AMD CEO downplays PC memory crunch, saying 'our focus areas are enterprise' — company wants to focus on growing 'higher-end of the market'

AMD expects its PC business to grow this year, but also expects the market overall to shrink.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

AMD's CEO Dr. Lisa Su expects AMD to continuing growing its PC business in 2026, despite a crunch of component pricing that the company believes will shrink the PC market overall. In a response on memory pricing in the client segment, Su said, "Our focus areas are enterprise... and just continuing to grow at the premium, you know, higher-end of the market."

Memory prices (and more recently SSD prices) have presented a significant hurdle for building a new PC, and despite prices starting to level-off, there's no sign of prices dropping any time soon. Given these pressures, AMD says it expects the PC market to shrink overall in 2026.

"Even in that environment, with the PC market down, we believe we can grow our PC business," said Su. "I think the PC market is an important market. Based on everything we're seeing today, we're probably seeing the PC [Total Addressable Market] down a bit."

Earlier in the year, AMD executives hinted at relaunching older Zen 3-based CPUs to combat memory shortages, allowing builders with existing DDR4 to upgrade. Su's comments echo what another AMD executive shared earlier in the year, however, with AMD's Rahul Tikoo telling Tom's Hardware, "We don’t see an issue there other than, you know, tightness leads to higher prices, eventually... I'm not seeing any impact to our business this year."

Memory prices continue to be orders of magnitude higher than they were just a few months ago. In our tracking of RAM pricing, we've seen many kits quadruple in price compared to lowest-ever prices, and many kits at least triple in price compared to September 2025.

AMD's enterprise business now represents its largest business segment, despite more growth year-over-year in its client and gaming business. During the call, Su also hinted at a next-gen Xbox launching in 2027.

AMD Q4 2025 and Full Year Financial Results

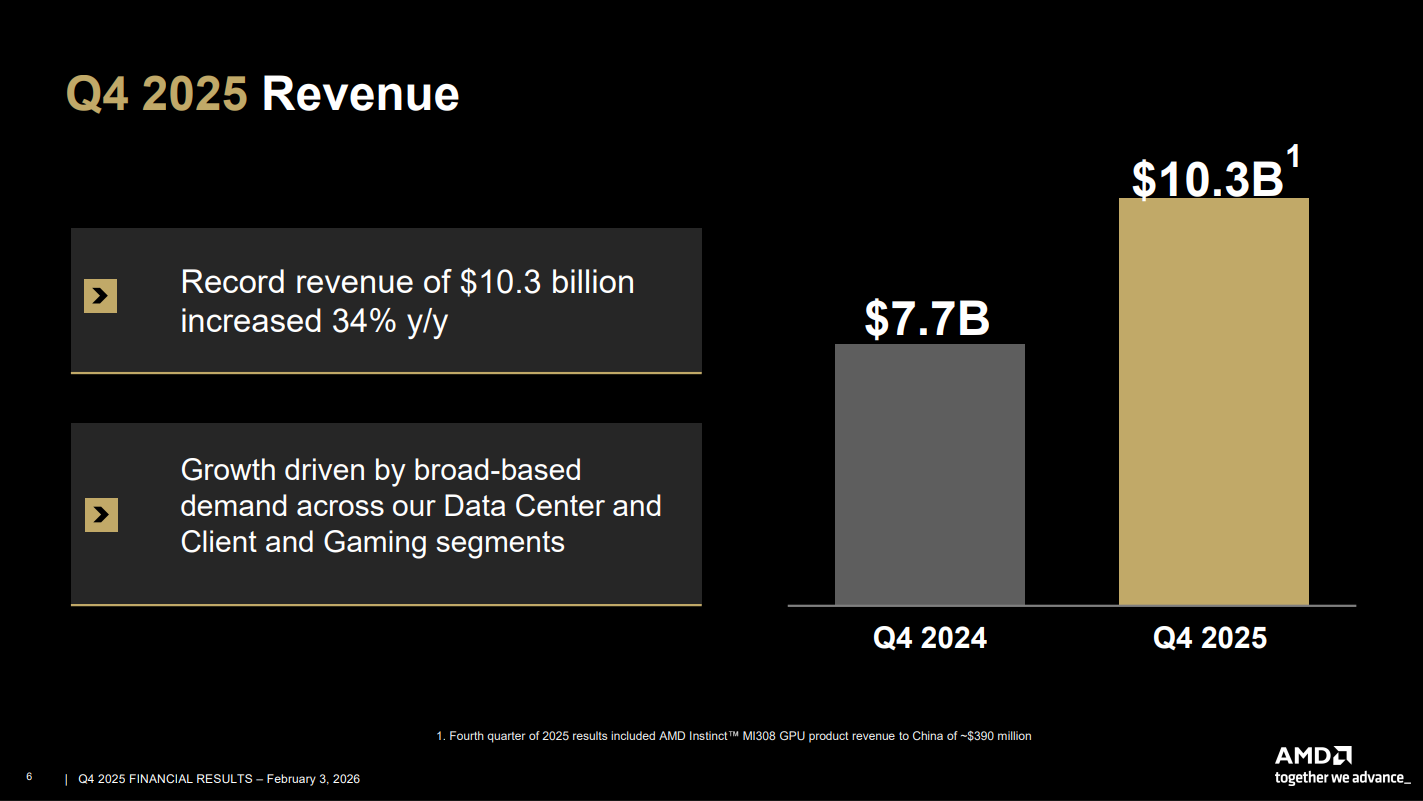

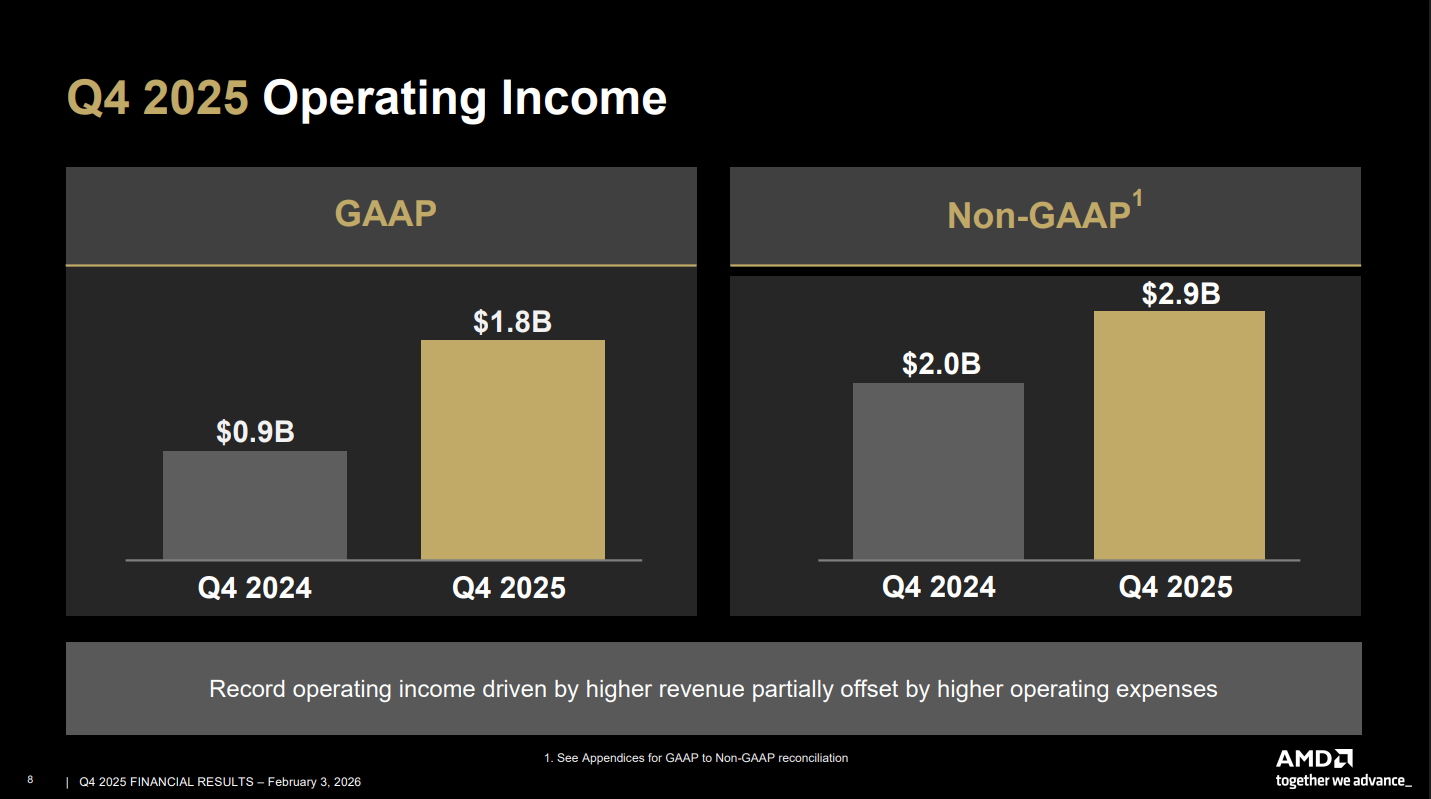

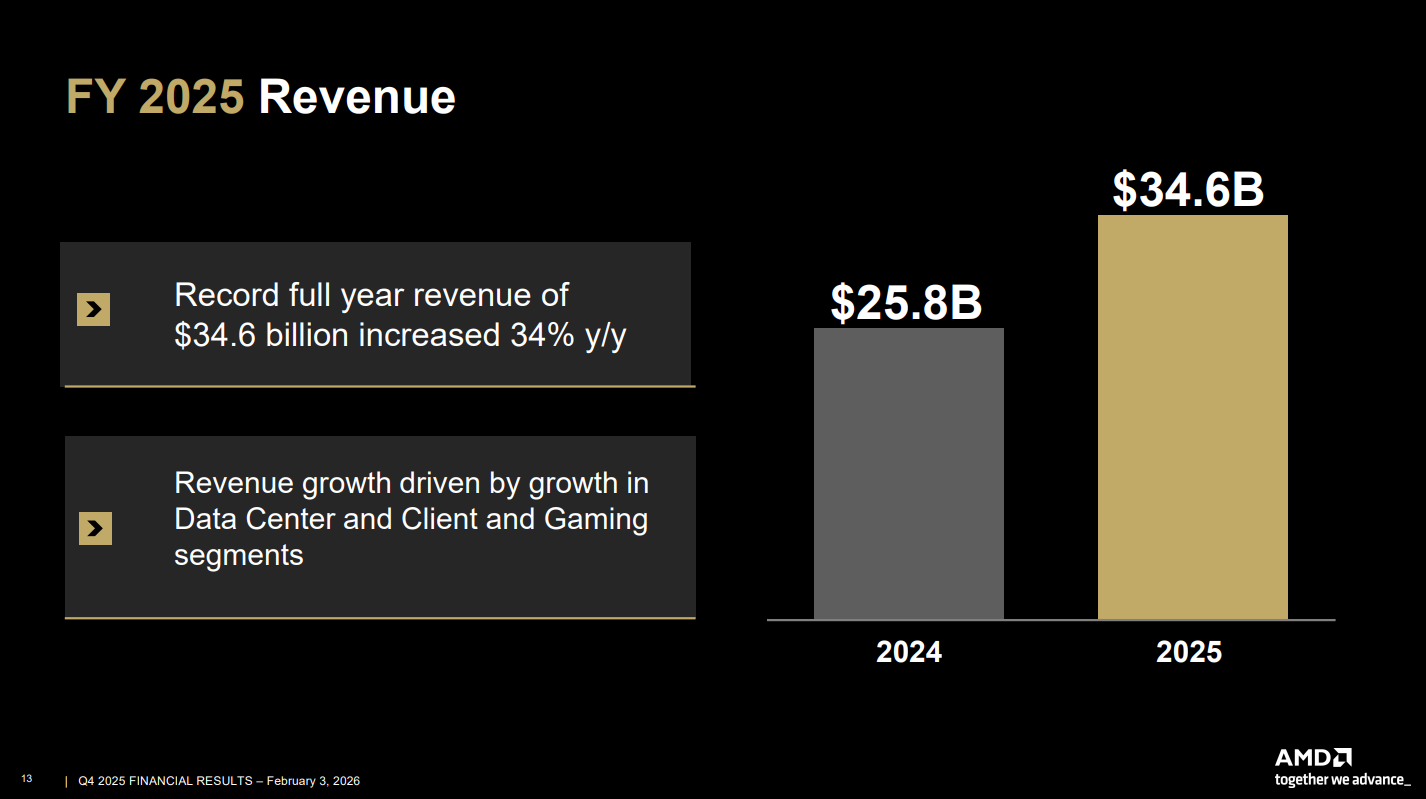

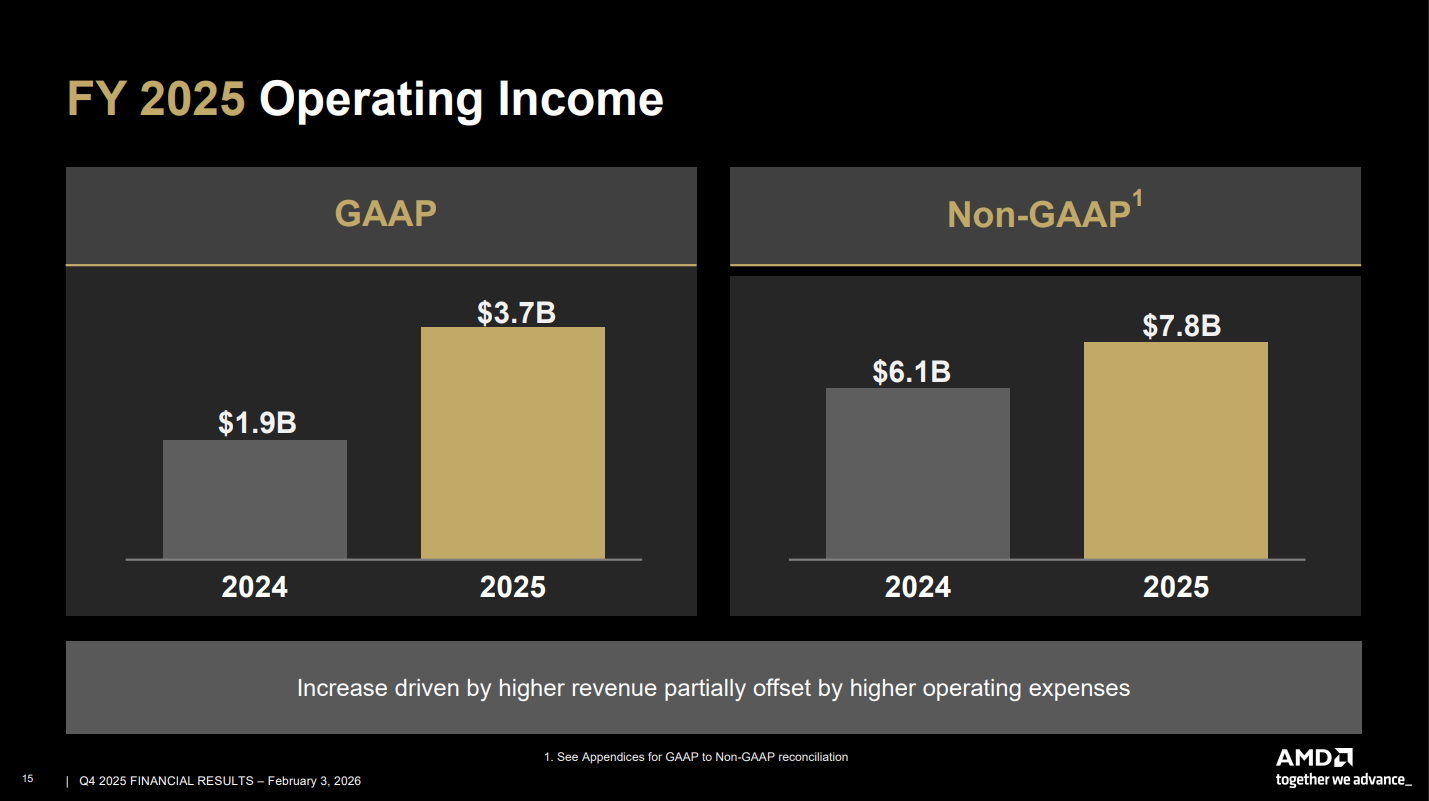

Overall, AMD brought in $10.3 billion in revenue for the quarter, up 34% year-over-year, bringing revenue for the full year up to $34.6 billion. The results include $440 million in inventory of Instinct MI308 accelerators, approximately $360 million worth of which was released from export control. For the fourth quarter, AMD says its total MI308 revenue for sales to China was approximately $390 million.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

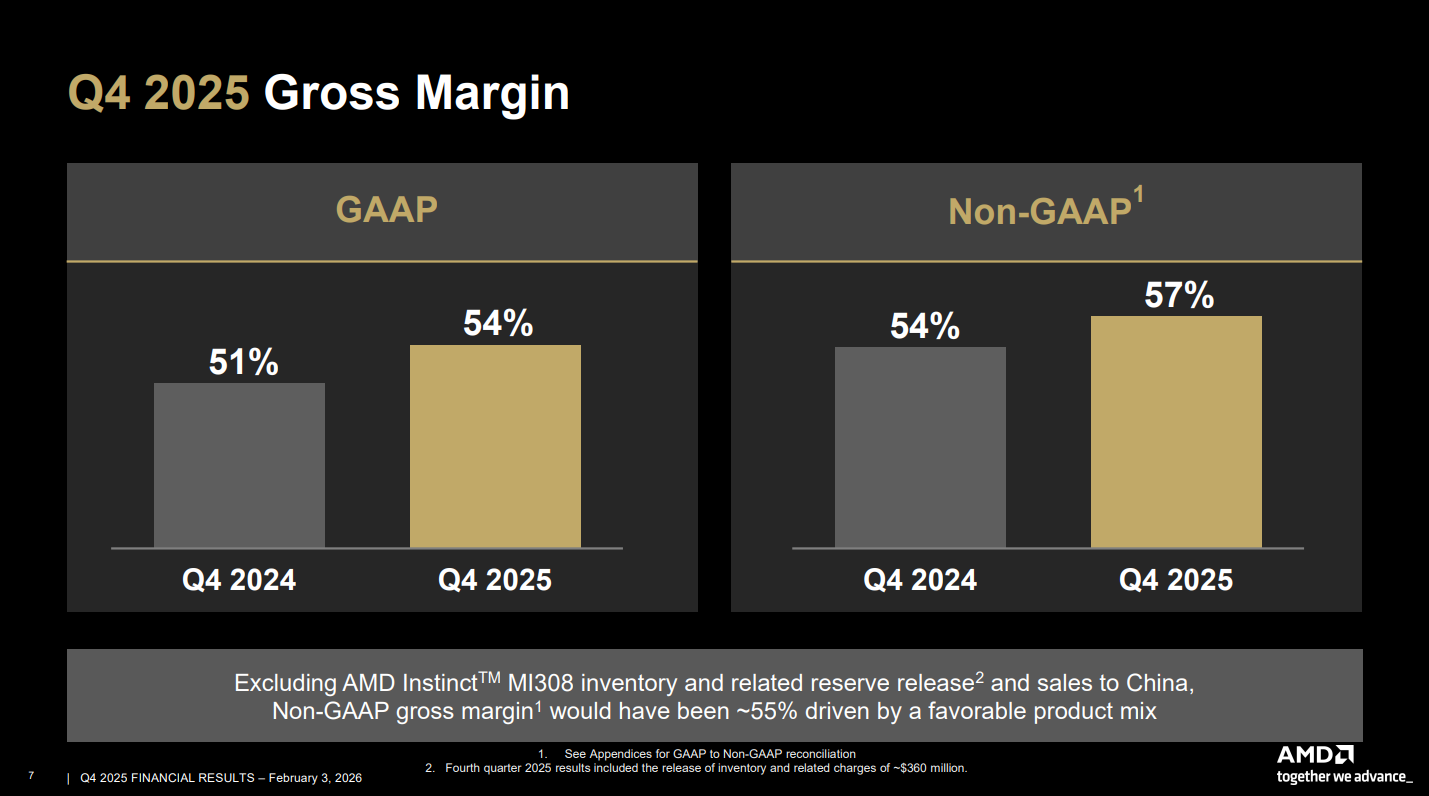

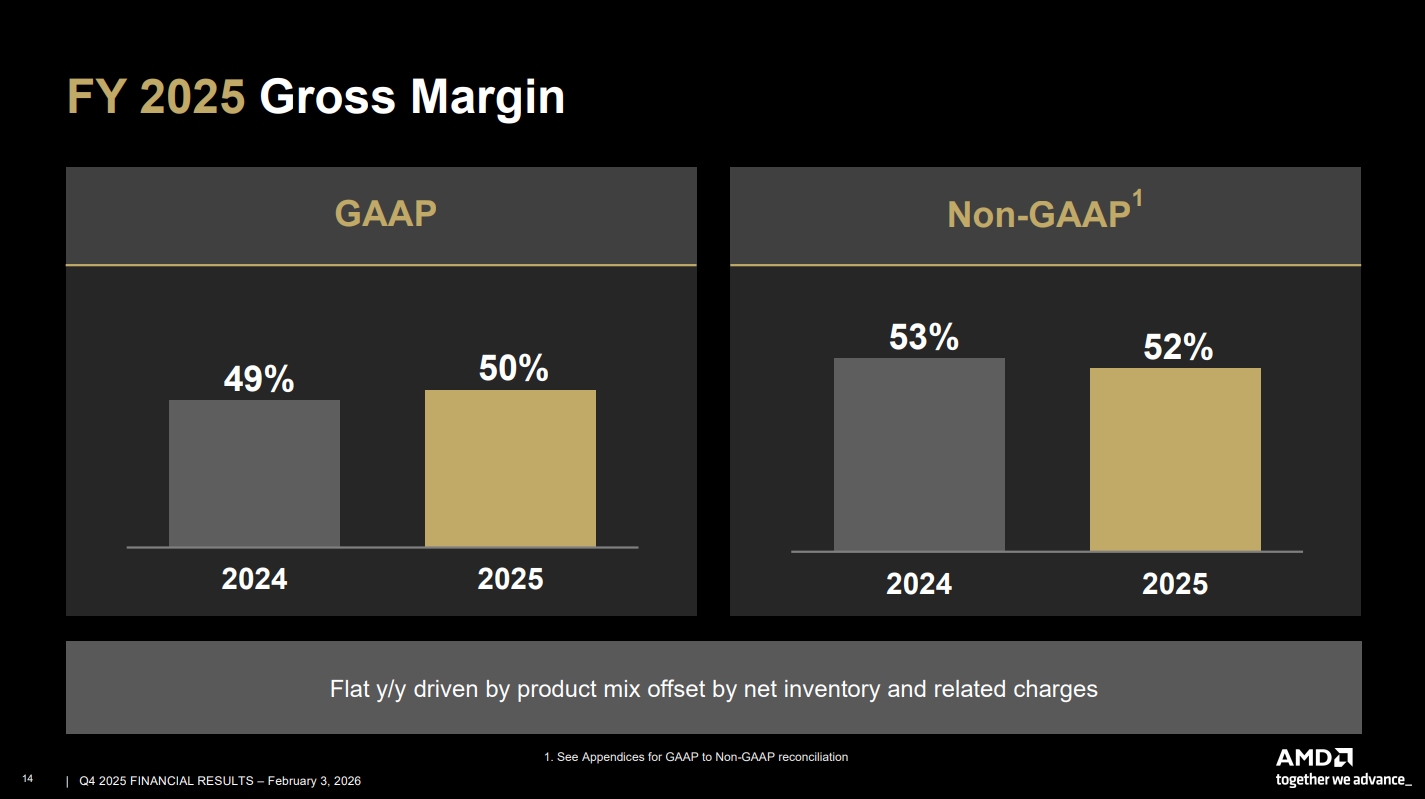

For the quarter, AMD had a gross margin of 54% and net income of $1.5 billion. For the full year, AMD's gross margin was 52% on a non-GAAP basis with a net income of $6.8 billion.

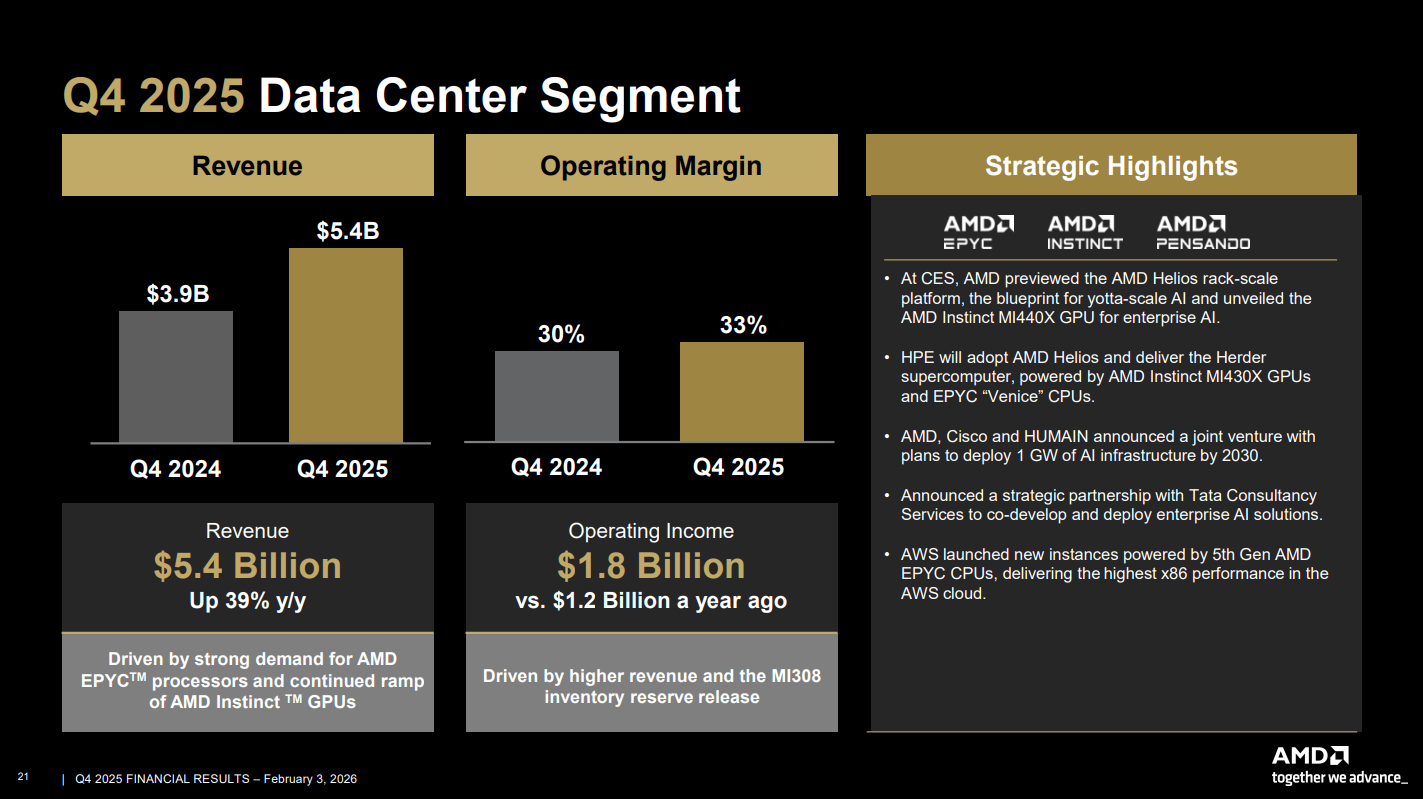

AMD's data center segment now represents its largest business. For the quarter, AMD reported $5.4 billion in revenue, up 39% year-over-year, and full year revenue of $16.6 billion, up 32% year-over-year. Although AMD continues to grow its data center business, it's still significantly behind Nvidia in overall revenue. Nvidia posted $51.2 billion for its data center business in its most recent earnings, showing 66% growth year-over-year.

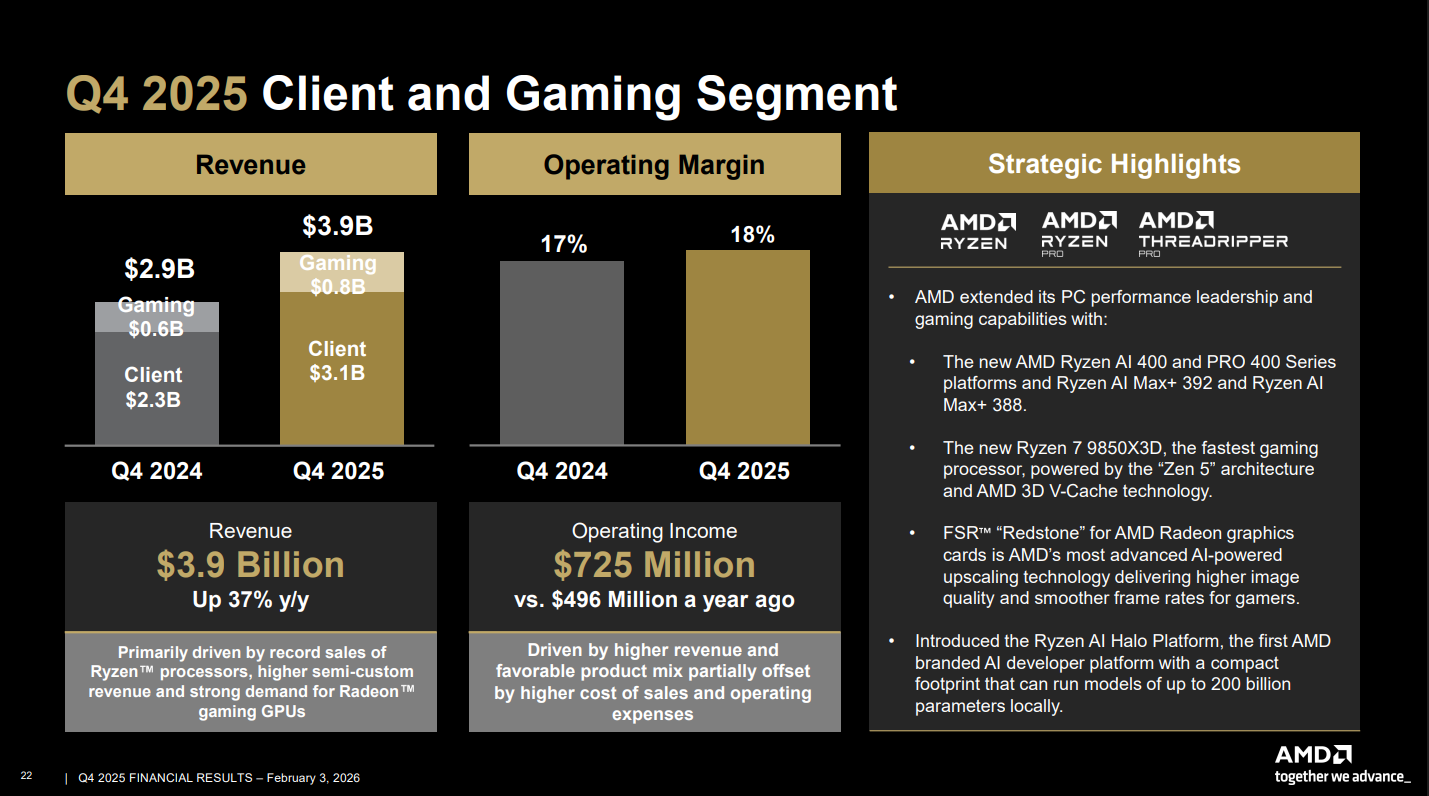

Growth in AMD's client and gaming business was slightly lower, posting $3.9 billion for the quarter which represents 37% growth year-over-year. For the full year, the segment brought in $14.6 billion, which actually shows more growth than the data center segment; it's up 51% year-over-year.

Especially interesting are the gaming-only numbers. AMD says gaming brought in $843 million for the quarter, which is a 50% increase year-over-year. Gaming only represents AMD's semi-custom business for consoles like the PlayStation 5 and handhelds like the Steam Deck, along with Radeon GPUs. Ryzen CPUs fall under the client segment.

AMD maintained gaming revenue above $1 billion for multiple years before seeing a sharp decline in segment revenue in 2024. Although the revenue is up significantly for the quarter, it's still a far cry from AMD's peaks in 2022 and 2023. AMD attributes the increase to higher semi-custom revenue, perhaps with the proliferation of handhelds, and demand for Radeon GPUs. The latter point is particular saliant, as recent AMD GPUs like the RX 9070 XT haven't seen the same sharp price increases and lack of availability as Nvidia's GPUs.

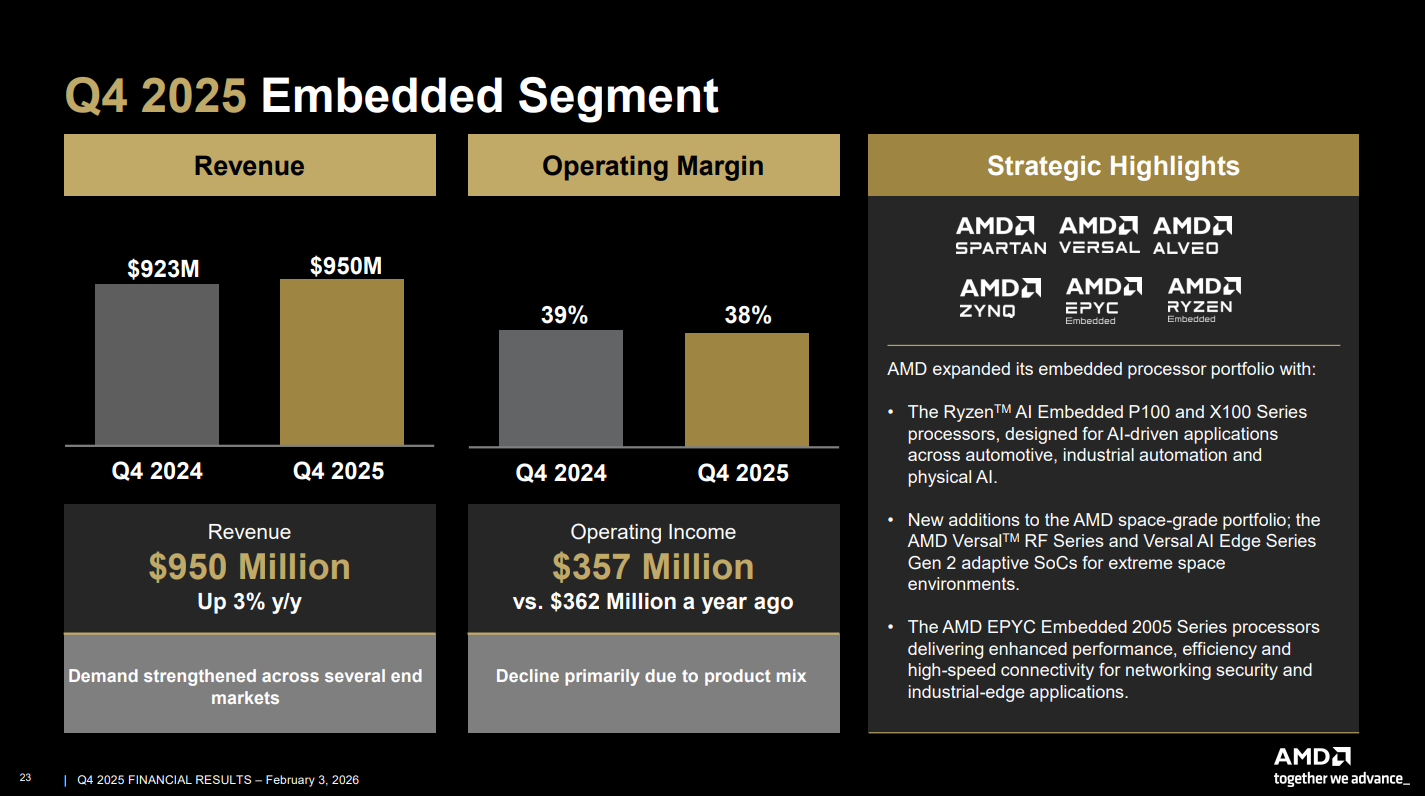

AMD's embedded segment remains its smallest business, with $950 million in revenue for the quarter, up 3% year-over-year. Despite a small improvement for the quarter, AMD's embedded revenue is down 3% for the full year, with full year revenue of $3.5 billion.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Jake Roach is the Senior CPU Analyst at Tom’s Hardware, writing reviews, news, and features about the latest consumer and workstation processors.

-

logainofhades In other words screw those that propped you up when you were almost bankrupt. This is why fanboys that shill for a big company that could care less about them, is always so amusing.Reply -

timsSOFTWARE And what happens when the market turns?Reply

I'm not anti-AI, but I think profits are going to be hard to come by, in both the short and long-term. It's important, but it's a bit like discovering algebra - though fundamental, who gets rich off of the existence of algebra? -

umeng2002_2 AMD was never consumer focused with GPUs, anyways. Just kept the light on at Radeon to remain competitive with SoCs and software support for said SOCs and with Compute IP blocks.Reply -

_Shatta_AD_ PC business growing while the PC market shrinks can only mean one thing, higher per unit prices for the consumer with higher profit margins because they’re selling legacy components as new products which cost them far less to produce on a mature process.Reply

Heck, they’ll probably start selling Bulldozer CPUs and 990FX motherboards at budget AM5 prices soon and smaller fabs will probably restart DDR3 production in 2026. Makes my blood boil everytime an executive have the audacity to announce they don’t give af about consumers cause we can and will buy obsolete tech and they’ll still make good money.