AMD Sees Highest Quarterly Revenue Since 2005 with 7nm Ryzen, Radeon and Epyc

AMD notches its highest revenue since 2005

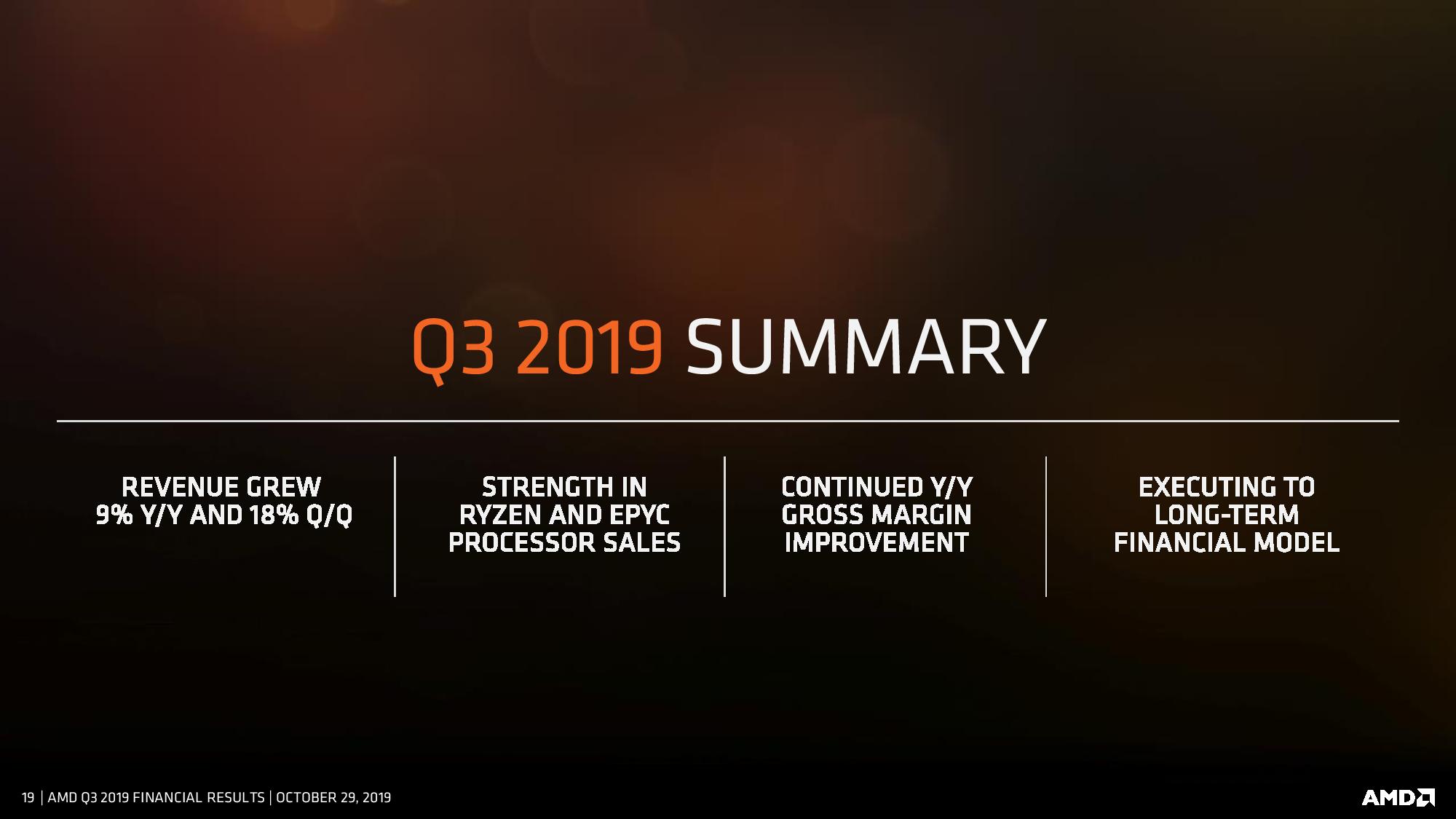

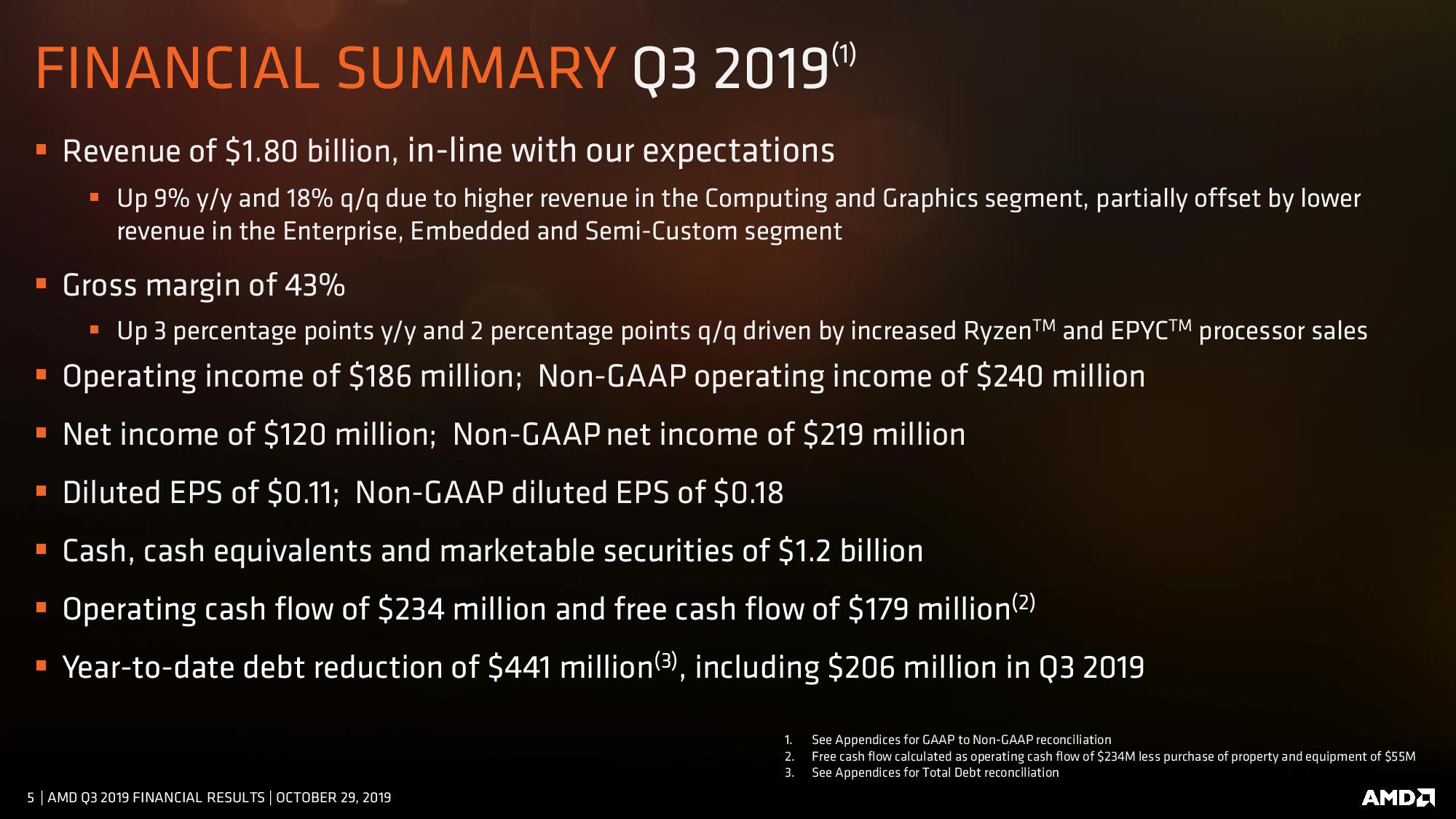

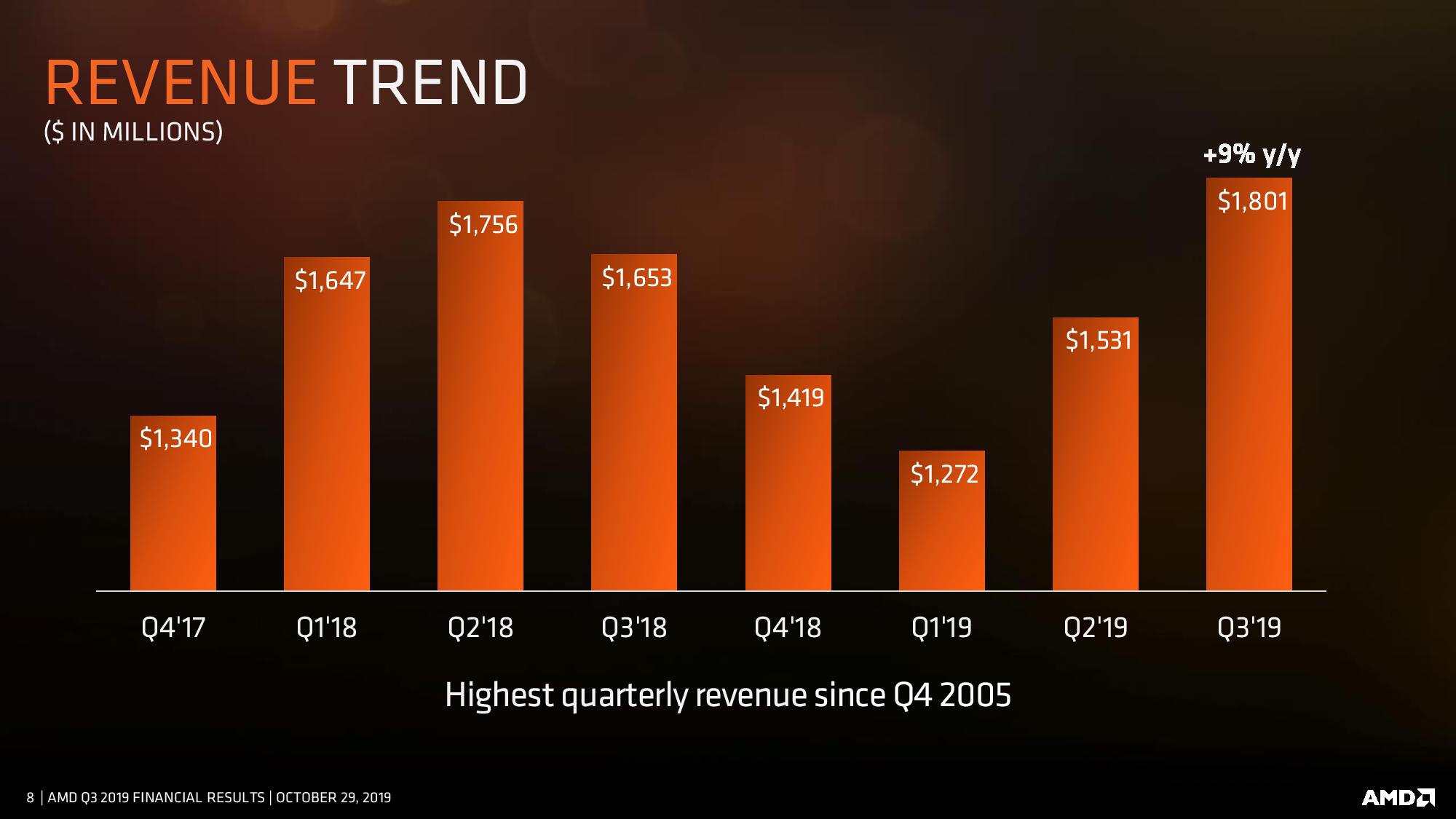

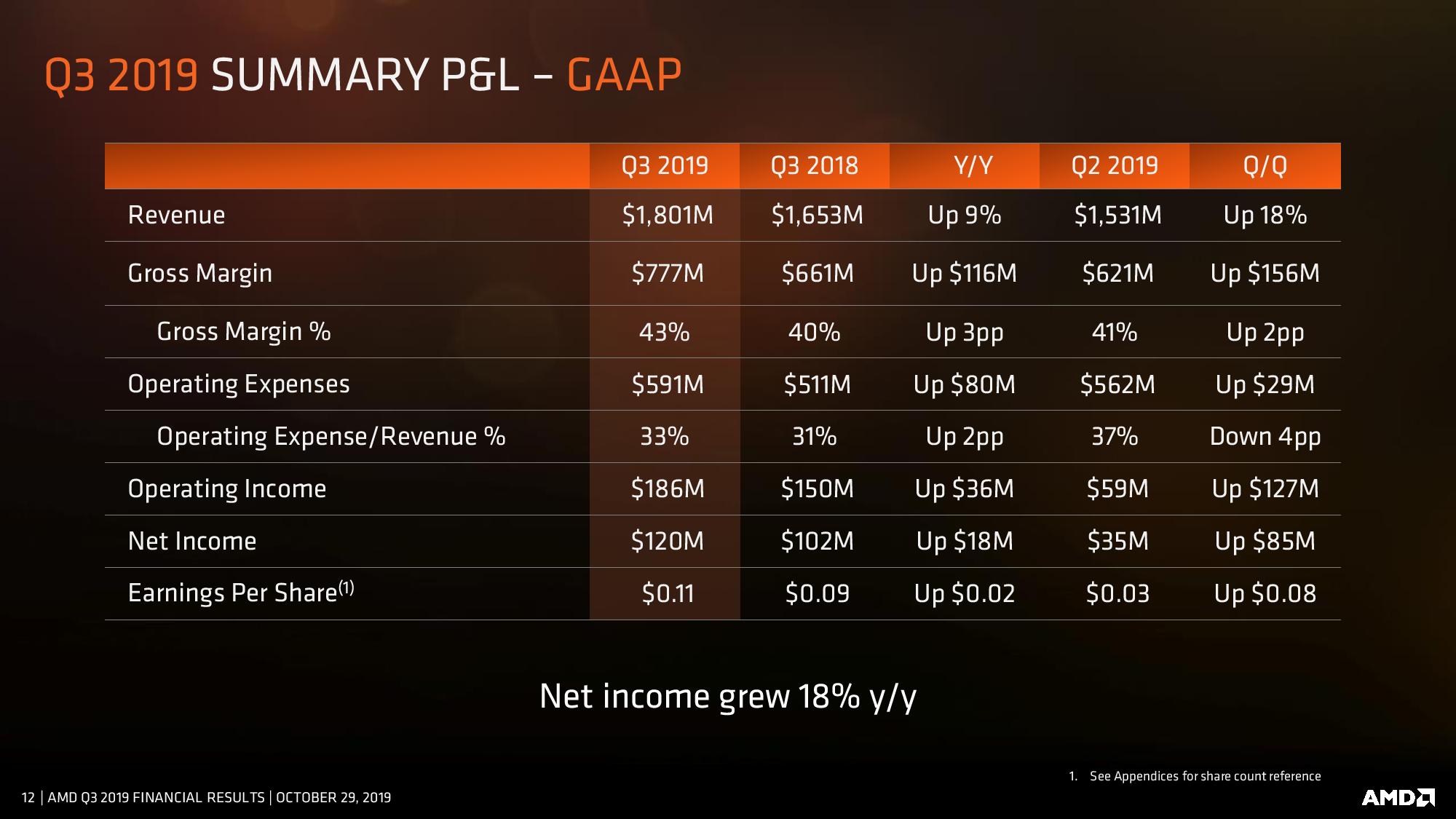

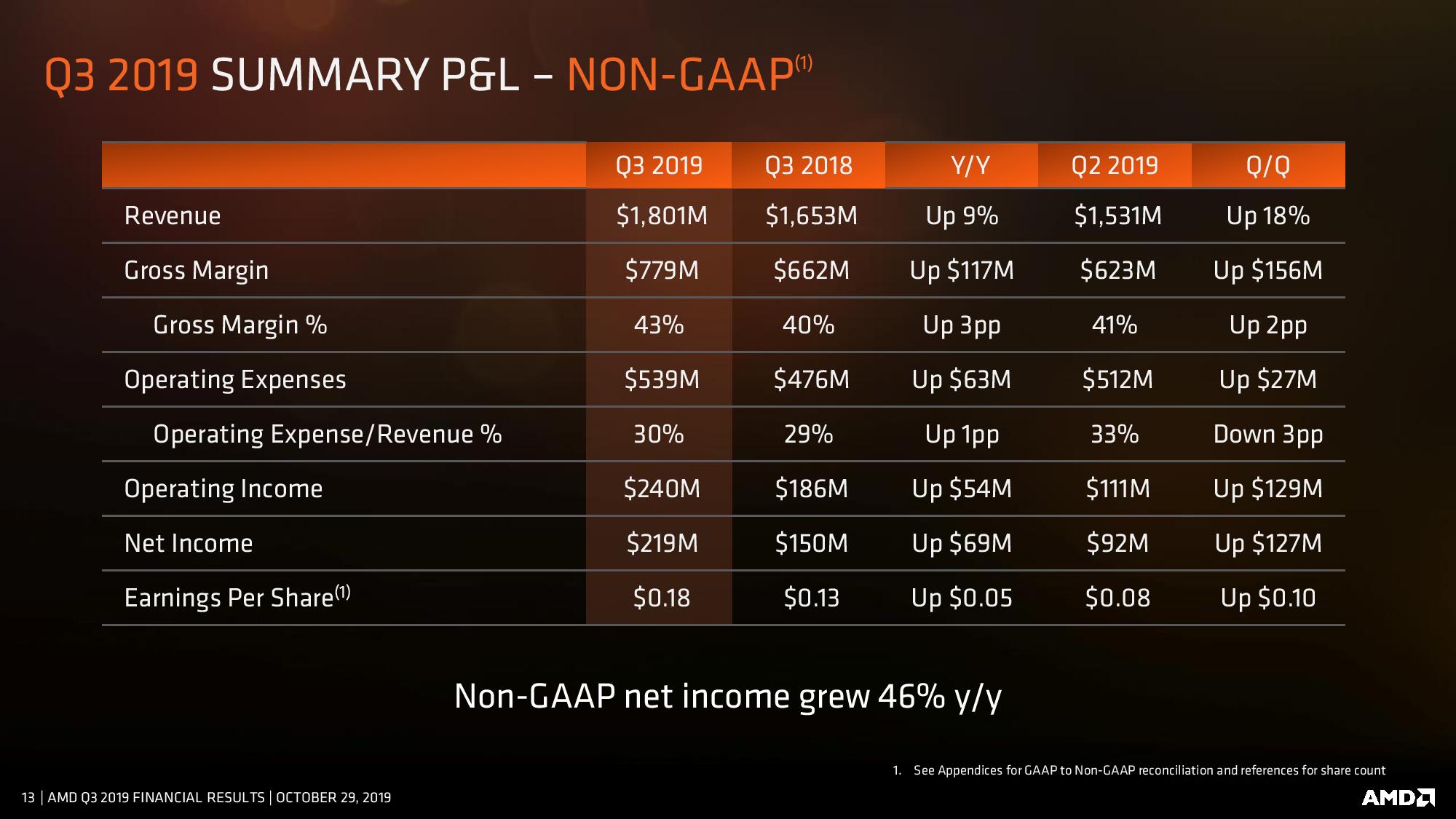

We opined that AMD's last quarterly earnings represented the calm before the 7nm storm, and today that storm made landfall as AMD posted its highest quarterly revenue since 2005 driven by its highest quarterly revenue for client (desktop) PC chips since 2011. Overall, AMD posted $1.8 billion in revenue for its third quarter 2019, a 9% year-over-year and 18% quarterly gain.

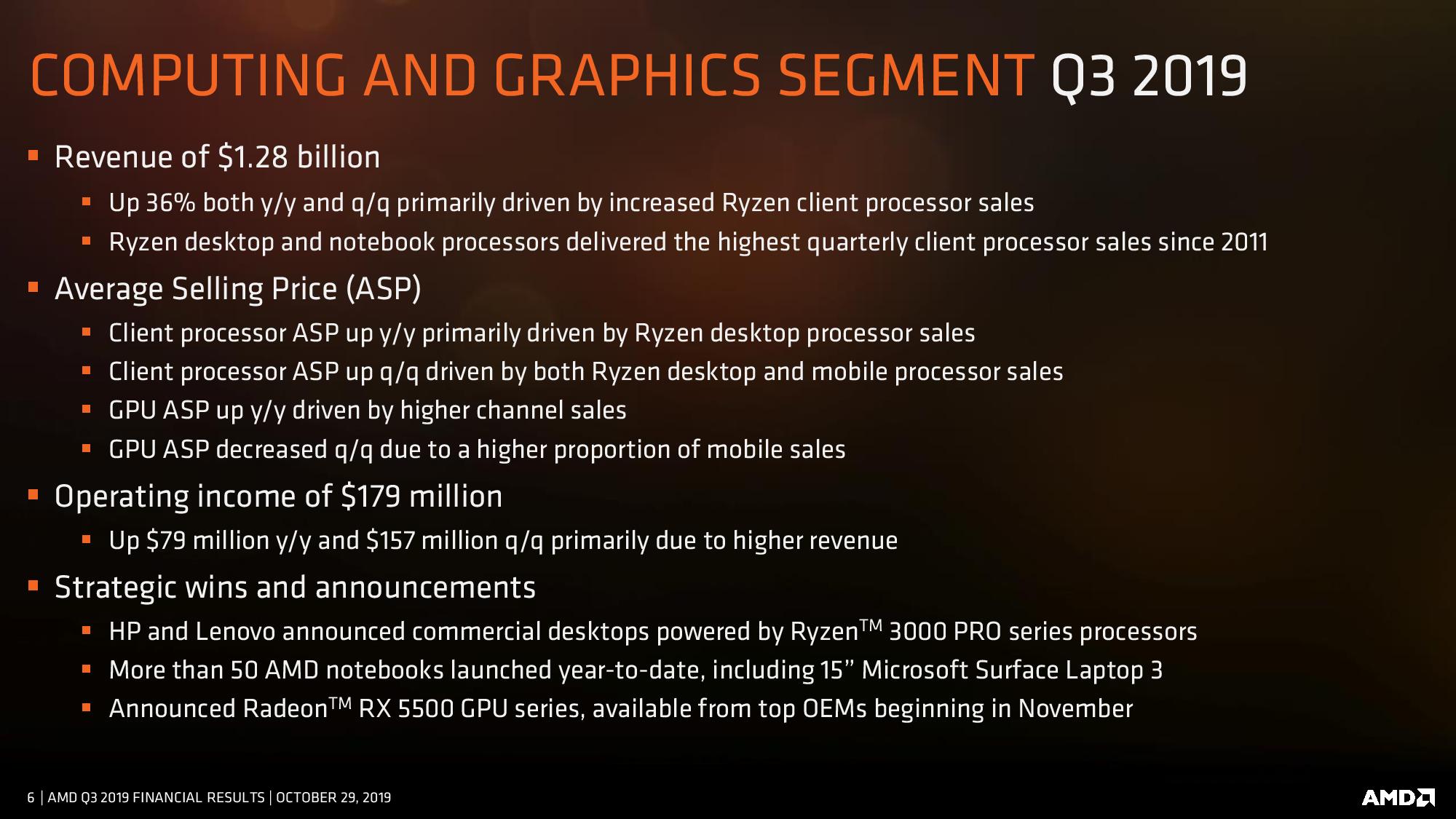

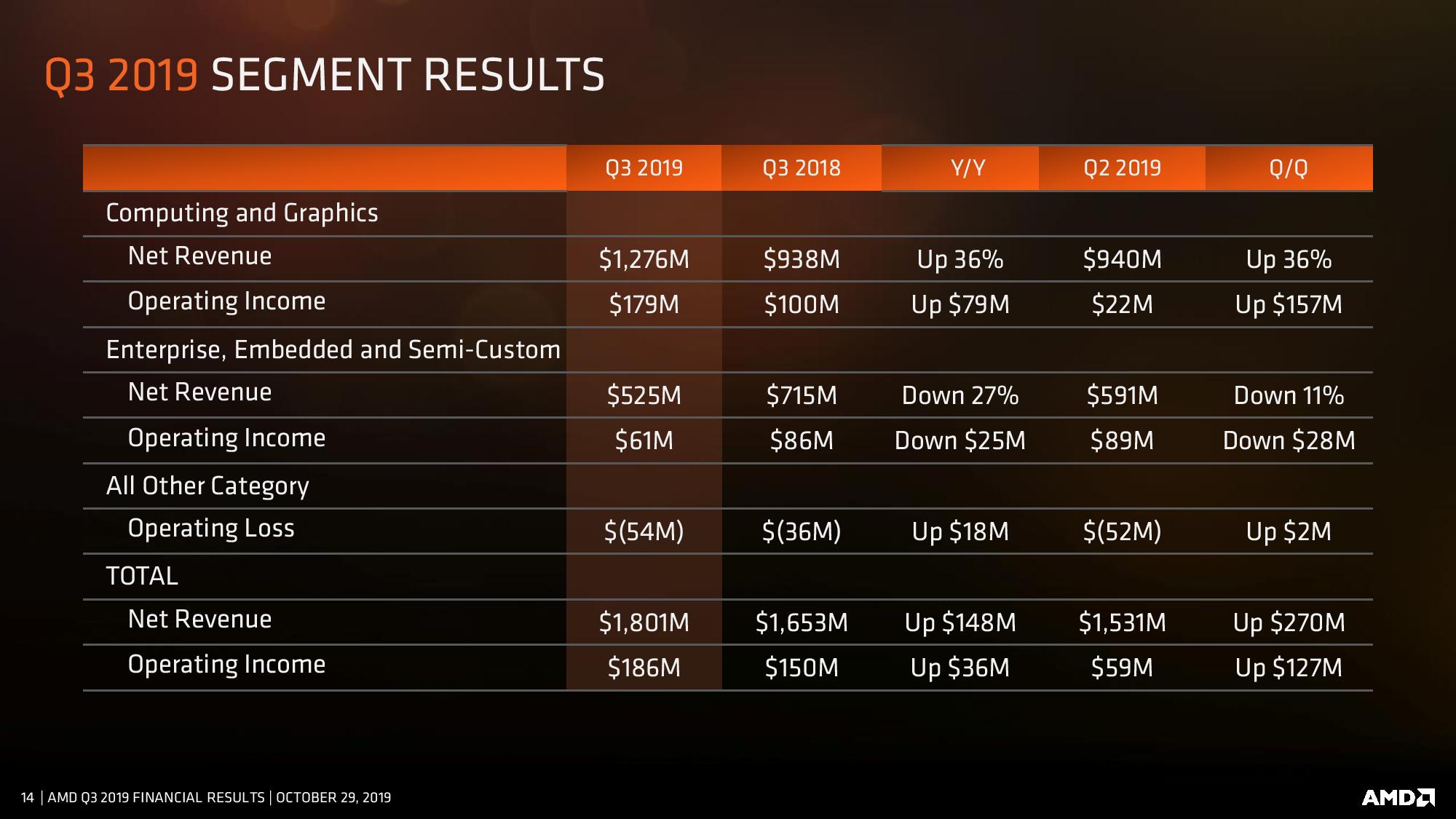

AMD's success in the client desktop segment came as a byproduct of burgeoning sales of its 7nm Ryzen 3000 processors that experienced so much demand the company had difficulties keeping shelves stocked with the most popular models. The strong sales drove AMD's client division to a healthy 36% year-over-year (YoY) increase in revenue, but lingering shortages may have constrained potential growth. AMD's Ryzen processors now command the pricing we'd expect of premium processors, leading to an increase in average selling prices (ASP). AMD also says that it gained more desktop market share during the quarter, marking the eighth straight quarterly increase.

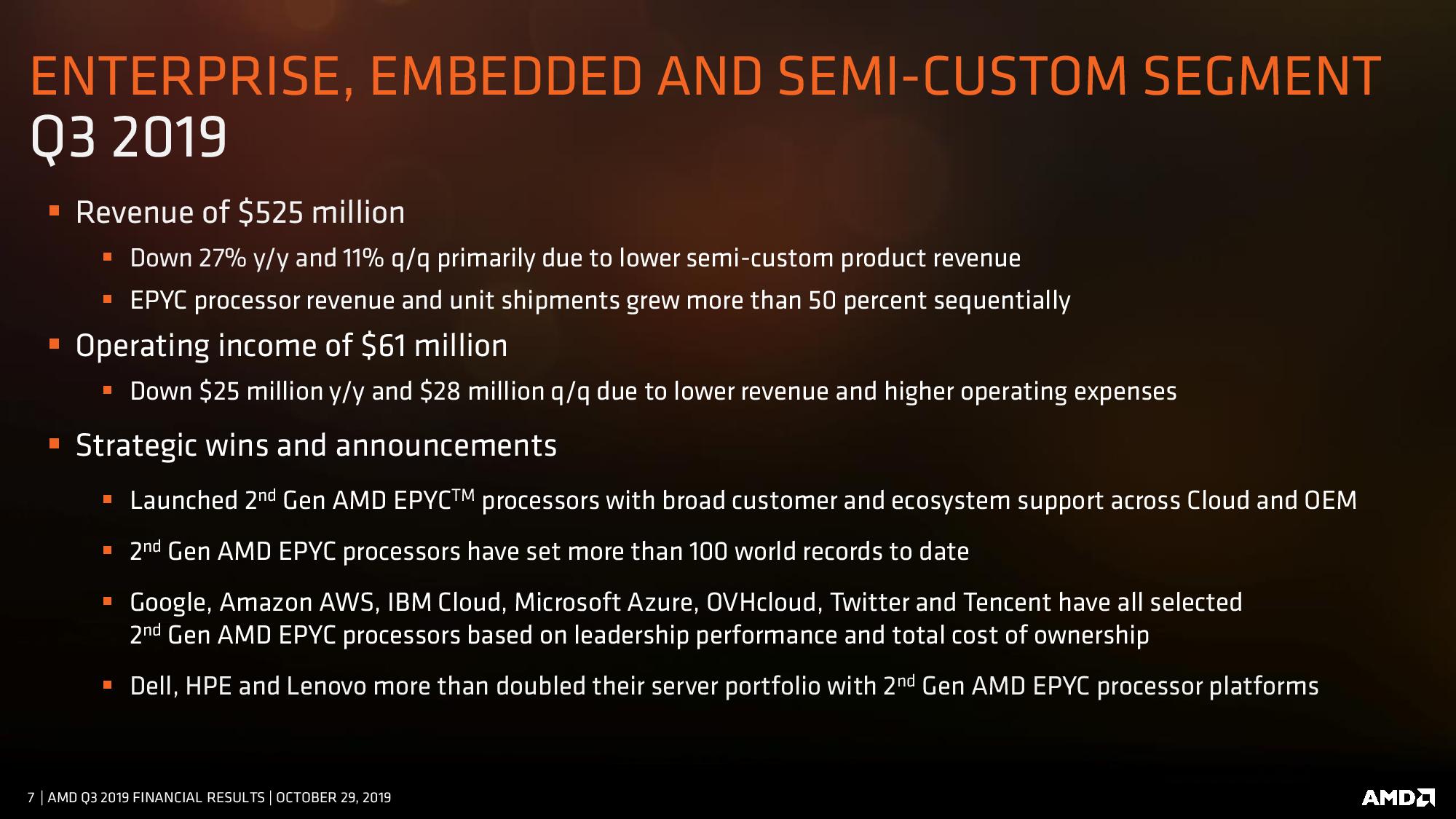

AMD's hotly-anticipated 7nm EPYC Rome processors also finally began shipping in volume, leading to a 50% quarterly increase in EPYC sales. However, lower sales in the company's custom silicon business (i.e., consoles) dragged down sales for the Enterprise, Embedded and Semi-Custom group, masking some of the gains from data center processor sales. Overall, the segment was down 27% YoY and 11% QoQ.

AMD's GPU business is also doing well with the arrival of 7nm Radeon graphics cards that helped fuel a year-over-year rise in average selling prices (ASPs), but AMD chalked up a quarterly decline in GPU ASPs to a higher proportion of mobile sales. AMD disclosed that its data center GPU sales declined, but didn't elaborate.

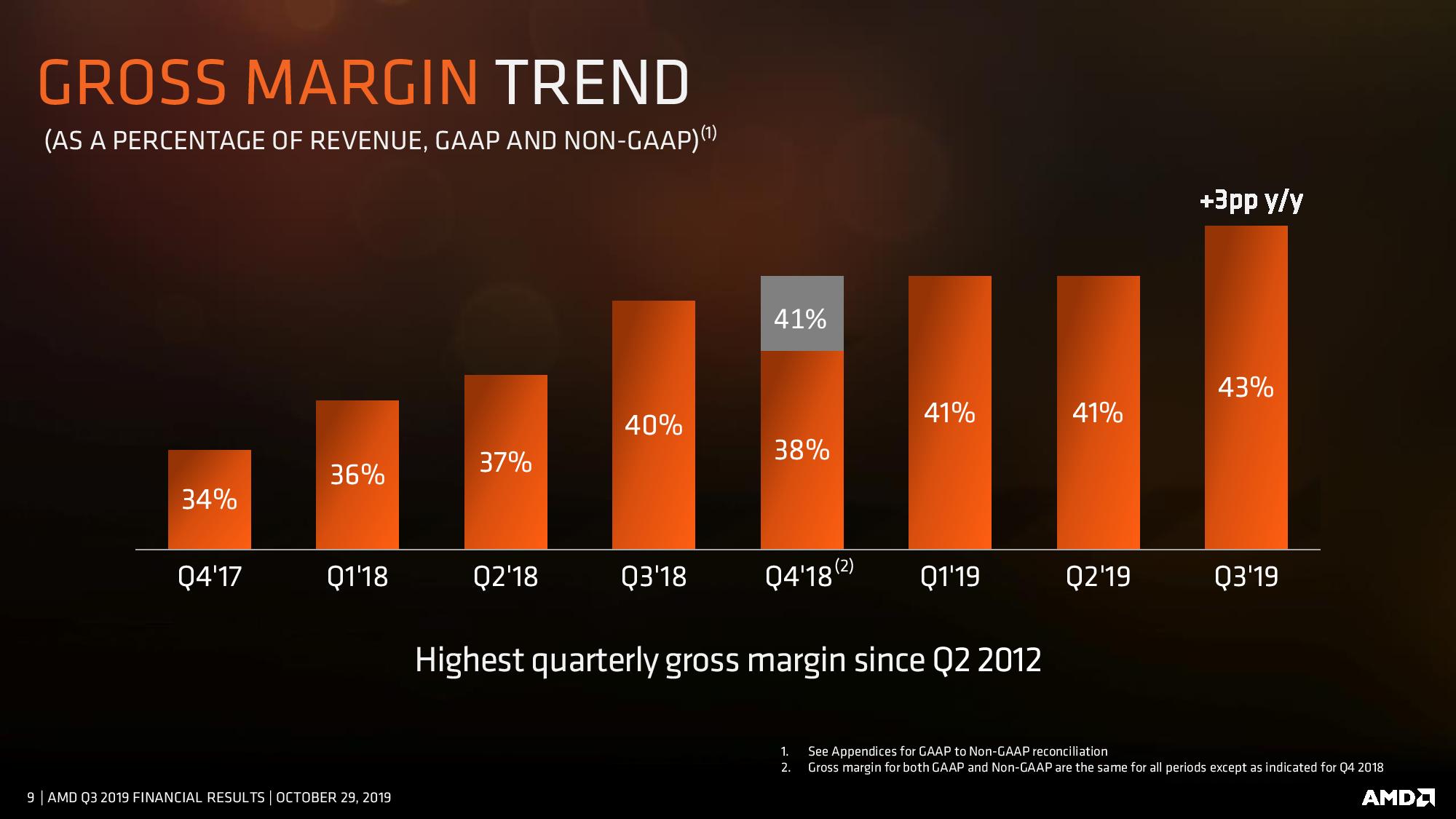

AMD's gross margins also improved to 43%, a 3% YoY gain that were the best since 2012. Profits weighed in at $121 million, an increase of 242%.

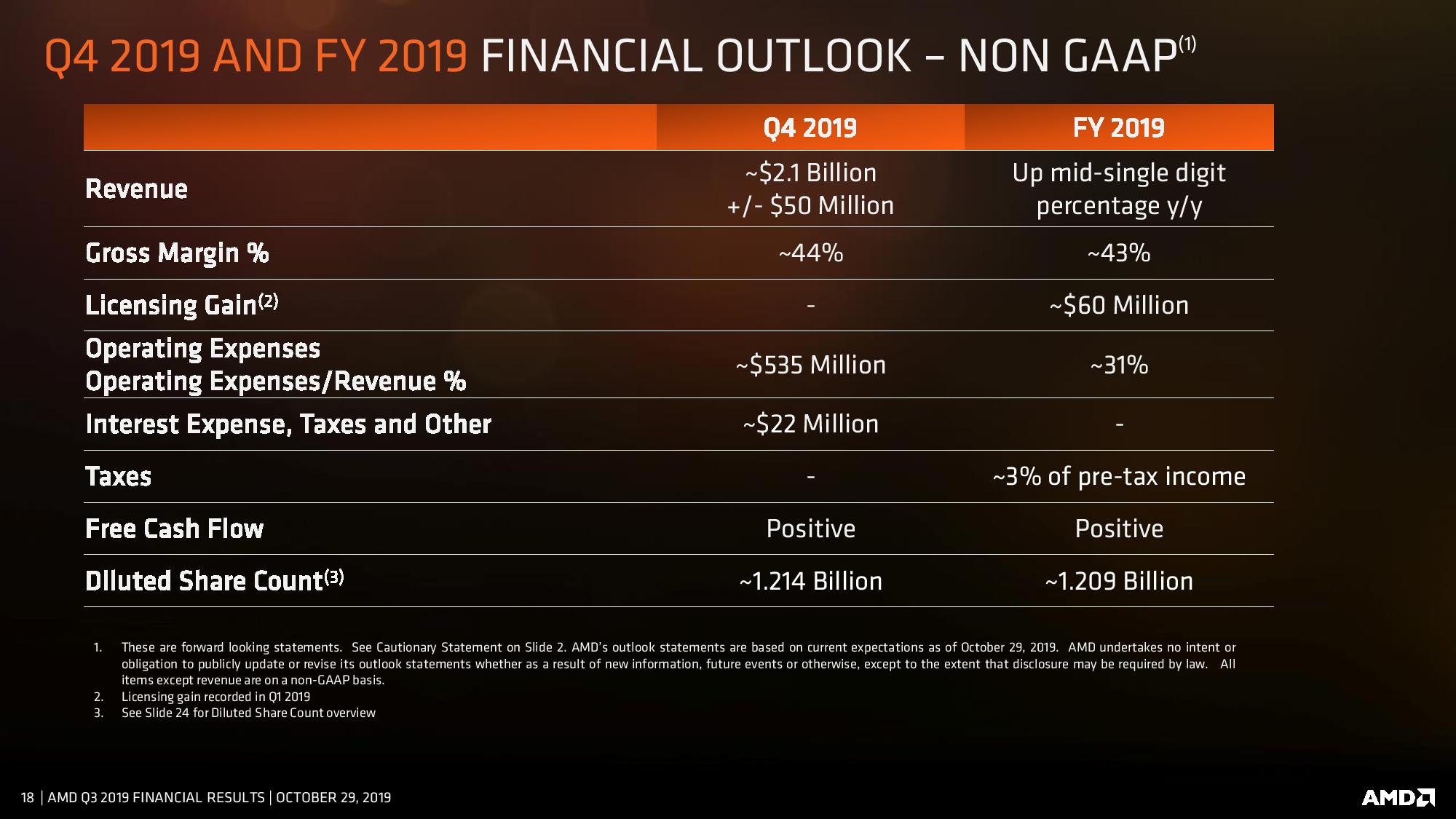

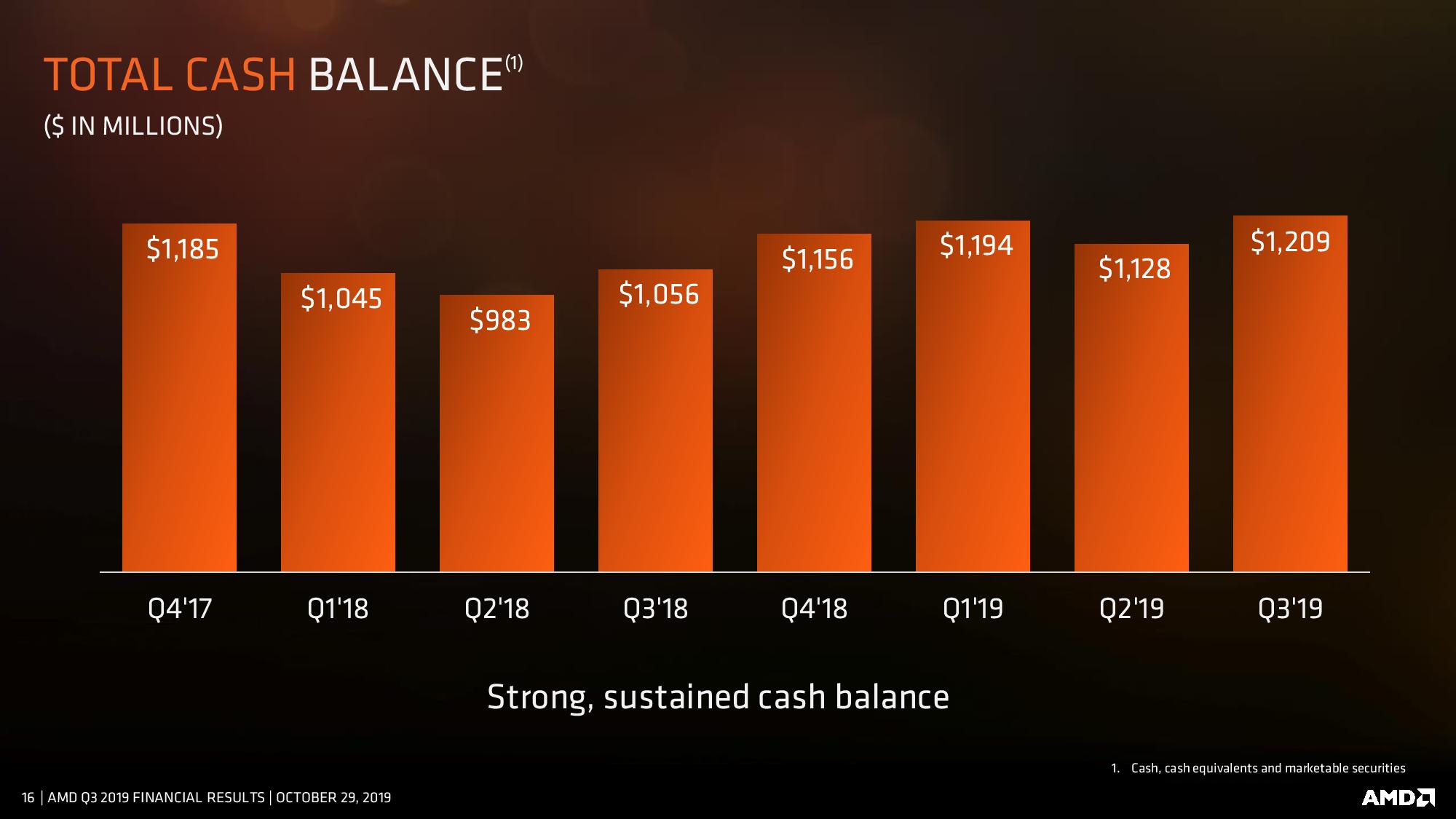

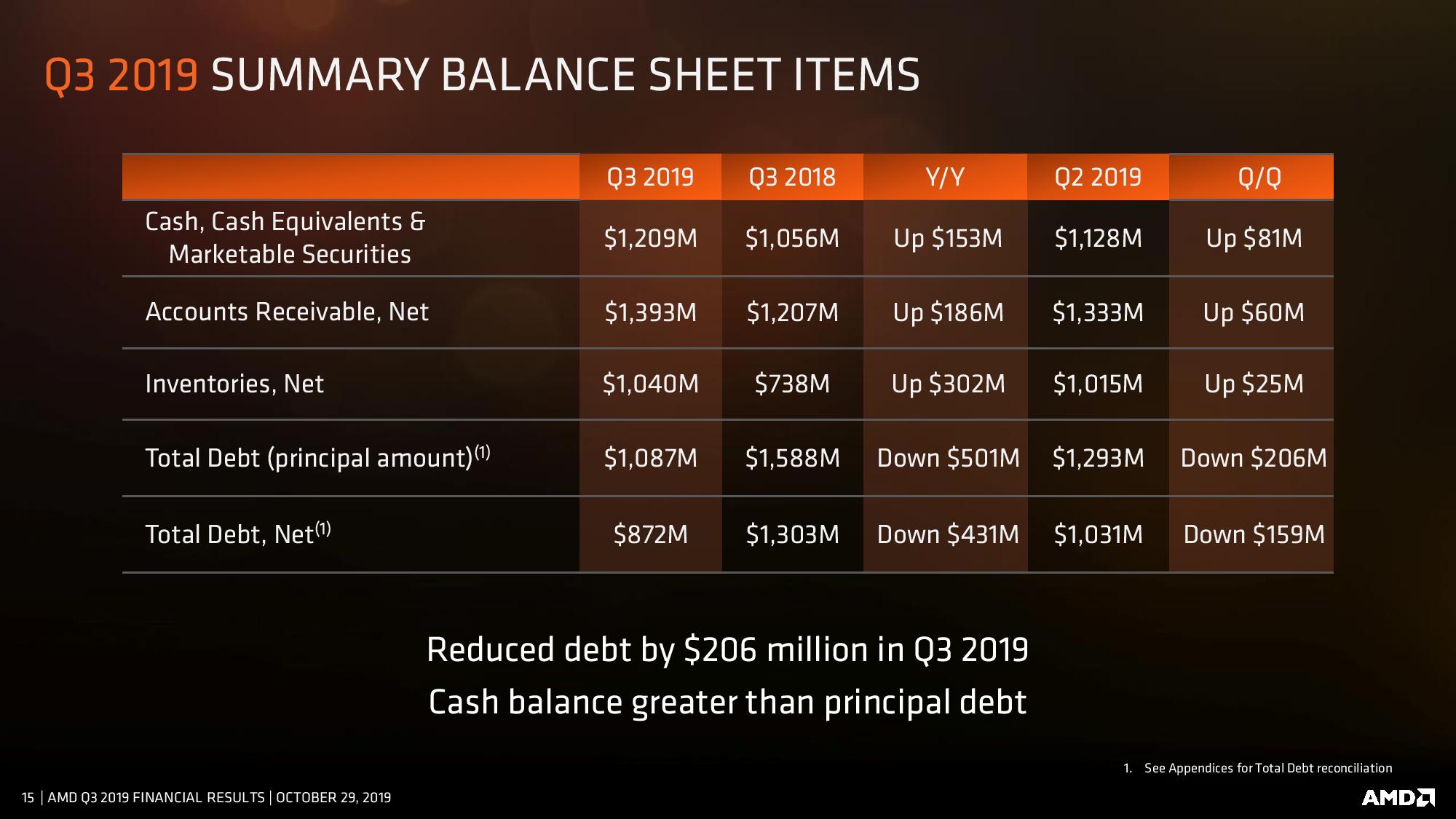

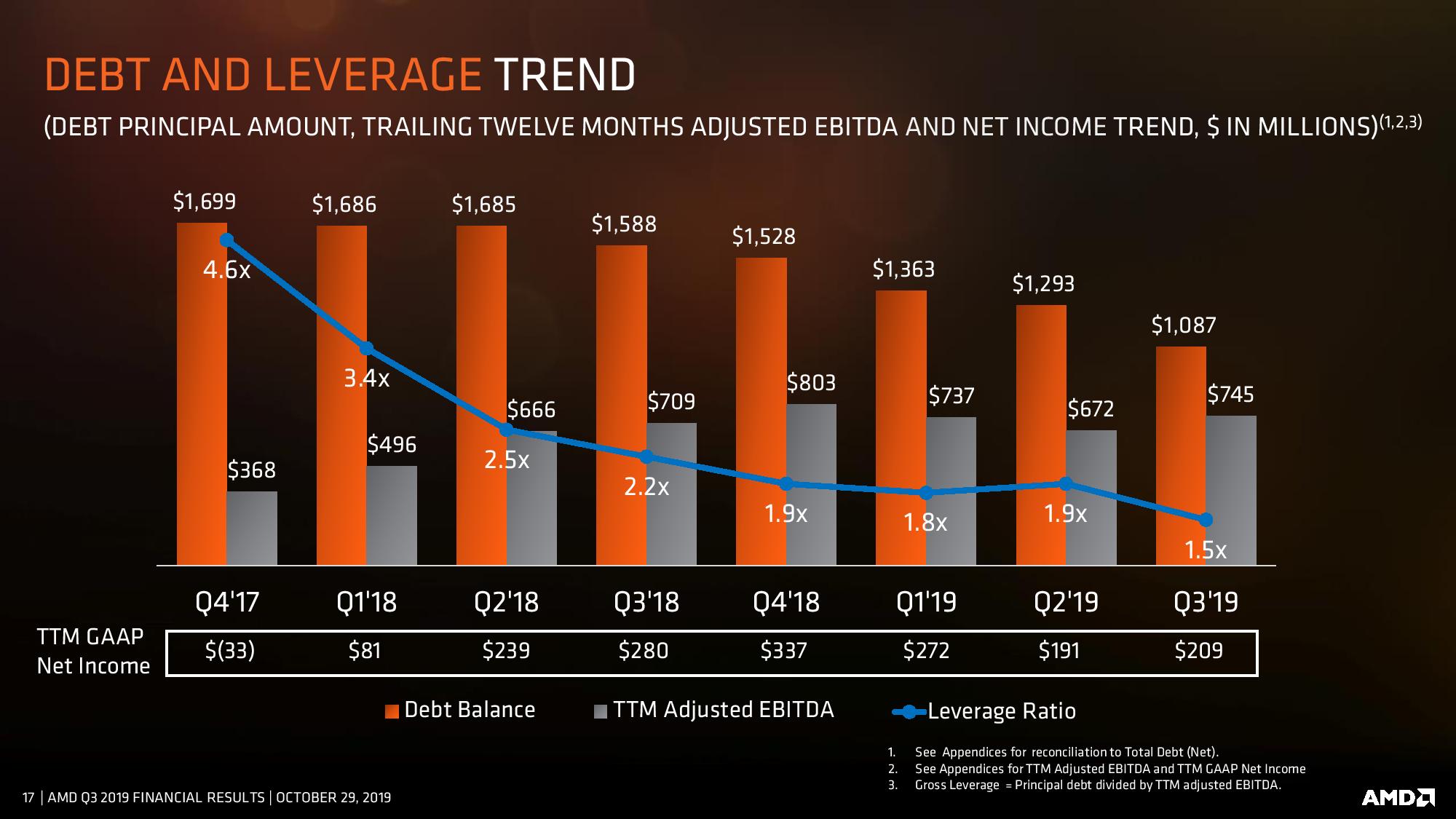

AMD also plans for more explosive gains in the coming quarter, projecting $2.1 billion in revenue, which would represent a 48% YoY and 17% quarterly gain. If AMD can deliver on those projections, it would equate to the highest quarterly revenue in the company's history. AMD also noted that it has reduced debt by $441 million this year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

jimmysmitty Who knew having a decent CPU that brings good competition would allow you to profit.Reply -

kinggremlin Only $120 million net profit on $1.8 billion in revenue? Last quarter Intel made about $67 million a day in net profits. So Intel generated more profits in 2 days than AMD did all quarter.Reply

AMD's Ryzen processors now command the pricing we'd expect of premium processors, leading to an increase in average selling prices (ASP).

No, they don't. As mentioned multiple times in this article, AMD has seen shortages of multiple models which left money on the table. They aren't charging enough. Intel saw 31% net profit last quarter. This "amazing" quarter from AMD saw under 7% net profit. It makes no sense to undercut Intel by so much that you can't meet demand. -

hannibal Intel is Also having shortage, so Intel is Also selling stuff too cheaply...Reply

But yeah... Intel is big, very big. Amd income pales compared to it. Hopefully amd can keep up Many years, because if it does not. Intel starts again pushing prises up... -

digitalgriffin Replykinggremlin said:Only $120 million net profit on $1.8 billion in revenue? Last quarter Intel made about $67 million a day in net profits. So Intel generated more profits in 2 days than AMD did all quarter.

No, they don't. As mentioned multiple times in this article, AMD has seen shortages of multiple models which left money on the table. They aren't charging enough. Intel saw 31% net profit last quarter. This "amazing" quarter from AMD saw under 7% net profit. It makes no sense to undercut Intel by so much that you can't meet demand.

Actually it does. Amd is also fighting a mindset share. Remember the early Lexus? The early Hyundai? They could have charged significantly more but didn't to grab a foot hold. And AMD is saddled by tremendous debt still. So the fact they pulled this off and pulled out of a lot of debt says a lot. The fact intels asp and margin is down also says a lot to investors. Look at amazon. They make squat for margin. Its about reading the tea leaves and where you place your bets. -

kinggremlin Reply

Lexus isn't a company, it's a brand under Toyota. Toyota was making plenty of money and could afford to generate lower profits with Lexus while getting their foot in the luxury market. AMD doesn't have a profitable parent company to absorb the low profit margins they're generating. Early Hyundai's were absolute garbage. That's why they were cheap. It wasn't until about 10 years ago that they started selling desirable vehicles.digitalgriffin said:Actually it does. Amd is also fighting a mindset share. Remember the early Lexus? The early Hyundai? They could have charged significantly more but didn't to grab a foot hold. And AMD is saddled by tremendous debt still. So the fact they pulled this off and pulled out of a lot of debt says a lot. The fact intels asp and margin is down also says a lot to investors. Look at amazon. They make squat for margin. Its about reading the tea leaves and where you place your bets.

Again, AMD saw product shortages. At their current prices, they aren't fighting any mindshare game.

AMD is not in a financial position to start a price war with Intel. They need to maximize profits as much as possible while they have the advantage. Intel pocketed $67million a day last quarter with their lower margins. Their margins can drop magnitudes more before experiencing any affect on their business. -

digitalgriffin Reply

Your completely missing the point.kinggremlin said:Lexus isn't a company, it's a brand under Toyota. Toyota was making plenty of money and could afford to generate lower profits with Lexus while getting their foot in the luxury market. AMD doesn't have a profitable parent company to absorb the low profit margins they're generating. Early Hyundai's were absolute garbage. That's why they were cheap. It wasn't until about 10 years ago that they started selling desirable vehicles.

Again, AMD saw product shortages. At their current prices, they aren't fighting any mindshare game.

AMD is not in a financial position to start a price war with Intel. They need to maximize profits as much as possible while they have the advantage. Intel pocketed $67million a day last quarter with their lower margins. Their margins can drop magnitudes more before experiencing any affect on their business.

They are priced appropriately based on where they are. AMD needs foothold in the server market to claim business victory. 3700/3800/3900 are priced appropriately given competition and AMD's position, the performance, and product stack pricing -

velocityg4 Replykinggremlin said:Lexus isn't a company, it's a brand under Toyota. Toyota was making plenty of money and could afford to generate lower profits with Lexus while getting their foot in the luxury market. AMD doesn't have a profitable parent company to absorb the low profit margins they're generating. Early Hyundai's were absolute garbage. That's why they were cheap. It wasn't until about 10 years ago that they started selling desirable vehicles.

Again, AMD saw product shortages. At their current prices, they aren't fighting any mindshare game.

AMD is not in a financial position to start a price war with Intel. They need to maximize profits as much as possible while they have the advantage. Intel pocketed $67million a day last quarter with their lower margins. Their margins can drop magnitudes more before experiencing any affect on their business.

AMD can't just simply start charging more because they are doing well. They're going to have multi-year contracts with desktop, laptop, server, workstation, &c manufacturers. In order to entice someone like Dell or HP to take a chance at producing more products with AMD inside. They would have to provide them specified pricing levels for however many years was agreed upon. Along with time tables for expected new products.

In turn those companies promise to purchase X number of units from AMD. There will also be contractual details about order increases, penalties, &c .

Whenever it comes time to set a new contract. If the AMD products are still doing well. They'll be in a position to negotiate more favorable terms. -

JamesSneed I believe AMD has the right pricing and approach. The desktop chips are not low balling Intel but the EPYC chips are. AMD is trying to get its foot into the datacenter and as such they simply have to go with razor thin margins. Frankly Intel's 14nm process is still better than TSMC's 7nm when it comes to high end desktop or server CPU's. Until AMD gets on TSMC's 7nm+ node I don't feel AMD's chips deserve a premium and I think the market would agree. If they get ahead on IPC and single threaded performance then they can start charging a premium.Reply -

kinggremlin Reply

If I completey missed your point then your response had zero relevance to my original post.digitalgriffin said:Your completely missing the point.

They are priced appropriately based on where they are. AMD needs foothold in the server market to claim business victory. 3700/3800/3900 are priced appropriately given competition and AMD's position, the performance, and product stack pricing -

kinggremlin Reply

No. They can charge more because they have a better product to sell. Your contract speil makes no sense. Zen 3000 CPU's were officially released in July. The price for those cpu's was not agreed upon 2 years ago. AMD is not locked into any pricing structure before the product is finalized unless it is a custom chip for a specific company like the apu in a video game console.velocityg4 said:AMD can't just simply start charging more because they are doing well. They're going to have multi-year contracts with desktop, laptop, server, workstation, &c manufacturers. In order to entice someone like Dell or HP to take a chance at producing more products with AMD inside. They would have to provide them specified pricing levels for however many years was agreed upon. Along with time tables for expected new products.