Amazon unveils Starlink rival capable of up to 1 Gbps satellite internet — Leo Ultra is an enterprise-grade terminal with 400 Mbps upload speeds

Amazon’s rebranded satellite internet service launches the Leo Ultra phased‑array antenna and begins enterprise preview ahead of 2026 rollout.

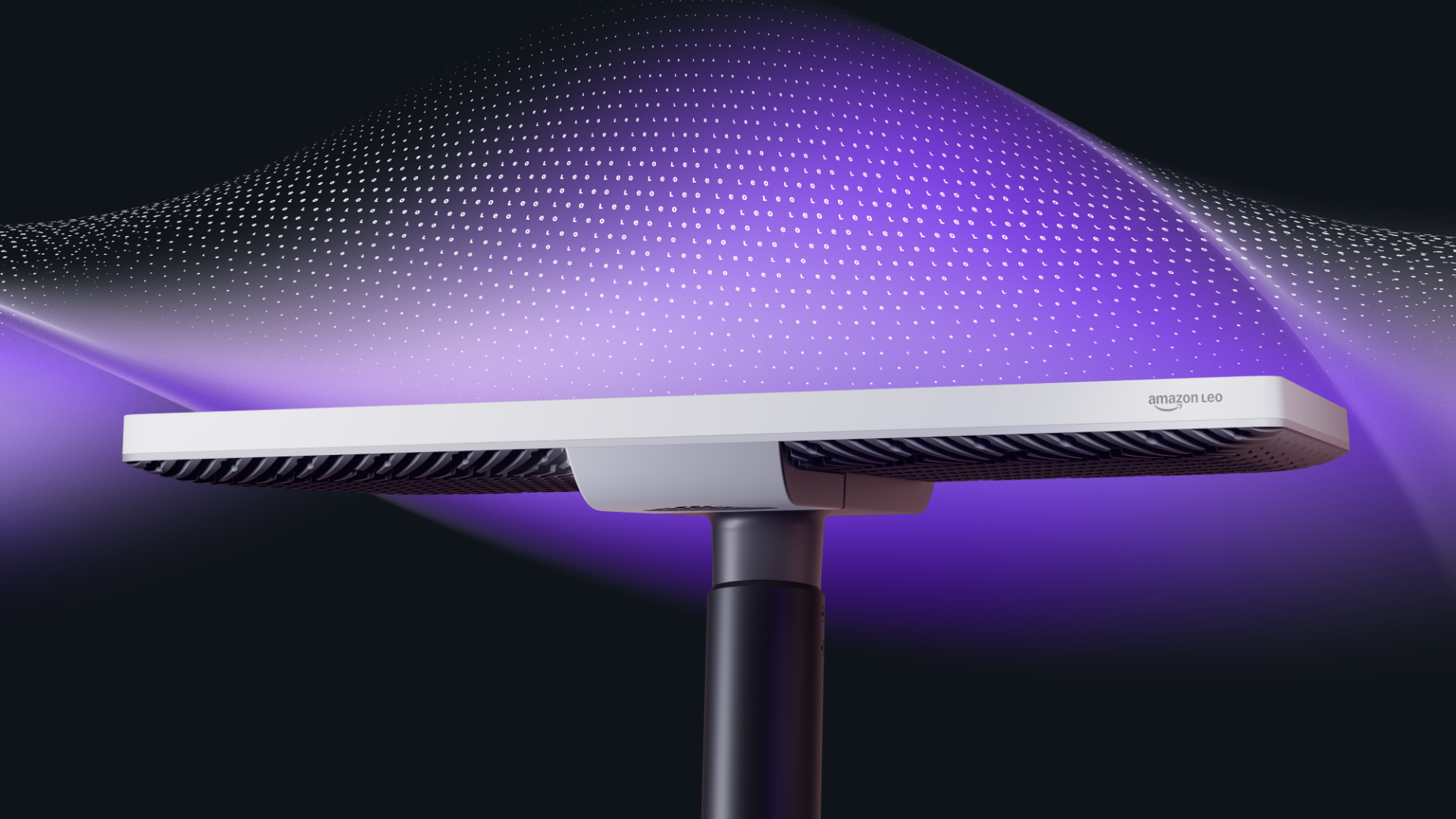

Amazon has unveiled Leo Ultra, a high-throughput phased-array terminal for its upcoming satellite internet service, now rebranded from Project Kuiper to Amazon Leo. The device is part of an enterprise-grade hardware lineup that will support initial customer deployments beginning in 2025, with broader availability scheduled for 2026.

The Ultra terminal is Amazon’s largest and fastest offering to date, designed for permanent installation at fixed sites. It measures roughly 20 by 30 inches with a chassis depth of 1.9 inches and is intended for pole-mounted outdoor use. Internally, the device incorporates Amazon silicon and a full-duplex phased-array system capable of simultaneous uplink and downlink, supporting download speeds of up to 1 Gbps and upload speeds of up to 400 Mbps.

NEWS: Amazon has unveiled its Starlink terminal competitor called Amazon Leo Ultra.• 1 Gbps download and 400 Mbps upload speeds • Full-duplex phased array technology• Amazon Leo silicon• Weatherproof• Integrated heat sink• 20" x 30" x 1.9"• Pole mount installation… pic.twitter.com/CaNgOZUntTNovember 24, 2025

Leo Ultra was one of three customer terminals shown as part of the new network push. Alongside it, Amazon previewed a mid-sized Leo Pro terminal designed for portable or vehicle-mounted use, and a compact 7-inch square Leo Nano unit rated for up to 100 Mbps. All three run on custom silicon developed by Amazon’s device teams and share the same core waveform and protocol stack.

The new hardware arrives as Amazon begins rolling out its constellation. As of November 2025, the company has launched more than 150 low-Earth orbit satellites under Project Kuiper, with multiple mass deployment launches completed since April. The company plans to launch several thousand satellites in total to meet its global coverage targets, and CEO Jeff Bezos has stated ambitions to begin deploying space-based data centers in the next 10 to 20 years.

Amazon is positioning the network as a hybrid connectivity layer that ties directly into AWS infrastructure. The Leo architecture includes support for “Direct to AWS” (D2A) links that route satellite traffic straight into cloud workloads without passing through the public internet. The company has not yet disclosed pricing details for the Leo terminals and service plans, but it is thought that the company intends to begin commercial service with select enterprise partners, followed by general availability next year.

Amazon’s entry into the satellite internet market arrives as rivals, including SpaceX’s Starlink, continue to expand their own constellations and service offerings. With gigabit-class performance and integrated cloud hooks, Leo Ultra represents Amazon’s first full hardware and network package aimed at the high-end segment of the market.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.

-

jp7189 Competition is good. Let's hope the initial offering has decent reliability. Thought admittedly, I'm having a hard time imagining how 150 sattelites with "thousands" planned will compete with starlink's 9000 deployed with thousands added every year. The direct link to AWS workloads is a nice touch and would be attractive to the right corporate user.Reply -

gggplaya Blue Origin is still kind of a joke compared to SpaceX. SpaceX's launch cadence is also insane at like 2-3 launches per month. I'm not sure how Amazon Leo will be able to compete, especially that SpaceX's super heavy is nearly ready which can launch their huge V3 sats.Reply

I'm all for competition and I hope Bezos has some secret ace up his sleeve. But as it is, I'm not seeing how this will compete and sustain itself. -

edzieba Reply

Per week (and closer to 4-5 per week now) and now about 15 per month.gggplaya said:SpaceX's launch cadence is also insane at like 2-3 launches per month.

Kuiper have a literal stack of Atlas V cores from contracted launches waiting payloads (stacked some in Decatur and some at the 'Cape), contracted launches on Vulcan awaiting payloads, Falcon 9 launches awaiting payloads, and contracted launches on Ariane 6 (though delays are on Arianespace, there). The limiting Factor in Kuiper deployment rate is not BO, but satellite manufacture. -

hotaru251 WHile starlink (and the like) is fine as helps those in rermote areas...these shouldnt be used in places of other options as the more people using them the slower the speeds so if everyone in a city uses one you gettign crap speed and betetr off using a normal provider.Reply -

gggplaya Replyedzieba said:Per week (and closer to 4-5 per week now) and now about 15 per month.

Kuiper have a literal stack of Atlas V cores from contracted launches waiting payloads (stacked some in Decatur and some at the 'Cape), contracted launches on Vulcan awaiting payloads, Falcon 9 launches awaiting payloads, and contracted launches on Ariane 6 (though delays are on Arianespace, there). The limiting Factor in Kuiper deployment rate is not BO, but satellite manufacture.

Only the SpaceX Falcon is reusable. So those launches must be very expensive. I don't see how they can be competitive with Starlink, considering each satellite is only designed to last 7 years. Meaning, you need to recoup the cost of the launch and satelite within a 7 year period just to break even. As well as the running costs of operators and ground stations.

SpaceX can at least launch Starlinks at cost, as well as launch starlinks as part of other activities when there's extra room from other payloads. -

DS426 Competition is gooooood. If someone can compete with Starlink, it's Amazon, even if they are behind. They have a unique market niche with Direct-to-AWS, and more broadly, Leo is enterprise-focused, not consumer. I think some previous commenters missed that context. Plus, big cities benefit from fat fiber trunks and fiber-to-the-premise, so those subscribers get higher speeds at a lower cost or the same speeds at a lower cost than satellite-based internet.Reply

Satellite in the enterprise can be great for management control planes rather than data planes -- things like out-of-band (OOB) management and backup internet. Control that isn't latency- and jitter-sensitive, of course. Roaming is obviously for handy for some as well, though the units in this article are intended to be fixed-position. -

Vanderlindemedia And does AWS have DC's in area's where normally bad to no internet reception is?Reply

It would beat the purpose; other then a marketing stunt offering up to a gigabit link, which is still highly dependent on air quality, sight and such. On top of that sending in all those satellites must have a collision sooner or later. -

das_stig and who's jurisdiction does Leo fall under if you problems, space by treaty is neutral. if a customer in UK loses connection and millions of £, is this decided under UK law or US law or international law, as I can't see companies being too happy of being bound to friendly and bias US Texas law?Reply -

John musbach Reply

How are all these satellites going to fit up there? Nobody's concerned about congestion amd satellite collisions?gggplaya said:Blue Origin is still kind of a joke compared to SpaceX. SpaceX's launch cadence is also insane at like 2-3 launches per month. I'm not sure how Amazon Leo will be able to compete, especially that SpaceX's super heavy is nearly ready which can launch their huge V3 sats.

I'm all for competition and I hope Bezos has some secret ace up his sleeve. But as it is, I'm not seeing how this will compete and sustain itself.