SoftBank pauses $50bn AI data center operator acquisition talks — move plunges Stargate data center plans into uncertainty as regulatory roadblocks pose significant challenge

Masayoshi Son’s ambitions for direct control of U.S. AI infrastructure hit financial and regulatory roadblocks.

SoftBank has paused talks to acquire U.S. data center operator Switch, stepping back from what would have been one of its largest deals to date, and a core pillar of founder and CEO Masayoshi Son’s plans to build out OpenAI’s Stargate project. A report claims that Son had pursued a full takeover for several months, only to concede in early January that an outright acquisition was no longer viable.

OpenAI’s $500 billion Stargate project is being funded by OpenAI, SoftBank, Oracle, and Abu Dhabi-backed MGX, among others. It’s an ambitious effort to grow U.S. AI infrastructure to 10 gigawatts by 2029, with sites in Texas, New Mexico, Wisconsin, and Michigan.

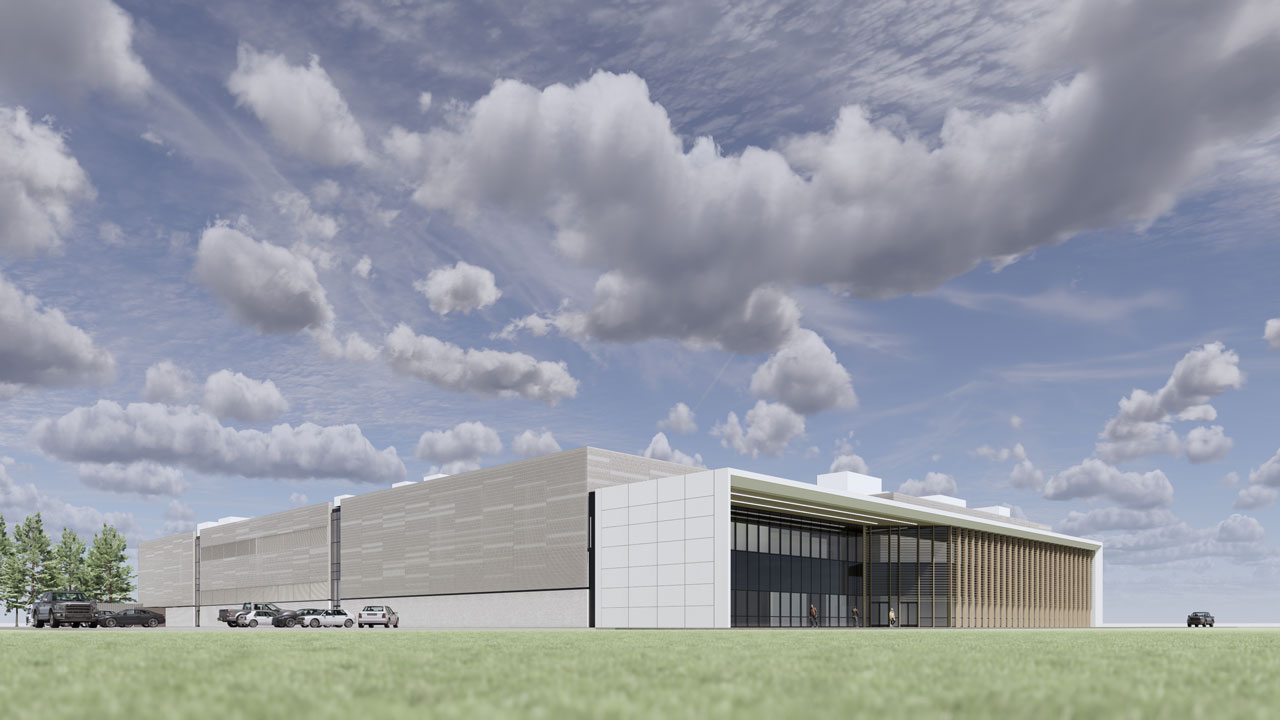

Control of physical infrastructure, not just chips or models, is — or was meant to be — a defining feature of the project. Switch, with its network of large-scale, energy-efficient campuses across the United States, would have played a major role in achieving these goals under SoftBank’s control, as the full report by Bloomberg notes.

Owning the physical layer

Stargate’s ambitions aren’t limited to just adding a few more servers here or there. The project is a major buildout of up to 10 gigawatts of AI capacity stretching all across the United States. At that scale, potential limiting factors will not just be access to capital — Trump has recently called for tech companies to “pay their own way” — or GPUs, but the ability to secure land, grid connections, and cooling systems that can support extremely dense AI racks.

Switch has built its facilities around solving those challenges, with campuses designed for large, contiguous deployments and an emphasis on power efficiency and the ability to support high per-cabinet power draw. An acquisition of Switch by SoftBank would have provided valuable vertical integration at a time when AI companies and hyperscalers are competing for scarce capacity and grappling with long lead times

Bloomberg Intelligence analysts Kirk Boodry and Chris Muckenstrum noted that ending talks on a full acquisition leaves SoftBank’s data center plans “in limbo, as Stargate announcements remain few and far between.” A minority investment or partnership would provide some exposure to the sector, but it would also fall short of the overall control SoftBank has sought in other areas, such as semiconductors and robotics. Without that level of control, the Stargate project becomes more dependent on third-party operators, and there’s less ability for SoftBank to exercise full control over factors like power allocation.

The chips are stacked against Softbank

Several factors appear to have weighed against a full acquisition by SoftBank. The first and most obvious is the sheer scale of it. With a reported valuation of around $50 billion, it would have made Switch one of SoftBank’s largest ever purchases. Some within SoftBank were, according to unnamed sources, “wary” not only about the price, but also about the operational complexity of running dispersed data center campuses.

Regulatory scrutiny was another factor because any takeover of a major U.S. data center operator by a foreign-owned entity would undoubtedly attract serious attention from regulators, particularly given the strategic importance and sensitivity of AI infrastructure to the United States. Even if the deal passed review by the Committee on Foreign Investment — and that’s a big if — it’s entirely feasible that such a review would have delayed or significantly reshaped the deal. All the while, Switch itself is preparing for an IPO as soon as this year, and its backers have discussed valuations of roughly $60 billion.

SoftBank has doubled down on AI investments over the past year, buying an 11% stake in OpenAI and committing tens of billions in fresh capital. It agreed to buy CPU designer Ampere for $6.5 billion and announced a $5.4 billion acquisition of ABB’s robotics unit. To fund this, SoftBank sold its T-Mobile US stake, exited its entire position in Nvidia, and expanded margin loans backed by its shares in Arm. Earlier this month, S&P Global warned that this combination of aggressive AI spending and a sharp decline in Arm’s share price was increasing pressure on SoftBank’s credit profile.

Partnerships over ownership

In late December, SoftBank completed a $4 billion deal to buy DigitalBridge, a New York-based investment firm that is a major backer of Switch. This deal, then, gives SoftBank that all-important albeit indirect access to data center assets without taking on full operational responsibility; SoftBank’s position allows the company to co-invest and align infrastructure development with the needs of its AI portfolio companies.

This is obviously a more asset-lite approach to infrastructure, but SoftBank has relied on similar structures before. The group owns an Ohio manufacturing facility operated by Foxconn under a partnership model. Applying that template to data centers will help to reduce regulatory and balance sheet risks, even if it ultimately limits SoftBank’s control.

Given all these factors, it’s unlikely that SoftBank and Switch will re-enter talks about a full acquisition, at least in the near future. However, it’s not completely off the table: Son himself has said that he eyed up Arm for several years before acquiring the company in 2016, only to return it to public markets via an IPO in 2023. In the near term, Stargate’s eventual buildout looks like it will have to rely on third-party partnerships to bring capacity online on schedule.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.