JP Morgan says Nvidia is gearing up to sell entire AI servers instead of just AI GPUs and components — Jensen's master plan of vertical integration will boost Nvidia profits, purportedly starting with Vera Rubin

Higher supply chain consolidation under Nvidia?

The launch of Nvidia's Vera Rubin platform for AI and HPC next year could mark significant changes in the AI hardware supply chain as Nvidia plans to ship its partners fully assembled Level-10 (L10) VR200 compute trays with all compute hardware, cooling systems, and interfaces pre-installed, according to J.P. Morgan (via @Jukanlosreve). The move would leave major ODMs with very little design or integration work, making their lives easier, but would also trim their margins in favor of Nvidia's. The information remains unofficial at this stage.

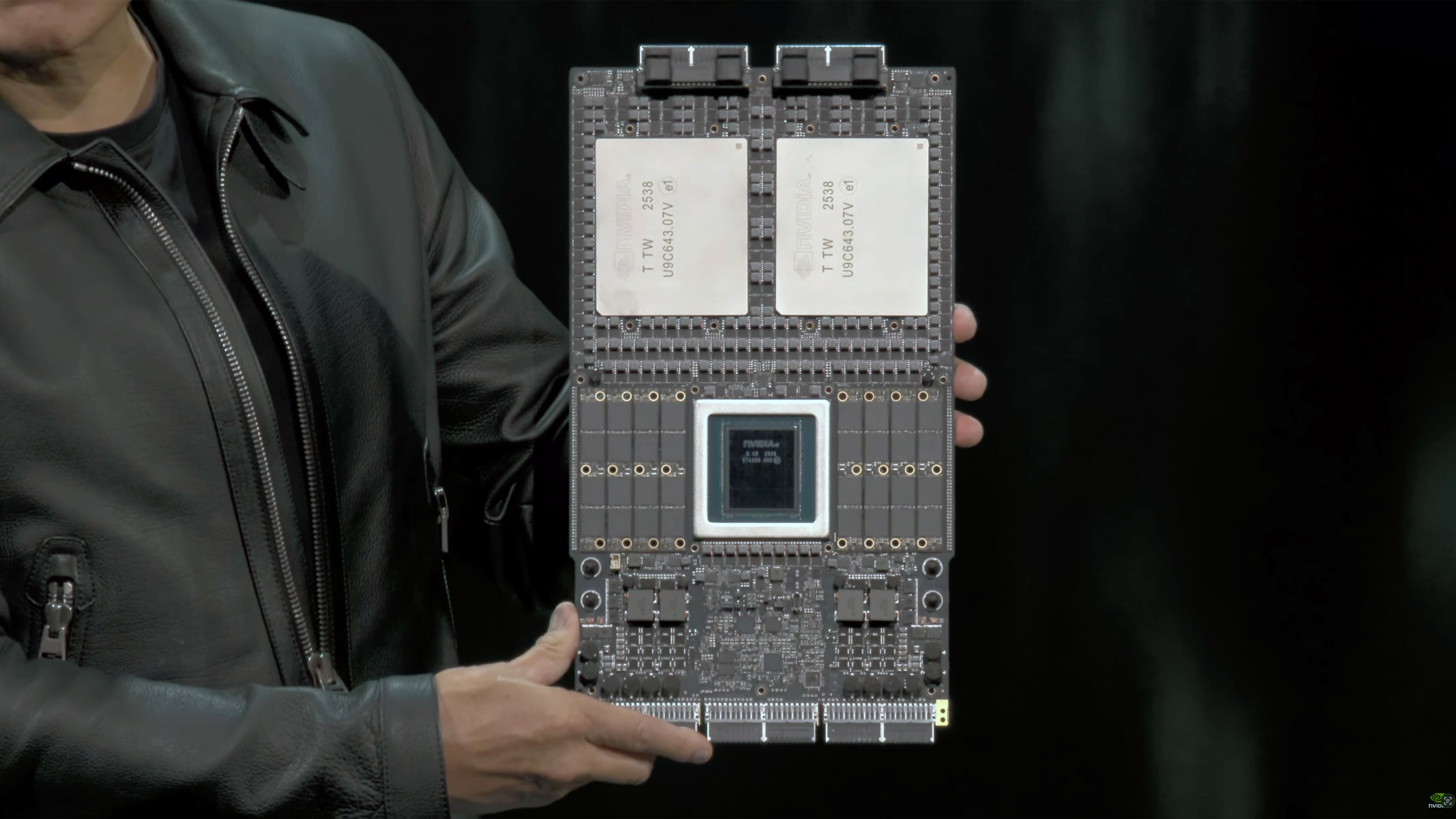

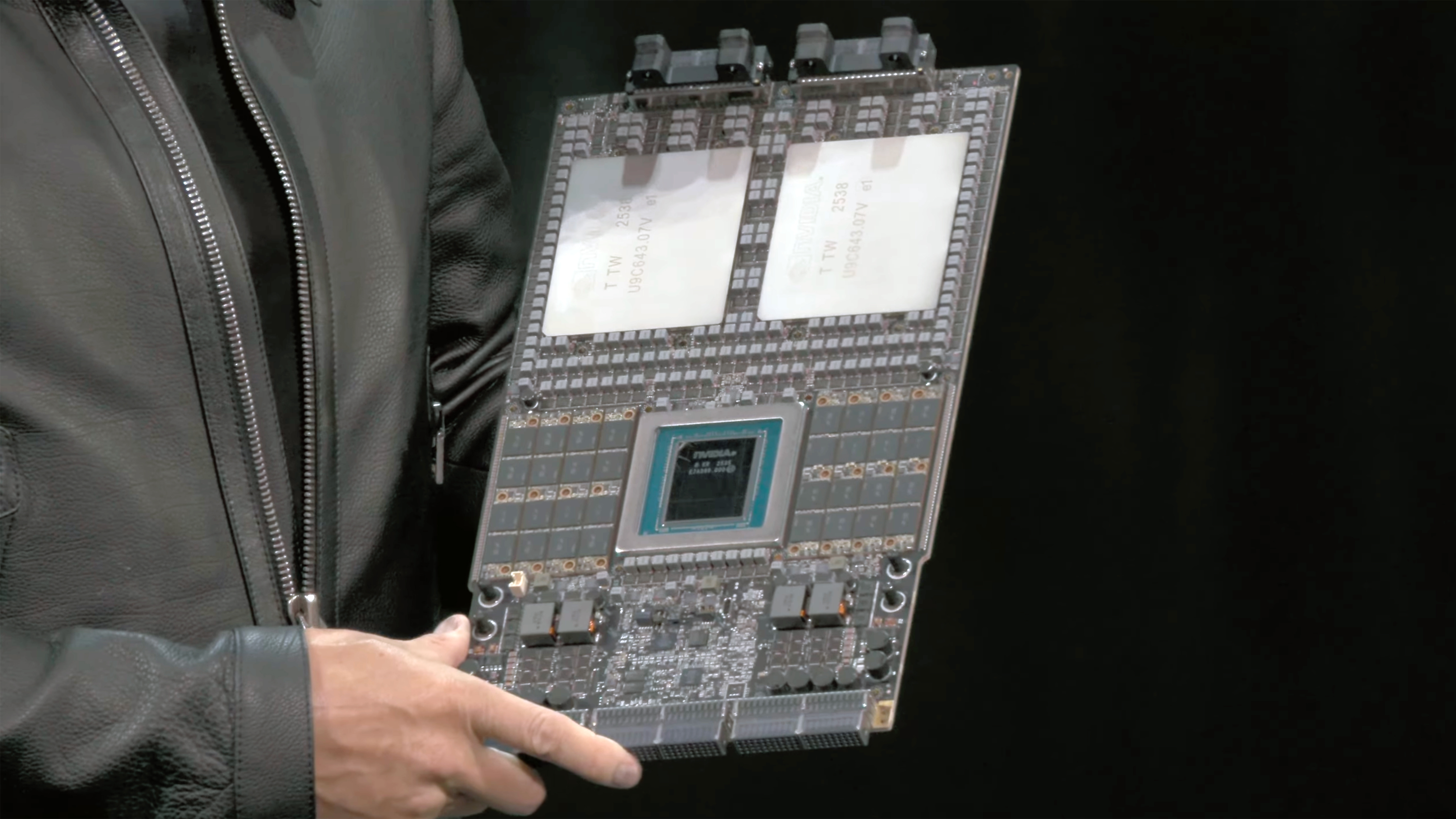

Starting with the VR200 platform, Nvidia is reportedly preparing to take over production of fully built L10 compute trays with a pre-installed Vera CPU, Rubin GPUs, and a cooling system instead of allowing hyperscalers and ODM partners to build their own motherboards and cooling solutions. This would not be the first time the company has supplied its partners with a partially integrated server sub-assembly: it did so with its GB200 platform when it supplied the whole Bianca board with key components pre-installed. However, at the time, this could be considered as L7 – L8 integration, whereas now the company is reportedly considering going all the way to L10, selling the whole tray assembly — including accelerators, CPU, memory, NICs, power-delivery hardware, midplane interfaces, and liquid-cooling cold plates — as a pre-built, tested module.

If the information is correct, and Nvidia will indeed ship its partners L10 compute trays (which probably account for 90% of the cost of a server), then Nvidia will only leave its partners with rack-level integration rather than server design. They would still build the outer chassis, integrate power supplies depending on requirements, install sidecars or CDUs for rack-level cooling, add their own BMC and management stack, and perform final assembly and testing. These tasks matter operationally, but they do not differentiate hardware in a meaningful way.

This move promises to shorten the ramp for VR200 as Nvidia's partners will not have to design everything in-house and could lower production costs due to the volume of scale ensured by a direct contract between Nvidia and an EMS (most likely Foxconn as the primary supplier and then Quanta and Wistron, but that is speculation). For example, a Vera Rubin Superchip board recently demonstrated by Jensen Huang uses a very complex design, a very thick PCB, and only solid-state components. Designing such a board takes time and costs a lot of money, so using select EMS provider(s) to build it makes a lot of sense.

J.P. Morgan reportedly mentions the increase in power consumption of one Rubin GPU from 1.4 kW (Blackwell Ultra) to 1.8 kW (R200) and even 2.3 kW (a previously unannounced TDP for an allegedly unannounced SKU (Nvidia declined a Tom's Hardware request for comment on the matter) and increased cooling requirements as one of the motivations for moving to supply the whole tray instead of individual components. However, we know from reported supply chain sources that various OEMs and ODMs, as well as hyperscalers like Microsoft, are experimenting with very advanced cooling systems, including immersion and embedded cooling, which underscores their experience.

However, Nvidia's partners will shift from being system designers to becoming system integrators, installers, and support providers. They are going to keep enterprise features, service contracts, firmware ecosystem work, and deployment logistics, but the 'heart' of the server — the compute engine — is now fixed, standardized, and produced by Nvidia rather than by OEMs or ODMs themselves.

Also, we can only wonder what will happen with Nvidia's Kyber NVL576 rack-scale solution based on the Rubin Ultra platform, which is set to launch alongside the emergence of 800V data center architecture meant to enable megawatt-class racks and beyond. Now the only question is whether Nvidia further increases its share in the supply chain to, say, rack-level integration?

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

DS426 There are definitely advantages of such levels of integration, but ultimately, it only bolsters Nvidia's monopolistic powers. When the AI world desperately needs a more open ecosystem, Nvidia is sure to double-down on forcing the standard for everyone.Reply

Hard as heck to change the status quo sometimes, ain't it! -

JTWrenn This makes me wonder if the stock slide is actually just heavy money moving around in the background at lower rates to try to free up capital to do this. Wonder how much this will tank Super MicroReply -

edzieba "Gearing up"? They've been selling not just servers but entire racks for years now (starting with DGX-1 back in 2016, so nearly a decade). If anything, this is unbundling those DGX boxes from the DGX pods to be sold as individual RUs for OEMS to integrate.Reply