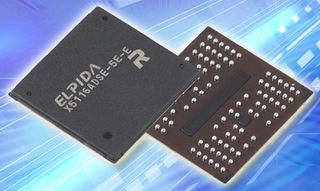

Micron Likely to Acquire Elpida for $2.5 Billion

Micron has won the right to exclusively bid for the acquisition of Elpida Memory.

According to the New York Times, Micron has offered "more than" 200 billion yen, approximately $2.5 billion, for the bankrupt memory maker. A substantial portion of the money would go toward Elpida's outstanding debt.

It's heavy lifting for Micron, which said it had only $2.1 billion in cash as of March 1, but the deal would enable the company to become a powerful rival for Samsung, which has been dominating the memory chip market for almost a decade, according to IHS. With Elpida in its pocket, Micron could become the world's second largest DRAM memory maker with a market share of about 25 percent.

The New York Times report stated that Micron would keep Elpida's two major factories open for production and not lay off any of its employees. An announcement of an acquisition is expected this summer as Elpida will be unveiling its plan of going forward by August 21.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

-

phamhlam Micron products are incredible. I can't believe their 128GB Crucial m4 was selling for $100 today and $125 on average. They are pushing the price per GB down hard without sacrificing performance.Reply -

rohitbaran ReplyMicron would keep Elpida's two major factories open for production and not lay off any of its employees.

Good -

Who pays $2 bil for BANKRUPT company?.... I would not by stock in Micron, as this does not seem like a good deal.Reply

Could Micron pick them up for a more of a bargain than this?

How modern are their facilities, and how strong are their future orders/contracts? If they are going bankrupt they are doing something WRONG.... -

anti-painkilla badideaWho pays $2 bil for BANKRUPT company?.... I would not by stock in Micron, as this does not seem like a good deal.Could Micron pick them up for a more of a bargain than this?How modern are their facilities, and how strong are their future orders/contracts? If they are going bankrupt they are doing something WRONG....Reply

Please read the article. It states that "A substantial portion of the money would go toward Elpida's outstanding debt."

As in they want the company in one piece, they are paying a bargain for it minus the debt. Also i'm guessing since they are paying Over $2B for this they have a fair idea what they are doing. If they can pull this off this acquisition gives them a great opportunity to increase their own production.

Most Popular