JPR Reports GPU Shipments Show Major Quarterly Drop

Beating the 10-year average of 5.2% sequential Q3 volume decline.

The latest report from industry analyst Jon Peddie Research paints continued growth for the PC-based GPU (Graphics Processing Unit) market. That growth comes in spite of strong historic seasonality impact on Q3 shipments, not to mention the still ongoing logistics and supply issues currently plaguing the tech sector — it's nearly impossible to find any of the best graphics cards at a reasonable price right now.

According to the report, GPU shipments reached 101 million units in Q3'21, marking a 12% year over year (YoY) increase. Despite that increase, and following historic trends, sequential quarterly GPU shipments took a dive in Q3, dropping 18.2% compared to Q2.

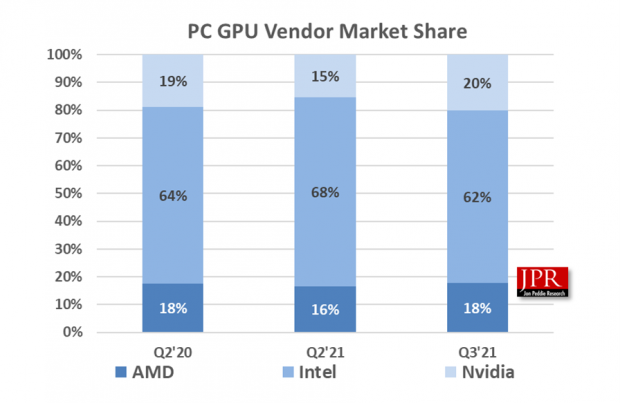

One interesting tidbit from the report is that AMD managed to increase its market share percentage from last quarter by 1.4%, while Intel's market share decreased by 6.2%, and Nvidia's market share increased 4.86%. That's a bit surprising, considering the difficulty of buying a dedicated graphics card.

Seasonality still weighs heavily on quarterly volumes, but even seasonality has been thrown off by the pandemic. The average slippage for Q3 in the last ten years stands at -5.2% compared to Q2 volumes, a far cry from the -18.2% seen this quarter. But how did this reduction translate across GPU manufacturers AMD, Intel and Nvidia?

When looking at general GPU attach rates (which includes integrated and discrete GPUs, desktops, notebooks, and workstations), AMD saw a volume decline for Q3 to the tune of -11.4%. Intel, the biggest purveyor of GPU solutions due to its integrated GPUs, saw the biggest losses, with shipments for Q3 decreasing by 25.6%. (Note that some of this was likely due to consumers and companies waiting for Intel's Alder Lake to launch.) Only Nvidia grew in the general GPU attach rate market, increasing its shipments by 8.0%.

Discrete GPU attach rates, on the other hand, are only fought over by AMD and Nvidia — at least until Intel launches its Arc Alchemist line-up of discrete graphics cards. If Intel had introduced its graphics products this quarter, the company would have to contend with an 83% market share for Nvidia, with the remaining 17% going to AMD. Market share between both companies stayed the same sequentially (compared to Q2); however, YoY results paint a shrinking AMD. Compared to Q3 2020, Nvidia increased its market share by 3%, at the cost of the only other player in this high-performance space.

The industry is still reeling, and will continue reeling, from the unavoidably severe impact of a global tech demand surge unlike anything the world has ever seen before. Jon Peddie, President of JPR, noted, “Covid continues to unbalance the fragile supply chain that relied too heavily upon a just-in-time strategy. We don’t expect to see a stabilized supply chain until the end of 2022. In the meantime, there will be some surprises.”

Supply chains, margins, demand projections, lead times — all of these elements and more are focused on maximising efficiency and profit while reducing the (costly) waste of either products or inventory space going unmoved for very long. The impact of COVID-19 throughout the industry is nothing less than that of a Black Swan: a highly improbable event with a disproportionately high impact. That will continue throughout the next year, according to Jon Peddie, which is a sentiment we've heard echoed from AMD, Intel, and Nvidia.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.