The Numbers Behind AMD's 2017 Ryzen Insurgency

This was a year enthusiasts and the industry alike will remember as the return of competition to the desktop PC market. It's been a busy year for AMD, and with the end of the year winding down, we got our hands on some market data that outlines how much progress the company has made.

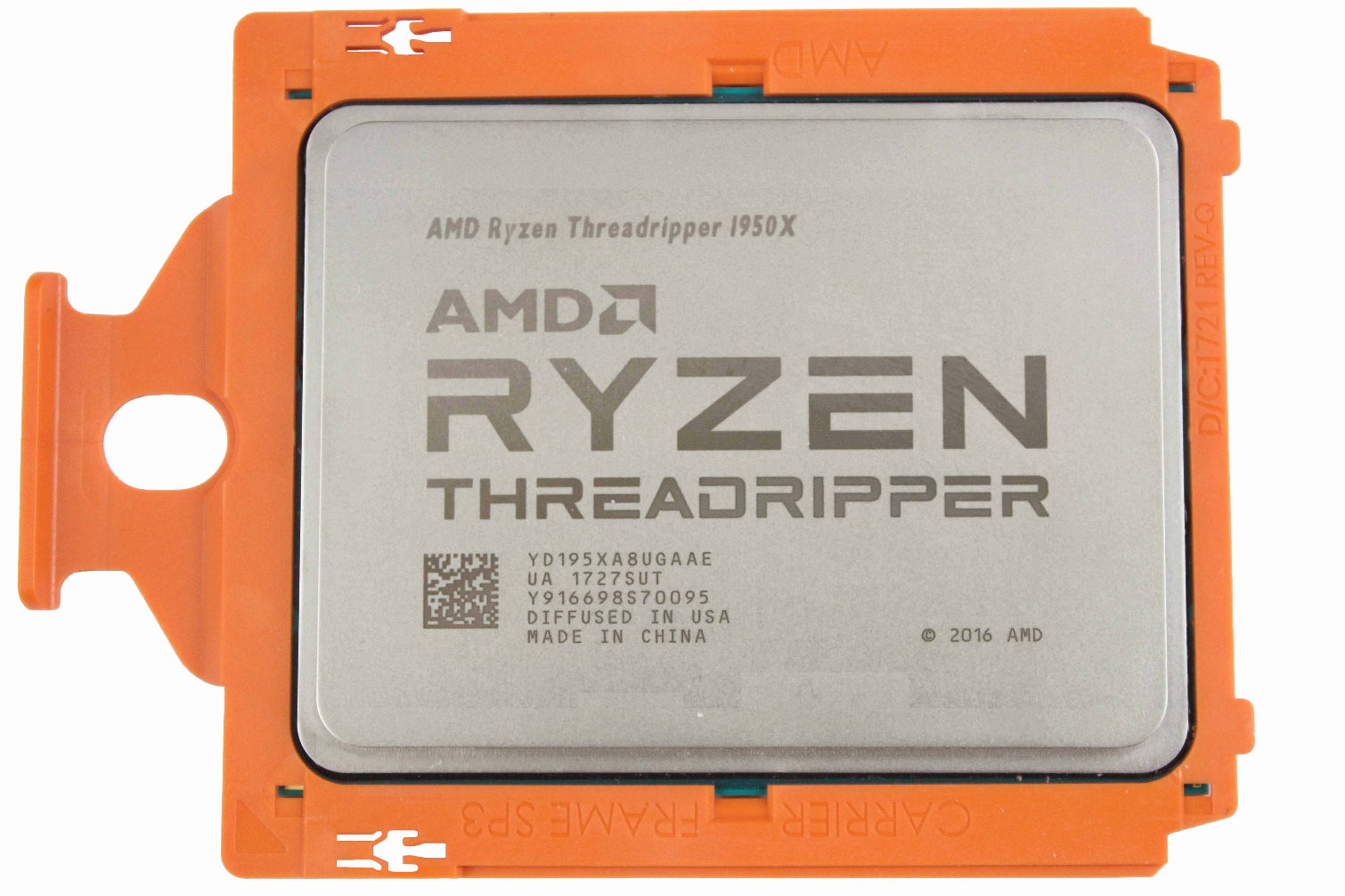

AMD's execution on the processor side of the company was nothing short of stellar, especially given the rapid-fire cadence of releases. AMD CEO Lisa Su first announced the company's new Zen microarchitecture in August 2016. The Ryzen 7 1800X finally landed in March 2017 and touched off an explosion of Zen-based processors. The Ryzen 5 series and Ryzen 3 processors followed in short order, and AMD finally put a cap on the year with the Threadripper lineup.

AMD also made time to bring Bristol Ridge, a new lineup of EPYC processors, and Vega to market in the meantime, but we're most interested in AMD's gains in the desktop PC market over the last year.

Where Not To Look

Unlike other market segments, definitive desktop market share numbers are hard to come by. Companies like Trendfocus, for example, publish detailed SSD market share reports on a quarterly basis, and companies like Seagate and WD present enough sales and unit data for us to compile reasonably accurate long-term data for analysis.

You won't find that, at least easily, for the desktop processor market. The big-name analyst firms rarely share detailed information. Neither do AMD and Intel. It's also hard to make projections based on financial results. For instance, AMD lumps its GPU and CPU revenue numbers together, making it impossible to reverse engineer.

We look to the Steam database often, but at times the data doesn't make sense. Wild monthly swings have become common, which makes us question the accuracy of the results. We don't know much (if anything) about the methodology, and Valve doesn't respond to our repeated inquiries.

Sometimes, in the absence of good information, the press embraces bad information. We see that with the recent Passmark "Market Share" reports. This is an example of blatantly misleading information intentionally passed off as legitimate. The number of Passmark test submissions doesn't represent market share by any stretch of the imagination, but it sure gets clicks. Unfortunately, the Passmark "results" have generated an untold number of breathless articles over the past year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

We also pay attention to Amazon's CPU Best Sellers list. We know this is accurate information because it's based on Amazon's internal sales data (just don't expect the same accuracy from Newegg).

German retailer Mindfactory.de also makes especially detailed sales data public. AMD overtook Intel processor sales at the retailer this year, upsetting Intel's decade-long dominance. The trend continues after Coffee Lake's release, although it will be interesting to see how the competition continues after Intel's latest are broadly available. Mindfactory provides a solid view of European hardware sales at one retailer, but we yearn for more expansive numbers.

Mercury Research Weighs In

We consulted with the experts at semiconductor suppliers and OEMs to see which firms are known for providing respected market analysis to the largest vendors. Mercury Research was widely recommended. The firm has been providing market analysis since 1994 and graciously agreed to share some market analysis with us. Of course, the company also offers much more in-depth reports for its customers, but it shared enough interesting information with us to help quantify AMD's share gains over most of the last year.

| Header Cell - Column 0 | 3Q16 | 4Q16 | 1Q17 | 2Q17 | 3Q17 |

|---|---|---|---|---|---|

| AMD Desktop Unit Share | 9.1% | 9.9% | 11.4% | 11.1% | 10.9% |

Mercury Research said these numbers reflect AMD's share of the overall desktop unit share. They exclude IoT sales. The company also said that the total cumulative number of units shipped into the market for the past year (4Q16 through 3Q17) totals 96 million desktop CPUs.

According to the data, AMD gained (roughly) an additional 960,000 CPU sales over the preceding four quarters. Although that may not seem as impressive as many have expected, there are many factors we also have to consider. The numbers don't include the lucrative fourth quarter and the Black Friday/Cyber Monday sales. AMD slashed pricing during this period and competed against a largely absent Coffee Lake, so this could have been a very successful period for AMD. In fact, Lisa Su said the company tripled its sales during this period.

After some of the inaccurate claims in the press, such as that AMD took 10% of the market share from Intel in a single quarter, these numbers may seem a bit underwhelming. But there is corroborating information and a few caveats.

We spoke with Dean McCarron from Mercury Research, and he provided a bit more color:

"If you only consider the markets where Ryzen is directly competing with Intel, e.g. the consumer PC market that's currently using Intel's i5 and i7 CPUs -- the TAM (Total Addressable Market) for AMD's Ryzen 5 and 7 is about 24 million units, and the present share of that is expected to be around 15%; In some very specific niches such as high-end gaming, however, the share could be significantly higher."

When we view the data in context, AMD's gains through 3Q17 are much more impressive. "One can safely say that Ryzen's share in its target market of high-end consumer desktops is notably higher than AMD's overall desktop share reflects," said McCarron.

Ryzen's lack of integrated graphics also means that it doesn't compete in the entire breadth of the desktop processor market; the processors are obviously only destined for desktops with a discrete graphics card. Jon Peddie Research's (JPR) latest GPU market share report says that 70% of shipped PCs had a discrete graphics card, which is a whopping 33.3% year-over-year increase. The third quarter is traditionally the strongest in terms of GPU sales, and JPR also notes that it is hard to gauge the impact of mining on the overall market accurately. But that implies that at least 30% of the processor market is out of Ryzen's reach.

A Bit Of Other Data

We also found information from Susquehanna's semiconductor analyst Christopher Rolland, but it comes with little context. The information does suggest that Mercury Research's data is reasonable, and it provides numbers for 4Q17. Of course, the year isn't over yet, so the company may be reporting based on projections. (We should not append these numbers to the Mercury Research data, as measurement methodology undoubtedly varies).

"AMD gaining ground in desktop CPU, although the Ryzen mobile ramp appears slow. We note that AMD continued to take desktop CPU share from Intel (up +2.4% to 12.9% in 4Q17). However, Intel still gained a bit of share in laptops as Ryzen Mobile’s limited ramp underwhelms thus far […] AMD also benefits from higher ASP CPUs; Threadripper now live. AMD could beat Street ASP/GM expectations in 4Q17 as Ryzen continued to take share from older AMD processors, driving ASPs up nearly +20% in desktops! We note ~3% of AMD powered desktops contain enthusiast CPU Threadripper, which has ASPs that are 2X premium Ryzen 7s." -- Christopher Rolland, Susquehanna

Rolland projects AMD gained 2.4% in 4Q17 to reach 12.9% share, which means that, according to his projections, AMD had 10.5% share in Q317. Although we are not privy to more expansive details on the data, that does place his projection within 0.4% of Mercury Research for Q317.

This information also highlights AMD's much higher ASPs (Average Selling Price), which are one of the keys to AMD's return to profitability. The report claims the company has increased ASPs by 20% and that Ryzen Threadripper models make up 3% of the company's processor sales.

The Year Ahead

For all of the activity this year, it is just the beginning for AMD. The company recently announced that it is transitioning both Vega GPUs and the Ryzen line of processors from the current 14nm LPP to the 12nm LP process. That will provide the company with a performance boost, but multiple factors will impact how much of the 10% in transistor-level performance gains translate directly to overall performance improvements. In either case, the new process will provide more performance and reduce AMD's manufacturing expenses.

Although AMD hasn't confirmed, we expect this to be a "tick-equivalent" shrink of the existing architecture, but the company could make other performance enhancements. For instance, the Threadripper processors feature lower L2 and L3 latency than the mainstream Ryzen models even though they employ the same basic Zeppelin die building blocks. That means AMD has likely made some adjustments that may worm their way into the 12nm LP models. It's rational to assume that we will hear more of AMD's plans at CES in a few weeks.

Intel's 10nm process is notably late, and we don't expect it to make its way to the desktop until the second half of 2018 -- if not later. That leaves a big window for AMD to execute its 12nm LP transition and challenge Intel's Coffee lake processors.

Many expect AMD to jump to GlobalFoundries' 7nm process in 2019, possibly with the new Zen 2 microarchitecture in tow. According to industry analysts and the recent 10nm and 7nm whitepapers presented at IEDM 2017, GloFo's 7nm is incredibly competitive. We could see a surprising chance for parity between Intel's 10nm and GloFo's 7nm. It's clear that Intel will no longer have the undisputed process leadership crown, and that is an exciting possibility for AMD. And the consumer.

AMD's EPYC just began shipping in significant volume this year, so it will really begin to take hold next year. EPYC presents a tremendous threat to Intel's x86 server dominance, particularly in the single-socket server space. We also see tremendous opportunities for AMD against Intel's Xeon W. In either case, it will take time for AMD to gain significant share in the server space, but any gain is a positive for AMD.

AMD's success hinges on its universally unlocked multipliers in the client space and unrestrained feature sets in both client and enterprise markets. AMD has been quite strategic in specifically attacking Intel’s weaknesses, namely price/core counts and segmentation practices -- and it's working. The company's bet on an MCM-based (Multi-Chip Module) architecture may prove to be its biggest advantage in the years to come, particularly in the server market. Pairing that underlying design philosophy with Global Foundries incredibly impressive 7nm process guarantees that the war for market share has just begun.

AMD's friendlier pricing and unrestricted feature set continues to gain steam, and we expect next year to be even more tumultuous and exciting as AMD cements its return to competitiveness. 2017 has proven to be one of the best years in recent history for the enthusiast, but it's just the beginning.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

Larry Litmanen To me Steam data should be very accurate. It's not like they ask people what they have, Steam simply sees what specs the user has on any given month and reports it. I would say Amazon sales data is not accurate because most people do not buy CPUs, they buy ready made systems. So a sale on Amazon simply means that people who build their own PC chose this or that CPU, that segment of people is not significant compared to overall PC user base.Reply

So when i look at Steam data it shows a MASSIVE decline in the last few months for AMD, they have less than 10% of the market for CPU and GPU respectively. Steam is obviously not an exact measure, not everyone games but i think it is very accurate, numbers on Steam are what they are. If you have an AMD CPU that's what the survey shows. -

blakerateliff Mr. Alcorn. I think the word you are looking for is "Resurgence."Reply

An insurgency is a violent revolt.

A resurgence is a revival or increase after a period of dormancy.

In other words, AMD is making a comeback, not blowing up a crowded marketplace. -

billy41415 People are currently buying intel CPUs 50:1 as they have over 96% of the market in desktop, server, and laptop marketsReply -

billy41415 Reply20508230 said:To me Steam data should be very accurate. It's not like they ask people what they have, Steam simply sees what specs the user has on any given month and reports it. I would say Amazon sales data is not accurate because most people do not buy CPUs, they buy ready made systems. So a sale on Amazon simply means that people who build their own PC chose this or that CPU, that segment of people is not significant compared to overall PC user base.

So when i look at Steam data it shows a MASSIVE decline in the last few months for AMD, they have less than 10% of the market for CPU and GPU respectively. Steam is obviously not an exact measure, not everyone games but i think it is very accurate, numbers on Steam are what they are. If you have an AMD CPU that's what the survey shows.

People are tired of AMD products. Just look at the other chart. nvidia made huge gains at exactly the same time. Glad everyone is one the same page now. Intel, nVidia, and windows 7 is the way to go

-

zach.hillerson I know AMD has said they will keep the socket active for a few years, but what is the likelihood that existing ryzen motherboards will be compatible with refreshes? Technically, the z370 is still the 1151 socket, but requires a new mobo purchase.Reply -

wownwow Paul,Reply

"70% of PCs had a discrete graphics card"

Intel has ~70% of the graphics market, should it be: 30% of PCs had a discrete graphics card? -

Paul Alcorn Reply20508631 said:Paul,

"70% of PCs had a discrete graphics card"

Intel has ~70% of the graphics market, should it be: 30% of PCs had a discrete graphics card?

I am referring to the attach rate for AIBs (listed in the JPR report linked in the article). Intel isn't included in those metrics (but they will be soon enough). It is possible those numbers are skewed, though, as JPR discloses that it is hard to accurately predict the impact of mining on the statistics. -

jaymc Excellent article very informative, clearly a lot of research went into it.Reply

It's new information that we haven't had access to in the tech community up until now that is, much respect ! -

hgchuong I wish everyone would give the whole "tick-tock" thing a rest, even Intel has buried that strategy yet everyone feels the need to bring it up once in a while.Reply

I understand Toms's Hardware has a responsiblity the industry to encourage technology sales but there are better ways in doing so.