SanDisk stock price jumps by 1,500% in almost a year — growth fueled by strong demand from AI data centers and enterprise clients, consumer revenue also up by 52%

SanDisk is making bank from the massive storage demand driven by the AI infrastructure build out.

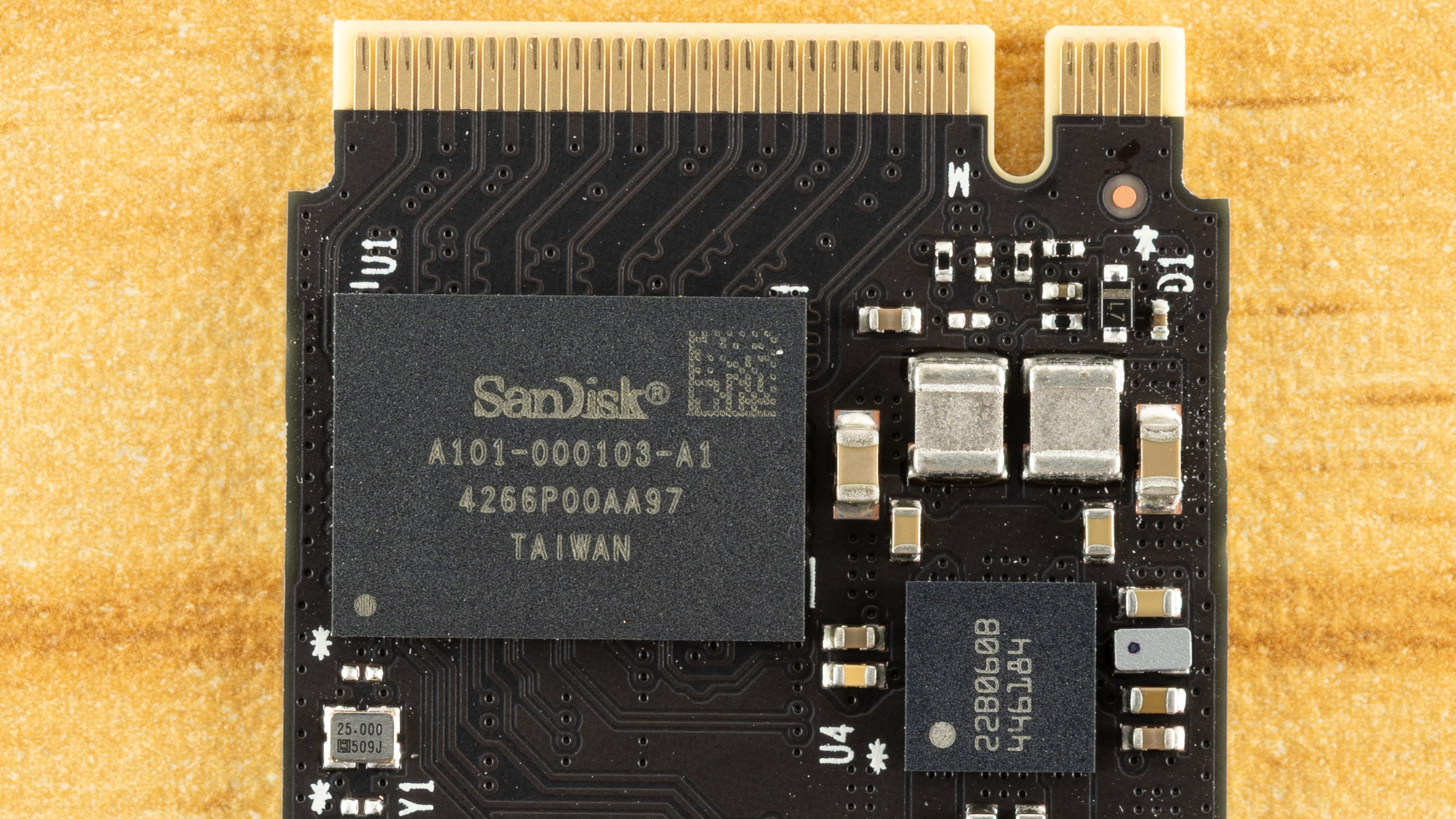

SanDisk’s stock price hit an all-time high of $650 per share at market open today, but has since dropped to $587.96. Despite that, it’s still an increase of over 1,500% from last year, when its stock was priced at $36 per share. This massive surge is driven by record-breaking profits for the company, which rose 7.7x year over year to $803 million, as reported by Digitimes. The company also noted in its January 29 earnings release that it will extend its joint venture with Japanese flash memory and SSD manufacturer Kioxia, as the two companies prepare to launch their next-generation 3D NAND in 2026.

This growth is primarily driven by the ongoing AI buildout, with revenue from AI data centers, hyperscalers, and semi-custom customers growing by 76%. Aside from that, revenue from industrial and automotive customers increased by 63%, while revenue from the consumer market grew by 52%. “This quarter’s performance underscores our agility in capitalizing on better product mix,” SanDisk CEO David Goeckeler said. “All at a time when the critical role that our products play in powering AI and the world’s technology is being recognized.”

Memory chips have made headlines as their prices have skyrocketed globally, but NAND is expected to follow close behind as AI tech companies pour money into infrastructure and siphon the world’s supply of memory and storage. In fact, a Kingston rep warned late last year that you shouldn’t wait if you need to upgrade your RAM or SSD, as “prices will continue to go up.”

SanDisk is one good example of this, as the company is set to double the price of its 3D NAND enterprise SSDs in the first quarter of this year. It’s unclear whether this move will also affect the 3D NAND used in consumer products, but they’re typically manufactured in the same fabs that produce these enterprise-grade chips. But as AI companies continue to build more advanced models, the ever-increasing training and inference workload will only increase demand for NAND chips, helping SanDisk increase its revenue even further.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Jowi Morales is a tech enthusiast with years of experience working in the industry. He’s been writing with several tech publications since 2021, where he’s been interested in tech hardware and consumer electronics.