AMD Likely Skipping 10nm For 7nm, Restructures GlobalFoundries Agreement

AMD announced that it restructured its Wafer Supply Agreement (WSA) with GlobalFoundries into a five-year contract. On the surface, the renegotiation appears to be a normal bit of strategic maneuvering, but it also indicates that AMD will likely skip the 10nm node and proceed directly to the goodness that is 7nm. GlobalFoundries recently announced that it is not investing in the 10nm node, which it claims is a "half-node" and does not provide enough scaling advantages in terms of cost, performance or power to be of extended value.

Intel is undoubtedly leveraging its 10nm process for its next-gen Cannonlake processors (it's already ramped up spending on 10nm fabs), but if AMD skips 10nm and transitions to the 7nm node, it just might gain the edge it needs to slip past the dominant Intel.

The agreement doesn’t guarantee that AMD will utilize 7nm for its upcoming CPUs. However, the announcement stated that the agreement "Establishes a framework for technology collaboration between AMD and GF at the 7nm technology node," so the transition is likely.

"The five-year amendment further strengthens our strategic manufacturing relationship with GLOBALFOUNDRIES while providing AMD with increased flexibility to build our high-performance product roadmap with additional foundries in the 14nm and 7nm technology nodes," said Dr. Lisa Su, AMD president and CEO. "Our goal is for AMD to have continued access to leading-edge foundry process technologies enabling us to build multiple generations of great products for years to come."

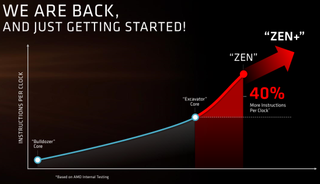

Kaby Lake and Zen will slug it out on the 14nm node, but AMD already has its next-generation Zen+ in the hopper. The Zen+ cores will likely consist of microarchitecture tweaks on the 14nm process. It is unlikely that 7nm, which appears to be a bit further out on the timeline, will be ready for Zen+. However, the future beyond Zen may find Intel fielding 10nm Cannonlake processors against competing AMD 7nm CPUs.

The new AMD and GlobalFoundries agreement covers microprocessors, graphics processors and semi-custom products for a five-year span from 2016 to 2020. The agreement does allow AMD to source wafers from other entities, but it also ties AMD into wafer purchase targets, which means that AMD has an obligation to order a fixed set of wafers every year or face levies. AMD is also required to pay an offset fee for any wafers it procures from other fabs.

AMD and GlobalFoundries have historically renegotiated the WSA on a yearly basis, so the extended term signifies a more stable relationship between the two companies. AMD will pay GlobalFoundries $100 million in cold hard cash as installments that begin in Q4 2016 and extend to Q3 2017. GlobalFoundries' parent company, Mubadala Development Company, also gains the option to purchase up to 19.9 percent of AMD's shares.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

The economics of developing new smaller lithographies requires an ever-increasing amount of investment (see Rock's Law), so long-term agreements between partners will likely become a necessity. In either case, it appears that AMD is headed in the right direction by ensuring a stable production base as it launches its renewed onslaught against Intel.

Paul Alcorn is the Managing Editor: News and Emerging Tech for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

M_Sketch Sounds good for amd, can't wait for any type of CPU competition, especially amd, haven't seen anything new for a while.Reply -

RomeoReject I recognize this is a computer site, not a business one, but isn't offering 20% of your company to someone you're contracting work to somewhat odd? Global Foundries is basically the employee here, yet AMD is saying "But you can also buy 20% of the value, which is almost assuredly tied in to your own work."Reply -

Jeffrey_32 GF already owns 18% of amd. To take advantage of the new shares they will have to sell of existing shares first. Not really and "employee" relationship.Reply -

viewtyjoe The stock transfer deal makes more sense when you consider that GlobalFoundries used to be AMD's semiconductor fab business, and it's a way for AMD and GF to signal they are returning to a closer relationship than they have had previously. It also incentivizes GF doing well for AMD, because if Mubadala's shares increase in value due to AMD's stock rising, it is effectively free value to them.Reply -

grsychckn Sorry for the previous comment. @Romeoreject: AMD is not offering 20% of their stock, rather <10% (75m shares of ~795m). Add to it that this is a warrant to exercise 75m options at the execution price of $5.98 AND that they cannot exceed 20% ownership of AMD on the whole. To me, the price of the options set at $5.98 means that AMD and GloFo believe the target price to be above $5.98 or GloFo won't exercise the options. Also, I've read unofficially that GloFo already owns something like 17% of AMD anyway so they could only exercise ~20m options and would have to immediately sell for profit in order to both stay below 20% ownership and have the ability to exercise more of these options.Reply -

salgado18 Reply18532317 said:I recognize this is a computer site, not a business one, but isn't offering 20% of your company to someone you're contracting work to somewhat odd? Global Foundries is basically the employee here, yet AMD is saying "But you can also buy 20% of the value, which is almost assuredly tied in to your own work."

I believe they did this deal to get a lower cash proposal. After all, they will really need this competitive edge in the near future. -

jasonelmore Yes it indeed does sound good for AMD, but Global Foundries has got to get their thermal problems under control.. 14nm should not be running hotter (or using more power) than 16nm TSMC, but it is.Reply -

mavikt I'll give them an A for effort; Having something 7nm ready to compete when Intel releases Cannonlake (as per the editors speculation)Reply -

Martell1977 This should be very interesting. AMD has historically always been behind Intel from node to node by varying degrees. This might give them a small jump on a smaller node, plus Zen is being teased as a HUGE improvement over AMD's last generation.Reply

I really hope this lights a fire under Intel, they get complacent with no real competition.

Most Popular