Intel Issues Update on 14nm Shortage, Invests $1B Into Fab Sites (Update)

Update: We've added Intel's statements in regards to the increased capital expenditures dedicated to 14nm manufacturing.

Intel's CFO and interim CEO Bob Swan penned an open letter to its customers and partners today outlining the steps it is taking to address a persistent and worsening shortage of 14nm processors.

The shortage has exploded into the public eye as several of Intel's partners have publicly outlined the impacts on their own businesses. Some processors are becoming scarce, while prices are simultaneously rising, particularly in regions outside of the U.S., like EMEA (Europe, the Middle East and Africa) and APAC (Asia-Pacific).

The shortage impacts nearly every aspect of Intel's business, from desktops to laptops, servers and even chipsets, so Intel is making the sound business decision to prioritize high-margin products. The firm has also expanded its testing capacity by diverting some work to a facility in Vietnam.

Intel has already communicated many of the statements found in the letter either via its earnings calls or in responses to queries from Tom's Hardware. There have also been several reports over the preceding week that Intel's rival, AMD, could gain market share due to the 14nm shortage. Swan's update today is likely an attempt to soothe both customers' and investors' fears.

Intel's statement also assures us that processors built on its 10nm fabrication will arrive in volume in 2019. Intel had previously stated that 10nm processors would be available in 2019, but hadn't made the distinction that they would arrive in volume. That's a positive sign, as the oft-delayed 10nm production is surely a contributing factor to the shortage. Intel also cites the booming desktop PC market, which has outstripped the company's original estimates earlier this year, as a catalyst.

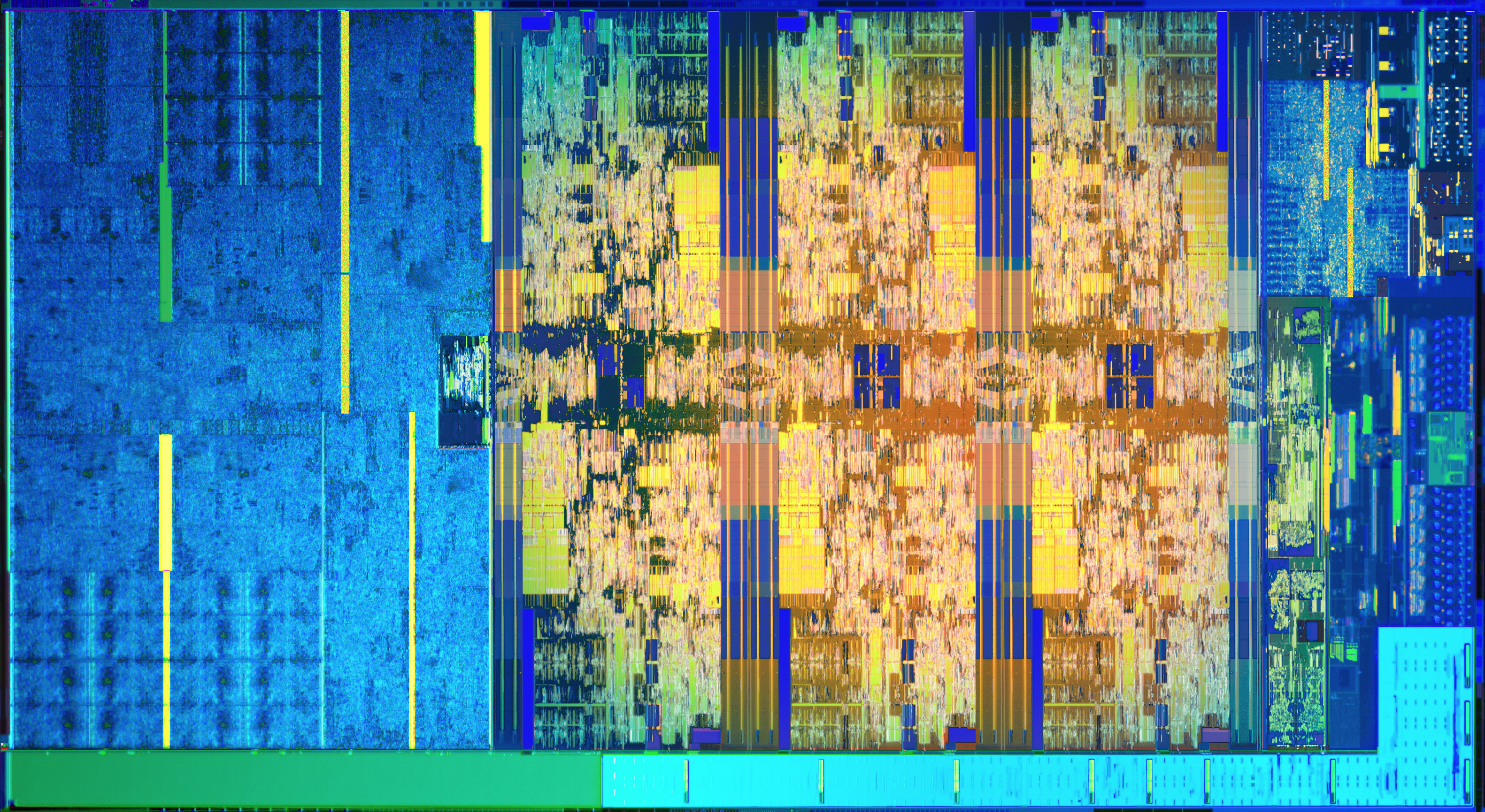

In either case, Intel concedes that "supply is undoubtedly tight, particularly in the entry-level of the PC market" but doesn't provide a firm timeline for when the processors will become fully available. Intel's letter also touts its $1 billion investment in 14nm fabs this year, but half of that capital expenditure was scheduled prior to its first public acknowledgement of the shortage. Given Intel's foresight into the production challenges, the prior $500 million investment was likely in response to the increases in demand and looming production shortfall. Intel provided us with further detail:

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Capex outlook: Our initial 2018 Gross Capex outlook was $14B (source: Jan earnings presentation). In April, 2018 Gross Capex outlook increased to $14.5B (source: April earnings presentation), in July 2018 Gross Capex outlook increased to $15B (source: July earnings presentation). So, $1B total capex increase between Jan – July (going towards increasing our 14 nm capacity as Bob’s letter explains).

Intel's statement comes on the heels of speculation from several industry behemoths that the shortage could last well into next year.

You can read the full release below:

An Open Letter from Bob Swan, Intel CFO and Interim CEOTo our customers and partners,The first half of this year showed remarkable growth for our industry. I want to take a moment to recap where we’ve been, offer our sincere thanks and acknowledge the work underway to support you with performance-leading Intel products to help you innovate.First, the situation … The continued explosion of data and the need to process, store, analyze and share it is driving industry innovation and incredible demand for compute performance in the cloud, the network and the enterprise. In fact, our data-centric businesses grew 25 percent through June, and cloud revenue grew a whopping 43 percent in the first six months. The performance of our PC-centric business has been even more surprising. Together as an industry, our products are convincing buyers it’s time to upgrade to a new PC. For example, second-quarter PC shipments grew globally for the first time in six years, according to Gartner. We now expect modest growth in the PC total addressable market (TAM) this year for the first time since 2011, driven by strong demand for gaming as well as commercial systems – a segment where you and your customers trust and count on Intel.We are thrilled that in an increasingly competitive market, you keep choosing Intel. Thank you.Now for the challenge… The surprising return to PC TAM growth has put pressure on our factory network. We’re prioritizing the production of Intel Xeon and Intel Core™ processors so that collectively we can serve the high-performance segments of the market. That said, supply is undoubtedly tight, particularly at the entry-level of the PC market. We continue to believe we will have at least the supply to meet the full-year revenue outlook we announced in July, which was $4.5 billion higher than our January expectations.To address this challenge, we’re taking the following actions:We are investing a record $15 billion in capital expenditures in 2018, up approximately $1 billion from the beginning of the year. We’re putting that $1 billion into our 14nm manufacturing sites in Oregon, Arizona, Ireland and Israel. This capital along with other efficiencies is increasing our supply to respond to your increased demand.We’re making progress with 10nm. Yields are improving and we continue to expect volume production in 2019.We are taking a customer-first approach. We’re working with your teams to align demand with available supply. You can expect us to stay close, listen, partner and keep you informed.The actions we are taking have put us on a path of continuous improvement. At the end of the day, we want to help you make great products and deliver strong business results. Many of you have been longtime Intel customers and partners, and you have seen us at our best when we are solving problems.Sincerely,Bob SwanIntel Corporation CFO and Interim CEO

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

Roland Of Gilead Reply21358682 said:21358656 said:'XX'....seriously!

Oops! That's me, not Bob Swan :P Fixed.

;) Brilliant! I thought Bob was being a little too overzealous! ;)

-

pug_s 1 billion on updating the fabs. Gees, other companies who operates fabs cost more than 1 billion.Reply -

TJ Hooker ReplyIntel's statement also assures us that processors built on its 10nm fabrication will arrive in volume in 2018.

I think this should say "2019" (based on what's said in the open letter as printed in this article). -

spiketheaardvark You don't dump a billion dollars in older tech that will take 6 months to bear fruit if the new hotness is just around the corner. I take this as Intel admitting that 10nm is at least another year away for chips of any substantial size and volume.Reply -

JamesSneed This is cute. Bob is saying don't devalue our stock because we can't meet demand because we put all our eggs in the 10nm basket and can't deliver so we are having to spin up more 14nm capacity. Also he could also say in 2019 we will have lost the manufacturing lead we have had for two decades. Interesting spin on what should be mostly bad news except for the fact Intel is selling chips as fast as they can make them.Reply

I hope AMD can get Zen2 server chips out early 2019. Will be nice to have a more balanced competition. -

Scooter 30 I would think it would make sense for them to farm out some production to TSMC instead of taking months to update their current fabs. I'm hoping AMD takes some of their market share because of shortages.Reply -

hannibal They are farming TSMC, but that is not enough. Some non essential products are made by TSMC. But those have to be relative simple thing, because making anything complicate like CPU would need completely reengineering of the whole silicon and that would take half year up to full year at minimum.Reply