Data centers turn to commercial aircraft jet engines bolted onto trailers as AI power crunch bites — cast-off turbines generate up to 48 MW of electricity apiece

With AI buildouts outpacing the grid, data centers are rolling in jet-powered turbines to keep their clusters online.

Faced with multi-year delays to secure grid power, US data center operators are deploying aeroderivative gas turbines — effectively retired commercial aircraft engines bolted into trailers — to keep AI infrastructure online.

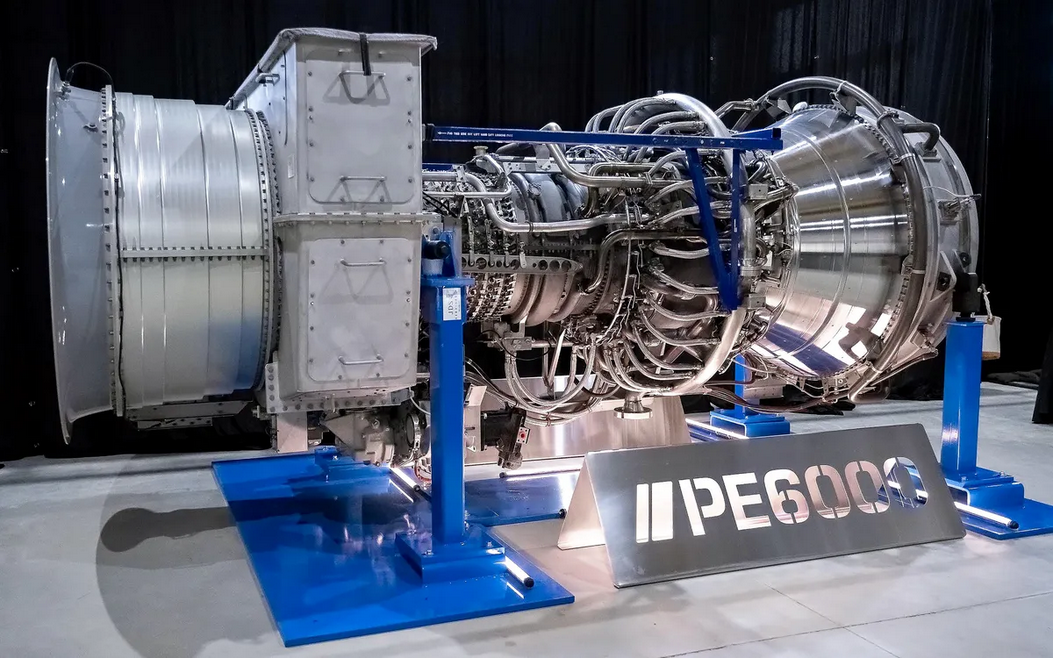

According to IEEE Spectrum, facilities in Texas are already spinning up units based on General Electric’s CF6-80C2 and LM6000, the same turbine cores once found on 767s and Airbus A310s. Vendors like ProEnergy and Mitsubishi Power have turned these into modular, fast-start generators capable of delivering 48 megawatts apiece, enough to support a large AI cluster while utility-scale infrastructure lags.

Fast, loud, and anything but elegant, these “bridging power” units come from vendors like ProEnergy, which offers trailerized turbines built around ex-aviation cores that can spin up in minutes to meet energy demand. Meanwhile, Mitsubishi Power’s FT8 MOBILEPAC, which derives from Pratt & Whitney jet engines, delivers a similar output in a self-contained footprint designed for fast deployment.

While this might not be the cheapest, and certainly not the cleanest, way to power racks, it’s a viable stopgap for companies racing to hit AI milestones while local substations and modular nuclear power deployments remain years away.

Jet-derived turbines are nothing new. They’ve been used in military and offshore drilling operations for decades, but this is the first time they’ve appeared in any meaningful way at data center sites. That speaks volumes about just how tight power supplies in the U.S. have become.

In one of the more visible examples, OpenAI’s parent group is deploying nearly 30 LM2500XPRESS units at a facility near Abilene, Texas, as part of its multi-billion-dollar Stargate project. Each unit spins up to 34 megawatts, fast enough to cold-start servers in under ten minutes.

What they gain in fast deployment and ramp speed, they lose in thermal efficiency. Aeroderivative turbines run in simple-cycle mode, burning fuel without capturing waste heat, which puts them well below the efficiency of combined-cycle plants. Most run on diesel or gas delivered by truck, and require selective catalytic reduction to meet NOx limits.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Still, it’s not difficult to see the appeal. Even a small AI buildout can demand 100 megawatts or more, and with some utilities quoting lead times of five years or more, we should expect to see more stopgap power generation being implemented to meet burgeoning AI power demands.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.

-

bit_user Reply

Yeah, those were pretty much my questions:The article said:What they gain in fast deployment and ramp speed, they lose in thermal efficiency. Aeroderivative turbines run in simple-cycle mode, burning fuel without capturing waste heat, which puts them well below the efficiency of combined-cycle plants. Most run on diesel or gas delivered by truck, and require selective catalytic reduction to meet NOx limits.

fuel type

efficiency

emissions

There was one other that you potentially covered, if these really can run on basically standard fuels. If not (and the remark about "selective catalytic reduction" is what puts some doubt in my mind), I was going to ask what the likely impact is on aviation fuel prices, since I assume the supply is fairly inelastic and well-matched to current aviation needs. -

Jabberwocky79 What blows my mind is that for the past 20 years everything has been about the danger of global warming and environmental concerns. Then the AI bubble hits, and all of that is suddenly thrown out the window. 'Energy conservation be damned! Let's fire up these gasoline generators!' LOL - Some of the biggest offenders were once some of the biggest proponents of so-called 'clean' energy.Reply -

CrazyCarrot911 Reply

Exactly !Jabberwocky79 said:What blows my mind is that for the past 20 years everything has been about the danger of global warming and environmental concerns. Then the AI bubble hits, and all of that is suddenly thrown out the window. 'Energy conservation be damned! Let's fire up these gasoline generators!' LOL - Some of the biggest offenders were once some of the biggest proponents of so-called 'clean' energy.

We are going down in a big Party, Ai and other useless things we never needed to survive.

Ask Ai if this nonsense is sustainable-----500mil BTU later it will tell you "No" -

JamesJones44 Reply

Gas turbines and Jet engines are very close in terms of power generating functionality. GE used to share turbine designs between their gas turbines for power generation and their turbofan jet engine turbines. However, as you mention their are some key differences. Gas turbines generally do not spin as fast and the fuel they use is very different making jet engines fair less efficient in terms power generators and byproduct emissions. It's conceivable that a turbofan could be converted to use natural gas and generate energy at lower RPMs but based on this story I have doubts that is how these are being deployed as the conversion would likely take too much time given the speed for which these are being deployed.bit_user said:Yeah, those were pretty much my questions:

fuel type

efficiency

emissions

There was one other that you potentially covered, if these really can run on basically standard fuels. If not (and the remark about "selective catalytic reduction" is what puts some doubt in my mind), I was going to ask what the likely impact is on aviation fuel prices, since I assume the supply is fairly inelastic and well-matched to current aviation needs. -

SomeoneElse23 Reply

I've made the same point as well.Jabberwocky79 said:What blows my mind is that for the past 20 years everything has been about the danger of global warming and environmental concerns. Then the AI bubble hits, and all of that is suddenly thrown out the window. 'Energy conservation be damned! Let's fire up these gasoline generators!' LOL - Some of the biggest offenders were once some of the biggest proponents of so-called 'clean' energy.

Makes you think all the prior talk was to sound good. They didn't really mean it. -

garthpool Power turbines are the machines used in combined-cycle plants. They operate continuously, thus requiring the high efficiency of the combined cycle. That is, two cycles, the Brayton cycle of the gas turbine and heat recovery from the turbine exhaust with a Rankine bottoming cycle.Reply

The rating of these power turbines is in the range of 300 MW. The units fire natural gas with distillate fuel as a backup, generally No. 2 diesel. They may use a low-Nox combustion system or selective catalytic reduction to reduce the Nox.

The power turbines in combined-cycle plants are single-shaft gas turbines. They operate at a speed suited for the frequency of the grid they are supplying. For a 60HZ grid the turbine speed is 3600 RPM. They are heavy machines, but that doesn't matter because they are stationary. However, even if their power rating were reduced to the range common for aircraft, 50-80 MW, their design is not suitable. They would still be too heavy.

As stated in the article, aero-derivative power units are generally simple cycle: no recovery of heat from the 1000F exhaust. The low efficiency is acceptable because these units operate only for short times, and not every day. Their purpose is to meet peak demand, which occurs for no more than a few hours a day if at all. They also fire natural gas with distillate fuel backup, generally No. 2 diesel, and use either low-Nox combustion or SCR. They are useful for peak demand because they can be on-line in a few minutes. They are called peakers for that reason.

Since these aero-derivative power units do not require the more expensive jet fuel used for aircraft, it must have to do with the operating conditions. I don't know the reason.

The design of aero turbines is different in important ways from that of power turbines. Aero turbines have at least two shafts, sometimes three. This is for ease in varying the power output and to drive the fans that give jet engines the most effect. They can operate at speeds substantially higher than 3600 RPM. Multiple shafts allow the lightest possible engine, a primary concern for aircraft. -

bit_user Thanks for the info!Reply

I'm struggling with this part. Why would reducing their output make them too heavy? Are you saying that such a design couldn't be used for aircraft, due to its inherent weight? Therefore aircraft engines must not be designed this way?garthpool said:They are heavy machines, but that doesn't matter because they are stationary. However, even if their power rating were reduced to the range common for aircraft, 50-80 MW, their design is not suitable. They would still be too heavy. -

Amdlova Last time I see something for the General Electric turbines their are after at 45% efficiency on the turbines.Reply

Something like perfecting it to the human body levels.

These turbines is way better than diesel for sure. -

garthpool Reply

That is what I am saying. A stationary power turbine is a heavy, single-shaft machine, mainly because that makes it simple and keeps the cost down. Shrinking all of its parts to reduce the rating from 300 MW to 50 MW for aircraft service would not work. It would still be too heavy, and it would not have the flexibility required of an aircraft engine.bit_user said:Thanks for the info!

I'm struggling with this part. Why would reducing their output make them too heavy? Are you saying that such a design couldn't be used for aircraft, due to its inherent weight? Therefore aircraft engines must not be designed this way?

While both types are gas turbines, which operate on the Brayton cycle, they are substantially different engines. The power turbine operates at a single speed and without much change in the power output. An aircraft engine operates at many different speeds and power levels, That is why they require a more sophisticated design than a power turbine.