Corsair Stock Falls as Inflation Rises and Gaming Demand Decreases

Preliminary EBITDA is just ~$15m, compared to ~$80m a year ago.

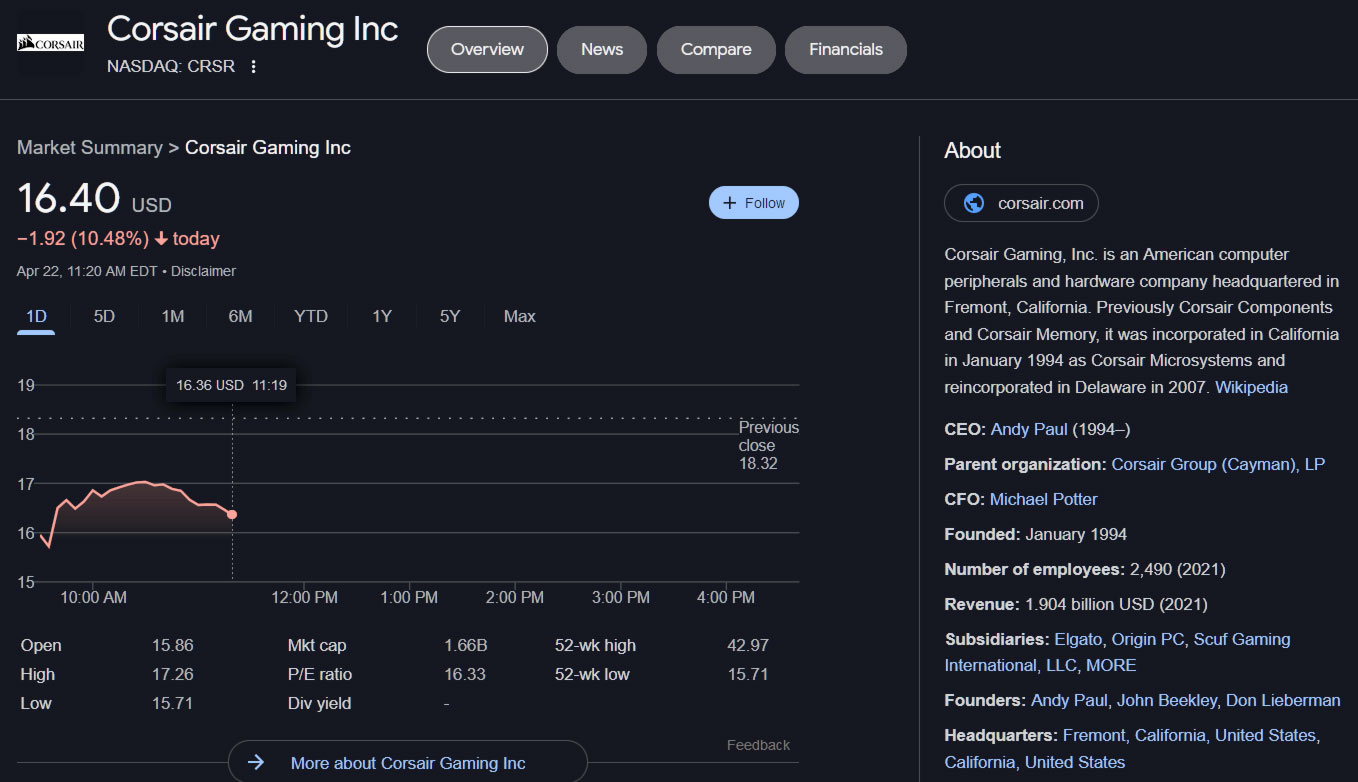

Corsair appears to have had a rough start to 2022. The popular PCs components and peripherals maker released its preliminary Q1 2022 results yesterday. It is fair to say the firm's share price has taken a beating today, down by over 10%. The problem is that the preliminaries telegraphed some disappointing financials ahead of when the Q1 2022 full results are due to be shared (3 pm Pacific time on Thursday, May 5, 2022).

Let us get an idea of how poor the Q1 2022 financials (for the three months ending March 31, 2022) are expected to be. Corsair says that its preliminary unaudited revenue for Q1 was approximately $380 million. This figure is low by two popular metrics – it is about 28% lower than a year ago, and it is well below consensus revenue estimates of $449.73 million.

Corsair also gave guidance on its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) figures. In Q1 2021, Corsair was happy to report that this figure was $80.4 million. However, the preliminary figures are pointing towards Q1 2022 EBITDA falling between $14 million and $15 million.

A 10% share price collapse seems relatively moderate considering the above information. Moreover, a statement by Andy Paul, Chief Executive Officer of Corsair, likely provided some support for the company's more optimistic shareholders.

Paul kicked off his defense of Corsair's share price by reminding investors that preliminary Q1 revenue looks good compared to Q1 2020 (but not compared with last year, as mentioned above). The idea the Corsair boss was conveying to investors was that Q1 2021 figures were somewhat special due to stimulus checks, lock-downs, and work-from-home demand. Many other tech companies experienced a boom, as folks were stuck at home needing to work and desperate for quality entertainment.

Another positive for Corsair that Paul was eager to put forward was the firm's "continued gains in market share in many of our categories." This seems to illustrate that any ill effects experienced by Corsair at this time are part of an industry-wide movement. Thus we aren't seeing any particular rejection of Corsair by its customers.

Corsair's CEO didn't promise that investors will see a sharp turnaround in Q2, for example. Instead, he went on to talk about Q1 macroeconomic financial issues and confidence maladies that are still present – think about the Ukraine war, energy prices, and impacts on consumer confidence. Nevertheless, Paul remains positive, as a warming wind of change has started to blow through the PC industry – graphics card availability has improved, and pricing has started to ease, nearly reaching MSRP in for some models.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The ongoing GPU pricing decline will be a big positive for the PC DIY market central to Corsair's business. "We are encouraged by many recent reports of GPU pricing falling and availability coming back to normal," wrote the Corsair CEO in the financial preliminaries statement. "We expect that to result in a surge of self-built gaming PC activity in the second half of this year." We hope he is correct for the sake of Corsair, PC enthusiasts, DIYers and gamers.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

mac_angel deleting my previous statement. Corsair reached out to me, which was a huge, pleasant surprise. I don't want to go into details, other than to say that they went far to make amends, and did so in a very friendly manner.Reply -

hotaru251 ReplyThe idea the Corsair boss was conveying to investors was that Q1 2021 figures were somewhat special due to stimulus checks, lock-downs, and work-from-home demand. Many other tech companies experienced a boom, as folks were stuck at home needing to work and desperate for quality entertainment.

least they understand this.

EKWB on otherhand seem to not udnerstand that past yr was a special case. -

Alvar "Miles" Udell Forget the GPU market, it's the CPU market that drives Corsair's sales. If people can't afford or obtain new CPUs they want, they don't need to buy a new CPU cooler or RAM, or even a new case.Reply

I'd love to buy a Corsair H150i, but with AMD refusing to drop the 5950X below $500 WHERE IT SHOULD BE, there's no reason for me to upgrade my cooler. -

thelovemuscle4u Personally, I have 0 sympathy for them as anyone who charges as much of a premium as corsair is bound to see a retraction in profits. I mean can get same quality, warranty and performance from much cheaper brands! ICue is a joke too half the time it bugs out, especially after updates, not to mention they are proprietary so your forced to use only corsair which is just anti-consumer imho, This is just my opinion of course.Reply