This $2,000 Bitcoin mining water heater can pay for itself by slashing your energy bills, company claims — can rake in $1,000 a year in BTC, offset 80% of electricity and water costs

It also estimates that a 700-apartment community could earn nearly a million dollars a year.

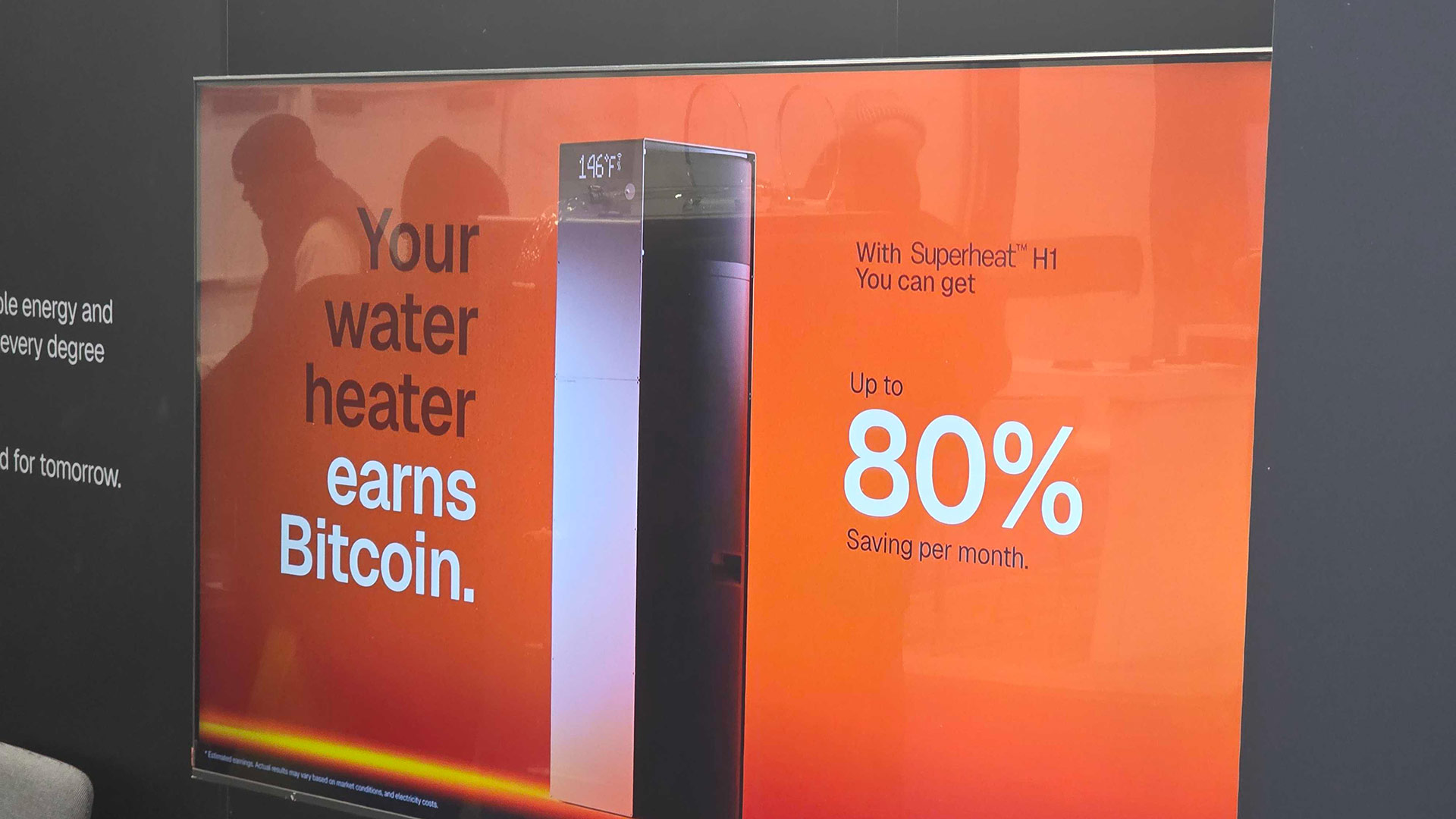

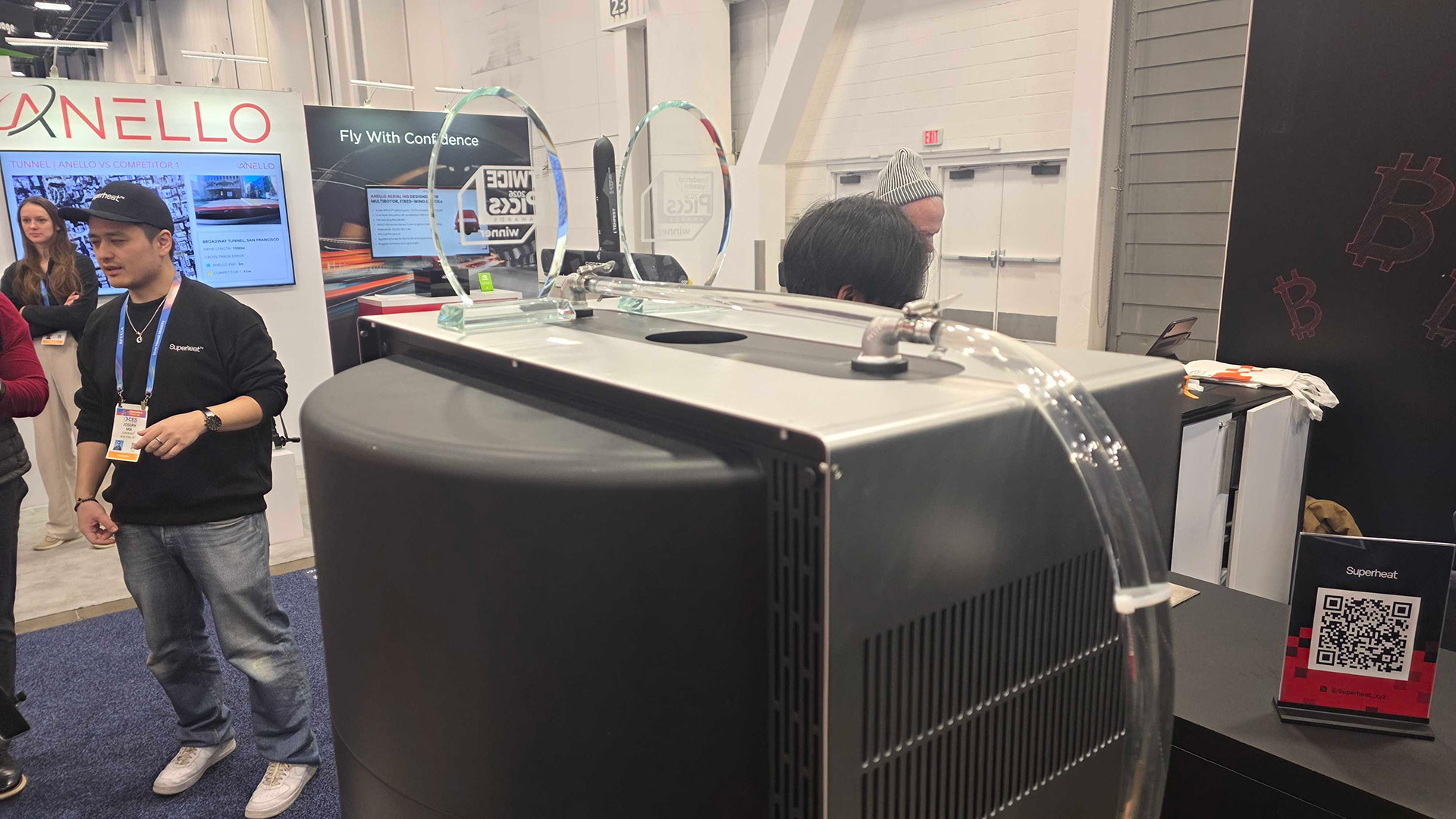

Superheat was at CES 2026 to showcase what it describes as “a water heater that pays for itself.” The new Superheat H1 is a $2,000 water heater that warms up your H2O using waste-heat from its built-in Bitcoin mining ASIC hardware, rather than an immersed resistive heating element.

It is claimed that owners of a Superheat H1 can “offset up to 80% of electricity and water costs” with earnings from cryptomining. Superheat extrapolates these numbers to suggest that a 700-apartment community could raise “up to $980,000 yearly earnings.”

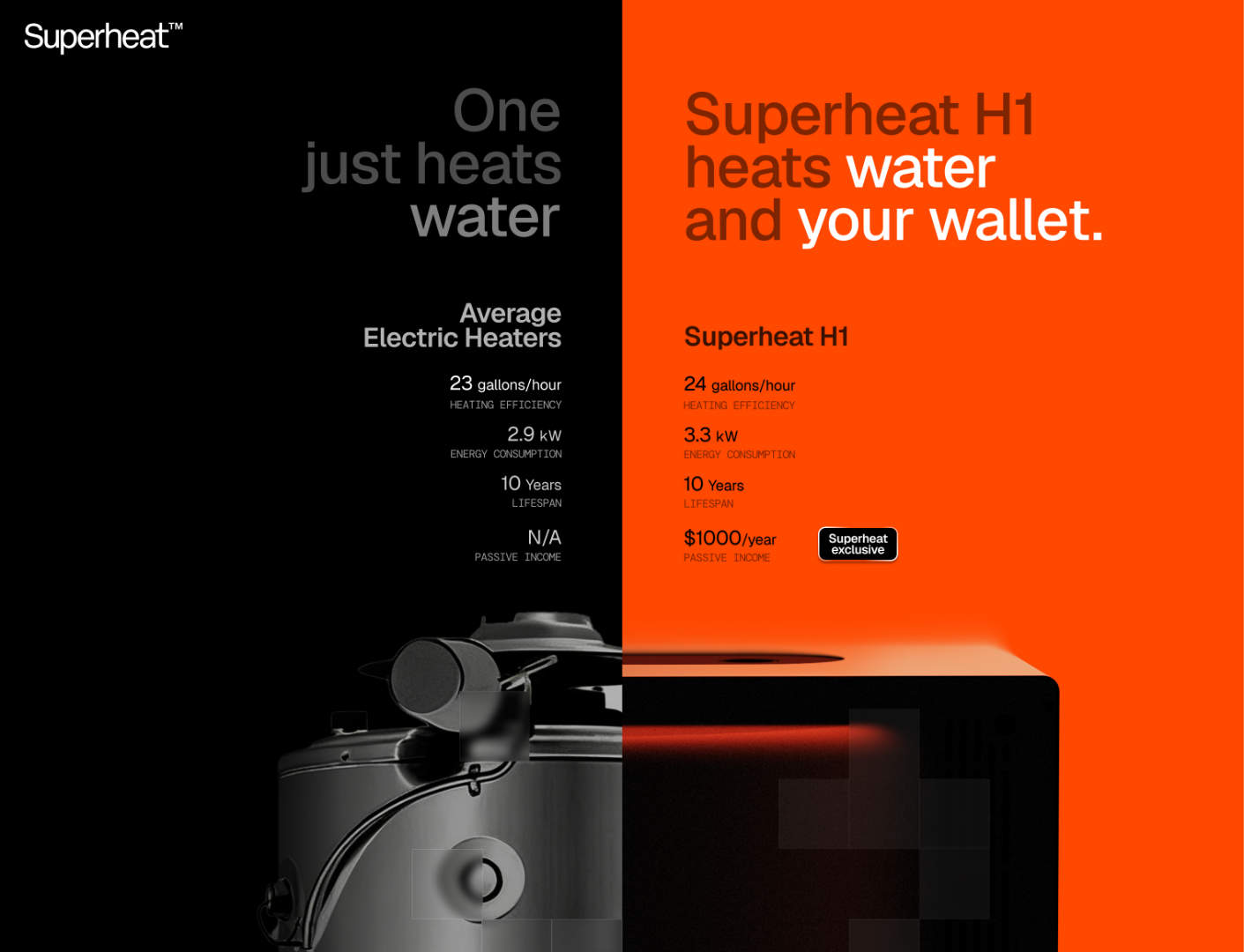

The infographic above shows that a Superheat H1 can earn $1,000 in passive income per year. Therefore, your initial hardware investment should be entirely paid-off in two years, while it reduces your water heater energy spend by 80%. The H1 has a predicted service life of 10 years, very similar to a regular domestic boiler.

Waste not, want not

Cooling data centers that run demanding workloads like cryptocurrency mining is a notoriously expensive business. It is estimated that cooling is the second most costly activity after actually powering the systems to chew through the tasks central to their existence.

But what if the ‘waste’ heat became a benefit? Indeed, some businesses, and most households, spend a lot of their energy budget heating water, for washing and heating systems, and so on, and get nothing else back except a hefty utility bill.

Enter the Superheat H1 with its “dual-value operation.” It requires roughly the same amount of energy as a regular electric water heater, according to the maker. Moreover, it is claimed to be scalable beyond homes, for apartment blocks, hotels, and so on.

“Heat is one of the world’s most overlooked resources,” said Andrew Geng, Co-Founder and CTO of Superheat. “The H1 proves that home appliances can create real economic and environmental value. As we expand into distributed AI and cloud computing, Superheat will redefine how buildings produce, reuse, and monetize heat.”

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Bitcoin pricing is rather volatile. In Q3 last year, it nudged over $125,000, but 1BTC is currently valued at around $91,000. Superheat H1 owners should benefit from a higher Bitcoin valuation, but no one really knows which direction, nor how high or low BTC could go in 2026. CNBC recently measured investor and analyst predictions and estimated that Bitcoin valuations of between $75,000 and $225,000 would be seen this year.

Owning a Superheat H1 might be yet another reason for not being able to tune out from watching information feeds and stressing about trends, charts, and valuations. Can I heat water with a heatsink on my forehead?

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

Notton This thing is so dumb...Reply

The video shows it installed with a tank, but tankless is more efficient these days. The only exception is when it's cold, but out of 365 days, how many of it are cold enough where a water heater w/ tank is cheaper? Do you live in Alaska?

Even if you opt for a tank, how many hours a day are you going to use hot water?

Instead of having a simple device that only heats water with a $50 controller board, you've now added a whole PC, thereby increasing the complexity, number of parts that can fail, and a SoC board that is way more expensive to replace. Congrats.

Lastly, how dystopian. Instead of folding a protein, or doing something useful or playing a game, we now have a home appliance built off of a ponzi scheme. -

Dementoss Reply

If your domestic boiler only lasts around ten years, you bought the wrong one...Admin said:The H1 has a predicted service life of 10 years, very similar to a regular domestic boiler. -

RusteeNailz Reply

A hot water heater is different from a boiler, both in operation and side effects from method of operation, especially an electric hot water heater. The electricity involved creates electrolysis betwixt and among the materials and components within the tank, in particular the tank body itself, and if you don't keep the sacrificial anode rod fresh, it will eat itself from the inside-out. Probably 90% of EHWHs die in this fashion, leaks inevitably develop and the only repair is replacement of the entire unit.Dementoss said:If your domestic boiler only lasts around ten years, you bought the wrong one...

Fun HWH fact: There was, circa mid-20th-century, a company that manufactured water heaters entirely out of copper, which don't suffer the same fate as steel-tank units. They were guaranteed for something like 50+ years. Company went out of business by the mid-late 60s. They ran out of customers that needed new water heaters because their product was too good. Haha -

USAFRet Reply

If your residence runs on electric, tankless water heater is less than ideal.Notton said:The video shows it installed with a tank, but tankless is more efficient these days. -

bill001g This more looks like scam to get investors to give this guy money. It seems to be some product on paper rather than somethings that is even close to existence.Reply

This is where they need to spell out the details of how they get their numbers. Bitcoin mining hardware tends to have very clear charts that show how long payback is based on the cost the hardware and the electricity.

The math doesn't seem to work even with zero electrical costs. Basic water heater is going to cost you about $1000 for the average house. All they are doing is replacing the heating elements with their bitcoin miner. Even if we assume this could just stuff the bitcoin miner directly in the tank this leaves them around $1000 for the asic hardware. They are going to be very hard pressed to find something for that price that can generate $1000 worth of bitcoin in a year.

The second big problem they have is to get the $1000 per year return the bitcoin miner needs to run 24/7. A water heater does not work that way. Its not like hot water is consumed by a house at some fixed rate per hour.

This will never work in actual home setting.

They talk about blocks of apartments later which is a different application but it would be a very niche case. There are a couple cities in alaska that use the waste heat from the eletrical generator plant to heat city buildings in the winter. They still have to dump this excess heat into the air in the summer.