Data centers will consume 70 percent of memory chips made in 2026 - supply shortfall will cause the chip shortage to spread to other segments

Soon enough, you might not even be able to buy a calculator.

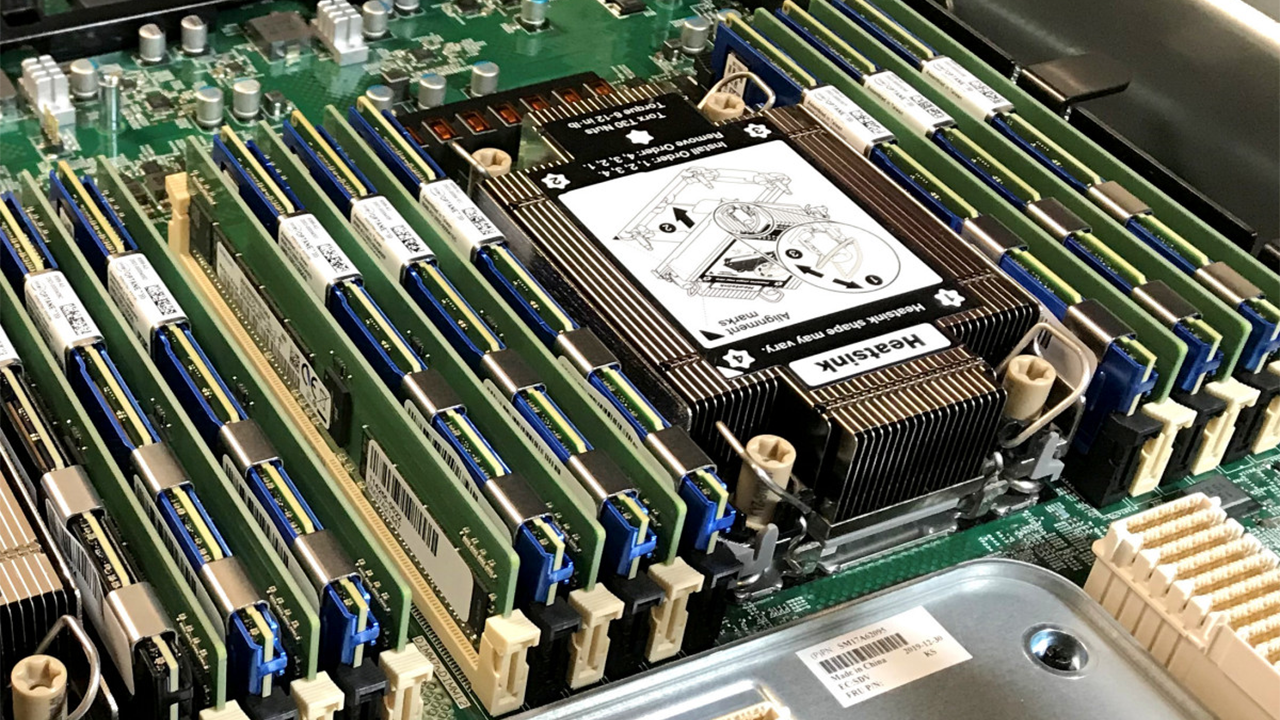

The tech press has been lit up like Chernobyl reactor #4 for months about shortages in memory, solid-state drives, and hard drives. The shortages are driven by explosive AI demand, and the latest report says that up to 70 percent of the memory produced worldwide in 2026 will be consumed by data centers. However, those specific topics have yet to be part of the global zeitgeist. That's quickly changing, as evidenced by a Wall Street Journal article (WSJ) describing just how dire the situation is, and how the fallout from the RAM shortage is set to irradiate several markets not directly linked to computing.

The WSJ details how the exponential rise in memory is all but guaranteed to hit the automotive sector, TVs, and consumer electronics, among many others. The publication goes as far as comparing the automobile situation to the production delays experienced during Covid, an event nobody has fond memories of.

Even though cars and most consumer gear use older types of memory, RAM makers have downsized or discontinued production of legacy chips altogether. To bluntly illustrate the point, the article cites Counterpoint Research's MS Hwang: "you gotta buy a plane ticket and get that allocation from manufacturers right now," going on to say that manufacturing capacity for 2028 is already being sold, never mind this year.

To state that most everything these days uses RAM is obvious, but even common household items like televisions, Bluetooth speakers, set-top boxes, and even "smart" appliances like fridges could become extremely pricey. The margins on these items are razor-thin, and one key component, like memory multiplying in price, implies a cost that manufacturers will be willing or unable to afford, thus passing it to the customer, assuming there is even any memory available to make the devices.

While component prices across all areas of industry float all the time, the waves are generally temporary enough to keep prices level, but that's not the case this time around. For his part, Huang thinks that RAM might become as much as 10% of the price of most electronics and 30% of the bill on items like smartphones.

IDC already updated its 2026 forecast with a 5% dip in smartphone sales and 9% on PCs — deals that may be altered further in just a few months' time. The firm also calls the current situation a "permanent reallocation" of supplier capacity towards AI datacenters. TrendForce's Avril Wu concurs, as "[she has] tracked the memory sector for almost 20 years, and this time really is different [...] It really is the craziest time ever."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Bruno Ferreira is a contributing writer for Tom's Hardware. He has decades of experience with PC hardware and assorted sundries, alongside a career as a developer. He's obsessed with detail and has a tendency to ramble on the topics he loves. When not doing that, he's usually playing games, or at live music shows and festivals.