Intel Completes Mobileye Purchase Offer, Aims To Become Important Player In ADAS Market

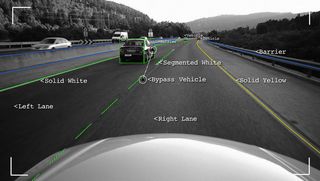

Intel announced that it has completed its tender offer for the purchase of 84% of Mobileye's outstanding ordinary shares. Mobileye is an Israeli computer vision and machine learning company that makes advanced driver assistance systems (ADAS) and autonomous driving solutions for the automotive industry.

Intel's Mobileye Acquisition

Mobileye is perhaps best known as the ADAS provider for Tesla Autopilot 1.0 (Autopilot 2.0 uses Nvidia’s Drive PX 2 solution). However, its customer list also includes BMW, General Motors, and Volvo.

Intel announced the $15.3 billion acquisition earlier this year, and now the two companies are ready to start developing the next-generation solutions together.

“With Mobileye, Intel emerges as a leader in creating the technology foundation that the automotive industry needs for an autonomous future,” said Intel CEO Brian Krzanich in a press release.“It’s an exciting engineering challenge and a huge growth opportunity for Intel. Even more exciting is the potential for autonomous cars to transform industries, improve society and save millions of lives," he added.

Intel will combine its own Automated Driving Group (ADG) with Mobileye, but Mobileye will remain headquartered in Israel and led by Prof. Amnon Shashua, a Mobileye co-founder, who will also become an Intel senior vice president as well as Mobileye's CEO and chief technology officer. Ziv Aviram, another Mobileye co-founder who served as the company’s president and CEO, is retiring from the company effective immediately.

“Leading in autonomous driving technology requires a combination of innovative proprietary software products and versatile open-system hardware platforms that enable customers and partners to customize solutions,” said Prof. Amnon Shashua. “For the first time, the auto industry has a single partner with deep expertise and a cultural legacy in both areas. Mobileye is very excited to begin this new chapter," he noted.

Intel's Struggles In New Markets

Intel has been dominant in the PC industry for decades, but it has struggled to enter other markets. In recent times, the company failed to become relevant in the mobile chip market, and it’s still struggling to remain in the mobile modem business through a (presumably quite lucrative) contract with Apple. However, according to Intel, Qualcomm is doing its best to stop the company from succeeding in this market, too.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Another market from which Intel seems to be backtracking now is the booming IoT industry, which also looks to be dominated by small ARM chips and microcontrollers.

Intel has already made serious efforts, as well as acquisitions, in the machine learning-optimized chip industry, but it remains to be seen if its Xeon Phi, FPGA, and other more customized machine learning-optimized chips can hinder Nvidia’s growth in the machine learning market. As this market seems to be dominated by GPU solutions such as Nvidia’s chips, AMD may also become a strong competitor in the not too distant future, even if right now it seems to be the furthest behind out of the three.

In the past few years, the automotive industry has become increasingly more interested in deploying ADAS on their cars. Intel believes this is a $70 billion market and that now is the right time to enter it via its Mobileye acquisition. However, Nvidia has already established itself as an important provider of ADAS and other machine learning solutions to Tesla, Volvo, and Volkswagen, so the ADAS market may not prove to be a walk in the park for Intel, either.

Future Outlook For ADAS Market

It will be interesting to see how this market will look in five or ten years. ABI Research's forecast shows a more than 10 fold growth in the ADAS market by 2026, compared to 2016. Several car companies, including BMW and Daimler, have promised Level 5 autonomy by 2021, and Tesla has said it may bring it even earlier than that.

Mobileye was there first, but Nvidia is making rapid gains in both machine learning and computer vision technology. The wildcard will be how effectively Intel manages Mobileye post-acquisition. We may also see some other ARM-based competitors emerge in this market in the next few years.

-

bit_user ReplyWe may also see some other ARM-based competitors emerge in this market in the next few years.

Nvidia's SoCs employ ARM-based CPU cores. Both stock ARM designs and their own custom cores.

And I doubt we'll see anyone using ARM's Mali GPUs, for this. In fact, with all the activity around machine learning ASICs, Nvidia might be the last to use a general-purpose GPU, here.

-

gdmaclew All this hype about ADAS is just speculation.Reply

You constantly hear reports in the news about how close we are to mainstream autonomous vehicles.

I think it's at least 10 years away. Governments and insurance companies are very wary of new technologies and governments are usually way behind when it comes to properly scoping out the issues with new technologies. Just look at all the distracting gadgets that have proliferated over the last decade and virtually no government regulations to address them.

-

bit_user Reply

Agreed, but assistants like lane-keeping, collision warning, and nighttime obstacle detection are becoming more common. Those still require much of the compute power of fully-autonomous driving.20043215 said:All this hype about ADAS is just speculation.

You constantly hear reports in the news about how close we are to mainstream autonomous vehicles.

I think it's at least 10 years away. -

gdmaclew Reply20044098 said:

Agreed, but assistants like lane-keeping, collision warning, and nighttime obstacle detection are becoming more common. Those still require much of the compute power of fully-autonomous driving.20043215 said:All this hype about ADAS is just speculation.

You constantly hear reports in the news about how close we are to mainstream autonomous vehicles.

I think it's at least 10 years away.

Very good point. Autonomous driving features are very powerful buying incentives and the city of Ottawa where I live is home to one of the companies right in the thick of it (Blackberry) with their QNX.

http://www.qnx.com/content/qnx/en/blackberry-qnx-autonomous-vehicle-innovation-centre.html

Most Popular