Intel posts return to growth and profitability in Q3 2025, but significant challenges remain — achieves $13.7 billion revenue with $4.1 billion operating profit

Not out of the woods yet, not even close.

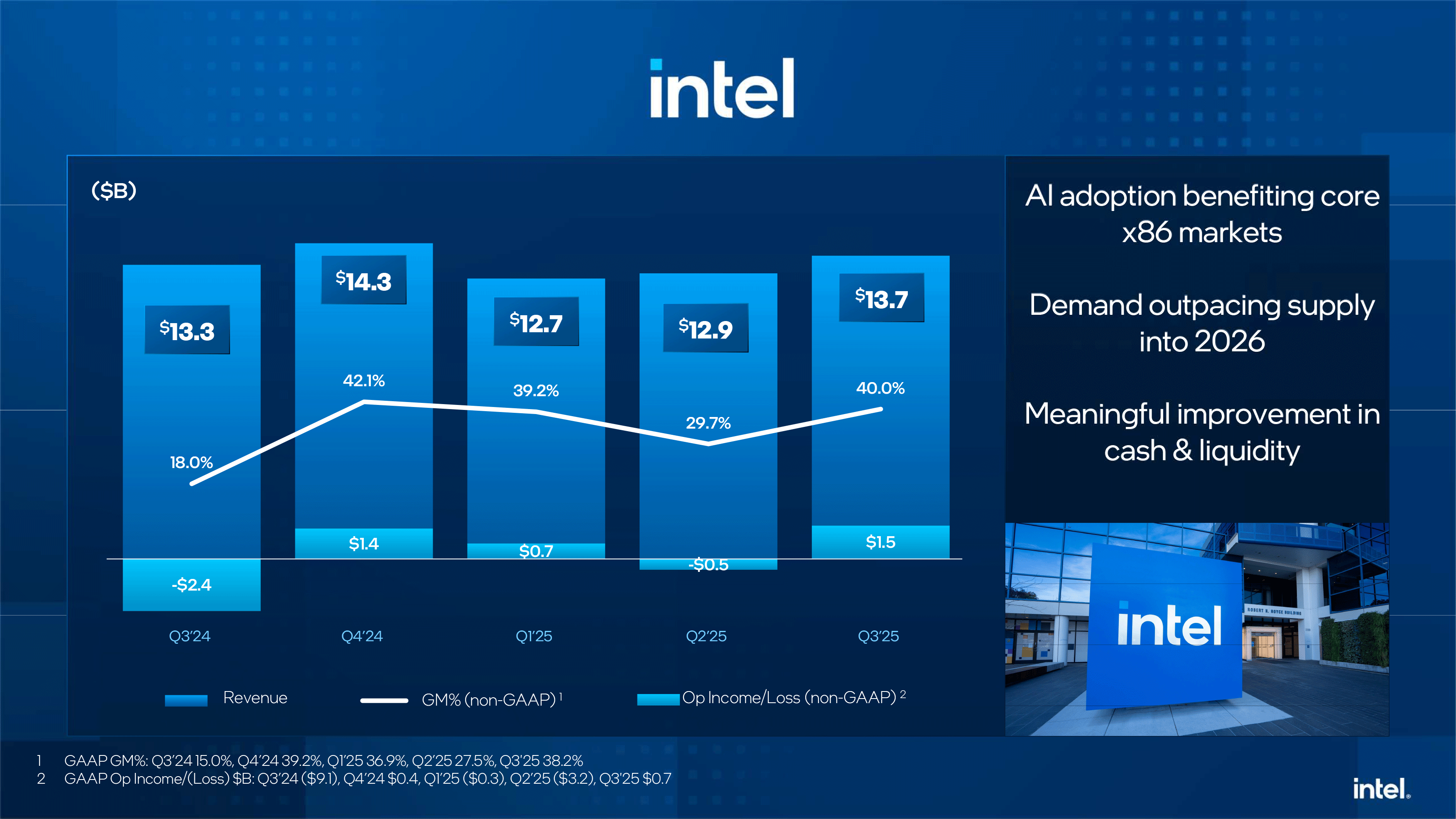

Intel on Thursday reported its better-than-expected financial results for the third quarter of 2025, marking its return to growth and profitability despite ongoing challenges. The company earned $13.7 billion, up both sequentially and year-over-year, and even posted $4.1 billion operating profit. However, the profit was not a result of a sudden turnaround of Intel's business, but was mainly driven by large one-time and non-operational gains, which helped to bring the company out of the red. Furthermore, Intel still has plenty of challenges to solve, and its Q4 outlook does not look strong.

$4.1 billion profit due to one time gains

"We took meaningful steps this quarter to strengthen our balance sheet, including accelerated funding from the U.S. Government and investments by Nvidia and SoftBank Group that increase our operational flexibility and demonstrate the critical role we play in the ecosystem," said David Zinsner, chief financial officer of Intel.

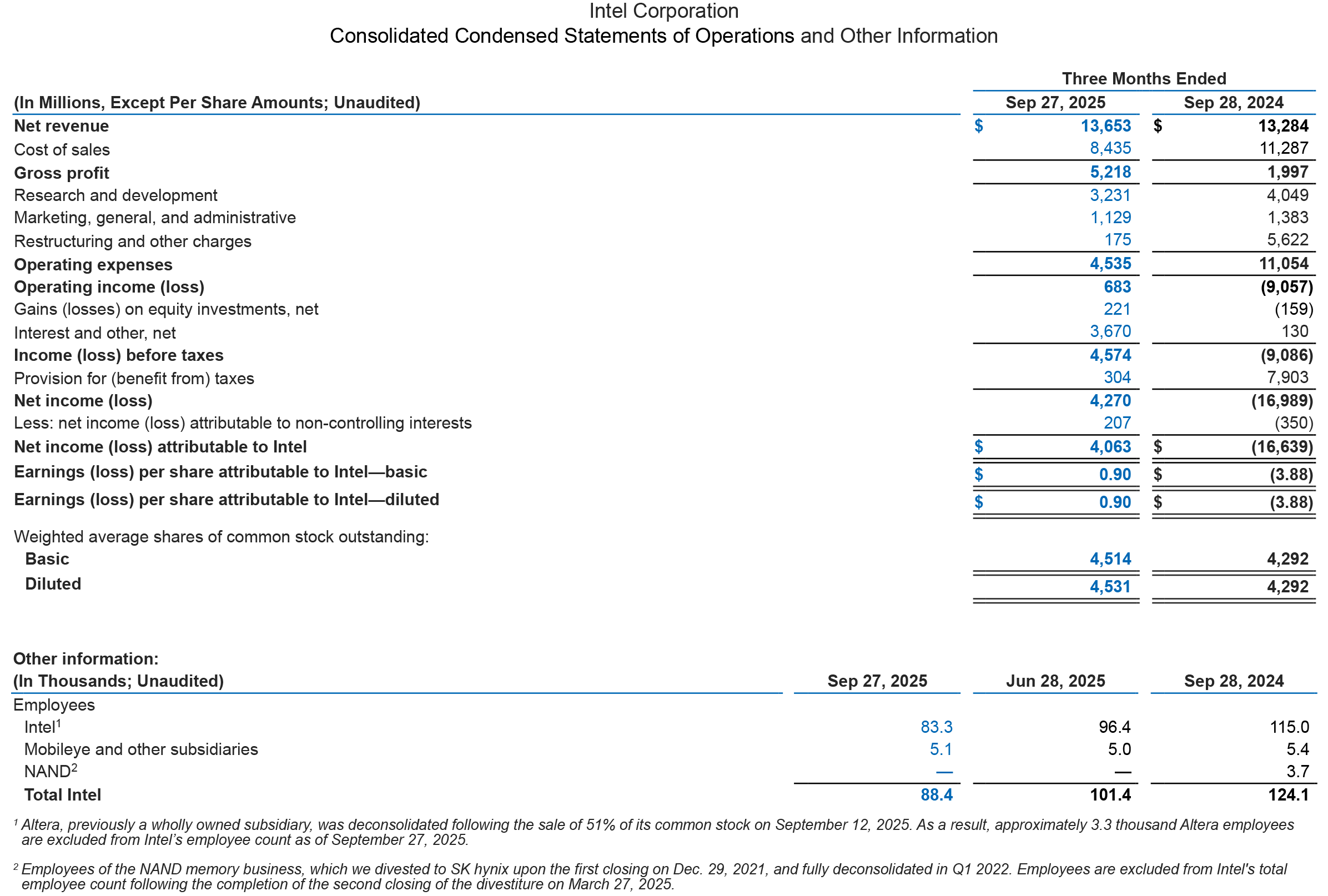

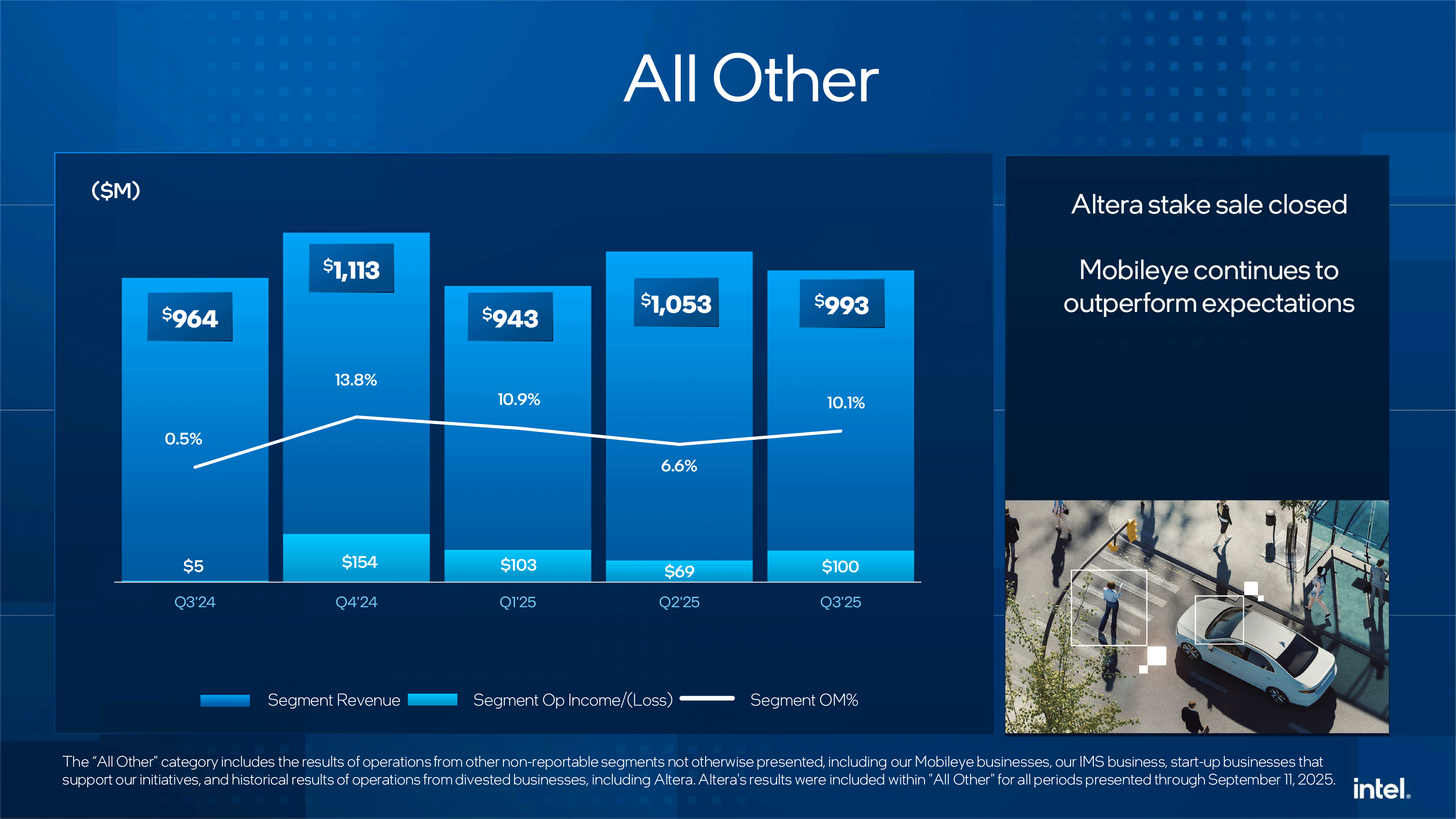

Intel earned $13.7 billion in revenue, up 3% year-over-year (YoY) and 6% quarter-over-quarter (QoQ), in the third quarter of 2025. The company's net income reached $4.1 billion, primarily due to non-recurring gains, while its gross margin increased to 38.2%. Meanwhile, operationally, Intel earned about $1 billion, while roughly $3 billion in asset-disposal gains (driven by the sale of Altera and part of its Mobileye stake) turned that modest recovery into sound profitability of $4.1 billion.

Intel's operating expenses — including research and development (R&D) as well as management, general, and administrative costs (MG&A) — totaled $4.4 billion in Q3 2025, down from $5.4 billion in the same quarter a year ago. The company spent $3.231 billion on R&D (down from $4.049 billion) and $1.129 billion on MG&A (down from $1.383 billion) in the third quarter. The company also recorded $175 million in restructuring and repairment charges.

Operational performance

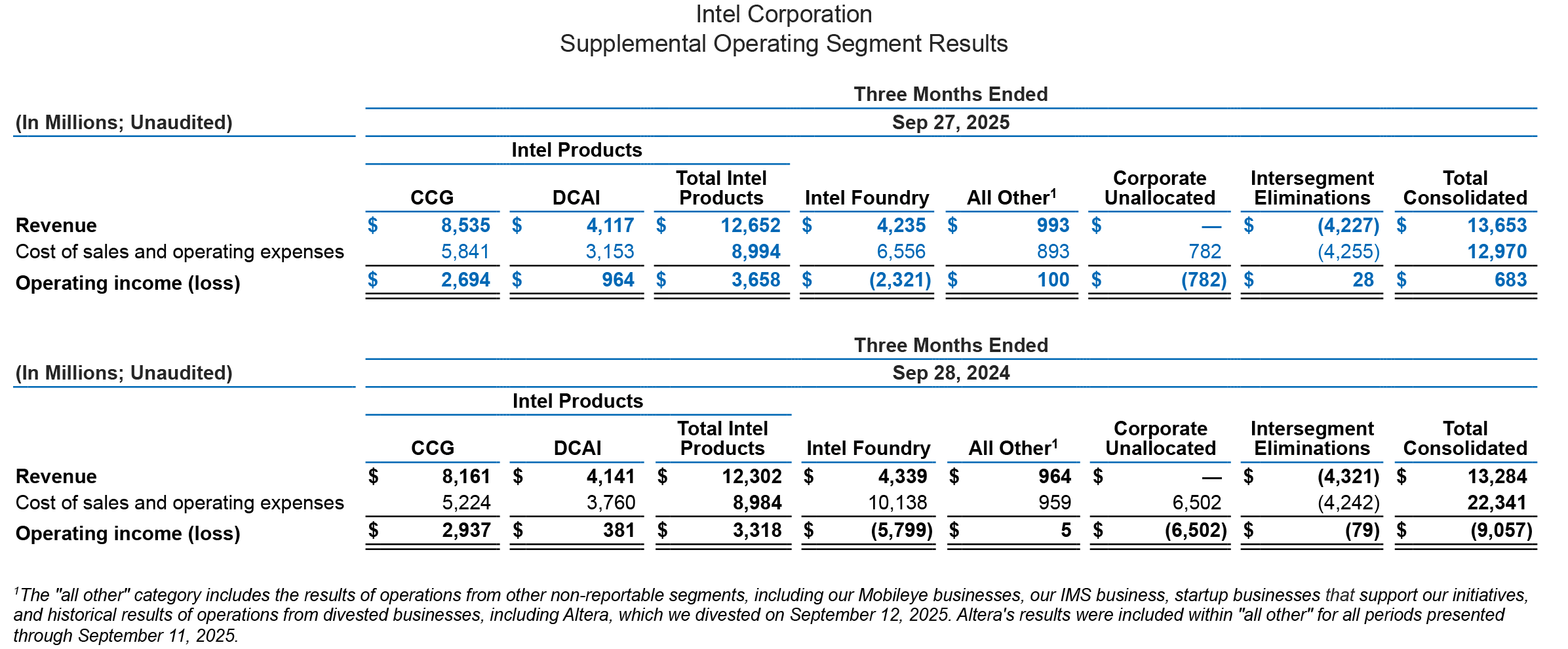

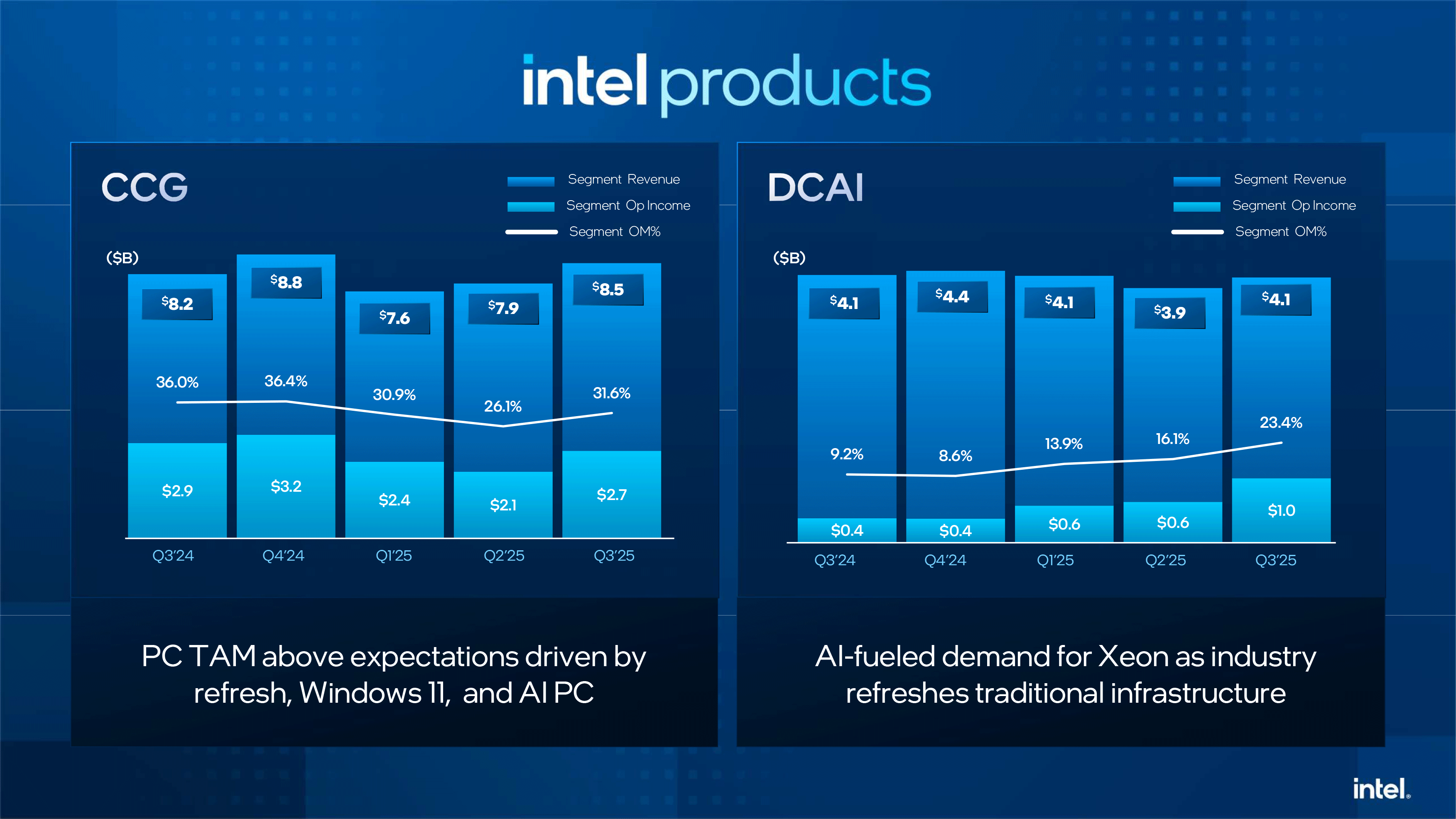

Intel's Client Computing Group (CCG) posted a strong rebound in Q3 2025 with $8.5 billion in revenue, up 7.6% from the prior quarter and 5% year-on-year. Operating income rose to roughly $2.7 billion, whereas operating margin increased to 31.6%. The results were driven by a more favorable product mix, lower inventory reserves at PC OEMs, and higher average selling prices due to growing demand for CPUs and shortages of Intel's previous-generation CPUs.

Intel deliberately steered capacity toward higher-margin models like the Arrow Lake and Lunar Lake and away from previous-generation client CPUs, which increased ASPs. Intel stressed that the recovery of its CCG was a result of disciplined execution rather than volume expansion. Meanwhile, CCG's growth was constrained by a shortage of Intel 7 capacity.

Intel's Data Center and AI Group (DCAI) delivered $4.1 billion in revenue in Q3 2025, up 5 percent sequentially and flat year-over-year, as demand from cloud and enterprise customers continued to strengthen. Operating income of the unit was $1 billion, whereas operating margin increased to 23.4%, the highest result DCAI posted in many quarters.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel's DCAI growth was driven by AI infrastructure refreshes as well as expanding deployments of Xeon 6 'Granite Rapids' processors, which improved the company's product mix and ASP. Due to a shortage of production capacity, Intel shifted some of its capacity reserved for client CPUs to data center processors, which improved the company's results. In addition, the company's management managed discussions about multi-year supply agreements with hyperscalers and other large data center customers.

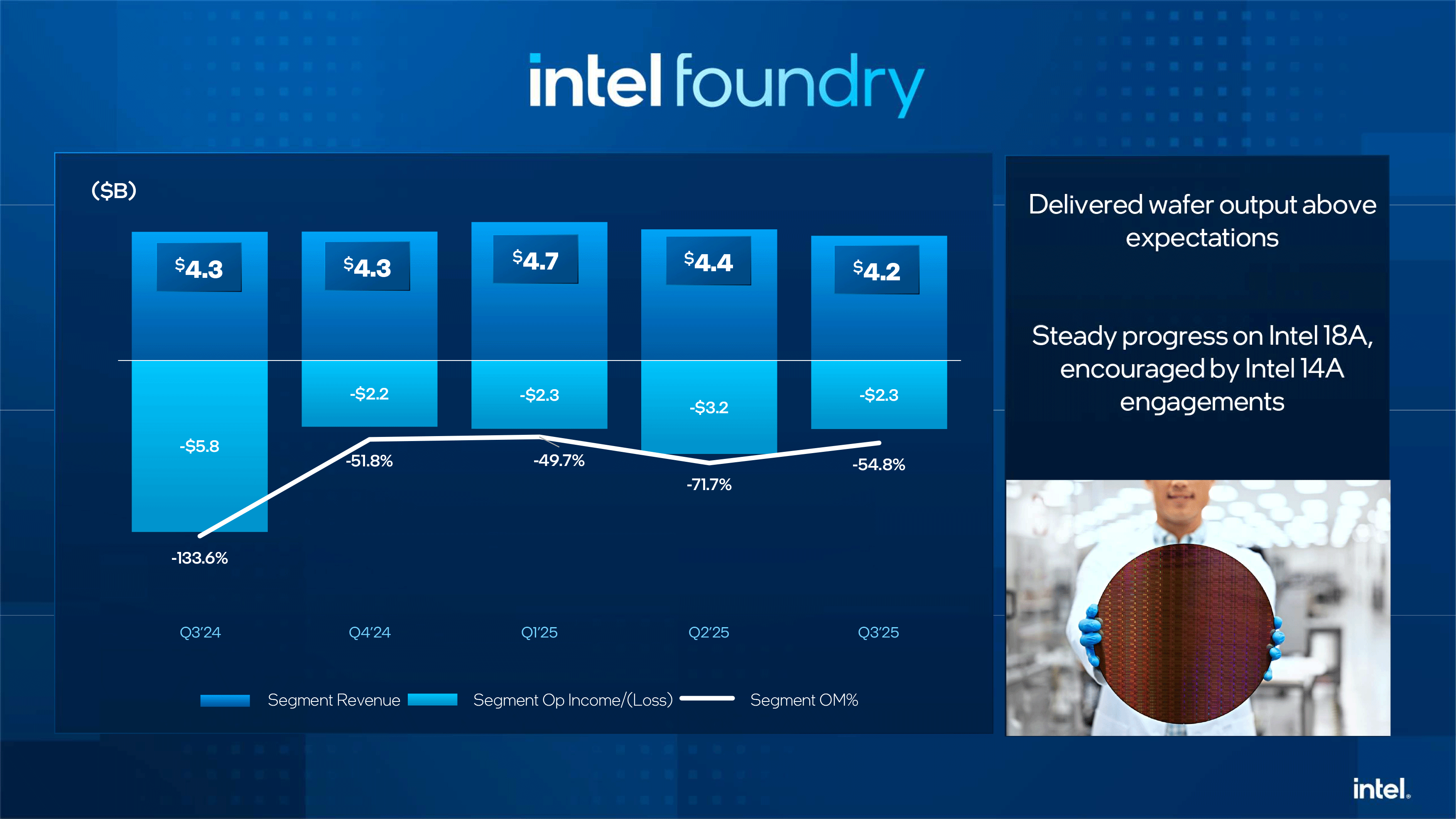

As for the Intel Foundry business, it generated $4.2 billion in revenue in Q3 2025, down $200 million QoQ and $100 million YoY. However, Intel managed to shrink losses to $2.3 billion, which may be considered a good result as the company continued to absorb startup costs for Intel 18A initial ramp amid lower-than-comfortable yields.

"Our stronger-than-expected Q3 results mark our fourth consecutive quarter of improved execution and reflect the underlying strength of our core markets," said Zinsner. "Current demand is outpacing supply, a trend we expect will persist into 2026."

Q4 outlook

For Q4 2025, Intel guided for revenue between $12.8 billion and 13.8 billion, which reflects seasonality and possible limitations incurred by shortages of production capacity. Intel's management indicated that DCAI revenue should rise modestly as shipments of data center CPUs will be prioritized, while sales of the Client Computing Group will decline, as usually happens in the fourth quarter.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Jimbojan Intel performance has not changed, the only changes is to reduce cost and cutting man power. yet the stock went up double, go figure.Reply