SK hynix invests $10 billion in creating a U.S.-based 'AI solutions' company — company to restructure California-based Solidigm enterprise SSD brand to bolster American investments

Solidigm brand to be spun off into a new subsidiary in the process

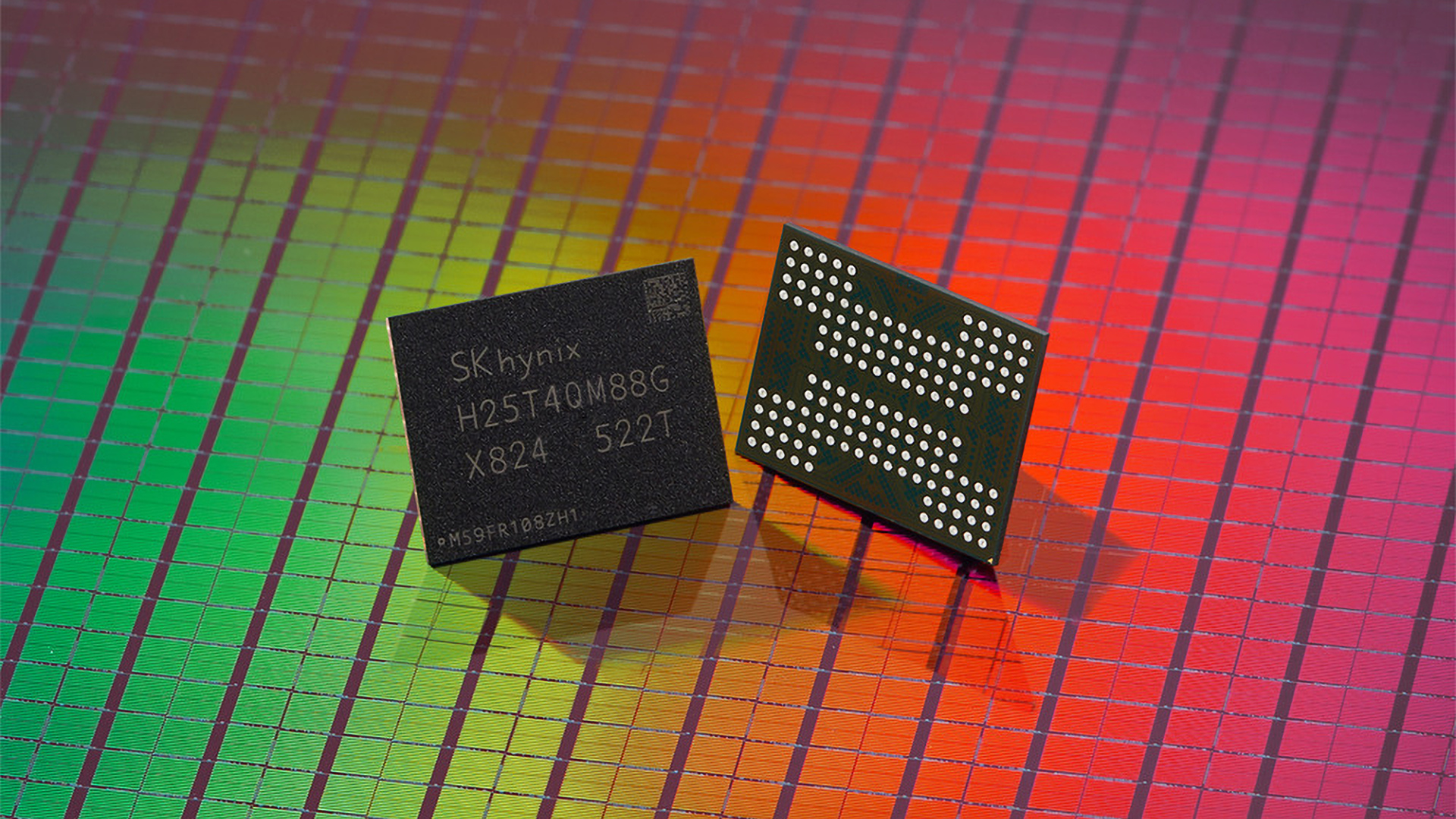

Memory chip giant SK Hynix is investing $10 billion in a new AI solutions company in the U.S, tentatively named AI Company. The new firm will have full access to this new investment and will be able to deploy it as it sees fit to promote the AI industry, bolster new AI startups and developments, and encourage its own strength and competitiveness in memory chip development, the company detailed in a press release. Such investment could even mean granting easier access to key SK Hynix technologies, like High Bandwidth Memory (HBM).

“Leveraging its unparalleled chip technologies, such as HBM, the memory chipmaker will try to play a pivotal role in delivering optimized AI systems for its customers in the AI datacenter sector,” SK Hynix said in a statement.

“The company will also continue making strategic investments in and collaborating with AI firms to strengthen its competitiveness in memory chips and provide a range of AI datacenter solutions.”

The new firm will be established by restructuring the California-based SSD manufacturing subsidiary, SK hynix NAND Product Solutions Corp, also known as Solidigm. It will retain its name under AI Company, but the new parent company will serve as its AI investment arm moving forward.

Following Nvidia's lead

One of the starkest stories of the past year in technology has been the sheer scale of investments in AI. Alongside the hundreds of billions in investment for data center projects, we’ve also seen Nvidia leveraging its vast stockpiles of cash to prop up other companies that are key to its ambitions for the AI industry and its ability to supply the hardware for it.

Nvidia invested heavily in OpenAI, in Intel, in CoreWeave, and in a range of European companies, too. It announced $1.5 in Nscale, $600 million in Quantinuum, $300 million in Black Forest Labs, $100 million in CuspAI, $20 million in PhysicsX – and the list goes on.

Although SK hynix can’t quite offer the levels of investment Nvidia is throwing around, the AI Company certainly sounds like that kind of investment vehicle. If SK hynix can help build up a range of companies developing AI software and hardware, it may encourage the industry as a whole to keep growing, ensuring that it has more customers for its memory products for years to come.

That kind of industry confidence could allow it to build up its own fabrication production without risking that capacity being wasted down the line if there’s an AI industry contraction or bubble-bursting effect.

A signal to Washington

Alongside making the foundations of its own business dominance firmer with targeted investment, SK hynix’s new AI Company is also a very public signal to the Trump Administration that it is investing in American companies. President Trump recently floated the idea of applying 100% tariffs to memory companies if they didn’t fabricate their chips in the U.S. While such an idea would effectively cripple the American tech industry by eliminating its access to cutting-edge memory, the industry has nonetheless responded.

Micron recently broke ground on a new fabrication facility in New York, with plans for it to produce some of the most cutting-edge memory products in America – and a huge portion of it by 2040. For its part, Samsung has been keen to highlight that it does already operate a semiconductor plant in Taylor, Texas, though whether that’s enough to hold off any punitive actions from the government remains to be seen. It’s not a NAND Flash fab, which is what the Trump Administration seems most keen on bringing to U.S. shores.

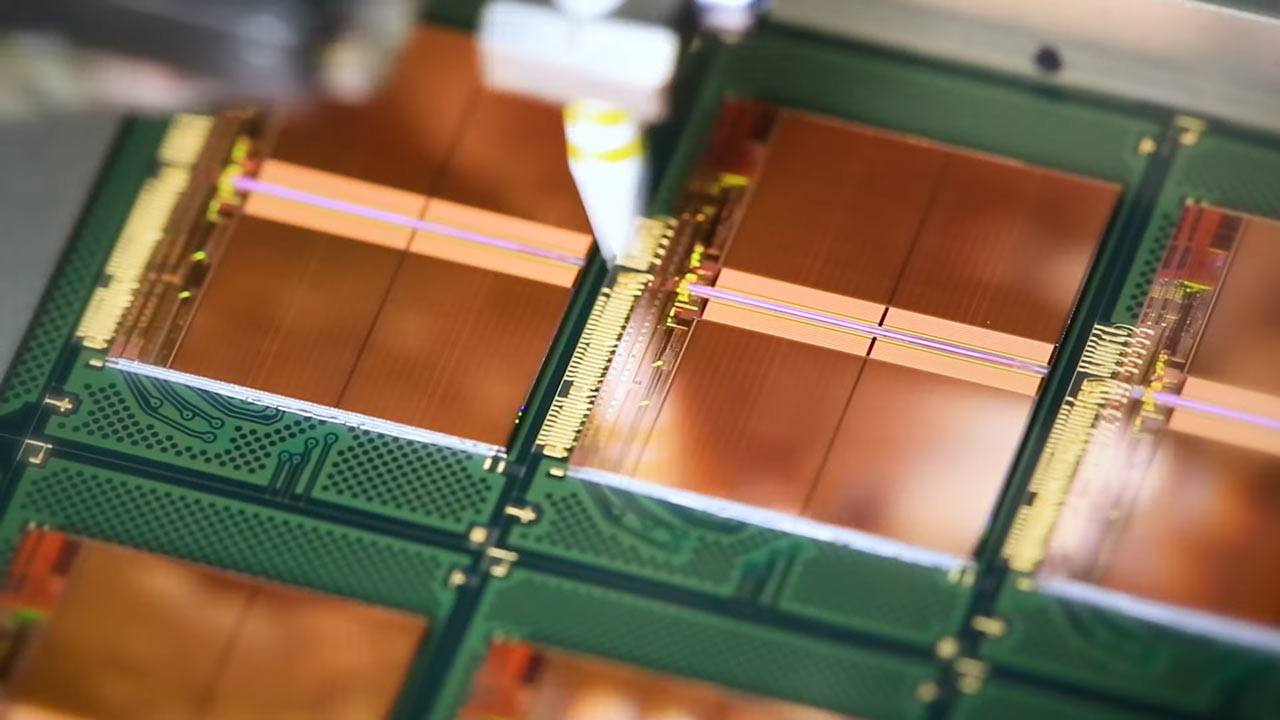

SK hynix is building an advanced packaging facility in West Lafayette, Indiana, but doesn’t actually fabricate memory in the U.S. It’s quite possible that this latest AI investment initiative may be a way to claim that it plans to produce memory inside America, or at least to cement its interest in American investment.

If either Samsung or SK hynix were to be hit with trade restrictions, but Micron was exempt, the effect on the memory industry would be dramatic to say the least.

Bolstering sustained growth

SK hynix may well find it easy to find new investment opportunities for its AI Company once it’s established. It said in its announcement that it will leverage its “unparalleled chip technologies, such as HBM,” to help it deliver “optimized AI systems for its customers.” That sounds an awful lot like gaining SK hynix investment could give a faster pipeline to access the latest HBM technologies.

In an environment where critical components and material shortages are bottlenecks to AI growth, having the backing of one of only three key memory producers in the world could be hugely beneficial.

SK hynix is making hay while the sun shines, too. It just posted forecast-beating profits in the recent quarter, increasing 137% year on year. That’s off the back of similarly impressive results this time last year, too. It’s using this new financial muscle to invest $13 billion in a new chip packaging plant in South Korea.

This latest $10 billion AI Company fund is just one more example of that. Like Nvidia and many other top tech companies, SK hynix is investing in the future of AI to give its current trajectory as long a tail as possible before any eventual contraction curtails it.

Jon Martindale is a contributing writer for Tom's Hardware. For the past 20 years, he's been writing about PC components, emerging technologies, and the latest software advances. His deep and broad journalistic experience gives him unique insights into the most exciting technology trends of today and tomorrow.