Kioxia and Western Digital Intensify Merger Talks: Report

Western Digital may acquire Kioxia, challenging Samsung in terms of NAND volumes.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Kioxia and Western Digital Corp are advancing their merger negotiations and finalizing the agreement specifics, according to a Reuters report citing two informed sources. The two companies are currently ranked as the world's second- and fourth-largest makers of NAND memory, according to TrendForce. So if Western Digital brings Kioxia into the fold, the combined company will become the largest supplier of flash memory.

If the two companies reach an agreement, 43% of the new entity will be owned by Kioxia, 37% will be owned by Western Digital, and the remaining 20% will be owned by existing owners, according to the report. It is noteworthy that Toshiba continues to hold a 40.6% stake in Kioxia, so it would still be a significant shareholder of the new entity.

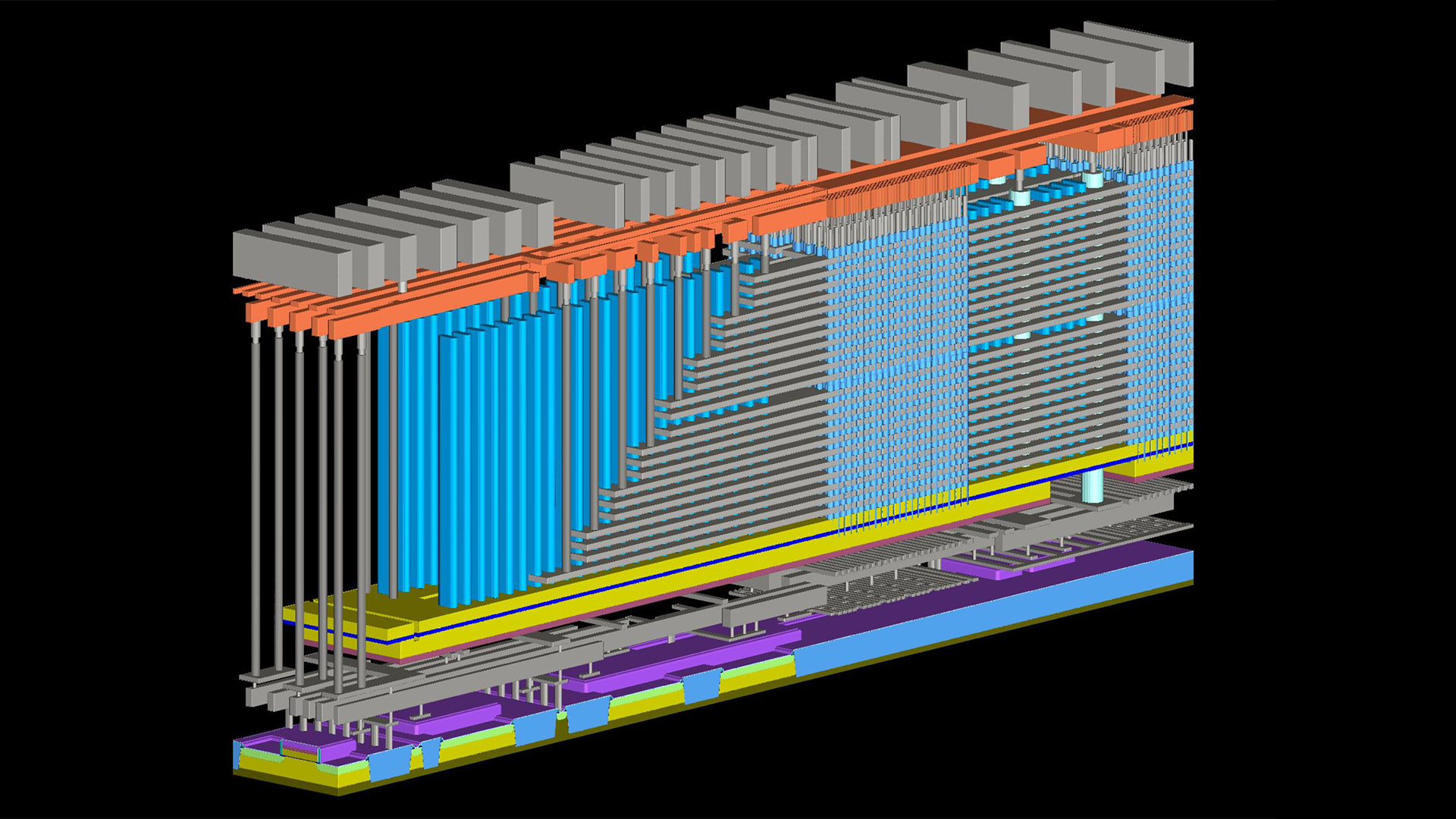

Although Kioxia and Western Digital jointly produce NAND memory, their business strategies are somewhat different. Kioxia is focused on selling memory, whereas Western Digital is focused on selling NAND-based products, including some of the best SSDs available today.

Kioxia, which was previously Toshiba Memory, was bought out from Toshiba Corp for $18 billion in 2018 by a consortium led by Bain Capital. In the face of the deteriorating flash-memory market, Kioxia has postponed plans for an initial public offering. Therefore, selling the unit to Western Digital, which co-develops process technologies and co-owns fabs with Kioxia, is a way for investors to get their money back amid a tough market due to falling NAND prices.

Previous attempts to merge Kioxia and Western Digital in 2021 fell through due to various issues, including differences in valuation. However, news of renewed merger discussions re-surfaced in January. Still, no decision has been made and the details could change, the report stresses.

Kioxia commanded a 19.1% NAND memory market share in Q4 2022, whereas Western Digital had a 16.1% market share, according to TrendForce. Samsung, meanwhile, shipped 33.8% of the NAND memory sold in Q4. Therefore, a company that combines Kioxia's and Western Digital's flash businesses would be the world's largest supplier of NAND, ahead of Samsung and SK hynix.

Some analysts questioned by Reuters also think that Kioxia and Western Digital may be more exposed to fluctuations in the NAND flash market, compared to South Korea-based makers, Samsung and SK hynix.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

cyrusfox Reply

They are already a partnership, its more of a consolidation than a purchase. The biggest issues to prevent deal closure would come from inside, not regulators. Very different than your Microsoft/Activision acquisition.hotaru251 said:Wonder if it will go throguh as a lot of large tech deals don't anymore.