Jet engine shortages threaten AI data center expansion as wait times stretch into 2030 — the rush to power AI buildout continues

Wait times for mobile gas turbines stretch into the 2030s as hyperscalers race to buy every jet engine they can find.

The greatest threat to AI datacenter expansion in 2026 might not be compute, land, or capital, but jet engines. Faced with multi-year delays to secure grid connections, data center developers have been racing to bolt ex-airliner turbine cores onto mobile generator trailers. These so-called aeroderivative gas turbines, long used in military and offshore energy, are now being ordered in bulk to deliver fast-start bridging power for hyperscale AI clusters, which face a deepening energy crunch. But the supply is running out.

Interviews and market research indicate that manufacturers are quoting years-long lead times for turbine orders. Many of those placed today are being slotted for 2028–30, and customers are increasingly entering reservation agreements or putting down substantial deposits to hold future manufacturing capacity.

“I would expect by the end of the summer, we will be largely sold out through the end of ‘28 with this equipment,” said Scott Strazik, CEO of turbine maker GE Vernova, in an interview with Bloomberg back in March.

Turbines pretty much sold out for the next half a decade. This is because AI is a very real secular trends and we will consume all that can be built. Cheers 👊🏻🫡 pic.twitter.com/nPuSsJkU7sOctober 22, 2025

60% of turbine orders linked to AI

General Electric’s LM6000 and LM2500 series — both derived from the CF6 jet engine family — have quickly become the default choice for AI developers looking to spin up serious power in a hurry. OpenAI’s infrastructure partner, Crusoe Energy, recently ordered 29 LM2500XPRESS units to supply roughly one gigawatt of temporary generation for Stargate, effectively creating a mobile jet-fueled grid inside a West Texas field.

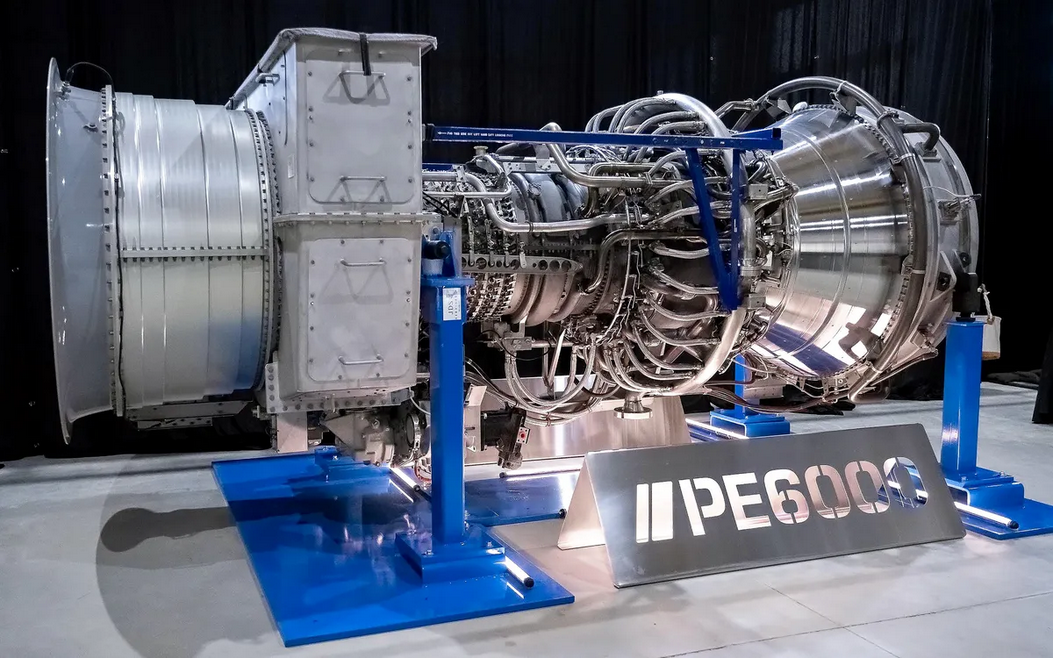

Meanwhile, ProEnergy, which retrofits used CF6-80C2 engines into trailer-mounted 48-megawatt units, confirmed that it has delivered more than 1 gigawatt of its PE6000 systems to just two data center clients. These engines, which were once strapped to Boeing 767s, now spend their lives keeping inference moving.

Siemens Energy said this year that more than 60% of its US gas turbine orders are now linked to AI data centers. In some states, like Ohio and Georgia, regulators are approving multi-gigawatt gas buildouts tied directly to hyperscale footprints. That includes full pipeline builds and multi-phase interconnects designed around private-generation campuses.

But the surge in orders has collided with the cold reality of turbine manufacturing timelines. GE Vernova is currently quoting 2028 or later for new industrial units, while Mitsubishi warns new turbine blocks ordered now may not ship until the 2030s. One developer reportedly paid $25 million just to reserve a future delivery slot.

Repurposed engines with real emissions

It’s not difficult to see why aeroderivative turbines are an attractive option. They’re faster to start, faster to ship, and entirely modular. An LM6000 can go from cold start to 50 megawatts of power in under 10 minutes. ProEnergy’s systems, mounted on trailers with integrated switchgear and cooling, can be dropped onsite and up and running in under 30 days. But they burn diesel or methane, and the emissions stack up quickly.

While newer models are shipped with selective catalytic reduction and oxidation systems that scrub nitrous oxide and carbon monoxide, regulators are sceptical. In Tennessee, Musk’s xAI supercomputer project — powered by dozens of methane turbines — has prompted backlash, with community groups filing appeals and the Shelby County Health Department issuing a permit for 15 turbines in July 2025 amid accusations that many more were already in operation without adequate authorization.

In many jurisdictions, mobile power units don’t trigger the same pollution thresholds as permanent plants unless they operate beyond a 12-month “temporary” window. But the current demand for AI compute is anything but temporary, and given how far away potential alternatives like modular nuclear power might be, operators will feasibly run these turbines for years, long enough to exhaust the useful life of their engine cores and, potentially, the public’s patience.

Climate considerations aside, some utility and grid‑planning analysts warn that the surge of data centers building or operating their own on‑site generation could complicate long‑term grid planning. By reducing the data center’s reliance on the public grid, these operators may avoid conventional utility rate structures and shift more of the infrastructure upgrade burden onto other users.

A bottleneck years in the making

Turbine manufacturing isn’t built for this kind of demand shock. GE Vernova is adding new production capacity, and Mitsubishi has pledged to double its turbine line output. But even those expansions won’t bring relief before 2028 at the earliest.

Unlike GPUs, turbines are physical behemoths whose manufacturing processes require high-alloy castings, precision heat treatment, and specialized testing that can’t be trivially scaled. Some components, like turbine blades and combustors, have lead times measured in years. A single LM2500 unit has thousands of hand-assembled parts, and final testing often takes weeks.

And while the U.S. government has earmarked billions for grid modernization and clean energy incentives, there’s been comparatively little federal coordination around the turbine supply chain. This gap may now limit buildouts across industries. Defense, petrochemical, utility, and offshore energy sectors all compete for the same classes of engines.

Despite the choke points, no one appears to be slowing down. Several gigawatts of new AI data center capacity are expected to come online in the U.S. in the near future. While there’s talk of small modular nuclear reactors and hydrogen turbines as long-term solutions, the future of AI, for now, is running on loud, dirty, and finite repurposed jet engines.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.