Why copper markets are feeling the pinch due to aggressive AI data center expansion — expansive buildout to demand 1.1 million tonnes of copper annually by 2030, close to 3% of global demand

Alongside energy, water and computer chips, the supply squeeze is being felt further up the chain, too.

Data center demand is skyrocketing as the generative AI revolution continues at pace. The racks of servers already use around 1.5% of global electricity, but by 2030, the International Energy Agency (IEA) expects their power demand to more than double to roughly 945TWh a year, with AI the single biggest driver of that surge.

Beyond energy and water use, and the insatiable demand for chips that has driven Nvidia to record highs and triggered an arms race between Nvidia’s GPUs and the tensor processing units (TPUs) favoured by Google, there’s another resource that’s in increasingly short supply: copper.

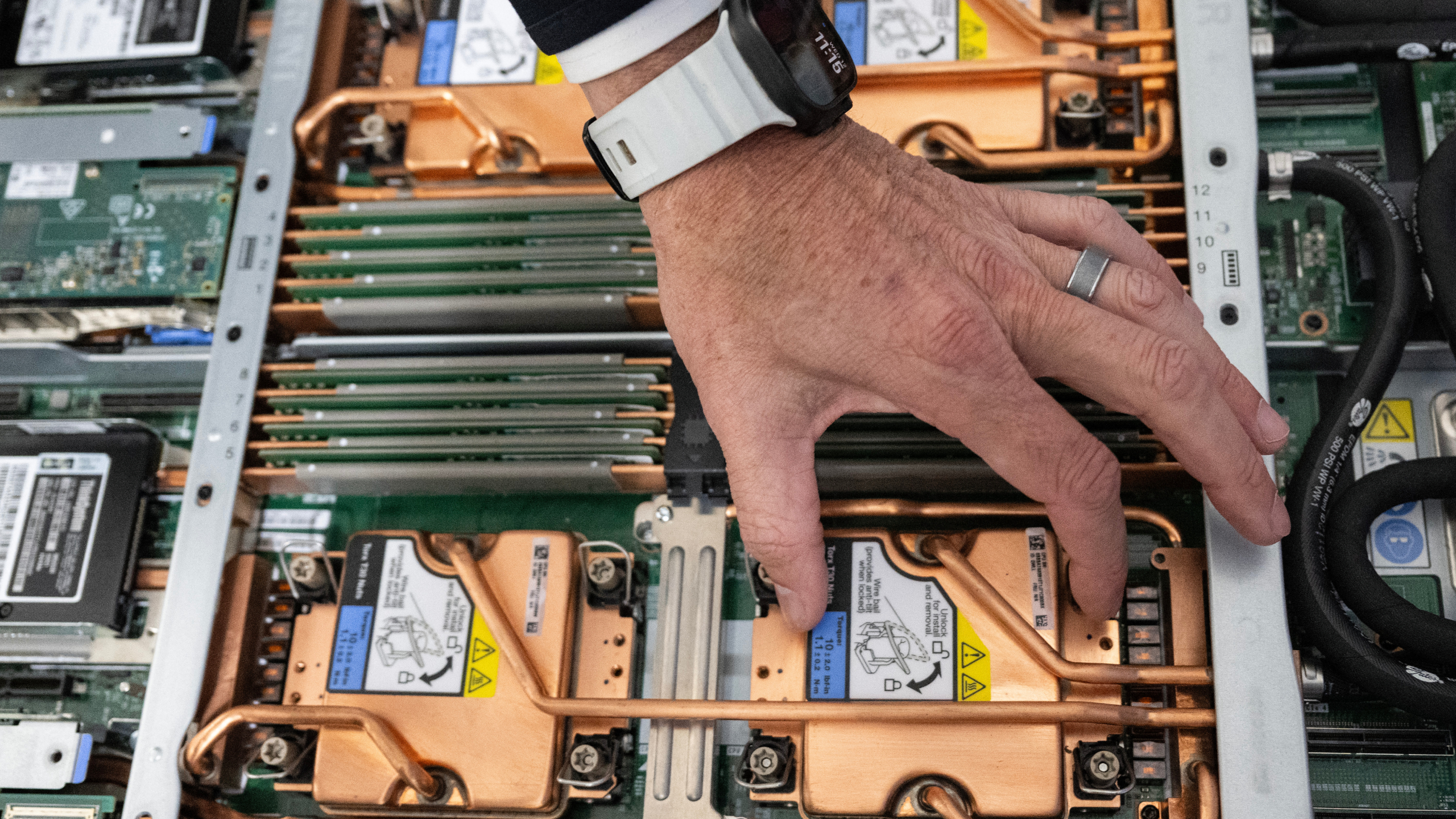

Copper is integral to data centers and to the AI revolution. It runs through the high-voltage lines that feed hyperscale campuses, the medium-voltage cables across those sites, the busbars that bring power into server halls, and the windings inside the cooling pumps that stop racks of GPUs from overheating and cooking themselves. It’s also already in short supply. Global refined copper demand is about 28 million tonnes this year, up from 2025 forecasts made just a year ago by the Copper Council. Demand is expected to keep rising, driven by electric vehicles, renewables, grid upgrades, and data centers.

The global copper market is now sliding into a deficit. The International Copper Study Group now expects a refined copper shortfall of around 150,000 tonnes in 2026, reversing what had been a forecast surplus of more than 200,000 tonnes. Investment bank UBS is even more worried about the supply gap, forecasting deficits of 230,000 tonnes in 2025 and more than 400,000 tonnes in 2026 as mine disruptions in Chile, Peru and Indonesia collide with rising demand.

“From my side, it's positive, it's a part of the general electrification story, and copper has to play an important role in that,” says Peter Schmitz, director of global copper markets research at Wood Mackenzie. “Copper is lucky in that it's a commodity that's quite widely used in various sectors and data centers.”

Big box problems

Wood Mackenzie estimates that roughly 700,000 tonnes of copper will go into data centers globally between now and 2030, in the “box itself” — the facility and its internal power systems. On top of that, Schmitz says there could be as much as a further 5 million tonnes tied up in new transmission and distribution infrastructure to bring power to those sites; CRU’s central case assumes about 1.1 million tonnes of that grid copper is directly associated with data centers.

In a market measured in tens of millions of tonnes a year, those numbers don’t sound catastrophic. Other forecasters are in the same ballpark. Macquarie Bank estimates between 330,000 and 420,000 tonnes of copper will be used in data centers by 2030. Yet Sprott, an asset manager, believes copper demand will be far more aggressive due to data centers. They estimate data centers will need about 1.1 million tonnes of copper annually by 2030, or close to 3% of global demand.

That’s good news for those selling copper. Data-center developers — especially the hyperscale cloud providers now racing to deploy generative AI —are among the few buyers in the world who can’t easily delay or downsize projects based on metals prices. But it’s worse news for the broader copper market, given its supply-demand deficit. Even a few hundred thousand tonnes of extra, price-insensitive demand can move prices for everyone else.

“If we are in deficit, and we do forecast a deficit for this year, next year, and thereafter in the market, then that just pushes it a little bit more into deficit, and that must be reflected in price,” Schmitz says. “It goes straight through to the price.”

To understand what’s happening further down the supply chain, Egest Balla, wire and cable analyst at CRU, looks at the world from the perspective of insulated wire and cable. Right now, he says, data centers are still a mid-single-digit slice of that business. “It's only around 4% to 5%, or somewhere in that mid-single digit range of the total insulated wired cable demand as a portion of the market,” Balla says. But by 2030, it's “between 9% to 11% of the overall picture globally,” he says. And in North America, where Donald Trump is encouraging AI firms to ‘build, baby, build’, “it's about 14% of insulated cable demand in North America from data centers,” Balla explains.

Insatiable, inelastic demand

Companies operating in the copper manufacturing and production space are capitalising on this newfound interest from data centers. “When we talk to people, especially wire rod producers, companies are really taking advantage of the swing and catering towards the data center markets,” Balla says. One US producer, Southwire, recently announced an expansion of its facility in Alabama to churn out more medium-voltage power cables – components which are “key to these data center applications,” Balla says.

On the demand side, he says, the cloud giants are more than happy to soak up that capacity. “There's a large appetite from a lot of these big operators like Google, Meta and Amazon,” says Balla. That willingness to pay has already helped prop up cable demand in the face of weaker housing starts and softer manufacturing, Balla says. “Residential construction, the US hasn't been as hot as it used to be,” he continues. “So data centers have really helped the general profile of power cables and low voltage cables, because those projects from data centers are giving a large amount of support.”

The crucial unknown in all this is copper intensity: how many tonnes of metal you need per megawatt of data center capacity.

A study of Microsoft’s Chicago facility, built in 2009, landed on an estimate of 27 tonnes per megawatt. Schneider Electric, looking over a longer life cycle and including refits, has suggested that the number could reach 66 tonnes per megawatt. Other analysts put traditional data centers in the 10 to 15 tonnes per megawatt range, with AI-focused ones closer to 25 to 30 tonnes as GPU-heavy racks drive up both power and cooling needs.

Schmitz thinks the top end of those ranges may be pulled down over time by better chips, more efficient software, and redesigned power systems. “We will see efficiencies in computing power going up for the same amount of power consumption,” he explains. “We've seen this in the past, and we'll see efficiencies in terms of how the power is used and provided.”

But he is also worried about how uncertain the build-out pipeline is. “One of the things I urge people to look at is not only the data center pipeline, but the expectation of what will actually be built in the end,” he says. “There's a lot of investment going in. But investment is not the same as buildings going up.” Just this week, IBM's CEO reiterated the same sentiment.

Seeking out alternatives

If copper does get too expensive or too scarce, there are alternatives – up to a point. Balla is already seeing “thrifting of metals” in data center designs, as engineers hunt for ways to reduce the amount of metal per megawatt. Smaller and mid-sized operators in particular are starting to look at aluminium conductors for some parts of their installations, he says, especially if copper prices trend higher or supply tightens. “Maybe Meta and Google will start to consider these usages of aluminium-based conductive material for their own projects.” But aluminium comes with trade-offs: cables have to be thicker to carry the same current, eating up space in already cramped server halls. That’s pushing interest in busbars and other alternative power-distribution hardware, Balla says.

On the data side, copper faces a different kind of competition. “One interesting trend, which is not the power side, but it's more of the data side,” he says, is that hyperscale operators are gradually swapping out short-distance copper Ethernet cables for fibre optics inside their facilities. “[data demands are now] pushing towards using more fibre than copper."

As silicon photonics and “co-packaged optics” mature, moving optical links closer to the chips themselves, Balla expects fiber’s share of the data center cable mix to grow further.

But even if copper supply can keep up with AI’s appetite within data centers, there’s a bigger question outside those walls: can grids deliver the power these facilities need, where they need it?

“Transmission networks are a whole other big bottleneck,” says Balla. “Especially in the U.S. and Europe, that’s been quite a challenge now for these bigger hyperscale projects to try to get to the grid, because obviously it's more cost-efficient for energy usage.” In Europe, the Commission has started to flag data centers as an “energy-hungry challenge”, warning that accelerated computing for AI is a core reason electricity use from server farms is on track to more than double by 2030. That implies tens of billions in new transmission investment – and more copper – just to keep lights on and GPUs running.

Not every planned data center will get built, and not every project will need new long-distance lines. Many will cluster near existing industrial hubs or power plants, which could lower the incremental copper required on the grid side, warns Schmitz.

One of copper’s benefits is that it’s endlessly recyclable. Almost a fifth of global refined copper already comes from scrap, and the share is expected to rise as energy transition hardware installed in the 2020s gets ripped out and replaced in the decades to come. That time will also come for data centers.

Recycling resources

“Even if we're talking about a large build-out of a data center, when do they become defunct?” Schmitz says. “We see copper coming back and being recycled, whether it's in vehicles or in buildings,” Schmitz says. There remain significant unknowns in the data center story and its impact on copper demand. “Is that cycle likely to be quicker for data centers than for other copper demand?” he asks. “Either way, it's incremental demand that we need to think about, and we need to think about some of the losses along the way.”

Given how quickly AI hardware is evolving, it is plausible that data centers will give back their copper faster than apartment blocks or transmission lines. That could slightly ease the long-term strain on copper supplies – but it could also mean ever larger volumes of metal cycling through a bigger system if the pace of build-out accelerates even further.

AI data centers aren’t the only reason copper markets are feeling the pinch right now. The metal’s biggest growth drivers are still electric vehicles, solar and wind farms, and the broader grid expansion needed for decarbonisation. The IEA and others expect copper demand for energy transition tech to more than triple by the mid-2030s, while total refined demand could almost double by 2035 in some scenarios.

But AI is a highly concentrated, politically sensitive, and very visible part of the issue. When a handful of trillion-dollar companies can pay almost any price to secure copper for their next model rollout, while schools or smaller manufacturers have to think twice, it does have an impact on markets.

Data centers are still “not as big of an industry in terms of the overall growth sector that people might originally have imagined it to be,” says Balla. But with deficits looming and prices rising, their inelastic demand and massive growth may end up still having an impact in a way the market didn’t expect.

Chris Stokel-Walker is a Tom's Hardware contributor who focuses on the tech sector and its impact on our daily lives—online and offline. He is the author of How AI Ate the World, published in 2024, as well as TikTok Boom, YouTubers, and The History of the Internet in Byte-Sized Chunks.