AMD Posts All-Time High $3.85 Billion in Quarterly Sales

AMD sets quarterly revenue record, double last year's earnings.

AMD this week posted its all-time-high quarterly revenue of $3.85 billion. The company's sales in Q2 2021 were up 99% compared to the same period a year ago due to extraordinary demand for the company's Epyc processors for servers, Ryzen processors for client PCs, Radeon GPUs, and semi-custom system-on-chips (SoCs) for game consoles.

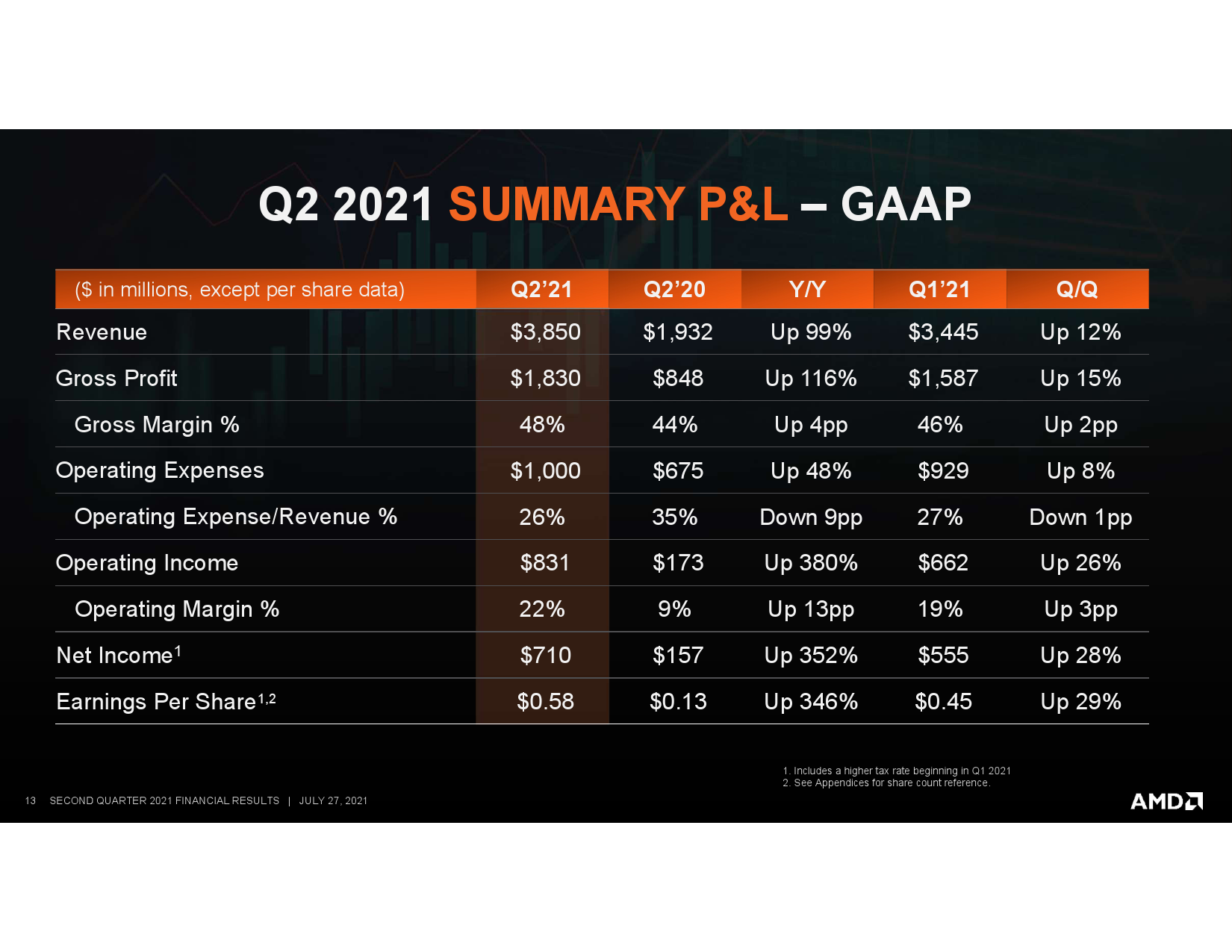

AMD's revenue has been growing steadily since the company introduced its Ryzen and Epyc processors in 2017 and started to win server designs with major customers in 2018. Along with revenue, AMD's profitability is also growing. For the second quarter 2021, the company posted $710 million in net income (an increase of 352% year-over-year), 48% gross margin, and $0.58 earnings per share. Cash from operations was $952 million, up $888 million in the previous quarter and $243 million a year ago. Cash, cash equivalents and short-term investments were $3.79 billion at the end of the quarter.

Client Segment

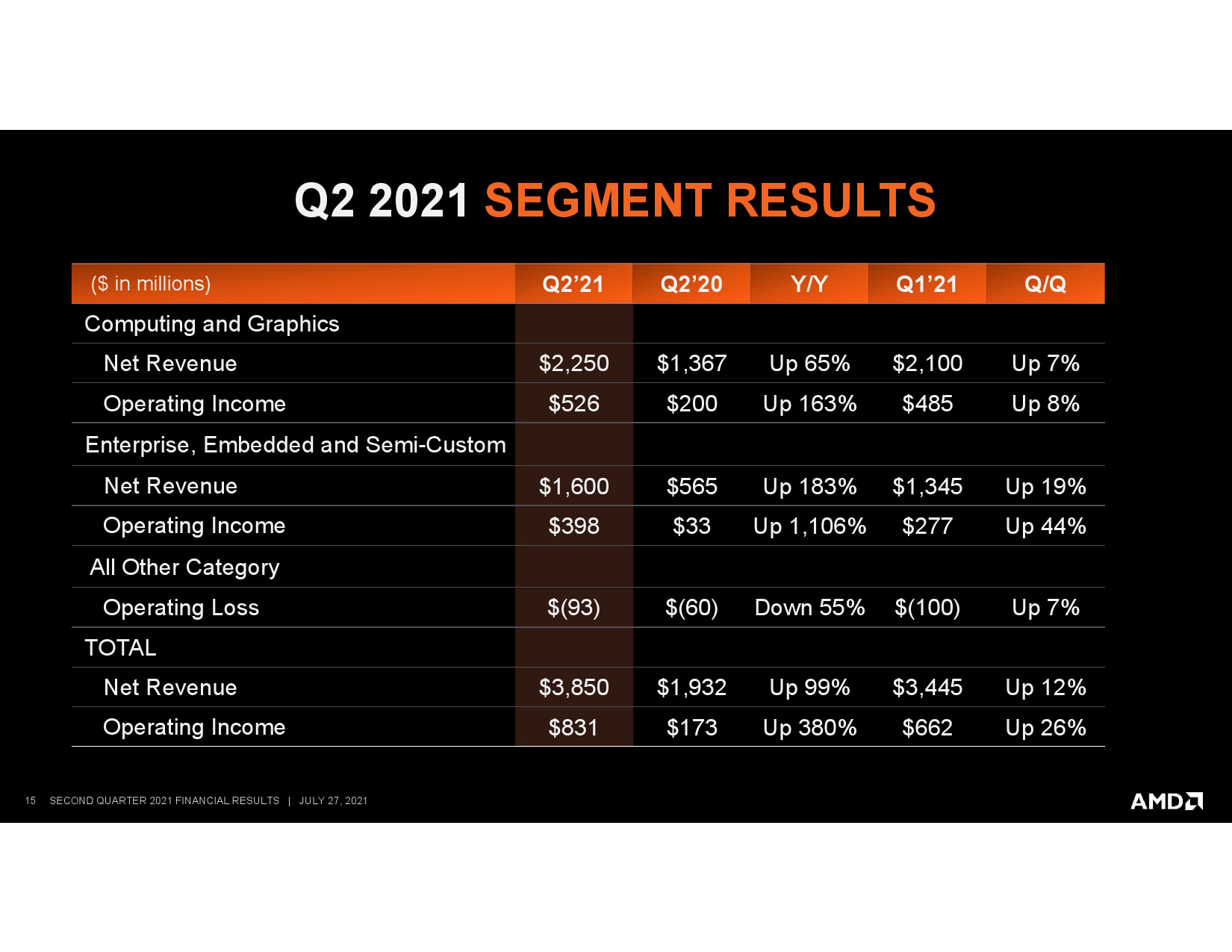

CPUs and GPUs for client PCs remain AMD's bread and butter. The company's Computing and Graphics business unit earned $2.25 billion, up 65% year-over-year (YoY) and 7% quarter-over-quarter (QoQ). Operating income of the unit was $526 million, up from $200 million in the same period last year.

Demand for AMD's client Ryzen 4000 and 5000-series processors based on the Zen 2 and Zen 3 microarchitectures remains very high, and AMD can barely meet it (or rather cannot, since many SKUs are not available). Since AMD prioritizes production of higher-end processors that sell at premium prices, average selling price (ASP) of the company's CPUs increases, which is part of why the company set records for revenue and profits this past quarter.

Demand for AMD's Radeon RX 6000-series graphics cards is also very high and the company says that its GPU ASP grew year-over-year and quarter-over-quarter, driven by sales of Radeon RX 6700/6800/6900 graphics cards as well as Instinct GPUs for datacenters. Unfortunately, the company says nothing about unit shipments of its GPUs. Like Nvidia's RTX 30-series GPUs, all of AMD's RX 6000-series cards generally remain sold out (at least in the U.S.)

Server and Semi-Custom Segment

AMD's Enterprise, Embedded, and Semi-Custom business unit posted revenues of $1.60 billion for Q2 2021, which was up massive 183% YoY, and a 19% growth QoQ. Operating income of the segment was $398 million compared to $277 million in the prior quarter and $33 million a year ago.

AMD says that its EESC unit's sales increases were driven by persistently high demand for the company's Epyc processors for servers, as well as SoCs for game consoles. Epyc CPUs now probably command a larger share of EESC's revenue given their very high ASP and higher volumes, now that they have won multiple contracts with exascalers, enterprises, and leading server makers. At the same time, Sony has recently reported sales of over 10 million PlayStation 5 consoles.

Outlook

Traditionally, revenues of semiconductor companies peak in the third quarter as manufacturers of virtually all types of computers and equipment buy loads of chips ahead of back-to-school and holiday seasons. In AMD's case, it means increased demand for its Ryzen CPUs from PC makers, Epyc processors from server manufacturers, console SoCs from Microsoft and Sony, as well as Radeon GPUs from the channel.

The company now expects it will set another record quarter, with revenue set to hit $4.1 billion ± $100 million, an increase of approximately 46% annually and approximately 6% sequentially.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

waltc3 Lisa Su and Papermaster at the top directing things, while thousands of dedicated AMD engineers and employees make it all happen! Good for AMD. AMD is a company honed in the fires of stiff competition while Intel is a traditional monopolist in terms of the difference between the two companies internally. That's exactly why AMD can run rungs around Intel with a scant fraction of the resources.Reply -

alceryes What AMD needs to NOT do right now is get greedy or complacent!Reply

Release some more advanced streaming functions for their GPUs. Throw some of this extra money into improving FidelityFX so that's it competes with DLSS across the spectrum (performance gain and quality).

Unreal Engine 5's move towards 'lumens' instead of traditional RTX hardware is a nice gift to AMD but AMD still need LOTS of work in the RT arena to compete with NVIDIA RTX.

Keep prices low and savagely improve on where AMD is lacking compared to NVIDIA - that's what AMD needs to do! -

sizzling Well done AMD. They seemed to have played a brilliant long game. They seem to have had a strategy 5+ years ago and instead of looking for a quick fix have invested in a longer term solution. I wish other companies had such vision and commitment to their strategies. It seem like a lot of companies change their long term strategy every few years for quick wins which doesn’t build a strong foundation.Reply -

JoBalz Bask in the good news tonight, then tomorrow hit the floor running. Intel may be behind at the moment, but they've come from behind in the past. Plow a significant portion of those new earnings back into R&D. Zen 4 needs to be able to run rings around whatever Intel releases in the next year.Reply -

TerryLaze Reply

It's not like AMD has any choice in that, they don't have the money nor the people nor the facilities to change anything, they have to choose a design and roll with it until its conclusion, sometimes they have good luck and they get athlon64 or zen other times we get 5 years of FX-hell where AMD just can't do anything about it because they lack everything they would need to change things.sizzling said:Well done AMD. They seemed to have played a brilliant long game. They seem to have had a strategy 5+ years ago and instead of looking for a quick fix have invested in a longer term solution. I wish other companies had such vision and commitment to their strategies. It seem like a lot of companies change their long term strategy every few years for quick wins which doesn’t build a strong foundation. -

musapablo But now the they are getting everything that they need to chamge everything. EPYC customers are long term commitment customers due to the nature of their need for stability, i.e. they don't switch architectures just like that, e.g. like change direction/speed like with a cruiser, but they switch very slowly like an aircraft carrier.Reply -

TerryLaze Reply

They are getting everything they need...from 3rd parties.musapablo said:But now the they are getting everything that they need to chamge everything. EPYC customers are long term commitment customers due to the nature of their need for stability, i.e. they don't switch architectures just like that, e.g. like change direction/speed like with a cruiser, but they switch very slowly like an aircraft carrier.

At a very reduced amount compared to what they could be selling at least now during the time of very high demand.

Customers that want EPYC also want steadiness as you yourself said, those that only need something for now are getting EPYC those that want to upgrade in the future and want to stay with AMD are looking very very carefully on if AMD will be able to keep buying all the supplies that they need.

Even just lately when intel bought a small batch of wafers from tsmc there was already a lot of concern if that would mean less wafers for AMD. -

renz496 Reply

Keep price low? That's only customer wishful thinking. Looking at AMD current share price now they need to make share holders happy. They need to prove that the investor are doing the right thing putting money on the company to bring them even greater return in the future.alceryes said:What AMD needs to NOT do right now is get greedy or complacent!

Release some more advanced streaming functions for their GPUs. Throw some of this extra money into improving FidelityFX so that's it competes with DLSS across the spectrum (performance gain and quality).

Unreal Engine 5's move towards 'lumens' instead of traditional RTX hardware is a nice gift to AMD but AMD still need LOTS of work in the RT arena to compete with NVIDIA RTX.

Keep prices low and savagely improve on where AMD is lacking compared to NVIDIA - that's what AMD needs to do!