Nvidia Estimates $100-$300 Million in Q4 Revenue from Miners

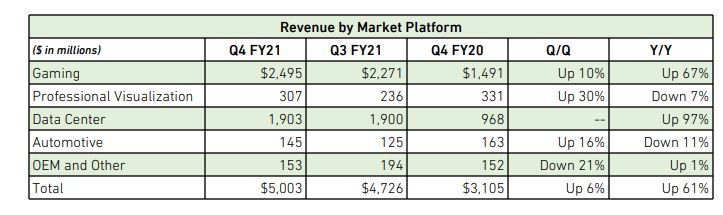

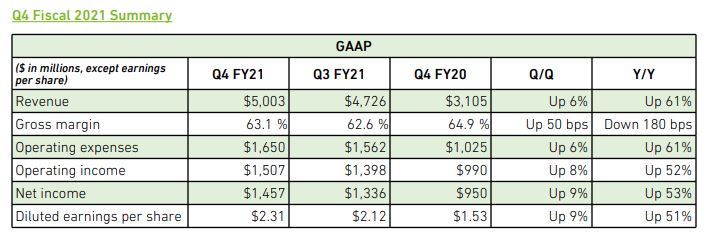

Nvidia is raking in cash in the midst of ongoing graphics card shortages, but there isn't a lot of good news for gamers on the near horizon. Nvidia released its Q4 and fiscal 2021 earnings today, notching an impressive record of $5 billion in quarterly revenue, up 61% over the prior year, as it powered its way to net earnings of $1.457 billion, but the company's comments on the current mining boom paint a dire picture.

Like most semiconductor manufacturers, Nvidia has suffered from a string of crushing shortages fueled by pandemic-induced supply chain disruptions. To make matters worse for gamers searching for a graphics card, the sudden reemergence of cryptocurrency mining, particularly Ethereum, has severely worsened the situation. Nvidia doesn't expect the situation to end any time soon, either, saying that it expects shortages in the channel to last throughout the quarter.

Nvidia CFO Collete Kress explained that the company predicts that, by its best estimates, $100 to $300 million of its Q4 revenue came from sales to cryptominers, but conceded that it couldn't accurately predict the impact due to sales through AIBs and distributors. Exposure to the finicky cryptomining market isn't a good look for Nvidia with its investors, and it's easy to think this is a lowball prediction: Overall, even at the full $300 million, this represents a small portion of Nvidia's $2.5 billion (up 67% YoY) of gaming revenue for the quarter.

"We suspect that the significant increase in the Ethereum hash rate observed over the past few months was driven by a combination of previously-installed mining capacity that was reactivated, as well as news sales of GPUs and ASICs," Kress explained.

Both Kress and Nvidia CEO Jensen Huang said that the company doesn't expect cryptocurrency mining to end soon, citing increased acceptance by companies and financial institutions along with a continued trend of 'proof of work' mining. These factors prompted the company to institute new measures that hamstring Ethereum mining performance on the upcoming RTX 3060 graphics cards.

Nvidia also recently introduced its new line of CMP (cryptomining processors) cards designed specifically for cryptocurrency miners. The company expects to sell roughly $50 million worth of those cards during the first quarter of the year. This number doesn't include sales of other graphics cards destined for mining over the coming months, though, and Nvidia didn't provide any predictions for its future overall mining income. Nvidia did say it will provide detailed revenue breakdowns for CMP cards in its future earnings reports.

Huang acknowledged that the company is supply-constrained but said that he doesn't expect GPU shortages to impact its supply to the lucrative data center market. That implies that Nvidia is prioritizing the supply of its data center GPUs over gaming GPUs, which makes sound business sense given the much higher margins in the data center. Nvidia says it sees continued strong demand for its gaming GPUs, though, citing that only 15% of its install base has upgraded to its RTX graphics cards.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Huang said that he expects mining to continue to rely upon 'proof of work,' which requires intense GPU computational power, and that the shift to 'proof of stake,' which doesn't require as much compute (GPUs), will take place gradually. That means that Nvidia sees demand for mining GPUs remaining strong for quite some time.

As we've seen in the past, a sudden drop in mining profitability can result in a flood of graphics cards on the second-hand market, which threatens Nvidia's profitability. Huang said that might not be the case this time around, as he thinks the majority of industrial miners will retain their graphics cards even if Ethereum profitability recedes temporarily, largely so they can press the cards back into service when profitability improves.

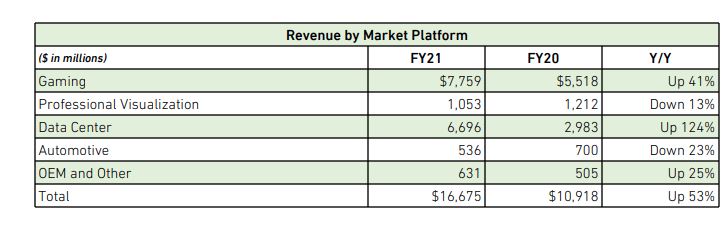

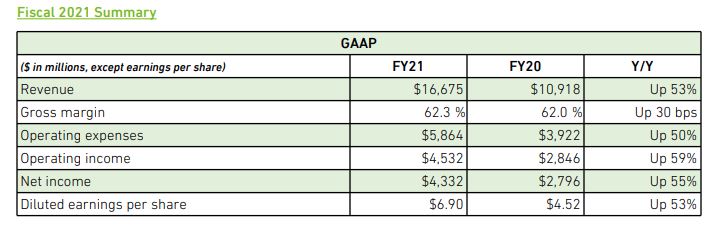

Nvidia raked in $16.7 billion for the year and $4.3 billion in net income as it continued to outperform estimates, and it says it still has room to grow despite the ongoing shortages. The company expects to earn another $5 billion this quarter, largely propelled by GPU sales to gamers. Unfortunately for gamers, Nvidia didn't give any predictions of when supply will return to normal.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

jkflipflop98 I really hate to even mention this. . . but Nvidia would make way more money just using their own chips to mine instead of selling them.Reply -

Jim90 Looking through the smokescreen bullcrap, deliberately selling direct to miners - and (clearly) 'encouraging' AIB's to do the same - is certainly profitable...isn't it Ngreedia?Reply

Let's hope every affected non-mining consumer takes note - and takes their business elsewhere when 'stocks' improve! -

bernieo To my mind, It does not make sound business sense .to upset and alienate a very large sector of your buying market .For the sake of a quick buck from miners.Reply

the gaming and data sales are your bread and butter. keep them happy ,they will keep coming back. Upset them they have long memories.

Nvidia need to start selling directly to the public, with a presence from Asus Gigabyte etc etc .A combined shop as it were. (obviously 1 per customer :-) )

Nvidia should be viewing this as a PR disaster.

we need more stiff competition in the Gpu market .at the moment its a 2 horse race -

sizzling Reply

Take business where? AMD are no better or worse, they just have smaller market share.Jim90 said:Looking through the smokescreen bullcrap, deliberately selling direct to miners - and (clearly) 'encouraging' AIB's to do the same - is certainly profitable...isn't it Ngreedia?

Let's hope every affected non-mining consumer takes note - and takes their business elsewhere when 'stocks' improve! -

MarsISwaiting Replyjkflipflop98 said:I really hate to even mention this. . . but Nvidia would make way more money just using their own chips to mine instead of selling them.

Well , maybe they are doing it and not telling anyone . -

InvalidError Reply

If it can make a meaningful amount of chips.Mandark said:This is a perfect time for Intel to mass produce their new video card and get some business

Intel has been slow ramping up 10nm and 7nm got delayed by a couple of months at the very least, could be a long time before Intel catches up with demand if it ever manages to do so. We're a solid three years into Intel deploying 10nm and Intel still doesn't have enough 10nm volume to shift the desktop CPU market over at least until the end of year, slowest transition to a new process in Intel's history by multiple years. -

spongiemaster Reply

Even worse, isn't TSMC supposed to be producing Intel GPU's on their 7nm? I wouldn't expect any massive volume for Intel GPU's if they're sharing the same fabs that everyone else can't get enough capacity from.InvalidError said:If it can make a meaningful amount of chips.

Intel has been slow ramping up 10nm and 7nm got delayed by a couple of months at the very least, could be a long time before Intel catches up with demand if it ever manages to do so. We're a solid three years into Intel deploying 10nm and Intel still doesn't have enough 10nm volume to shift the desktop CPU market over at least until the end of year, slowest transition to a new process in Intel's history by multiple years. -

InvalidError Reply

There was that too.spongiemaster said:Even worse, isn't TSMC supposed to be producing Intel GPU's on their 7nm?

Practically all fabs of consequence have been maxed out for a while, are maxed out now and will remain maxed out for the foreseeable future. Doesn't matter what gets manufactured where, supplies will still be limited. -

usiname Reply

More like slowest transition in their history.InvalidError said:Intel has been slow ramping up 10nm and 7nm got delayed by a couple of months at the very least, could be a long time before Intel catches up with demand if it ever manages to do so. We're a solid three years into Intel deploying 10nm and Intel still doesn't have enough 10nm volume to shift the desktop CPU market over at least until the end of year, slowest transition to a new process in Intel's history by multiple years.