Nvidia Tegra Sales Soar, But The Chip's Future In The Mobile Market Is Uncertain

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

According to Nvidia's earnings report for "fiscal 2015" (essentially the year 2014), which ended on January 25, Nvidia saw returns that exceeded the expectations of Wall Street analysts. The company made $4.68 billion in revenue, which was a 13.4 increase year over year. Profit also soared by 43.4 percent year over year to $631 million.

Nvidia still made most of its money from PC GPUs, which represented 85.8 percent of its total revenues in the last quarter. The company's GPU sales grew by 10.7 percent last year to $3.84 billion. Gaming was a strong driver for Nvidia last year, and the company saw an increase of 38 percent for PC and notebook GPUs.

Although its Tegra chips brought only a little over half a billion dollars ($579 million) for the whole year, the company saw its mobile chip sales increase by 45.5 percent. Nvidia credited this sharp rise in sales mainly thanks to its SHIELD tablet and the high interest auto makers seem to have in the company's chips. (Nvidia's automotive chip sales doubled year over year.)

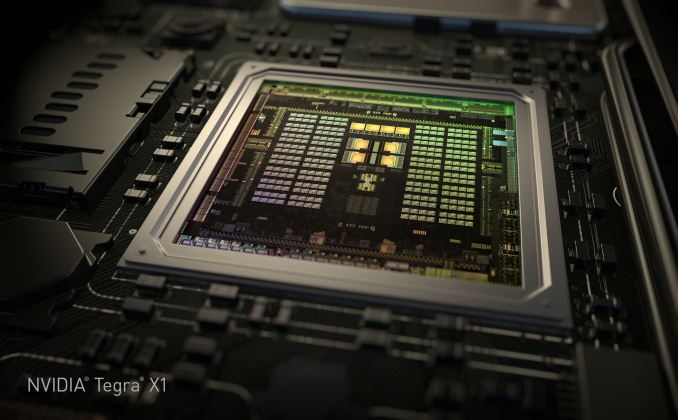

Earlier this year at CES, Nvidia unveiled the Tegra X1, which for now specifically addresses the automotive market. Nvidia believes its visual computing expertise is critical for self-driving cars, because the cars will need to "see" the environment around them and make sense of it in order to drive safely through it.

Nvidia, being one of the few companies that can make chips that are low-power enough yet still deliver incredible graphics performance, seems to have become a good partner for car makers that are ready to embrace the future by taking advantage of advanced mobile technology.

Although the Tegra sales saw significant growth, Nvidia is still considered a relatively minor player in the mobile market, and the company has been almost non-existent in the smartphone market for the past two years. Nvidia has chosen to focus more on high-performance chips and "winning" against other mobile chip competitors through raw performance, but at a major cost in power consumption.

Other chip makers such as Qualcomm and Mediatek have become so successful in the smartphone market because they have made low power consumption a bigger priority than absolute performance. The companies still compete in performance, but only after they've ensured a certain threshold of power consumption which they cannot exceed.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nvidia, on the other hand, is more concerned with winning in performance metrics at all costs. This has arguably been a strategic flaw for Nvidia that has kept it from gaining significant market share in the mobile market. With its newfound success in the automotive market, Nvidia's future in the smartphone and even the tablet market (which has been in decline lately) is uncertain, but we're looking forward to see what the company has prepared for the Mobile World Congress next month.

Follow us @tomshardware, on Facebook and on Google+.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

Reepca "Nvidia believes its visual computing expertise is critical for self-driving cars, because the cars will need to "see" the environment around them and make sense of it in order to drive safely through it."Reply

Speaking of visual computing... why hasn't NVIDIA joined the HSAFoundation yet? Open standards lead to wider adoption, and from what I can see Tegra could really benefit from HSA features.

Normally I could see them using proprietary tech (like GSync or CUDA), but in those cases they beat the open standard to the punch - whereas now, they're behind. -

vmem Sure, credit your Tegra ales to your own SHIELD... I am SURE the Nexus 9 carrying a Tegra chip have nothing to do with the chips selling wellReply -

tomfreak they need to get even more aggressive on pricing and may be the power usage. U need a huge advantages in everything so people would switch over.Reply -

ZolaIII Go with same X1 architecture to Samsung's 14nm finFET adjust the GPU clock & make reference smartphone (for sells as shield) with mid range price & you have it. Stupid pushing race with Apple & making SoCs with power consumption suitable only for larger tables won't do you any good. Recipe is simple enough! If you want seriously to go into mobile business consider buying Songs struggling mobile division (to fave world wide distribution wide & loved brand by both costumers & developer's) & that's it. Their are also other less expensive options but are not certain win wins. Option B start licensing GPU cores IP's. You have the only really good performing full GPU architecture with ironed out driver's on Linux (Android) but still you don't use this advantage.Reply -

bit_user I wonder to what extent the auto wins are about machine vision vs. in-car navigation, entertainment, and digital instrument cluster.Reply

If I were an auto maker, I would insist on standard APIs. I would flat-out refuse to use any vendor who required me to use a proprietary API. I believe avoiding vendor lock-in is the reason Apple pushed OpenCL, in the first place. I'm sure it was also a driving force behind HSA and other open standards.15282033 said:Speaking of visual computing... why hasn't NVIDIA joined the HSAFoundation yet? Open standards lead to wider adoption, and from what I can see Tegra could really benefit from HSA features.

-

somebodyspecial Reply15282331 said:Sure, credit your Tegra ales to your own SHIELD... I am SURE the Nexus 9 carrying a Tegra chip have nothing to do with the chips selling well

Apple's ipad sales are down 18%, and nexus 9 was not well received and had some problems. I don't think they are running off the shelves. Tablet sales are just down (due to phablets probably). So if you make a bad product, charge extra over last models, and you're in a down market, I'd expect it sold poorly. Shield is likely picking up as they add games, have been adding many software features etc and it was really AUTO that exploded as you can see from the Q report etc. They credited SHIELD (two devices, handheld and tablet) and AUTO. The bulk being AUTO. Unlike nexus 9 (which again had problems, find a "I loved it" review - good luck), Shield tablet and handheld (hope they X1 the handheld too!) are AIMED at gamers and with more and more ports are gaining steam I'd guess (now works with chromecasting too). The original nexus devices had great hardware, a great price and performance. I can't find the same reasons to buy a nexus 9. I don't think lollipop on it was that good either (that part may improve surely, I mean it's rev1 of 64bit so no surprise), but the whole thing (device too) seemed 2 months too early and needed polishing in many areas. No review I read made me WANT IT. Instead my thoughts were more like, I'll wait until they get it all fixed and patched up (hardware and OS). By that time, you're waiting for the next big release from someone else I think.

NV is likely telling the truth, the bulk is auto, some more from shield stuff and probably only a few million nexus 9's. Unfortunately google doesn't release sales figures for it, but NV should know.

When a Android leading website categorically says NO to nexus 9 for xmas wish list that says something right? They recommended Ipad Air 2...LOL:

http://www.androidpolice.com/2014/12/07/android-police-holiday-gift-guide-2014-stuff-want-newer/

"Yes, I am breaking the gift guide by putting this here. Why? Because as you'll notice, none of us recommended the Nexus 9"

They've struck that part now as one did recommend it, but they tell you to ignore that guy...LOL. Their review said it sucked basically too. I can't say exactly what is to blame. Is it aspect ratio (apps don't all scale properly etc), lollipop, hardware issues, Denver kinks etc...who knows. It just had a lot against it no matter how you slice it and a price hike too.

http://seekingalpha.com/article/2915726-nvidia-seeing-just-the-tip-of-the-iceberg-in-infotainment-solutions

7.5mil cars used tegra and they don't all use ONE either and it's a solution with software so revenue from here is larger than a mobile device. Just a point of ref. -

bit_user Reply

I'm having trouble parsing this sentence. Are you saying some cars use multiple tegra chips?15296382 said:7.5mil cars used tegra and they don't all use ONE either and it's a solution with software so revenue from here is larger than a mobile device. Just a point of ref.

And is anyone actually using tegra for image processing (e.g. lane-keeping, pedestrian detection, etc.)? Or is it all just in-car entertainment, dash board, and Nav?

-

somebodyspecial Reply15300336 said:

I'm having trouble parsing this sentence. Are you saying some cars use multiple tegra chips?15296382 said:7.5mil cars used tegra and they don't all use ONE either and it's a solution with software so revenue from here is larger than a mobile device. Just a point of ref.

And is anyone actually using tegra for image processing (e.g. lane-keeping, pedestrian detection, etc.)? Or is it all just in-car entertainment, dash board, and Nav?

Yes. Up to 4 AFAIK now, but they just intro'd their driverless type stuff and that won't land for a few years or more probably. They said at some point they could use 16-20 socs.

http://www.computerworld.com/article/2864593/nvidias-tegra-x1-aims-to-make-driverless-cars-more-reliable.html

"Nvidia's Tegra X1 will be used in the Drive CX car platform, which Huang called the "world's most advanced cockpit" for vehicles. It has two Tegra X1 chips"

Just an example of the new system. How many do you think it takes to do driverless stuff? I guess 16-20...LOL. Today they just apply brakes etc. The CX is just for dash crap.

"Nvidia is using two Tegra X1 chips in its new Drive PX hardware platform for the development of intelligent cars."

This will have to be massively amped up to do more than park your car probably. There are more in depth articles all over the place, just a quick google on above.

http://blogs.nvidia.com/blog/2015/01/04/ces-tegra-x1-nvidia-drive-auto/

It was discussed in most CES reports.

"“Your future cars will be the most advanced computers in the world,” Jen-Hsun told a crowd of more than 350 reporters, analysts and partners packed into a ballroom at The Strip’s Four Season’s Hotel. “There will be more computing horsepower inside a car than anything you own today.”

You're going to need more than 4 x1's to beat a top end PC of today correct? ;) NV is trying to (at some point) take out stuff like google's $150K radar like system for much less. That price is NOT the car, just the system and it's taken years and only has a few routes google's cars can drive on (vegas trip, and some crap in California etc, very limited and it can't ID much yet). I'm guessing NV will leapfrog them quite easily as their tech (as patrick moorhead states) is geared to do this already (image recognition, via 12cams etc). They already have a good start working with Visual Computing companies to ID objects.

http://arstechnica.com/gadgets/2015/01/nvidia-announces-tegra-x1-soc-with-maxwell-based-gpu/

For people that think Denver is dead. They clearly state in the update that is NOT true, and it's on future chips.

From above, you can see it's already going to be pretty capable, but we're talking driver assistance here, not DRIVERLESS (years away probably).

"Used in conjunction with up to 12 separate HD cameras, a car with the Drive PX can build an "environment model" that it can use to "see" and "understand" its surroundings—it can supposedly detect other vehicles, pedestrians and cyclists, road signs, and other information. Using something Nvidia calls "deep learning," the system can be trained to detect partially obscured pedestrians, whether school buses or ambulances are flashing their lights, and other context-sensitive things that a real driver might see and respond to."

"All of this data is then used to help the car automatically perform pathfinding and help drivers avoid collisions."

Note however, google is having trouble with this stuff. Green/red light was tough for them until recently...LOL

http://www.extremetech.com/extreme/181508-googles-self-driving-car-passes-700000-accident-free-miles-can-now-avoid-cyclists-stop-for-trains

Just added new abilities last year for SOME signs, railroad crossings etc. As it says not NEARLY ready.

"Basically, every single driving situation that can possibly occur must be painstakingly programmed into the software. It isn’t like Google has built an artificial intelligence that can learn how to drive a car from basic principles — if Google doesn’t tell the car what to do, it doesn’t do anything."

Nvidia's way says it learns every mile it drives. Seems like a faster way if true.

An example of one users google experience:

http://www.telegraph.co.uk/motoring/11382073/Roadtesting-Googles-new-driverless-car.html

" Just minutes later, the car proves that hunch right. A vehicle in front turning right on a red light - a manoeuvre allowed in California - fails to spot a jogger crossing the street and comes very close to hitting her.

We are all too busy watching the drama unfold to realise we are heading straight for our own jaywalking jogger up ahead. Luckily for us humans, our driver was not distracted and stopped in the nick of time. "

We'll see how fast a true visual computing company like NV can get this done soon enough I guess. The CES vids were pretty impressive though already.

Regarding numbers in revenue etc note the car solutions with K1 were $50-60 assumed due to software etc.

If you're selling 7.5mil cars x4 socs for example that's 30mil chips at $50-60 you're already at 180mil and who knows if there are more charges and not sure if that's NV's cost or what is charged (never got that info really clear, it was just some stock analysis post at seeking alpha or motley fool etc). Tegra revenue for the year was ~570mil IIRC. I'd sure like to know how many shields they sold though (tablet/handheld both).

Hopefully it makes more sense now :) Two devices, each using two chips for the tasks you mentioned, but again valet crap etc, is not driving out on the streets alone yet ;) This is just the beginning, but I like the future no matter who wins. I'd like to get a chauffeur soon (the car itself that is, nobody in the driver seat at all) so I could have a drink in the back seat all day if desired...ROFL. That will require much more power though IMHO.

http://mashable.com/2015/01/05/las-vegas-self-driving-audi/

Then again, K1 already drives some ;) Just like google though, not many places (vegas just like google I guess). Note the 550mil SF to vegas trip used the expensive system.

"Audi notes that the system will work from 0 to 70 mph, but when the car approaches an urban area it will alert the driver to take over manual control."

"During a ride in Audi's self-driving car along a freeway in Las Vegas at last year's CES, the system failed and the driver had to take over."

Not so good a year ago.

http://jalopnik.com/autonomous-audi-a7-drives-from-sf-to-vegas-probably-no-1677737814?utm_content=bufferd11aa&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

Guess it made it this year. Clearly still massive limits on these. But google wants theirs on the road in 2020 everywhere. Hmmm...Funny they say it made it, but a driver still had to take over in urban areas from SF to Vegas. I don't really call that success yet if a human was needed a bunch of times still.

http://blogs.nvidia.com/blog/2015/01/06/audi-tegra-x1/

Audi using X1 in A8 I guess. Audi guy showing off here a few days later that first nv blog link.

"“With every mile it drives, every hour, the car will learn more and more,” said Ricky Hudi, the carmaker’s executive vice president for electrics/electronics development."

That deep learning system seems better than google's "program every situation" deal. Hype or real, we'll know more soon I guess. Thanks for making me dig deeper... :) -

bit_user Reply

Thanks for the writeup.15303738 said:That deep learning system seems better than google's "program every situation" deal. Hype or real, we'll know more soon I guess. Thanks for making me dig deeper... :)

I'm not sure about deep learning. Such systems perform well on data similar to what they're trained with, but exactly how well they can adapt to different situations is unpredictable.

Some of the systems you mentioned suggest they're doing online training, which can be tricky but at least has the potential to adapt to the specific situations and environments a given driver frequently experiences.

All of these systems are susceptible to hacks. And not just electronic attacks, but also through fooling their vision systems. Because of this, I predict their sensor arrays will continue to be a significant cost item for quite a while.