Apple concedes it is constrained by TSMC's supply of advanced chips; storage and memory are also in short supply — firm isn't projecting supply conditions beyond the second quarter

Or it is not that easy.

Apple this week said that its performance in the second quarter of its fiscal 2026 would be constrained by the availability of processors made on TSMC's leading-edge production nodes, a type of announcement that the company has not made in years. Apparently, as AI accelerators based on some of TSMC's latest manufacturing processes ramp up, Apple believes it cannot secure enough capacity to produce more chips for its popular products.

Apple sets new business records, but warns about supply constraints

"On the supply side, I had made comments earlier about the constraint that we are seeing in Q2, that is reflected in the revenue guidance that Kevan [Parekh] gave earlier," said Tim Cook, chief executive officer of Apple. "The constraint, as I had mentioned, is due to the advanced node capacity, and it is really a result of growing so well in Q1 with — by 23% — and having less flexibility, partly due to that in the process, to increase it as much as we would like to increase it."

The company's chief financial officer, Kevan Parekh, emphasized that its guidance for next quarter is based on the company's 'best estimates of constrained supply,' meaning that things are dynamic.

"Beyond Q2, I do not really want to comment on supply [as] supply is a function of a lot of things in the industry that move around a lot," said Cook. "So, I would not want to comment on that."

Sales of Apple's products and services increased 15.6% year-over-year to $143.756 billion during the quarter that ended on December 27, 2025. Although sales of Macs ($8.386 billion) and wearables ($11.493 billion) decreased year-over year, sales of iPhones ($85.269 billion), iPads ($8.595 billion), and services ($30.013 billion) set records and were up considerably — by 23%, 6.3%, and 13.9%, respectively — compared to the same quarter a year ago, which contributed to the company's record business performance.

However, for the second quarter of its fiscal 2026, the company expects revenue to grow by 13% - 16% year-over-year to around $107.75 billion - $110.62 billion due to constrained iPhone supply during the quarter.

TSMC's N3 supply reaches the limit?

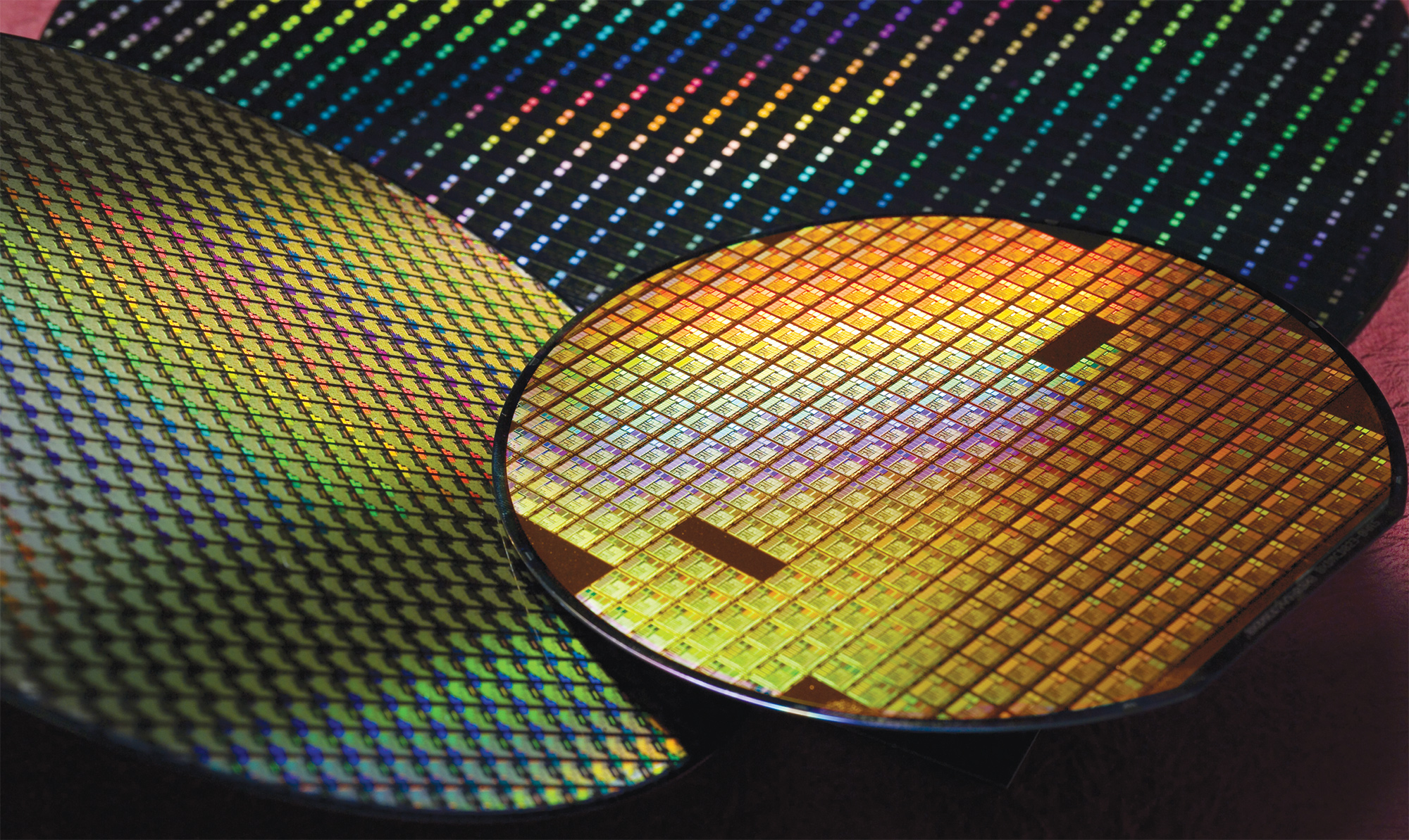

Apple's latest iPhone 17 and iPhone 17 Pro are based on the company's A19 and A19 Pro chips that are produced by TSMC using its N3P fabrication technology. Apple was the first company to adopt TSMC's N3B — the foundry's original 3nm-class node — in 2023, and for a while was the only major user of N3B before Intel jumped on board a bit later, and then AMD and Qualcomm joined with N3E in 2024.

Being TSMC's alpha customer for new nodes, Apple has always had supply priority, but it looks like demand for its products based on processors made on 3nm-class technologies exceeded supply just when TSMC's N3 supply reached its limit.

TSMC now runs multiple N3-capable fabs, but virtually all of its major customers produce 3nm-class products. More importantly, Nvidia has begun mass production of its next-generation Rubin GPUs and accompanying process for its next-generation Vera Rubin platform for AI, which takes a lot of N3 capacity.

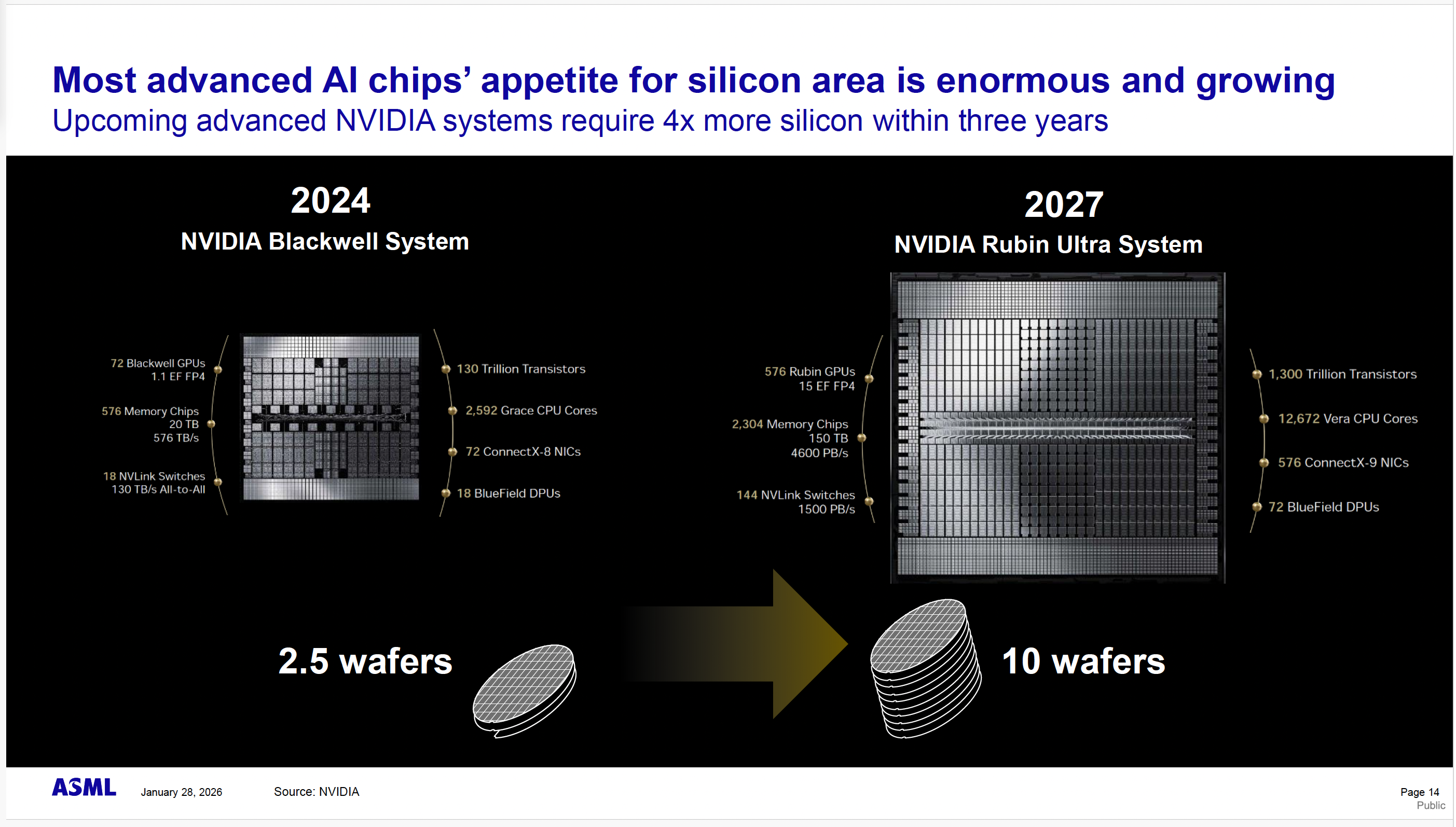

In fact, ASML recently estimated that while Nvidia's original GB200 NVL72 system required 2.5 300-mm silicon wafers — which includes CPUs, GPUs, NVLink switches, Ethernet/InfiniBand processors, BlueField DPUs, memory, and storage — the company's upcoming VR300 NVL576 Rubin Ultra rack-scale solution will need ten 300-mm silicon wafers. It is hard to estimate how much of this silicon real estate is attributable to TSMC, but probably more than 25% but less than 50%.

While the Nvidia Rubin ramp is a very significant event for the industry, as the company controls the lion's share of the data center AI market, it looks like there are more customers ramping up their silicon-intensive platforms on TSMC's N3, which is why the foundry has limited capabilities to respond to Apple's requests for extra capacity.

All of TSMC's widely used 3nm-class nodes — N3E and N3P — use up to 19 EUV lithography layers, which is down from 25~28 supported by the original N3B, according to reports. Reduced usage of EUV exposures allows TSMC to lower its reliance on EUV scanners, which can positively affect output for cases when the number of EUV lithography systems in a fab is limited. In fact, TSMC has been working for some time converting its N5 to N3-capable capacity, which to a large degree meant adding EUV tools where possible or maybe upgrading EUV systems where possible. This is a mid-term project, though.

"We are also pulling forward the existing fab schedules to the extent possible, both in Taiwan and in Arizona," said C.C. Wei, chief executive of TSMC, back in December. "We are also leveraging our manufacturing excellence to drive greater productivity in our fabs to generate more output, convert N5 capacity to support the N3 wherever necessary, and focus on capacity optimization across nodes, to maximize the support to our customers."

Logic =/= memory

Also in the call, Apple's chief executive mentioned the company's concerns about memory and storage supply as well as prices going forward. Large OEMs tend to have long-term volume-related supply agreements for commodities, with additional negotiations concerning supply and prices happening early in the year. To that end, it was a surprise to see supply chain genius Tim Cook saying that Apple was in 'a supply chase mode to meet the very high levels of customer demand.' Yet, the supply chain of logic chips like those used in iPhones and memory used in the said devices is structurally different.

It just so happened that memory is a commodity. DRAM vendors can redirect capacity across customers, die densities, and even memory types (HBM, LPDDR, GDDR) with fewer process changes and shorter qualification cycles. Large OEMs like Apple must qualify the said memory devices, then they are good to go into production of iPhones or Macs. Apple is rumored to have qualified YMTC's 3D NAND memory for iPhones sold in China.

Foundry capacity at TSMC is structurally harder to secure than memory, as it is booked well in advance. Once you have it, it sticks across the variety of products and volumes. When demand surges, there is no fast substitution: you cannot shift N3 volume to N5 without redesigning the chip, nor can you split production across foundries without essentially redesigning the IP that keeps you competitive.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.