Cryptocurrency Markets Tumble Following India Finance Minister Speech

If you invested in Bitcoin in December, today is going to be a bad day for you. Following an announcement from India's Finance Minister, the cryptocurrency took a hard tumble in the last 24 hours and washed away the recent gains. Bitcoin is currently trading at levels not seen since November, and Ethereum is back to sub-$1,000 prices.

Last year was an incredible year for Bitcoin and other cryptocurrencies, but investors may have gotten carried away during the holiday season. Following a steady climb for most of the year, the price of Bitcoin spiked sharply following Thanksgiving, and it continued to rise until mid-December, when it peaked just shy of $20,000 per coin. Days later the value plummeted to $12,000.

The price of Bitcoin (and all cryptocurrencies for that matter) is extremely volatile, and big swings should be expected. However, if you invested in Bitcoin in December, you may have to sit on your holdings for a while just to break even. In the early hours of February 2, Bitcoin traded for as low as $7,550 (on Coinbase’s GDAX exchange). At time of writing, it’s trading at $8,500, which could be an indication that it will rise again, but that still represents a 57% drop from the peak seven weeks ago.

The value of Bitcoin is also having a severe effect on its market cap. At its peak, Bitcoin commanded more than a quarter trillion dollars in market capacity. Now, it’s barely holding on to $150,000,000.

Bitcoin isn’t the only cryptocurrency that’s taking a beating today, though. Ethereum is also trading at a significant deficit compared to its all time high of $1,425 on January 13. Ethereum appears to be bouncing back (trading currently hangs at around $900), but it too hit a slump early this morning and dipped as low as $730 per coin on GDAX.

According to the charts on Coinmarketcap, which tracks the prices at many exchanges around the world, almost every top-100 coin is down on value. We counted 92 of 100 that were in the red, and of the eight that are on the rise, most of them are barely in the green.

What’s behind the crash?

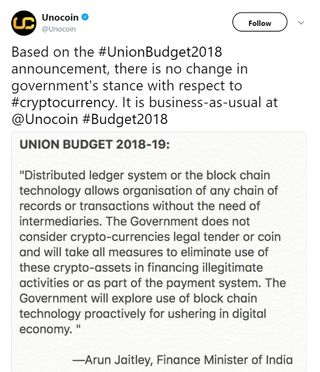

So, why is this happening? Well, it is likely that the government of India kicked off an inadvertent panic sale. India’s Finance Minister, Arun Jaitley, on Thursday announced that India “does not consider crypto-currencies legal tender or coin and will take all measures to eliminate the use of these cryptoassets in financing illegitimate activities or as part of the payment system.”

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Jaitley didn’t say a lot about the India government’s plans for cryptocurrency, which left much for interpretation. Some people think India is preparing to ban cryptocurrencies, and following Jaitley’s speech, several news outlets announced that India would be banning cryptocurrencies and their use in the country. However, the following line in the speech contradicts such a notion.

“The Government will explore use of block chain technology proactively for ushering in digital economy,” said Jaitley.

Unacoin, India’s most prominent Bitcoin company, which provides Bitcoin wallets and currency exchange services, isn’t worried about the announcement. The company interpreted Jaitley’s words as an indication that the government of India hasn’t changed its stance on cryptocurrencies. The company said that “it’s business-as-usual” today at Unicoin.

With the rapid increase in cryptocurrency adaption, regulators are scrambling to figure out how to tax and restrict the use of this new form of asset. In September, the Chinese government introduced new regulations that prompted the country’s largest exchange to shutdown. The closure announcement prompted a panic sale that caused Bitcoin to lose nearly half its value overnight. And just days ago, South Korea introduced new rules for cryptocurrency trading, as reported by CNBC, that would legitimize the practice while removing the anonymous factor of exchanging cryptocurrencies.

Kevin Carbotte is a contributing writer for Tom's Hardware who primarily covers VR and AR hardware. He has been writing for us for more than four years.

-

bit_user It's instructive to look at the fallout of the bitcoin crash in 2013. If you bought at the peak, you'd have had to hold for about 3 years, in order to break even. That's a long time to be out of the market.Reply

And it's not even a given that it'll ever return to its recent heights... or, it could go yet higher. -

Jeff Fx Reply20662531 said:Let it fall even lower , so the Card Prices drop for Gamers.

GPUs aren't used to mine Bitcoin, but they are used to mine other Cryptocurrencies. If Etherium drops to the point where the electricity used to mine costs more than the coin is worth, that could mean a lot of used cards on the market. The fans may need replacing, but they're otherwise be solid cards. -

positiveinflux Gamer here but its not just video cards that have gone up either. Replacing hardware isn't fun and building a new system is out of the question right now. We all wish it would end price wise, just my 2 cents and not in cryptocurrency.Reply -

Jeff Fx Reply20662655 said:It's instructive to look at the fallout of the bitcoin crash in 2013. If you bought at the peak, you'd have had to hold for about 3 years, in order to break even. That's a long time to be out of the market.

And it's not even a given that it'll ever return to its recent heights... or, it could go yet higher.

I don't think it'll go higher. If the price was rational, it wouldn't have crashed. You can't bypass governments using technology forever. Eventually they crack down. -

canadianvice Reply20662664 said:20662531 said:Let it fall even lower , so the Card Prices drop for Gamers.

GPUs aren't used to mine Bitcoin, but they are used to mine other Cryptocurrencies. If Etherium drops to the point where the electricity used to mine costs more than the coin is worth, that could mean a lot of used cards on the market. The fans may need replacing, but they're otherwise be solid cards.

People keep commenting this, but it's always based on something they forget:

When bitcoin falls, so do these other currencies. Seriously, look at the charts, and it's lock step. So, if BTC falls, we still get what we want.

Edit: It's literally in the charts.... the fall may not be proportional, but larger BTC news has bearing on those markets for other eCoins, and thus far they have gone down almost in tandem with BTC. They may be different commodities, but they share an investor base and news in one does generally have bearing on the others. -

juju_357 Reply20662664 said:20662531 said:Let it fall even lower , so the Card Prices drop for Gamers.

GPUs aren't used to mine Bitcoin, but they are used to mine other Cryptocurrencies. If Etherium drops to the point where the electricity used to mine costs more than the coin is worth, that could mean a lot of used cards on the market. The fans may need replacing, but they're otherwise be solid cards.

You don't think miners clock those cards as hard as they can? -

TJ Hooker @junu_357 eth mining doesn't really benefit from high core frequencies. So for eth mining you typically underclock/under volt to minimize power costs.Reply -

bit_user Reply

Um... lots of prices crash, only for many to recover, later on. As I pointed out, bitcoin has already been through numerous boom & bust cycles - most notably in 2013.20662667 said:20662655 said:It's instructive to look at the fallout of the bitcoin crash in 2013. If you bought at the peak, you'd have had to hold for about 3 years, in order to break even. That's a long time to be out of the market.

And it's not even a given that it'll ever return to its recent heights... or, it could go yet higher.

I don't think it'll go higher. If the price was rational, it wouldn't have crashed. You can't bypass governments using technology forever. Eventually they crack down.

I don't mean to defend bitcoin, but I think you're off-base by bringing rationality into the picture. It's purely speculative - we all know that - but that hasn't killed it, yet. Why would it suddenly happen, now?

I think it'll take a bigger existential crises to really bring it low. Until then, it might recover or it might not, but I don't think we're seeing its last days. -

bit_user Reply

What about memory clocks, though?20663162 said:@junu_357 eth mining doesn't really benefit from high core frequencies. So for eth mining you typically underclock/under volt to minimize power costs.

Anyway, it reminds me of this slide (page 55), from AMD's Polaris Architecture presentation (http://gaming.radeon.com/wp-content/uploads/sites/7/2016/08/Polaris-Tech-Day-Architecture-Final-6.24.2016.pdf):

Adaptive aging compensation■ GPUs require 2 - 3% clockspeed margin to accommodate transistor aging

■ Other aspects of the system also exhibit aging (e.g. lower voltage from system)

■ We want our parts to self-calibrate and adapt to changes over time – good or bad

■ More robust operation over time

■ Out-of-box performance is improved

Most Popular