Nvidia prepares shipment of 82,000 AI GPUs to China as chip war lines blur — H200 shipments with 25% tax to begin as US loosens restrictions

U.S. policy reversal opens the door for mid-February exports.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

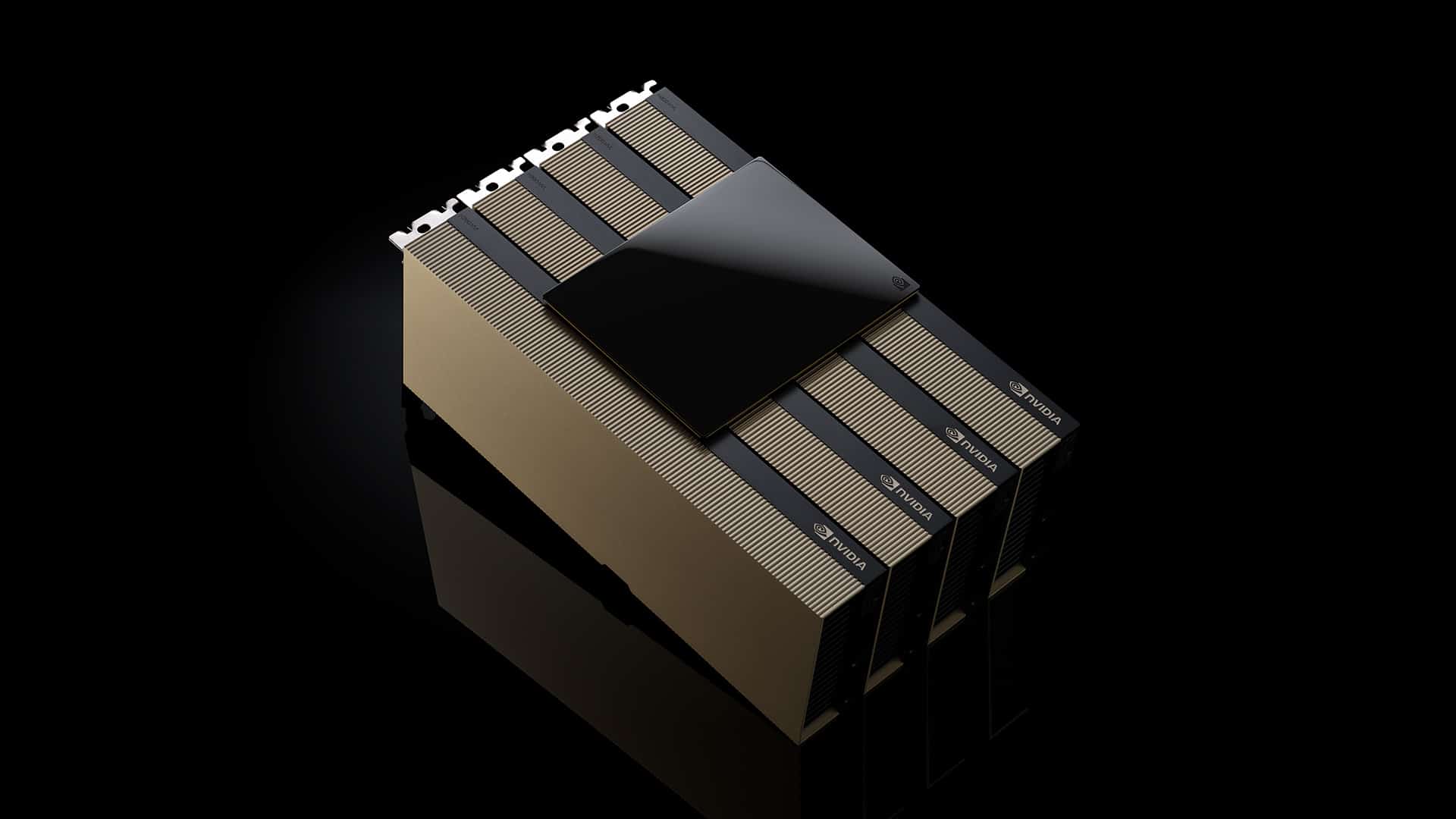

Nvidia is preparing to deliver up to 80,000 H200 AI chips to China before the Lunar New Year holiday — marking the first time this level of silicon would be legally exported to the country since 2022.

The shipments are scheduled for mid-February and will be drawn from existing inventory, according to Reuters. The company says it can meet initial demand for 5,000 to 10,000 H200 modules, pending government approval in Beijing.

The deal would give Chinese firms access to a GPU that dramatically outpaces the H20 variant, which was designed to bypass U.S. restrictions. The H200 is a Hopper-based part that Nvidia had mostly sidelined in favor of its newer Blackwell and Rubin architectures. But following a recent policy reversal by the Trump administration, the H200 has reemerged as a politically viable and commercially strategic export part, provided recipients are vetted and a 25% revenue share is paid to the U.S. Treasury.

Chinese authorities have not yet cleared the shipments, but the scale of interest and Nvidia’s offer to open new H200 production capacity in 2026 suggest that they expect capitulation from Beijing authorities, which, given how far ahead the H200 is of anything Chinese fabs can produce, is understandable.

Replacing restriction with revenue

The Biden administration’s export controls on AI chips to China, which began in 2022 and expanded through 2023, had cut off access to Nvidia’s A100, H100, and H200 silicon. In response, Nvidia designed lower-performing parts specifically for the Chinese market. The H20 was the most powerful of these, but still underperformed relative to the training needs of large foundation models. Chinese firms adapted, turning to Huawei’s Ascend series and other local vendors, but none of those efforts matched the performance envelope of Hopper-based GPUs.

In early December, Trump overrode the existing restrictions, allowing H200 chips to be sold into China, provided each deal is subject to inter-agency approval and includes a 25% levy. The decision does not extend to Nvidia’s current Blackwell or upcoming Rubin GPUs. In effect, the U.S. is granting limited access to older silicon under strict financial and procedural oversight, while keeping cutting-edge hardware firmly out of reach.

The Trump administration’s backtracking also gives Nvidia a reason to reintroduce H200 production. The company had largely transitioned away from Hopper-class manufacturing to focus on next-gen designs, but in light of demand from China and a green light from Washington, Nvidia has signaled that it will take new H200 orders starting in 2026. While modest in scale compared to Blackwell, this production would serve a lucrative niche: international buyers whose political or technical environments preclude access to newer chips.

Power now or progress later

All this has created a dilemma for China’s domestic chip ambitions. The H200 is far more powerful than any domestically produced alternative, but reliance on it may hinder progress toward a self-sufficient AI hardware stack. Huawei’s Ascend 910C, for instance, trails the H200 significantly in both raw throughput and memory bandwidth. Biren’s BR104 is similarly constrained, and the underlying Chinese software ecosystem remains heavily CUDA-dependent. Switching to Nvidia’s Hopper parts offers immediate compatibility with existing workflows, whereas transitioning to local chips will require building a software infrastructure from the ground up.

This performance and integration gap is one reason the H200 is so attractive to buyers in China. We already know that the chip is being used unofficially, and there have been several high-profile attempts to skirt around import restrictions through black- and grey-market channels. Even university labs and medical research institutions with ties to the military have reportedly acquired H200s through indirect channels, sometimes via foreign subsidiaries or offshore procurement.

In terms of policy, Chinese officials have held emergency meetings to determine how to respond. One proposal would require all H200 purchases to be bundled with a minimum ratio of domestic chips, thereby preserving demand for homegrown vendors like Cambricon and Moore Threads. The extent to which such a bundling rule could be enforced, especially across private-sector cloud providers, remains unclear. But the idea reflects concern that an influx of H200s could tilt the domestic market away from Chinese silicon just as it begins to mature.

That concern is not unwarranted. Despite clear progress, the Chinese AI chip ecosystem remains a generation behind in key areas. Approving large-scale imports of Hopper-class hardware risks creating a dependency on foreign training infrastructure, the most critical layer of the AI stack.

A tactical concession

Resuming H200 shipments will address multiple short-term problems for Nvidia, providing an opportunity to monetize inventory that might otherwise depreciate and to address pent-up demand in a restricted yet technically important market. And it can do this without violating export rules, which still draw a hard line between the H200 and next-gen architectures.

In terms of U.S. policy, the 25% tariff creates a mechanism to extract value from technology transfers that would otherwise be banned outright. It positions the federal government to benefit from Nvidia’s China business, while nominally maintaining a security buffer. Yet this arrangement also weakens the original logic of the export controls. If older chips are still sufficiently powerful to close the AI compute gap, or worse yet, to enable military applications, then allowing them in any quantity may undermine the broader goal of tech containment.

The Institute for Progress has warned that expanding China’s access to Hopper-class hardware could significantly increase the country’s aggregate training capacity. Even if Blackwell remains off the table, the volume of H200s in play — up to 80,000 from existing stock alone — could enable more advanced model training than domestic chips currently support. That, in turn, would affect both commercial competition and military readiness in fields where AI performance is critical.

No public statements from Chinese regulators have confirmed or denied approval of the pending shipments. But based on the scale of the order and the timing aligned with the Lunar New Year, Nvidia appears confident enough to begin staging deliveries. Should the plan proceed, it would mark the most significant legal export of high-end AI silicon to China since the restrictions were first imposed. And with new H200 production capacity now in planning, the repercussions are likely to stretch well into 2026.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.