3.5” desktop mainstream, the Cheetah is the 3.5” offering for servers, Momentus 2.5” aims for notebooks and the Savvio 2.5” are for servers. The DB, SV and LD series are drives for consumer applications. And there is a 1.8” drive called Lyrion, which might not get a successor. Only few years ago, Seagate acquired Maxtor, which helped it become the market leader, while others, such as Samsung and WD, are gaining ground.

Western Digital is more conservative, as it focuses on niches, but moves carefully and strategically within conventional form factors. As a consequence, WD doesn’t want to deal with any drives at 1.8” or smaller sizes. It has been a major player in the 3.5” space and it went into the 2.5” arena, but it typically isn’t first to market when it comes to introducing new technologies such as perpendicular magnetic recording (PMR). Its efforts went into the Scorpio 2.5” mobile drive series and the new entry-level server 2.5” VelociRaptor, which helped to both increase market share and gross margin. The Green Power series also was the first of its kind and WD is expected to re-enter the enterprise market soon.

Hitachi had offered drives for all important markets, but it pulled out of the 1.8” sector. Deskstar is its 3.5” family, while Ultrastar is the name of the 3.5” and 2.5” server drives. You’ll find mobile 2.5” drives under the Travelstar brand and consumer drives are called Cinemastar. Endurastar is a 2.5” line for applications requiring better robustness. Hitachi and Seagate are the only two manufacturers that build all components on their own.

Samsung has made impressive steps, as it came from nowhere to position itself as a growing player right after Hitachi. It started with 3.5” drives and added 2.5” drives to its portfolio. Unlike the bigger players, Samsung is focusing on 1.8” and 1.3” drives as well. All drives are called Spinpoint, with the suffix determining the particular family: F1 represents the terabyte 3.5” drive, MP2 is the performance 2.5” notebook drive, etc.

Fujitsu pulled out of the 3.5” desktop market years ago, and has been focusing on 3.5” and 2.5” server drives, as well as 2.5” mobile drives. The firm is quick to release new mobile hard drives, but it stays away from niche solutions. Its product names are cryptic, though.

Toshiba does not offer any 3.5” drives and no server drives. Instead, the Japanese drive maker caters to mobile drives in the 2.5” and 1.8” sizes.

Who is Who: Who Builds Which Component?

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

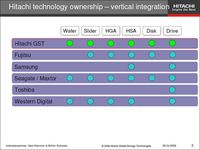

Not all hard drive makers are created equal. Some of them build all components on their own and control the entire supply chain. Others only build some of the parts and hand over the designs to other vendors who provide the components. Seagate has full control of its component supply. Fujitsu and WD are close. Toshiba designs all parts, but has to purchase them from other suppliers. To our knowledge, Samsung is in the process of assuming better control of the process.

Editor’s Note: A reader named York correctly points out that Western Digital purchased Komag some time ago and is now able to manufacture its own drives. The purchase happened around the same time as Hitachi’s seminar, which explains the inaccuracy in its chart.

Current page: Philosophies and Production Details

Prev Page Players and Market Shares Next Page Market Opportunities