NAND Flash revenues surpass NOR for the first time

El Segundo (CA) - The first quarter of this year brought a historic event for the Flash memory industry. For the first time since the introduction of the technology in 1988, revenues of the more recent NAND type surpassed the original NOR Flash driven by booming demand of MP3 players and digital cameras.

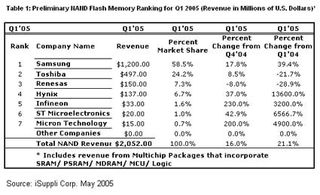

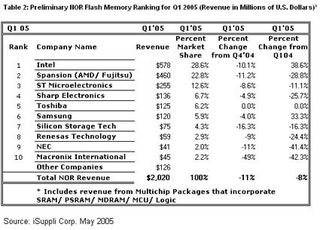

According to a report released by market research firm iSuppli, revenue for NAND flash in the first quarter rose to $2.05 billion, up 16 percent sequentially and up 21 percent from the first quarter of 2004. In contrast, NOR flash revenue declined to $2.02 billion, down 11 and 8 percent, respectively.

"Since the inception of the market, NOR has been the predominant form of flash memory, with its sales routinely dwarfing those of the newer NAND," said Mark DeVoss, senior analyst, covering flash memory for iSuppli.

"For example, NOR accounted for 91 percent of overall flash memory revenue in 2000, compared to just 9 percent for NAND. However, since 2002, sales have boomed for NAND flash, due to its extensive use for data storage in fast-growing products like MP3 players, digital still cameras, memory cards and USB drives," he said.

According to Voss, growth in the NOR "has been relatively weak as cutthroat competitive conditions have driven down Average Selling Prices (ASPs)." In 2006, iSuppli forecasts NAND will account for 59 percent of overall flash-memory revenue, compared to 41 percent for NOR. In 2009, NAND will account for 65 percent of all flash revenue, compared to 35 percent for NOR.

NAND was invented by Toshiba in 1989 but had little success until the early 2000s. NAND technology offers about ten times the number of write cycles, and higher speeds in both the save and delete processes. The memory cells in NAND memory are only half as large as those in NOR memory. This results at least in a theoretical cost advantage for NAND: the smaller cell size allows larger capacities to be used in a given space, which means both a lower price for the buyer and a higher margin for the manufacturer. NAND is used today especially in Flash memory cards and is expected to replace NOR in certain applications, such as cellphones, soon.

According to iSuppli, the top-two players in the NAND flash market, Samsung and Toshiba "easily retained their ranks in the first Quarter". The firms reached market shares of 58.5 percent and 24.2 percent respectively. However, the strong performance of the market was driven by some relative newcomers to the market such as Hynix, Infineon, Micron and STMicroelectronics. Number-five supplier Infineon achieved market-leading growth, with its first-quarter NAND sales rising a whopping 230 percent compared to the fourth quarter to reach $33 million.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Meanwhile, Intel kept the top ranking in NOR for the third consecutive quarter. The company has been engaged in a close competition with rival Spansion (AMD/Fujitsu) for NOR leadership over the past few years. The two companies have traded off the number-one position more than once on a quarterly basis starting in the third quarter of 2003. Most recently, Spansion reported increasing losses from its Flash business as a result of pricing pressure driven by Intel.

Related stories:

Is Flash Heading for Retirement?

Most Popular