Nvidia pumps another $2 billion into CoreWeave and announces standalone availability of Vera CPU — chipmaker increases stake in its customer to 9%

CoreWeave was experiencing funding issues in December.

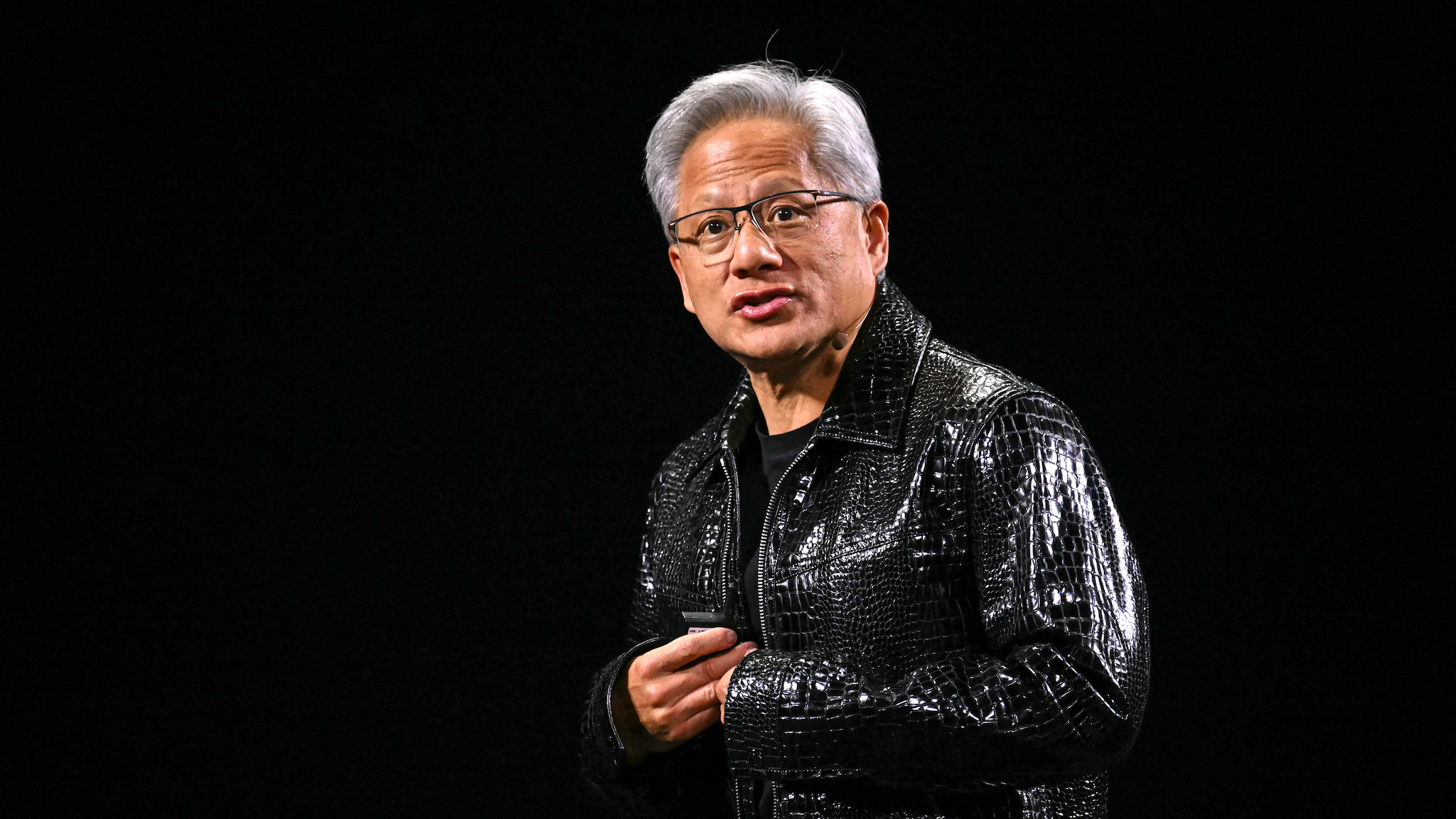

Another day, another deal earmarking large amounts of money from a big corporation to one of its customers in the AI world. The latest exchange is between Nvidia and cloud datacenter makers CoreWeave, where Jensen Huang's outfit bought a helping of CoreWeave Class A shares, for $87.20 a piece.

Before the deal, Nvidia owned just over 6% of CoreWeave, a slice that ought to have increased today to around 9%. Although those figures and today's purchase relate to standard Class A shares, some outfits are reporting that the chipmaker also owns some Class B stock — shares with 10x voting rights, privately traded.

For Huang, this investment reflects "confidence in their growth and confidence in CoreWeave’s management and confidence in their business model" [sic]. CoreWeave is one of the many companies rapidly burning through far more money than it's getting revenue, a fact that previously had some investors skittish, particularly after December when the firm revealed a plan to raise $2 billion by issuing debt to be exchanged for shares.

After today's news, though, CoreWeave's shares rallied to a 9% bump, reflecting the sizable cash injection and perhaps also Huang's outlook on the matter. Additionally, CoreWeave is apparently the first Nvidia customer getting access to its Vera CPU chip as a standalone unit, something that might have helped with the stock rise.

The green team's fresh Arm-based design was previously only available as part of an entire system board, but it's now going to be available as a standalone product, though seemingly for datacenter customers only for the time being.

As a refresher, Vera's specs are 88 cores and 176 threads, an Arm v9.2-A instruction set, 2 MB of L2 cache on each core, and 162 MB of shared L3 cache. Among many other interesting bits of info, Nvidia's Spatial Multithreading should allow each Vera core to effectively run two hardware threads, by way of divvying up resources by partition instead of time slicing them like standard SMT.

Other interesting figures include up to 1.5 TB of precious RAM per CPU, capable of pushing data at up to 1.2 TB per second. The onboard NVlink interconnect can also handle 1.8 TB/s of bytes flying by. As a rather obvious statement, the chip's super-wide design makes it perfect for AI workloads.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Bruno Ferreira is a contributing writer for Tom's Hardware. He has decades of experience with PC hardware and assorted sundries, alongside a career as a developer. He's obsessed with detail and has a tendency to ramble on the topics he loves. When not doing that, he's usually playing games, or at live music shows and festivals.