Client SSDs: Samsung Retains No.1 Spot, SSDs Outsell HDDs by 2.6x

Samsung remains world's largest SSD maker, but Western Digital is catching up.

Shipments of solid-state drives in the second quarter of 2021 remained almost flat, due in part to a slight sequential decline in PC shipments in Q1 and to ever looming shadow of component shortages. Unit wise, SSDs outsold hard drives by 47% as most client systems now use solid-state storage, but HDDs lead in terms of capacity by 411% as they are used to store the majority of data generated today. Samsung remained the world's largest supplier of SSDs followed by Western Digital, and Kioxia.

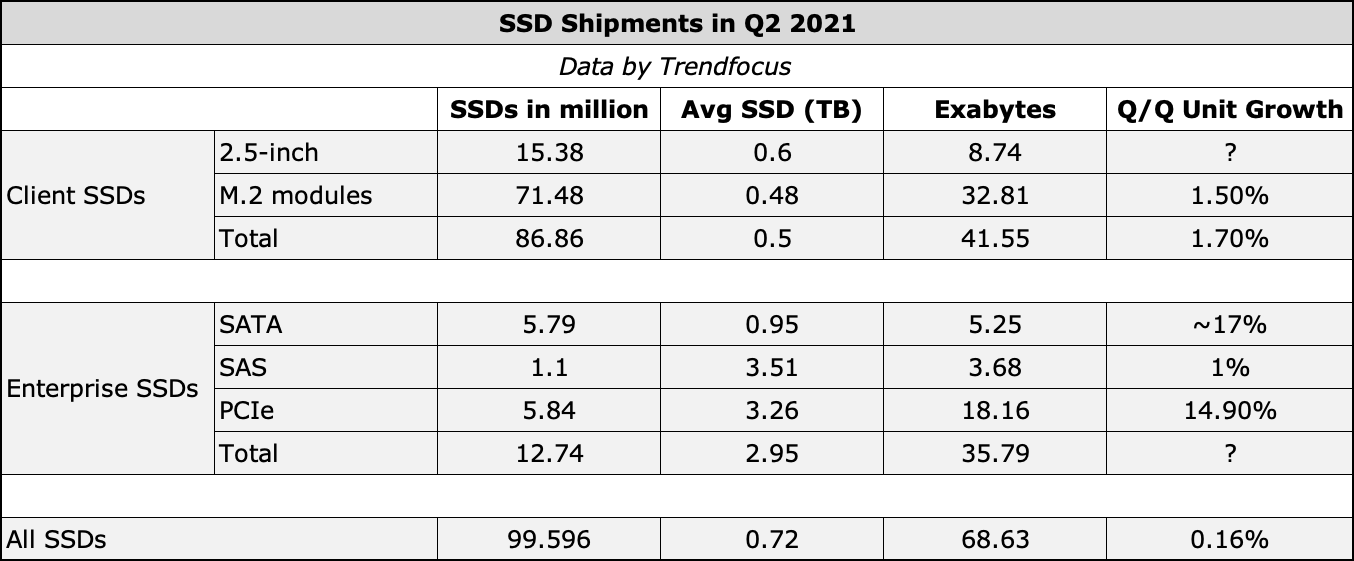

99.6 Million SSDs Shipped in Q2

The industry shipped 99.6 million SSDs in Q2 2021, up slightly from 99.438 million drives in Q1, according to Trendfocus (via StorageNewsletter). These drives can store 68.63EB (exabytes) of data, up 10.7% from 62EB in the first quarter. By contrast, three makers of HDDs shipped 67.6 million hard drives with a capacity of 350.7EB.

Avid readers know that while SSDs lead in terms of unit shipments these days, HDDs lead in terms of capacity as they are used for bulk storage in hyperscale datacenters operated by companies like AWS, Google, Facebook, and Microsoft.

86.86 Million Client SSDs

In terms of units, client SSDs commanded the largest share of shipments with 86.86 million drives sold in the second quarter of 2021, up 1.7% from Q1 2021. Meanwhile, sales of PCs in the second quarter totaled 83.614 million units (according to IDC), down slightly from 83.981 million PCs in Q1 2021.

M.2 modules are cheaper to make than drive form-factor (DFF) SSDs, which is why they are cheaper and therefore more popular than 2.5-inch solutions. It is a bit surprising that DFF devices feature a higher average capacity than M.2 drives, but perhaps people are buying more high-capacity 2.5-inch SSDs to upgrade their old PCs and this causes such an effect. In any case, 500/512GB SSDs are now considered average, so while manufacturers still sell many 250/256GB drives, higher-capacity models are gaining traction.

It is noteworthy that while client SSDs outshipped client hard drives by 2.6 times as far as units are concerned in Q2 2021, the average capacity of a client HDD is over 5 times higher compared to that of a client SSD.

12.74 Million Enterprise SSDs

Enterprise-grade SSDs are sold in lower quantities than client drives, around 12.74 million units were sold in Q2 2021. But these SSDs feature considerably higher capacities and prices, so manufacturers prioritize their production over client SSDs.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

During the quarter both SATA and PCIe enterprise drives demonstrated rather impressive sequential shipments growth with 5.79 million and 5.84 million units sold, respectively.

Sales of SAS SSDs stagnate as there are barely any new mass SAS deployments. Meanwhile, the average capacity of a SAS SSD is 3.51TB, which is higher than that of PCIe/NVMe as well as SATA drives, so their average selling price is probably higher too. Furthermore, the average capacity of a SAS SSD is nearly 2.5X higher when compared to a 2.5-inch SAS HDD.

It should also be noted that since SAS SSDs are in many cases are used for mission critical applications, they are sold at a substantial premium, so companies like Western Digital are probably happy with this business.

Samsung Remains on Top, But…

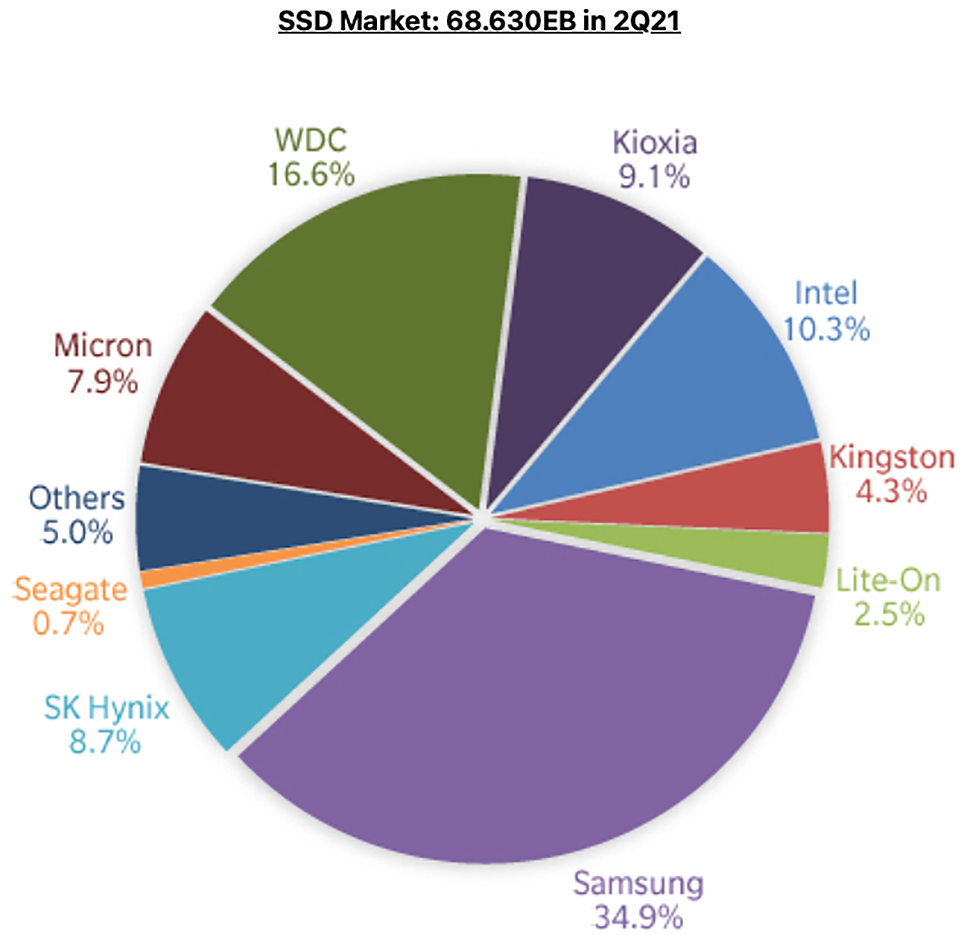

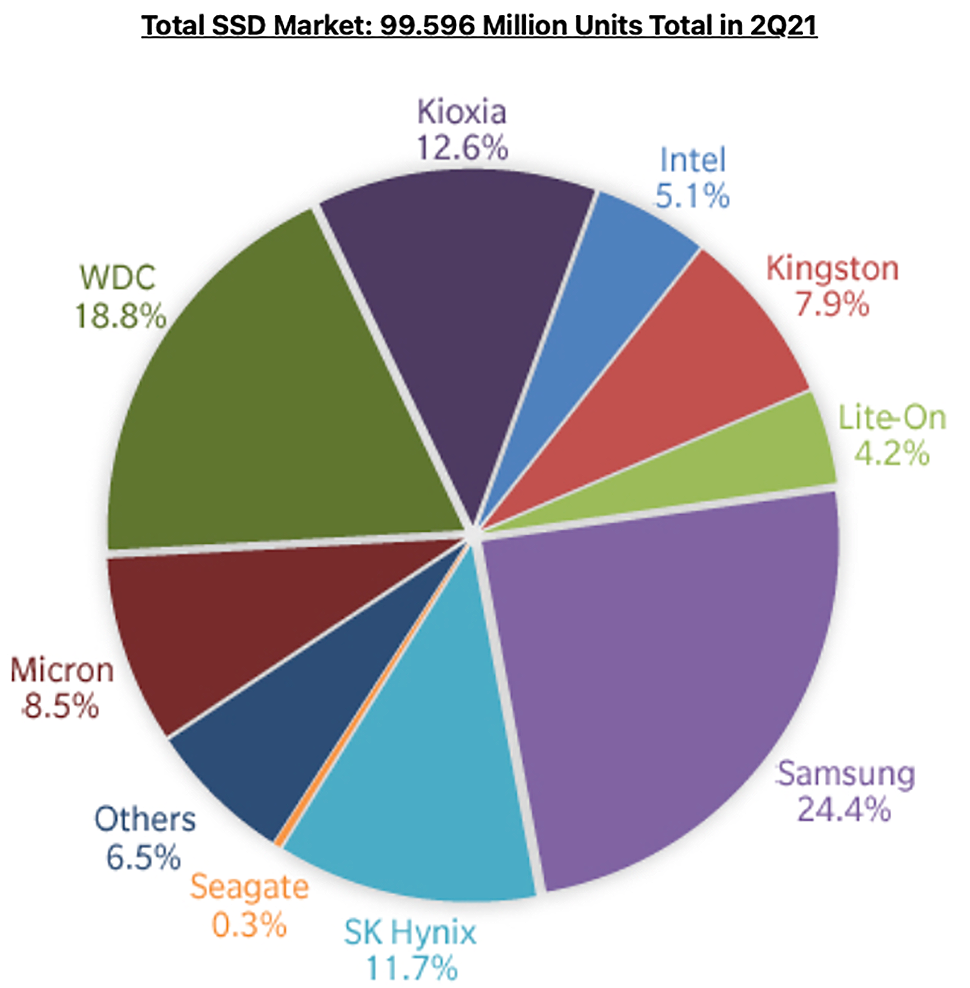

Samsung, which certainly makes some of the best SSDs available today, leads the SSD market both in terms of unit sales and in terms of exabytes shipments. This is not something surprising as Samsung is also world's No. 1 maker of NAND flash memory.

In Q2 2021 Samsung shipped 24.3 million SSDs and controlled a 24.4% chunk of the SSD market. As far as exabytes shipments are concerned, Samsung also lead the pack with a 34.9% share (23.95EB), which exceeds the share of Samsung's closest rival — Western Digital — by almost two times.

Meanwhile, Samsung is not the champion in terms of the highest average SSD capacity. The average capacity of a Samsung-made drive was 1.03TB in Q2 2021, which is significantly lower than Seagate's 1.69 and Intel's 1.46TB average capacity. Intel has always been focused primarily on enterprise-grade SSDs and it is evident that its efforts are paying off. Seagate only sold around 299 thousand of SSDs in the second quarter, but those were mostly high-capacity specialized offerings, so it is not surprising that the company, so the company's average drive is a high-capacity one.

As far as average SSD capacities are concerned, Intel, Samsung, and Seagate are significantly ahead of all of their rivals. For example, average capacities of Micron's and Western Digital's SSDs are 0.67TB and 0.64TB, respectively. Others can boast with something like 0.5TB per drive on average.

Successful SSD suppliers also produce 3D NAND memory

There are tens, if not hundreds, of SSD brands these days. Yet, the most successful SSD suppliers also produce 3D NAND memory, so Jerry Sanders's famous phrase about real men and fabs is true about SSD manufacturers.

Production of SSDs is relatively easy and does not require expensive tools and a cleanroom like those needed to produce NAND flash or assemble hard disk drives. There is also plenty of 3D NAND on the market (141.19EB of NAND was produced in Q2 2021, according to TrendForce) and each manufacturer has some spare capacity, so getting flash memory and assembling drives is a relatively easy task. Yet, vertically integrated manufacturers of SSDs — those who produce both 3D NAND and SSDs — are leading the game and almost no company can really challenge them.

No one except Kingston. Being one of the world's largest makers of memory modules, the company gets special treatment by memory producers and can secure enough 3D NAND chips to make loads of drives. The company also holds a stake in Phison and can secure enough controllers (which may come with memory) and develop unique firmware versions to build specialized SSDs. In Q2, Kingston controlled a 7.9% unit share of the SSD market and was ahead of Intel and just 0.6% behind Micron. Yet, even Kingston does not really ship many high-capacity drives, so its exabytes share is 4.3%, whereas the average capacity of a Kingston SSD is 0.39TB.

Of course, there are independent makers of ultra-high-end enterprise-grade SSDs that are successful on niche markets and more than competitive against vertically integrated SSD suppliers. But when it comes to volumes, it is close to impossible to compete against companies that have their own 3D NAND memory.

In Q2 2021 independent SSD makers controlled about 18.9% of the SSD market as far as units are concerned. The biggest of them were Kingston (7.9%) and Lite-On (4.2%). The remaining makers (except Seagate) commanded 6.5% of unit shipments and supplied 6.47 million SSDs (with the average capacity of 0.53TB).

Summary

Shipments of SSDs stagnated in the second quarter of 2021 due to shortages of components and a slight decline of PC sales. By contrast, HDD supplies slightly increased mainly because of demand from exacalers and Chia famers.

These details do not change long term trends: more client PCs adopt solid-state drives due to performance, dimensions, and power reasons; datacenters expand usage of SSDs because of their performance, but will not give up HDDs for bulk storage any time soon.

Samsung remains the leading producer of SSDs both in terms of units and in terms of capacity shipments. It is unclear whether shortages of controllers affected Samsung's sales, but it is a possibility.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Krotow Kingston themselves use "special treatment" to their consumer SSDs. They ship good units to reviewers and ones with worse controller and memory chips under same model name to the rest of us.Reply -

Reply

Exactly and that is the reason I will never buy cheap SSDs. Basically I stick with Samsung and Micron (Crucial) But mostly SamsungKrotow said:Kingston themselves use "special treatment" to their consumer SSDs. They ship good units to reviewers and ones with worse controller and memory chips under same model name to the rest of us.