GPU sales skyrocketed 27% last quarter — tariff jitters sparked an odd gaming hardware spending surge in Q2 '25

Unfortunately, we live in interesting times, and the sales data reflects that.

The middle of the year is usually a sleepy season for PC hardware sales, and so summer quarter shipments tend to sag a bit as people hold off until holiday deals. Of course, 2025 has been anything but typical. Instead of the usual slowdown, the latest numbers from Jon Peddie Research (JPR) show a surprising surge in CPU and GPU shipments. The culprit? Fear of tariffs, according to the analyst.

With new U.S. import tariffs hanging over tech imports, PC makers and consumers alike went into buy-ahead mode. The result was a markedly unseasonal rush on gaming hardware that pulled demand forward, creating what could be called a "panic‑build quarter" in the client PC industry.

The numbers tell the story, as CPU shipments were up about 8% quarter‑over‑quarter and 13% year‑over‑year. Desktop CPUs increased their share versus laptops by 9% to grab 33% of the market share, a healthy bump in a segment that's been overshadowed by laptops in recent years.

Total GPU shipments jumped 8.4% from last quarter, up to 74.7 million units. Nvidia scooped up more share at the expense of AMD and Intel, likely due in part to the superior availability of its GPUs. However, Intel still sells more GPUs than either of the other two combined, thanks to its dominance in the laptop CPU market.

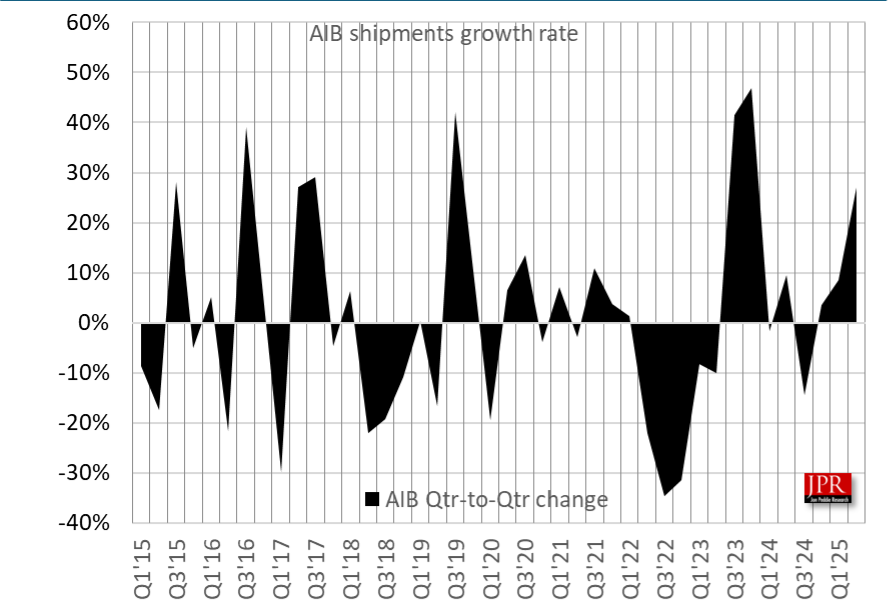

The standout statistic was discrete desktop graphics cards, or add-in boards (AIBs), up a wild 27% quarter‑to‑quarter and 22% year‑over‑year, due in part to impressive new hardware from all three vendors. Nvidia's grip tightened further, rising to 94% of the AIB market as we previously reported.

That's not normal for Q2. Usually, shipments drift lower before rebounding at year's end, but this time, tariffs flipped the script. Retailers and distributors didn't want to get caught flat-footed if regulations suddenly raised costs, and enthusiasts picked up on the same cues. Nobody wanted to be the one paying 15–25% more for a graphics card a few months later, so they bought early, clearing stock and pushing prices higher at the high end.

JPR calls this "buying ahead of tariffs," and it comes with a warning: demand that gets pulled forward can leave a hole later. Q3 and Q4 might look weaker because so many buyers have already opened their wallets.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

This wasn't just about economics, though; it was also about timing. Nvidia's new entry- and mid-range Blackwell cards, as well as AMD's new RDNA 4 GPUs, were filling shelves right as the tariff panic set in. Gamers who might have otherwise waited for the latest hardware to mature instead rushed to lock down fresh GPUs while they could.

Interestingly, Dr. Peddie notes that the midrange stayed relatively affordable as vendors leaned on it to keep shipments moving. Still, flagship GPUs saw rising prices and severe shortages, reflecting what we've seen with the GeForce RTX 5090, which is unobtanium (at least, at MSRP). The psychology is easy to trace: better to grab a new graphics card today than risk paying even more tomorrow.

Trump's tariffs didn't just bend economic charts; they bent gamer behavior. The 2025 mid-year surge appears more like panic buying than organic growth. Whether the past quarter turns out to be a quirky blip or the start of a volatile cycle will depend on how hard the comedown hits in Q3.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button!

Zak is a freelance contributor to Tom's Hardware with decades of PC benchmarking experience who has also written for HotHardware and The Tech Report. A modern-day Renaissance man, he may not be an expert on anything, but he knows just a little about nearly everything.

-

Co BIY Is the end of Windows 10 support driving hardware upgrades ?Reply

It's a factor in my decision to upgrade my very old and marginally functional desktop. -

Alvar "Miles" Udell I don't think it's so much "panic buying" as the fact that after the shortages and inflated prices of the RTX 3000 and 4000 series, the RTX 5000 series is available at reasonable prices, so the pent up demand is starting to be released. It also doesn't hurt that it seems more and more games are requiring "AI frame generation" and "AI upscaling" to make games playable at 66% of "4K" (or even lower in the case of a certain newly released game), a feature basically requiring a RTX 5000 series for.Reply

Of course you could probably also tie in other things like real wages increasing the better part of $1000 a year on average so people have more money to spend, a YOLO attitude given current world events, an increase in discressionary funds due to the switch from lower yield savings accounts to investment accounts combined with a switch to spending more on personal goods instead of experiences post COVID rebound, the last 2-3 generations of phones being very meh so there's no need to upgrade them, and probably a dozen other things, but it's just easy for JPR to say "tariffs" as the definitive cause.

I know for me it was the fact the 5070 was 100% faster than my old 2070 Super and available at the same price I paid for it 5 years ago, with the added bonuses of being more efficient, quieter, supporting more features, and being a 2 slot design so I could vertically mount it in my case compared to the 3 slot behemoth I couldn't before. It also helped that since the Galaxy S24 and S24 series were so meh compared to my S23 that the $20 or so I set aside every month for eventual big purchases could be used on it. -

Shiznizzle When i bought my new AMD 9060XT 16GB GPU in that mentioned quarter, the impending tariffs did not even enter my head.Reply

What did was that the initial mad spike in cost of the new tier of GPU's had peaked and was on its way down again. I let the market settle a bit. I watched as retailers all had tons of card in my range and were sitting on them for months. AMD did not have the supply chain issues that nvidia had. Shortly after they released their cards they were in stick everywhere.

Once prices settled, i pulled the trigger. I skipped two generations of GPU tiers so needed to replace my 3060 12gb